Analysis: Infineon (IFX) Sales Guidance And The Trump Tariff Factor

Table of Contents

Infineon's Sales Guidance: A Deep Dive

Key Figures and Projections

Infineon's latest sales guidance [insert date and source of guidance] provides a detailed outlook for the coming quarters/year. [Insert specific numbers from the guidance – e.g., projected revenue of €X billion, representing a Y% increase/decrease year-over-year]. This growth is expected to be driven primarily by strong performance in specific segments.

- Automotive segment: Projected revenue growth of Z%, fueled by increasing demand for electric vehicles and advanced driver-assistance systems (ADAS).

- Industrial Power Control segment: Anticipated revenue growth of W%, driven by the growth in renewable energy and industrial automation.

- Power & Sensor Systems segment: Expected revenue growth of V%, supported by the ongoing digitalization across various industries.

Infineon typically utilizes a combination of internal market research, industry analysis, and macroeconomic forecasts to formulate its revenue projections. This methodology involves assessing various factors influencing chip demand and supply, as well as considering their own production capabilities.

Underlying Market Conditions

The semiconductor market presents a mixed bag of opportunities and challenges. While global demand for chips remains robust in certain areas, overall growth is moderated by factors such as:

- Global chip shortage easing but still impacting supply: While the acute shortage has lessened, supply chain bottlenecks persist, impacting production timelines and potentially impacting Infineon's ability to fully meet demand.

- Increased competition: Intense competition from other major semiconductor manufacturers requires Infineon to continually innovate and enhance its product offerings to maintain its market share.

- Macroeconomic headwinds: Global economic uncertainty, inflation, and potential recessionary pressures could dampen demand for semiconductors across various sectors.

The Trump Tariff Legacy: A Continuing Challenge

Direct Impact on Infineon

The Trump-era tariffs imposed on various goods, including semiconductors, have directly impacted Infineon's operations. These tariffs resulted in:

- Increased import costs: Higher tariffs on imported components increased Infineon's production costs, squeezing profit margins. [Insert specific data on increased costs if available].

- Impact on export markets: Tariffs imposed by other countries in response to US tariffs created additional challenges for Infineon in export markets. [Cite examples if applicable].

- Price adjustments and market share impact: The company was forced to adjust pricing strategies to offset increased costs, potentially impacting competitiveness and market share in some segments.

Indirect Impacts and Ripple Effects

Beyond the direct costs, the Trump tariffs caused a ripple effect across Infineon's supply chain and global operations, including:

- Supplier price increases: Infineon's suppliers also faced increased costs due to tariffs, leading to higher input prices for Infineon.

- Supply chain disruptions: The uncertainty created by the tariffs led to disruptions in the global supply chain, impacting production schedules and increasing logistics costs.

- Shifting manufacturing locations: Companies considered relocating manufacturing facilities to mitigate tariff impacts, leading to complex and costly restructuring efforts for many businesses, including potentially Infineon.

Investor Implications and Strategic Considerations

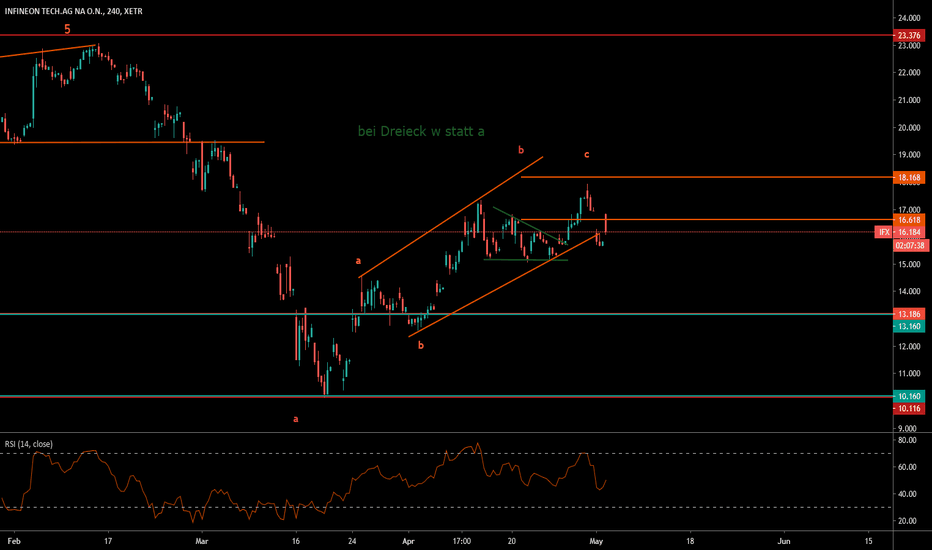

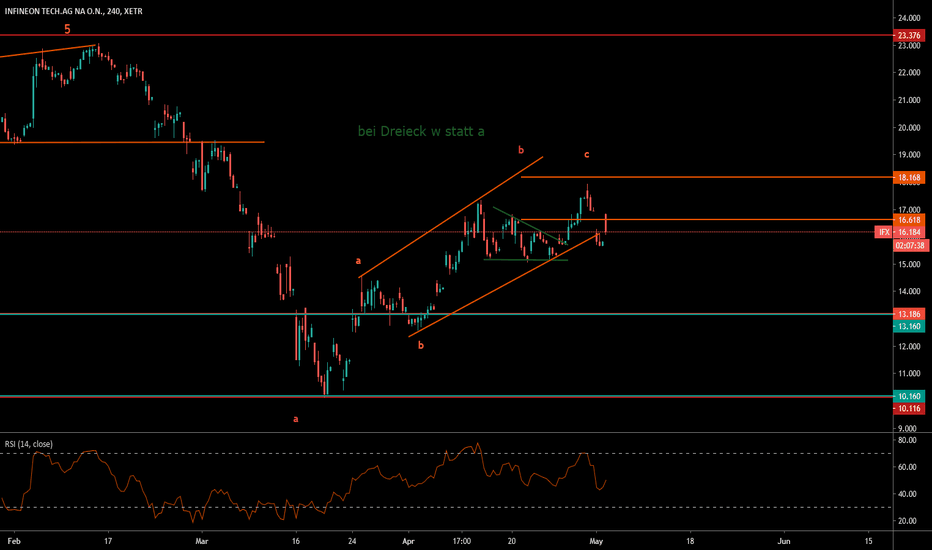

Stock Valuation and Price Movements

Infineon's sales guidance and the ongoing impact of trade policies influence investor sentiment and stock price movements. [Insert relevant data on stock price fluctuations since the guidance release]. Analyst ratings and investor recommendations vary, with some expressing concerns over the tariff-related challenges and others remaining positive on Infineon’s long-term prospects. [Include a chart showing stock price movement if available].

Strategic Responses by Infineon

To mitigate the impact of tariffs and maintain its competitive edge, Infineon has implemented or is likely considering various strategic responses:

- Supply chain diversification: Reducing reliance on single-source suppliers and geographically diversifying its supply chain to minimize disruption.

- Pricing strategies: Adjusting pricing to account for increased input costs while maintaining competitiveness.

- Technological innovation: Investing in research and development to develop more efficient and cost-effective products.

- Lobbying efforts: Engaging in industry advocacy to influence trade policies and reduce tariff barriers.

Conclusion

Infineon's sales guidance reflects a complex interplay between robust market demand in specific sectors, persistent supply chain challenges, and the lingering effects of the Trump tariffs. While the company's projections show growth in key segments, the increased costs and uncertainties caused by trade policies remain significant challenges. Understanding the interplay between Infineon’s revenue projections and the tariff-related complexities is crucial for informed investment decisions.

Call to Action: Stay informed about future Infineon (IFX) sales guidance and the ongoing impact of trade policies on the semiconductor industry. Continue researching Infineon’s financial releases and industry news to gain a comprehensive understanding of its trajectory in the evolving semiconductor market. Thorough analysis of IFX's performance and the larger global economic landscape is essential for any investor considering a position in this important company.

Featured Posts

-

9 Potential Nhl Players To Eclipse Alex Ovechkins Career Goal Total

May 09, 2025

9 Potential Nhl Players To Eclipse Alex Ovechkins Career Goal Total

May 09, 2025 -

The Fentanyl Crisis And Its Impact On U S China Trade Relations

May 09, 2025

The Fentanyl Crisis And Its Impact On U S China Trade Relations

May 09, 2025 -

Dakota Johnson Por Que El Bolso Hereu Es El Accesorio Perfecto

May 09, 2025

Dakota Johnson Por Que El Bolso Hereu Es El Accesorio Perfecto

May 09, 2025 -

The Great Decoupling And Its Impact On Supply Chains

May 09, 2025

The Great Decoupling And Its Impact On Supply Chains

May 09, 2025 -

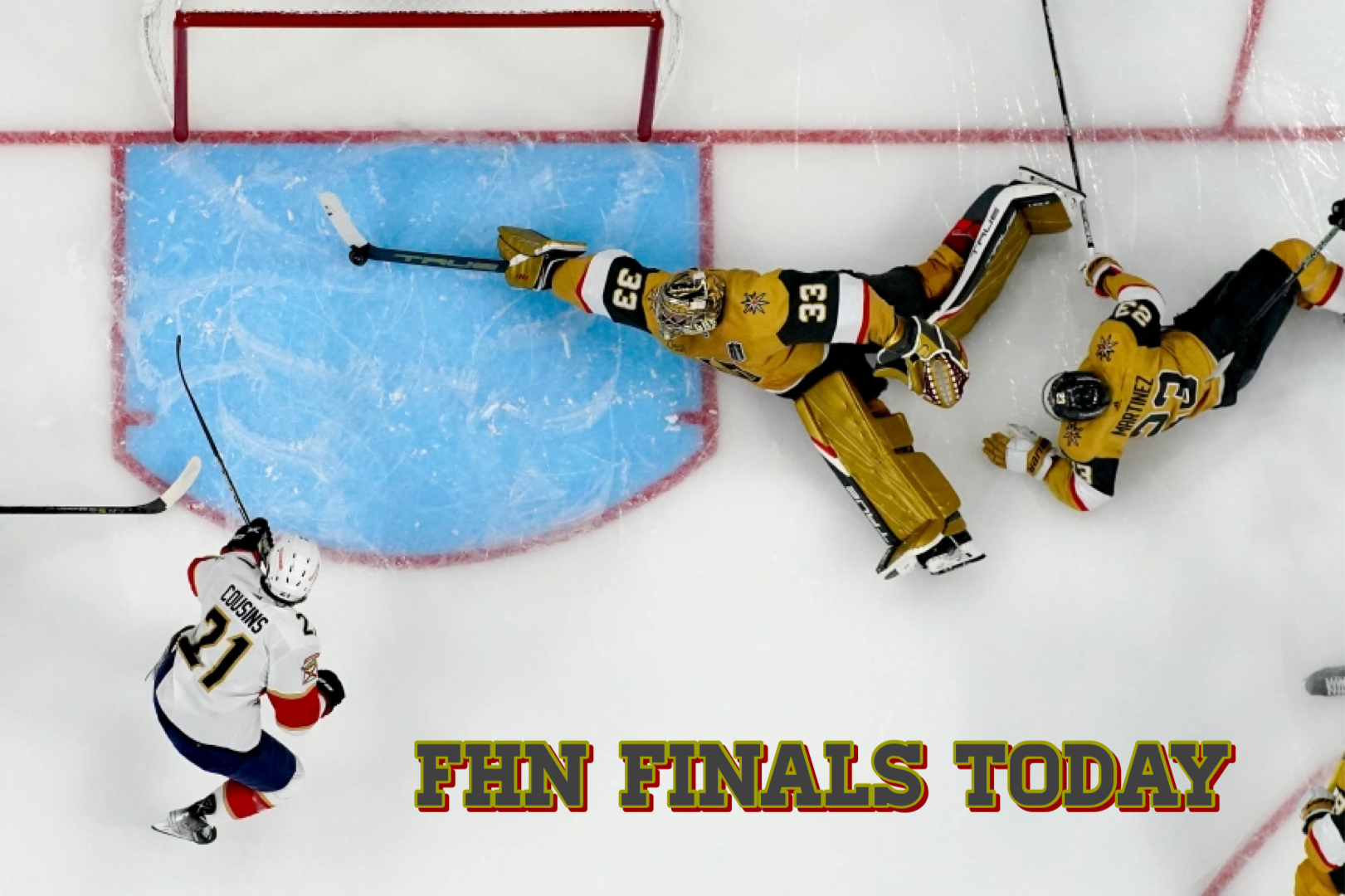

Adin Hills 27 Saves Propel Vegas Golden Knights Past Columbus Blue Jackets

May 09, 2025

Adin Hills 27 Saves Propel Vegas Golden Knights Past Columbus Blue Jackets

May 09, 2025

Latest Posts

-

Wynne And Joanna All At Sea A Detailed Analysis

May 09, 2025

Wynne And Joanna All At Sea A Detailed Analysis

May 09, 2025 -

Go Compare Advert Star Wynne Evans Removed Following Strictly Incident

May 09, 2025

Go Compare Advert Star Wynne Evans Removed Following Strictly Incident

May 09, 2025 -

Strictly Come Dancing Fallout Wynne Evans Out Of Go Compare Ads

May 09, 2025

Strictly Come Dancing Fallout Wynne Evans Out Of Go Compare Ads

May 09, 2025 -

Wynne Evans And Girlfriend Liz Enjoy Cosy Date Amidst Bbc Meeting Postponement

May 09, 2025

Wynne Evans And Girlfriend Liz Enjoy Cosy Date Amidst Bbc Meeting Postponement

May 09, 2025 -

Wynne Evans Seeks To Clear His Name With Fresh Evidence In Strictly Scandal

May 09, 2025

Wynne Evans Seeks To Clear His Name With Fresh Evidence In Strictly Scandal

May 09, 2025