Analysis: Japan's Steep Bond Curve And Its Economic Consequences

Table of Contents

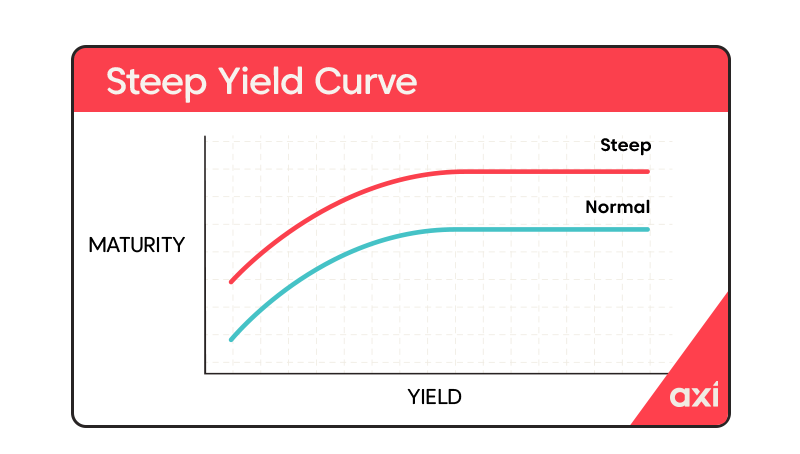

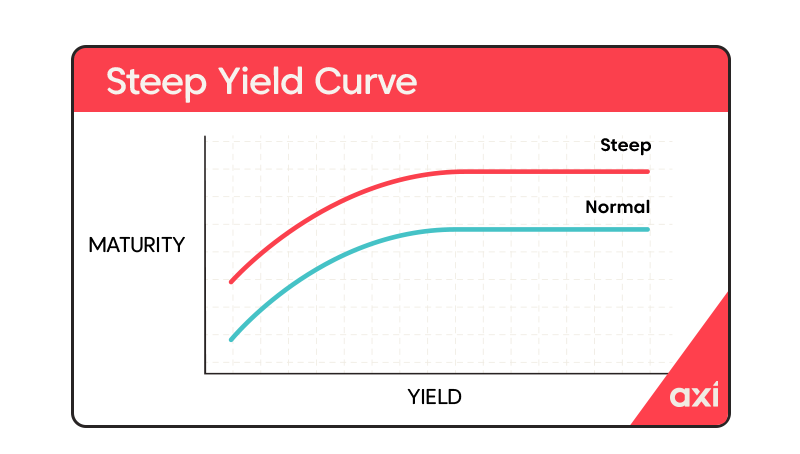

The Mechanics of Japan's Steep Yield Curve

The Japanese yield curve, which plots the yields of JGBs against their maturities, currently displays a significant upward slope. This means that long-term JGB yields are substantially higher than short-term yields. Several factors contribute to this steepness:

-

BOJ's Yield Curve Control (YCC) Policy and its Limitations: The Bank of Japan's (BOJ) YCC policy, aimed at keeping short-term interest rates near zero and controlling the 10-year JGB yield, has faced increasing pressure. While initially successful in suppressing long-term yields, the policy's effectiveness has been challenged by rising inflationary pressures and global interest rate hikes. The BOJ's attempts to maintain its yield target have created a significant divergence between short and long-term rates, contributing to the steep curve.

-

Inflationary Pressures and Market Expectations: Rising inflation, fueled by global factors and supply chain disruptions, has led to market expectations of higher future interest rates. Investors are demanding higher yields on long-term JGBs to compensate for the increased risk of inflation eroding the value of their investments.

-

Global Interest Rate Hikes and their Impact on JGB Yields: The aggressive interest rate hikes implemented by central banks globally, including the Federal Reserve, have pushed up global interest rates. This makes JGBs, which have historically offered relatively low yields, less attractive to international investors, leading to increased pressure on long-term JGB yields.

-

Supply and Demand Dynamics in the JGB Market: The sheer volume of JGBs issued by the Japanese government, coupled with shifting investor sentiment, plays a role in the yield curve's shape. Changes in the demand for JGBs from both domestic and international investors directly impact their prices and consequently, their yields.

[Insert chart/graph visually representing the current JGB yield curve here]

Economic Consequences of a Steep Bond Curve

A steep yield curve, while not inherently negative, has several significant economic consequences for Japan:

Impact on Borrowing Costs

A steep yield curve translates to higher borrowing costs for both businesses and the government. Companies will face increased costs when seeking long-term loans for capital investment, potentially hindering economic growth. Similarly, the government will incur higher interest payments on its substantial debt, impacting fiscal policy and potentially limiting its ability to fund social programs or stimulate the economy. Keywords: borrowing costs, government debt, corporate investment, economic growth.

Effects on the Financial Sector

The steep yield curve presents both risks and opportunities for Japan's financial sector. Japanese banks, holding substantial amounts of JGBs, will see changes in their profitability as yields shift. Pension funds and insurance companies, heavily invested in JGBs, will experience fluctuations in the value of their assets. Effective risk management will be crucial for navigating these challenges. Keywords: Japanese banks, financial stability, pension funds, insurance companies, risk management.

Implications for Monetary Policy

The BOJ faces a significant challenge in managing its monetary policy with a steep yield curve. The effectiveness of quantitative easing (QE) may be diminished, and the continued maintenance of YCC becomes increasingly difficult. The BOJ might need to adjust its policy stance, potentially leading to unpredictable consequences for the economy. Keywords: monetary policy, Bank of Japan (BOJ), quantitative easing, interest rate adjustments.

Potential Future Scenarios and Uncertainties

Predicting the future trajectory of Japan's bond market is inherently uncertain. Several scenarios are possible:

- Further Steepening: Inflationary pressures and global interest rate hikes could continue to push long-term JGB yields higher, leading to a further steepening of the curve.

- Flattening: The BOJ might adjust its YCC policy, potentially leading to a flattening of the yield curve.

- Inversion: Under certain circumstances, the yield curve could even invert (short-term yields exceeding long-term yields), signaling a potential recession.

The uncertainties surrounding future inflation rates, global economic growth, and BOJ policy make forecasting challenging. Keywords: future outlook, inflation expectations, global economic uncertainty, policy challenges.

Assessing the Implications of Japan's Steep Bond Curve – A Call to Action

Japan's steep bond curve presents a complex situation with significant economic implications. Higher borrowing costs, potential risks for the financial sector, and challenges for monetary policy are key concerns. Close monitoring of the situation is crucial. Understanding the evolving dynamics of Japan's bond market, the intricacies of its yield curve, and the implications for various sectors requires continued observation and analysis. We encourage readers to stay informed about developments in Japan's bond market and conduct further research on the implications of the steep bond curve for their specific interests – whether it's investment strategies, economic forecasting, or understanding broader economic trends in Japan. Keywords: Japan bond market, yield curve analysis, economic outlook, investment strategies, further research.

Featured Posts

-

How Tom Thibodeau Rescued The Knicks Addressing A Persistent Flaw

May 17, 2025

How Tom Thibodeau Rescued The Knicks Addressing A Persistent Flaw

May 17, 2025 -

Condo Crack Crisis Seaweed Breakthroughs And Company Failures Daily News Summary

May 17, 2025

Condo Crack Crisis Seaweed Breakthroughs And Company Failures Daily News Summary

May 17, 2025 -

Pga Championship Opening Round Struggles And Surprises

May 17, 2025

Pga Championship Opening Round Struggles And Surprises

May 17, 2025 -

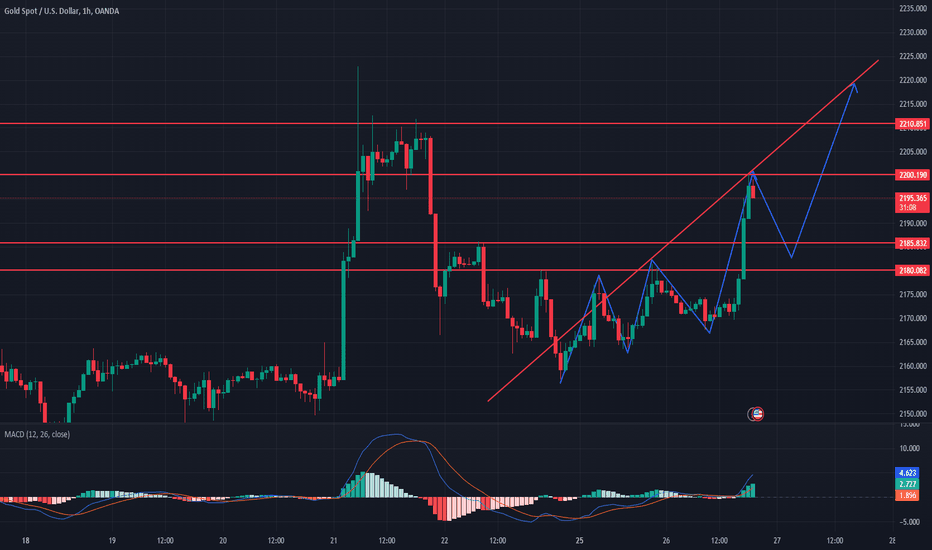

Us Economic Data Weighs On Dollar Spurs Gold Xauusd Price Increase

May 17, 2025

Us Economic Data Weighs On Dollar Spurs Gold Xauusd Price Increase

May 17, 2025 -

The Post Roe Shift Over The Counter Birth Control And Its Implications

May 17, 2025

The Post Roe Shift Over The Counter Birth Control And Its Implications

May 17, 2025

Latest Posts

-

Tom Thibodeaus Pope Joke Unlikely Knicks Connection Explained

May 17, 2025

Tom Thibodeaus Pope Joke Unlikely Knicks Connection Explained

May 17, 2025 -

How Tom Thibodeau Rescued The Knicks Addressing A Persistent Flaw

May 17, 2025

How Tom Thibodeau Rescued The Knicks Addressing A Persistent Flaw

May 17, 2025 -

Tom Thibodeaus Knicks Redemption Overcoming A Career Long Weakness

May 17, 2025

Tom Thibodeaus Knicks Redemption Overcoming A Career Long Weakness

May 17, 2025 -

New York Knicks Face A Crucial Choice With Landry Shamet

May 17, 2025

New York Knicks Face A Crucial Choice With Landry Shamet

May 17, 2025 -

Landry Shamet And The New York Knicks A Difficult Decision

May 17, 2025

Landry Shamet And The New York Knicks A Difficult Decision

May 17, 2025