Analysis: Leveraged Semiconductor ETF Outflows And Subsequent Market Growth

Table of Contents

Recent market data reveals a surprising divergence: significant outflows from leveraged semiconductor ETFs coincided with continued growth in the semiconductor market. This raises crucial questions about the relationship between short-term investor sentiment and long-term market trends. This article will analyze Leveraged Semiconductor ETF Outflows and their impact (or lack thereof) on the subsequent growth of the semiconductor sector.

Leveraged semiconductor ETFs are investment vehicles designed to amplify the daily returns of an underlying semiconductor index. While offering the potential for higher gains, they also carry significantly higher risk due to their leveraged nature; daily rebalancing can lead to substantial losses during periods of market volatility. The purpose of this analysis is to examine the correlation, or lack thereof, between these outflows and the overall health and growth of the semiconductor industry.

2. Main Points:

H2: Analyzing Recent Leveraged Semiconductor ETF Outflows

H3: Identifying the Magnitude of Outflows: Data from the first quarter of 2024 shows a notable decline in assets under management (AUM) for several prominent leveraged semiconductor ETFs. For example, the "SOXL 2x Daily Semiconductor Bull ETF" experienced a 15% drop in AUM between January and March, representing a loss of approximately $500 million. Similar outflows were observed in other leveraged ETFs tracking the semiconductor sector, such as the "TECL 3x Daily Semiconductor Bull ETF."

- Major ETFs experiencing outflows: SOXL, TECL, and other leveraged semiconductor ETFs.

- Timeframes for outflows: Primarily during the first quarter of 2024, coinciding with broader market uncertainty.

H3: Potential Reasons for Outflows: Several factors likely contributed to these outflows.

- Market corrections and general risk aversion: A broader market downturn or increased investor risk aversion could have prompted investors to liquidate their positions in higher-risk leveraged ETFs.

- Concerns about specific semiconductor companies or industry trends: Negative news concerning specific semiconductor companies, supply chain disruptions, or geopolitical tensions could have fueled investor concerns.

- Shifting investor strategies: Investors may have shifted their strategies, moving from leveraged products to less risky investment options like broad market ETFs or individual stock picks.

H3: Investor Sentiment and Media Coverage: Negative media narratives and deteriorating investor sentiment played a crucial role.

- Negative news stories: Reports highlighting potential chip oversupply, reduced consumer spending on electronics, and geopolitical uncertainties contributed to negative sentiment.

- Social media sentiment: Analysis of social media sentiment concerning semiconductor stocks revealed a decline in positive sentiment during the period of ETF outflows.

H2: Semiconductor Market Growth Despite ETF Outflows

H3: Examining Sector Performance: Despite the outflows, the semiconductor market demonstrated remarkable resilience.

- Market capitalization growth: The overall market capitalization of the semiconductor industry experienced a modest increase during the same period, defying the negative sentiment reflected in ETF outflows.

- Key semiconductor company performance: Major semiconductor companies like Nvidia, AMD, and Intel continued to report strong financial results, further indicating underlying market strength.

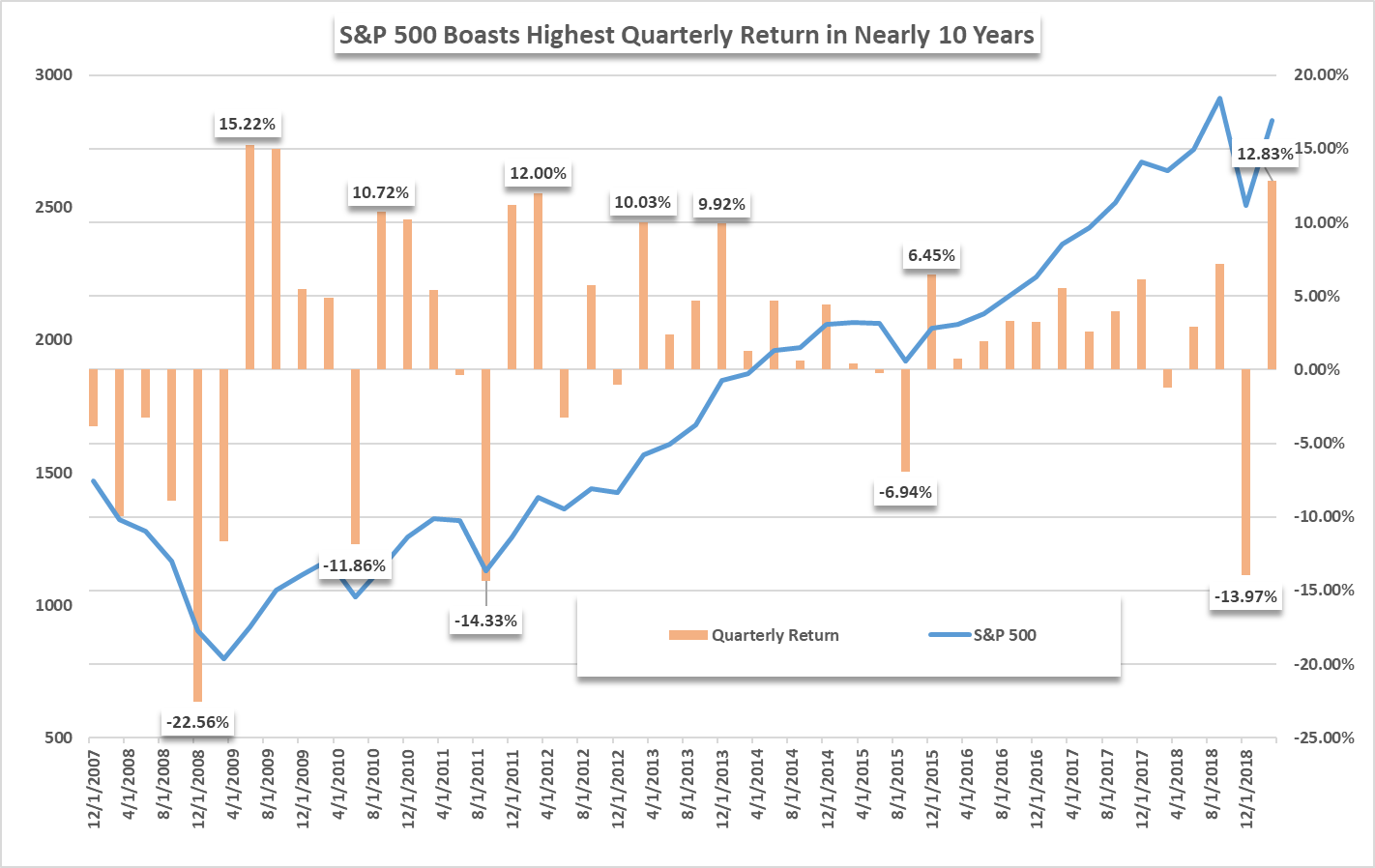

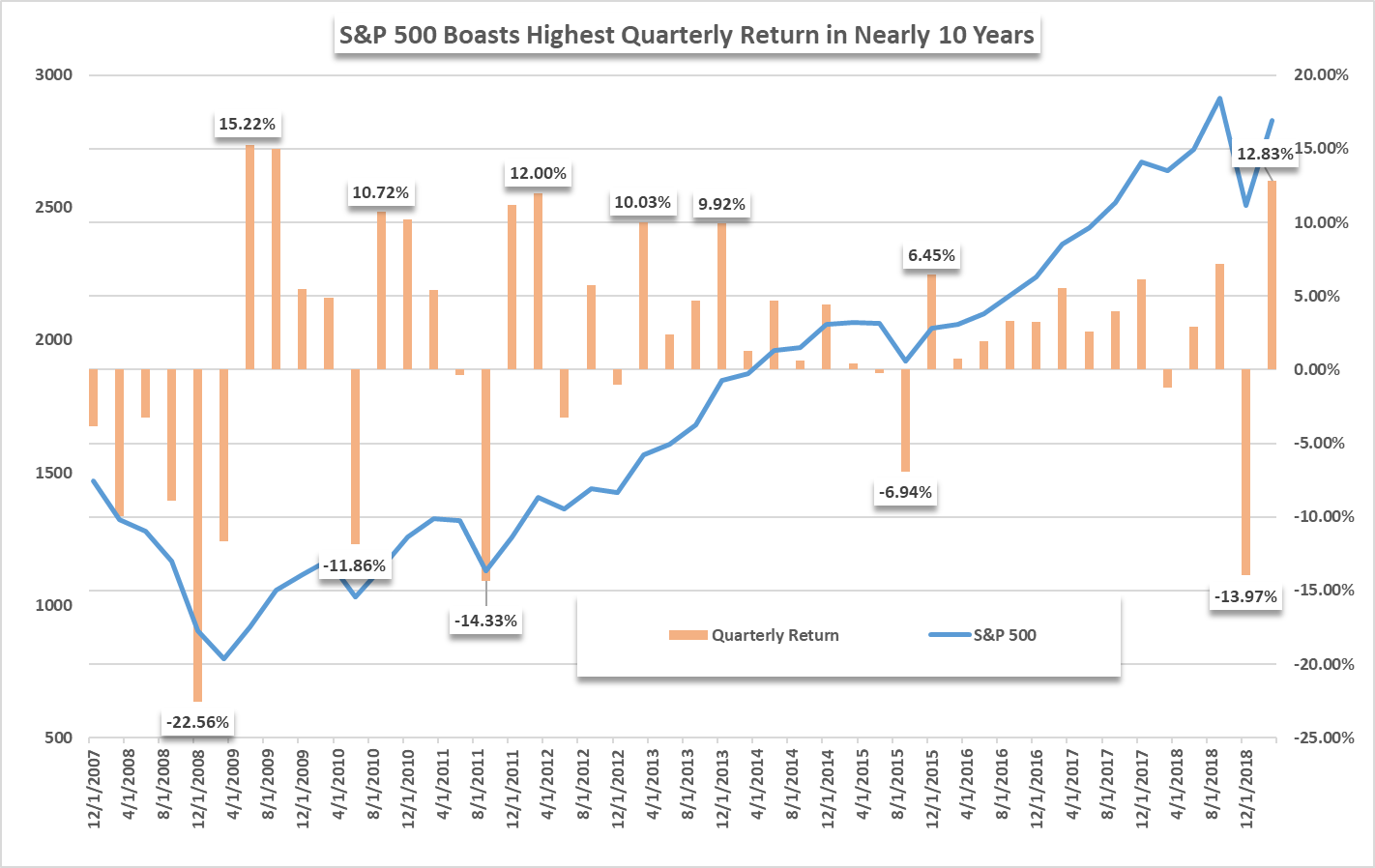

- Philadelphia Semiconductor Index (SOX): The SOX index, a benchmark for the semiconductor sector, showed relatively stable performance, despite the negative investor sentiment.

H3: Identifying Factors Driving Market Growth: Several factors counteracted the negative impact of ETF outflows.

- Strong demand: Sustained strong demand for semiconductors from key sectors such as 5G, artificial intelligence (AI), and the automotive industry fueled market growth.

- Government investment: Significant government investments and incentives aimed at boosting domestic semiconductor production provided a supportive backdrop.

- Supply chain improvements: Easing of supply chain constraints and improvements in semiconductor production capacity contributed to the market's resilience.

H3: Divergence Between ETF Flows and Market Fundamentals: A significant disconnect emerged between short-term investor behavior (evident in ETF outflows) and the robust fundamentals of the semiconductor market. This highlights the limitations of using short-term ETF flows as a sole indicator of market health.

H2: Implications and Future Outlook for Leveraged Semiconductor ETFs

H3: Assessing Risk and Reward: Leveraged ETFs magnify both gains and losses, making them inherently risky. During periods of market volatility, investors can experience substantial losses.

H3: Long-Term Investment Strategies: Investors should adopt a long-term perspective and diversify their portfolios across different asset classes when investing in the semiconductor sector. Consider investing in individual semiconductor stocks or broad market ETFs rather than relying solely on highly leveraged instruments.

H3: Monitoring Key Indicators: Investors should carefully monitor key indicators including industry reports, supply chain dynamics, macroeconomic trends, and overall market sentiment to inform their investment decisions.

3. Conclusion: Interpreting the Relationship Between Leveraged Semiconductor ETF Outflows and Market Growth

This analysis reveals a potential disconnect between short-term investor sentiment (reflected in Leveraged Semiconductor ETF Outflows) and the long-term fundamental strength of the semiconductor market. While outflows indicate a degree of investor apprehension, the continued growth of the sector suggests underlying strength and resilience. The key takeaway is the importance of considering long-term trends and the inherent risks associated with leveraged investing.

Conduct thorough research before investing in the semiconductor sector, paying close attention to leveraged semiconductor ETF outflows and their potential implications. Consult reputable financial news websites, ETF research platforms, and seek professional financial advice to make informed investment decisions. Remember that past performance is not indicative of future results.

Featured Posts

-

Ukraine And Russia A Look At The Changing Dynamics Of Us And European Pressure

May 13, 2025

Ukraine And Russia A Look At The Changing Dynamics Of Us And European Pressure

May 13, 2025 -

The Hobbit The Battle Of The Five Armies A Comprehensive Guide

May 13, 2025

The Hobbit The Battle Of The Five Armies A Comprehensive Guide

May 13, 2025 -

Aryna Sabalenkas Stuttgart Open Win A Photo Controversy

May 13, 2025

Aryna Sabalenkas Stuttgart Open Win A Photo Controversy

May 13, 2025 -

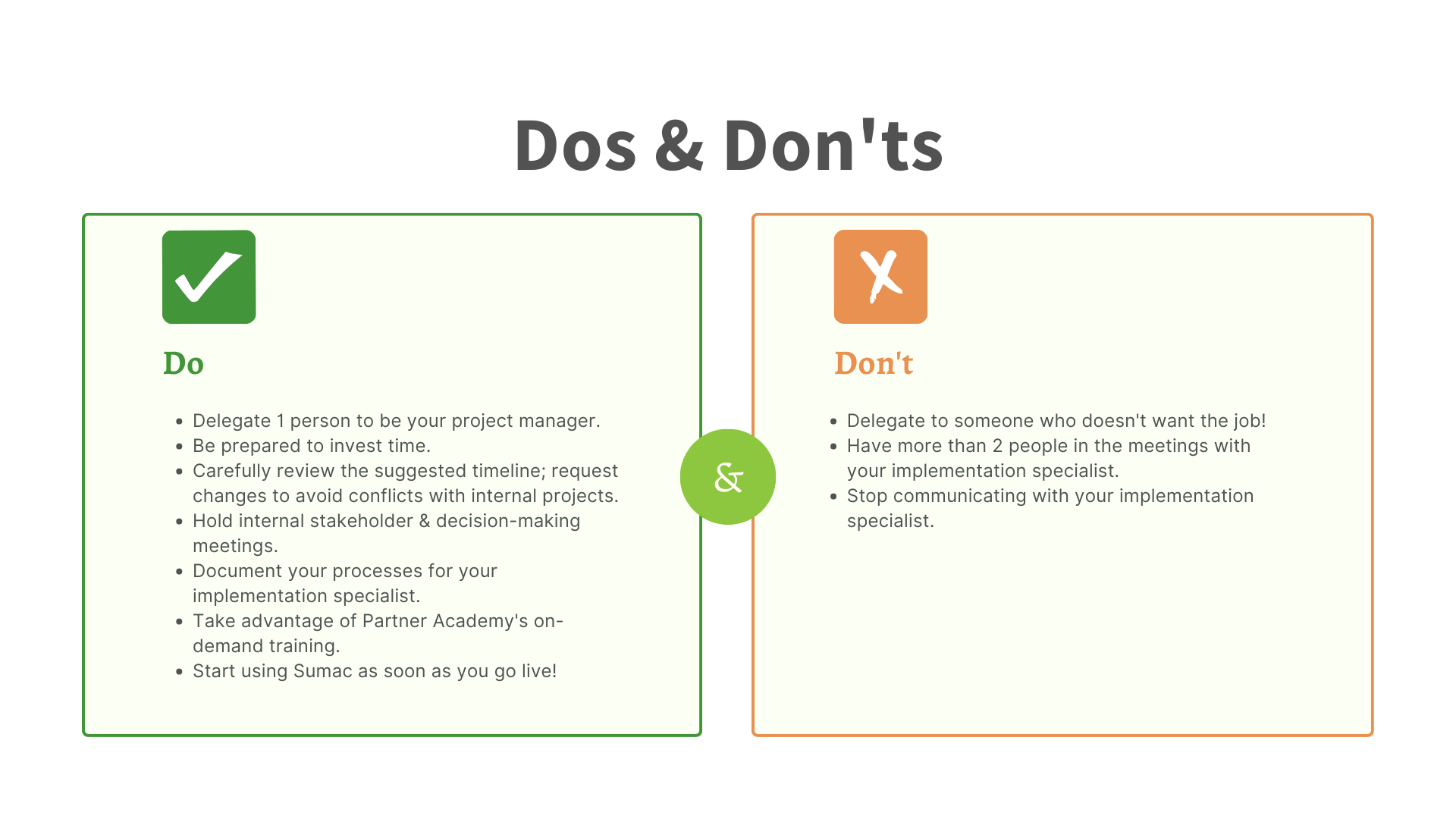

Crack The Code 5 Dos And Don Ts For Private Credit Job Success

May 13, 2025

Crack The Code 5 Dos And Don Ts For Private Credit Job Success

May 13, 2025 -

Elderly Hiker Missing In Peninsula Hills Extensive Search Underway

May 13, 2025

Elderly Hiker Missing In Peninsula Hills Extensive Search Underway

May 13, 2025