Analysis Of Musk's X Debt Sale: Impact On Company Finances

Table of Contents

The Scale and Structure of X's Debt

The acquisition of X saddled the company with a substantial debt burden. Understanding the specifics of this debt is crucial to assessing its impact.

Total Debt Amount and Sources

The exact figures regarding X's total debt are not publicly available in their entirety due to private financing. However, reports suggest billions of dollars in debt were incurred to finance the acquisition. This debt likely encompasses a mix of:

- Bank Loans: Secured loans from various financial institutions.

- High-yield Bonds: Bonds issued to institutional investors, often carrying higher interest rates due to increased risk.

- Equity Financing: While largely leveraged by debt, a degree of equity financing from various sources also likely contributed to the acquisition.

Precise interest rates and the breakdown of each debt type remain largely undisclosed, making comprehensive analysis challenging. This lack of transparency contributes to the uncertainty surrounding Musk's Twitter debt and X debt financing.

Debt Maturity and Repayment Schedule

The repayment schedule for X's debt is a critical factor influencing its financial stability. Key maturity dates, potentially spread over several years, are a significant concern.

- Short-term maturities: The presence of significant short-term debt increases the pressure on X to refinance or repay within a short timeframe. This creates X refinancing risk.

- Interest Rate Sensitivity: Fluctuations in interest rates will directly impact X's debt servicing costs. Rising interest rates increase the X debt burden and could strain profitability.

- Potential Refinancing Challenges: Securing favorable refinancing terms in a volatile economic climate could prove challenging, further complicating debt maturity timelines.

Impact on X's Financial Statements

The massive debt incurred during the acquisition significantly impacts X's financial statements, affecting key ratios and overall financial health.

Debt-to-Equity Ratio and Leverage

The debt sale drastically increased X's debt-to-equity ratio, a crucial indicator of financial leverage. A higher ratio indicates increased financial risk. Comparing this ratio to industry benchmarks provides crucial insights into X's financial leverage and solvency relative to its competitors.

- Pre-acquisition ratio: A low debt-to-equity ratio reflecting a financially sound position.

- Post-acquisition ratio: A significantly increased ratio reflecting substantially heightened financial risk. This necessitates rigorous analysis of its potential long-term effects.

Impact on Profitability and Cash Flow

The significant interest expense associated with X's debt directly reduces its net income, impacting X profitability. The resulting strain on cash flow analysis will become increasingly pronounced unless substantial revenue growth is achieved.

- Projected interest expense: A substantial portion of X's revenue will be dedicated to interest payments.

- Impact on margins: Profit margins will likely be compressed due to increased interest expense.

- Free cash flow: The availability of free cash flow for reinvestment, acquisitions, or debt reduction will be greatly constrained.

Strategic Implications of the Debt Sale

Musk's vision for X and his approach to leveraging debt significantly influence the overall strategic implications.

Musk's Vision for X and Debt Utilization

The large amount of debt suggests aggressive plans for X’s future. Musk's vision likely necessitates significant investments to achieve ambitious goals. The funds may be used for:

- Technological advancements: Investments in new technologies to enhance user experience.

- Content moderation improvements: Addressing long-standing criticisms concerning content moderation.

- Expansion into new markets: Entering new geographical areas and diversifying revenue streams.

- Acquisitions: Potential acquisitions to expand capabilities or reach new markets.

The success of these strategic initiatives and their effect on X's profitability will determine whether the debt was strategically deployed. Crucially, the strategic use of this debt will shape Musk's X strategy.

Potential Risks and Challenges

The high debt level exposes X to considerable financial risks, especially in an uncertain economic climate.

- Debt default risk: The possibility of X failing to meet its debt obligations.

- Interest rate hikes: Increased interest rates would further strain X's financial resources, creating a heavier X debt burden.

- Credit rating downgrades: A downgrade could increase borrowing costs and reduce investor confidence.

Conclusion: Assessing the Long-Term Implications of Musk's X Debt Sale

Musk's X debt sale has profoundly impacted the company's financial position. While the debt provides funding for ambitious growth initiatives, it also introduces significant financial risks. The success of X's future hinges on its ability to generate sufficient revenue to service its debt and achieve profitability. Careful monitoring of X financial ratios and cash flow analysis will be critical in understanding the long-term consequences. To stay informed about the ongoing financial implications of this substantial debt load, it's recommended to follow financial news and X's official statements. For deeper analysis of X's financial restructuring, explore resources specializing in corporate finance and credit analysis. Stay informed about the evolving situation surrounding Musk's X debt sale and its long-term consequences.

Featured Posts

-

Alberta Faces Economic Fallout From Dow Project Delay Due To Tariffs

Apr 28, 2025

Alberta Faces Economic Fallout From Dow Project Delay Due To Tariffs

Apr 28, 2025 -

U S Dollar Weak Start To Presidency Mirrors Nixon Era

Apr 28, 2025

U S Dollar Weak Start To Presidency Mirrors Nixon Era

Apr 28, 2025 -

Yankees 2000 Season A Diary Entry The Royals Game

Apr 28, 2025

Yankees 2000 Season A Diary Entry The Royals Game

Apr 28, 2025 -

U S Dollars Troubled Start Parallels To The Nixon Presidency

Apr 28, 2025

U S Dollars Troubled Start Parallels To The Nixon Presidency

Apr 28, 2025 -

Post Roe America How Otc Birth Control Impacts Access

Apr 28, 2025

Post Roe America How Otc Birth Control Impacts Access

Apr 28, 2025

Latest Posts

-

75

Apr 28, 2025

75

Apr 28, 2025 -

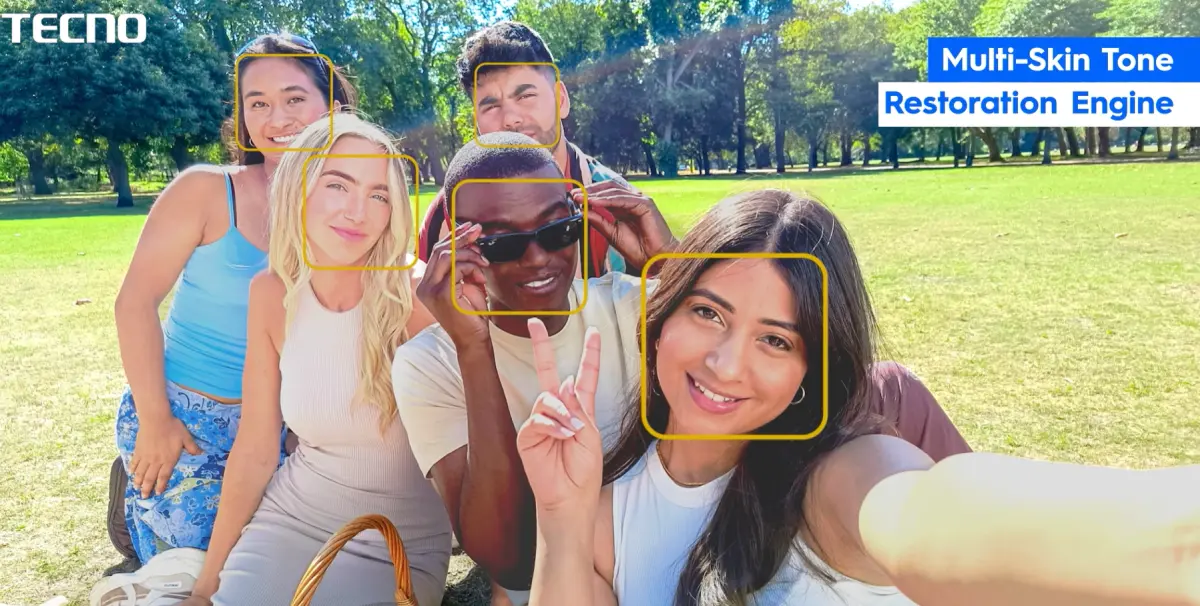

Universal Tone Tecno

Apr 28, 2025

Universal Tone Tecno

Apr 28, 2025 -

Tecno Universal Tone

Apr 28, 2025

Tecno Universal Tone

Apr 28, 2025 -

Boston Red Sox Lineup Modifications For Doubleheaders First Game

Apr 28, 2025

Boston Red Sox Lineup Modifications For Doubleheaders First Game

Apr 28, 2025 -

Red Sox Game 1 Lineup Coras Minor Adjustments

Apr 28, 2025

Red Sox Game 1 Lineup Coras Minor Adjustments

Apr 28, 2025