U.S. Dollar: Weak Start To Presidency Mirrors Nixon Era

Table of Contents

Parallels Between the Current Dollar Weakness and the Nixon Era

The Nixon Shock and its Impact on the U.S. Dollar

The Nixon Shock of 1971, a series of economic measures implemented by President Richard Nixon, dramatically altered the international monetary system and significantly weakened the U.S. dollar. The key event was the closure of the gold window, ending the Bretton Woods system where the dollar was pegged to gold. This action effectively devalued the dollar, allowing its value to fluctuate freely against other currencies. The consequences were profound: inflation soared, international monetary instability reigned, and the world moved towards a system of floating exchange rates. This period of uncertainty and economic upheaval offers valuable insights into the current challenges facing the greenback.

- Devaluation of the dollar: The dollar experienced significant devaluation against major currencies like the German mark and Japanese yen.

- Increased inflation rates: The U.S. experienced a sharp increase in inflation, impacting purchasing power and eroding consumer confidence.

- Uncertainty in international markets: The shift away from a fixed exchange rate system created uncertainty and volatility in global financial markets.

- Shift towards floating exchange rates: The abandonment of the gold standard paved the way for the current floating exchange rate system. This system, while offering flexibility, also introduces greater volatility.

Analyzing Current Factors Contributing to Dollar Weakness

Inflation and Rising Interest Rates

The correlation between inflation, interest rates, and the dollar's value is undeniable. High inflation erodes the purchasing power of the dollar, making it less attractive to foreign investors. To combat inflation, central banks, like the Federal Reserve, typically raise interest rates. Higher interest rates, in theory, attract foreign investment, increasing demand for the dollar and bolstering its value. However, aggressively raising interest rates can also slow economic growth, potentially leading to a recession – a double-edged sword. Comparing current inflation rates (which are significantly higher than those seen in recent decades) to the inflationary spiral of the Nixon era reveals striking similarities. The Federal Reserve's current actions to combat inflation mirror, to some extent, the reactive policies of the 1970s, albeit with different tools and approaches.

- Current inflation rates: Current inflation rates are significantly higher than the average seen in the past several decades, exceeding the Federal Reserve's target rate.

- Federal Reserve policy: The Federal Reserve is aggressively raising interest rates to combat inflation, potentially impacting economic growth and the value of the dollar.

- Impact of global inflation: Global inflationary pressures, exacerbated by factors like the war in Ukraine and supply chain disruptions, are further contributing to dollar weakness.

Geopolitical Uncertainty and Global Economic Slowdown

Geopolitical events significantly influence currency markets. The ongoing war in Ukraine, trade tensions between major economies, and rising political instability contribute to uncertainty in the global economy. This uncertainty reduces investor confidence and can lead to a flight to safety, potentially away from the dollar. Furthermore, concerns about a potential global recession are weighing heavily on the dollar's value. A global slowdown would reduce demand for U.S. goods and services, impacting the dollar's value. This mirrors the uncertainty and economic slowdown that characterized the Nixon era, although the specific geopolitical factors differed.

- Impact of specific geopolitical events: The war in Ukraine and other geopolitical events have created uncertainty, impacting investor confidence and currency markets.

- Global economic outlook: Concerns about a global recession are impacting investor sentiment and putting downward pressure on the dollar.

- Comparison to the 1970s: While the specific geopolitical factors differ, the current level of global uncertainty shares parallels with the 1970s, contributing to dollar volatility.

Potential Future Scenarios for the U.S. Dollar

Short-Term and Long-Term Projections

Predicting the future value of the U.S. dollar is inherently challenging. However, based on current trends and expert opinions, several potential scenarios exist. In the short term, continued inflation and geopolitical uncertainty could lead to further devaluation. However, if the Federal Reserve successfully manages inflation without triggering a severe recession, the dollar could see a partial recovery. Long-term projections are more uncertain, depending heavily on factors such as global economic growth, geopolitical stability, and U.S. economic policies. Policy responses will play a crucial role; whether the government chooses fiscal stimulus or austerity measures will significantly influence the dollar's trajectory.

- Expert opinions: Experts offer diverse views on the future of the dollar, ranging from cautious optimism to predictions of continued weakness.

- Potential policy interventions: Government intervention, through monetary or fiscal policy, could influence the dollar's value but might also introduce unintended consequences.

- Risks and opportunities: A weak dollar can boost exports, but it also makes imports more expensive and can lead to higher inflation.

Conclusion

The current weakness of the U.S. dollar shares striking similarities with its performance during the Nixon era. Both periods are characterized by high inflation, geopolitical uncertainty, and significant economic shifts. Understanding the historical context of U.S. dollar weakness, as exemplified by the Nixon era, is crucial for navigating the current economic landscape. Stay informed about the latest developments impacting the U.S. dollar and its implications for your investments and financial well-being. Continue your research on the U.S. dollar and its future trajectory to make informed decisions.

Featured Posts

-

When Professionals Sold Individuals Bought Understanding Recent Market Shifts

Apr 28, 2025

When Professionals Sold Individuals Bought Understanding Recent Market Shifts

Apr 28, 2025 -

Influential Chef Creates Award Winning Fishermans Stew For Eva Longoria

Apr 28, 2025

Influential Chef Creates Award Winning Fishermans Stew For Eva Longoria

Apr 28, 2025 -

Nixons Shadow A Look At The Current U S Dollars Performance

Apr 28, 2025

Nixons Shadow A Look At The Current U S Dollars Performance

Apr 28, 2025 -

Series Clinching Win For Yankees Thanks To Judge And Goldschmidt

Apr 28, 2025

Series Clinching Win For Yankees Thanks To Judge And Goldschmidt

Apr 28, 2025 -

X Corps Financial Restructuring Insights From Musks Recent Debt Sale

Apr 28, 2025

X Corps Financial Restructuring Insights From Musks Recent Debt Sale

Apr 28, 2025

Latest Posts

-

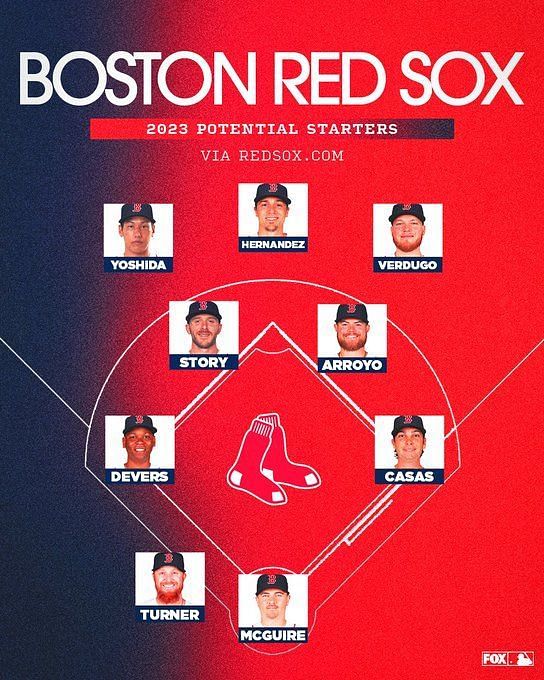

Red Soxs Shifting Lineup Impact Of Outfielders Return And Casas Lowered Spot

Apr 28, 2025

Red Soxs Shifting Lineup Impact Of Outfielders Return And Casas Lowered Spot

Apr 28, 2025 -

Analysis Red Sox Lineup Changes Following Outfielders Return And Casas Demotion

Apr 28, 2025

Analysis Red Sox Lineup Changes Following Outfielders Return And Casas Demotion

Apr 28, 2025 -

Updated Red Sox Lineup Casas Position Change And Outfielders Reinstatement

Apr 28, 2025

Updated Red Sox Lineup Casas Position Change And Outfielders Reinstatement

Apr 28, 2025 -

Red Sox Lineup Outfielder Returns Casas Moves Down In The Order

Apr 28, 2025

Red Sox Lineup Outfielder Returns Casas Moves Down In The Order

Apr 28, 2025 -

Triston Casas Continued Slide Red Sox Lineup Adjustment And Outfielders Return

Apr 28, 2025

Triston Casas Continued Slide Red Sox Lineup Adjustment And Outfielders Return

Apr 28, 2025