Analysis: Point72's Emerging Markets Fund Closure And Trader Departures

Table of Contents

The Closure of Point72's Emerging Markets Fund: A Detailed Look

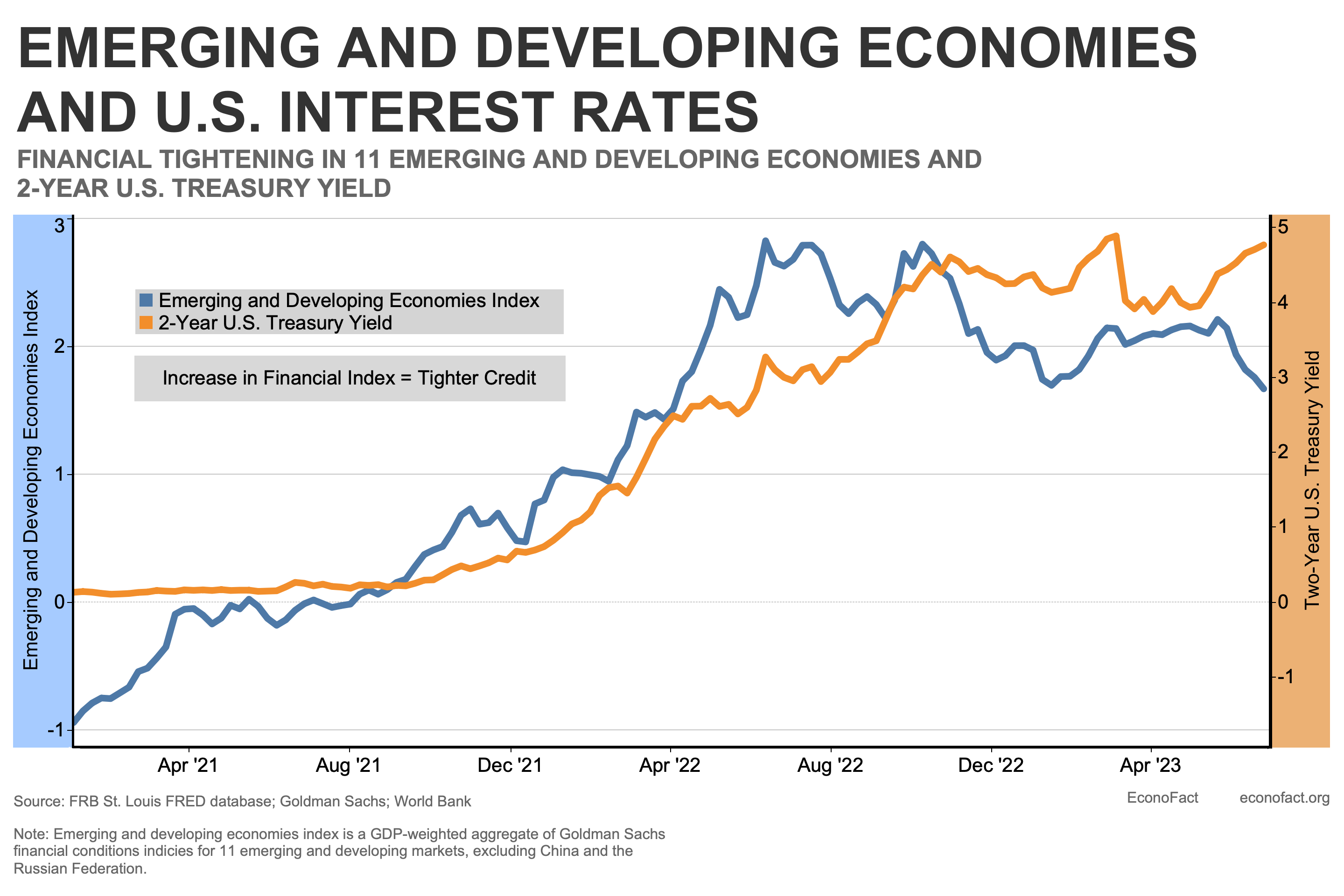

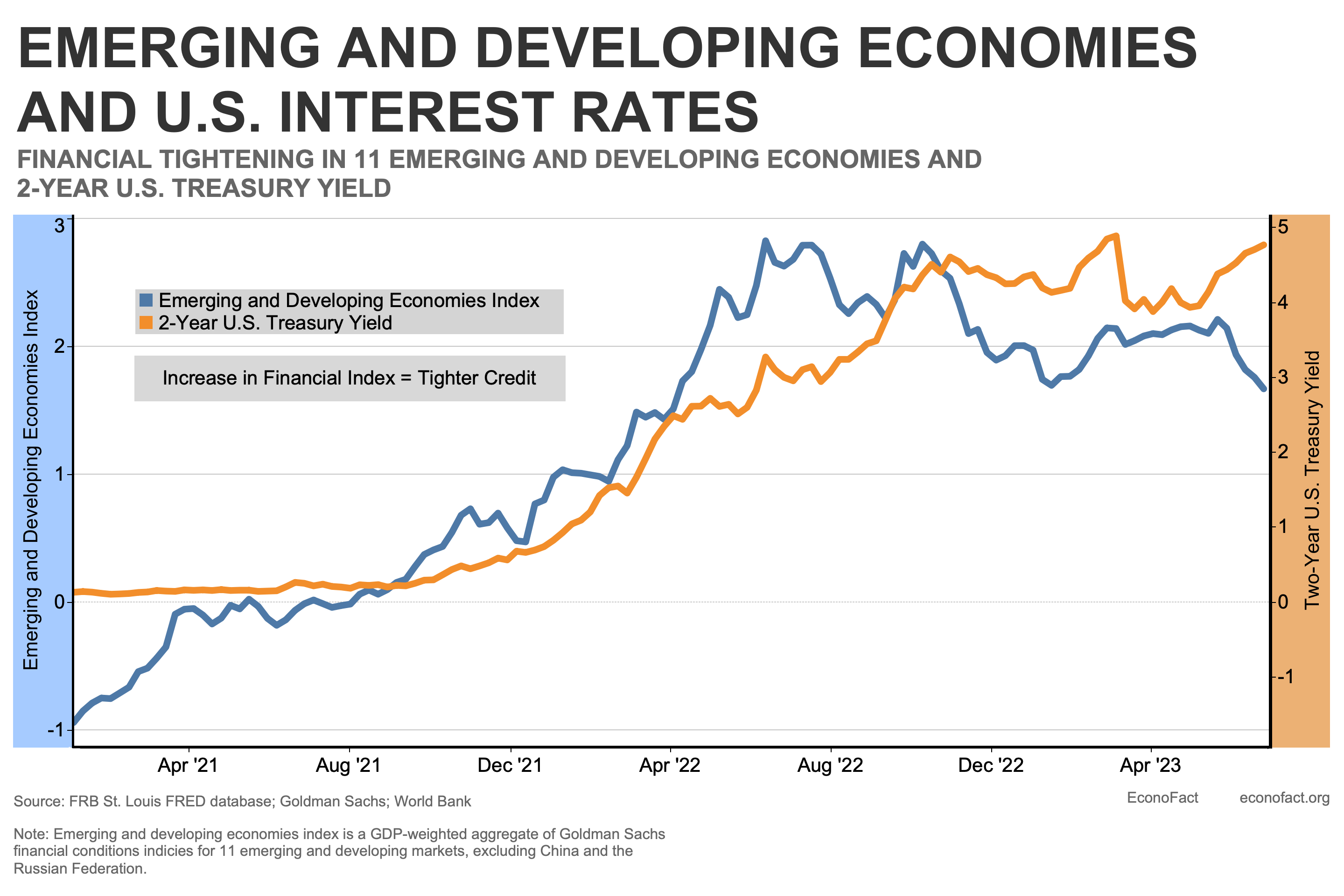

Point72's decision to shutter its emerging markets fund marked a surprising turn of events. While the exact timeline and official statements remain somewhat opaque, the closure followed a period of reportedly underwhelming performance. Although Point72 hasn't publicly disclosed specific figures, industry sources suggest the fund struggled to meet its benchmarks over several quarters.

The fund's performance history, prior to its closure, is crucial to understanding the decision. While early years may have shown promising returns, leveraging opportunities in rapidly developing economies, later periods likely saw significant losses, potentially driven by unforeseen geopolitical events, currency fluctuations, or inaccurate market predictions. Detailed performance data, if publicly available, would provide a clearer picture.

Several potential reasons contribute to the closure of Point72's emerging markets fund:

- Underperformance compared to benchmarks: Consistent failure to meet established performance targets is a major factor in fund closures. The competitive landscape of emerging markets investing demands high returns, and underperformance quickly erodes investor confidence.

- Changes in investment strategy or market outlook: Point72 may have reassessed its overall investment strategy, deciding to reallocate resources to areas perceived as offering better risk-adjusted returns. This shift could reflect a change in the firm's long-term outlook for emerging markets.

- Increased regulatory scrutiny or compliance costs: The regulatory environment for emerging markets investing is complex and often subject to change. Increased compliance costs and the risk of regulatory penalties could have influenced the decision to close the fund.

- Difficulty in attracting and retaining top talent: The loss of key personnel, as detailed in the next section, undoubtedly contributed to the challenges faced by the fund and might have accelerated the decision to close.

Key Trader Departures and Their Significance

Following the closure of the emerging markets fund, several experienced traders left Point72. These departures are significant, representing a loss of institutional knowledge and expertise crucial for navigating the complexities of emerging markets. While Point72 has not publicly named all individuals, reports suggest several portfolio managers and analysts specializing in specific emerging market regions departed.

The reasons behind their departures are likely multifaceted:

- Seeking new opportunities in other firms: The closure of the fund presented these experienced traders with opportunities to join other firms with potentially more favorable strategies or compensation packages.

- Dissatisfaction with the firm's direction or compensation: Internal disagreements regarding investment strategies or compensation structures could have contributed to the exodus.

- Difficulty in navigating the changing landscape of emerging markets: The inherent volatility and complexities of emerging markets necessitate constant adaptation. Disagreements on the optimal approach to risk management or the interpretation of market signals could lead to departures.

The impact of these departures is substantial. The loss of experienced traders represents a significant blow to Point72's ability to effectively manage and analyze investments in emerging markets, affecting their capacity to identify and exploit future opportunities.

Implications for the Hedge Fund Industry and Emerging Markets Investing

Point72's actions carry significant implications for the hedge fund industry and the broader landscape of emerging markets investing. The closure signals potential challenges in generating consistent returns within this asset class, potentially impacting investor confidence. Some might view this as a sign that emerging markets are becoming less attractive for hedge fund investment, at least in their current form.

This event forces a reassessment of investment strategies. Hedge funds may re-evaluate their exposure to emerging markets, potentially diversifying further or increasing their focus on specific, less volatile sectors within those economies. Investors may seek out alternative investment vehicles specializing in specific emerging markets or regions, demonstrating a more nuanced approach to risk management.

The future of emerging market investment within hedge funds remains uncertain. We might see a shift towards more cautious, less aggressive strategies, or a greater emphasis on fundamental analysis and due diligence to mitigate risks. The competitive landscape will inevitably evolve, with some firms potentially gaining market share as others reassess their strategies.

Conclusion: Understanding Point72's Emerging Markets Fund Closure

The closure of Point72's emerging markets fund and the subsequent departures of key traders highlight the challenges inherent in emerging markets investing. Underperformance, strategic shifts, regulatory pressures, and the loss of talent all played a role in this significant event. The implications resonate across the hedge fund industry, prompting a reassessment of investment strategies and potentially impacting investor confidence. Understanding Point72's Emerging Markets Fund Closure provides valuable insights into the evolving dynamics of this complex and dynamic asset class.

To stay informed about further developments regarding Point72's strategic shifts and the wider implications for emerging markets investing, continue following reputable financial news sources and industry analysis. The evolving narrative of Point72's emerging markets strategy will undoubtedly shape the future of hedge fund investments in this crucial sector.

Featured Posts

-

Clash Of Titans An American Battleground With The Worlds Richest

Apr 26, 2025

Clash Of Titans An American Battleground With The Worlds Richest

Apr 26, 2025 -

Investing In The Future Identifying The Countrys Newest Business Hotspots

Apr 26, 2025

Investing In The Future Identifying The Countrys Newest Business Hotspots

Apr 26, 2025 -

Secret Service Closes Investigation Into White House Cocaine Discovery

Apr 26, 2025

Secret Service Closes Investigation Into White House Cocaine Discovery

Apr 26, 2025 -

Wildfire Gambling Examining The Ethics And Implications Of Betting On Natural Disasters

Apr 26, 2025

Wildfire Gambling Examining The Ethics And Implications Of Betting On Natural Disasters

Apr 26, 2025 -

A Conservative Professors Prescription For Harvards Revitalization

Apr 26, 2025

A Conservative Professors Prescription For Harvards Revitalization

Apr 26, 2025