Investing In The Future: Identifying The Country's Newest Business Hotspots

Table of Contents

Analyzing Key Economic Indicators for Emerging Markets

Understanding key economic indicators is paramount when identifying areas with strong investment potential. These metrics provide a snapshot of the overall health and dynamism of a region, offering valuable insights for prospective investors seeking future investments in emerging markets.

-

Examine GDP growth rates: Higher growth signals a dynamic economy ripe with opportunities. A consistently rising GDP indicates strong economic momentum, attracting both domestic and foreign investment. Look for regions with GDP growth significantly above the national average.

-

Analyze unemployment rates: Lower unemployment rates indicate a healthy job market and strong consumer spending. A low unemployment rate signifies a robust economy capable of supporting new businesses and absorbing increased labor demand.

-

Consider inflation: Manageable inflation is positive for investment. While some inflation is expected in a growing economy, excessively high inflation can erode investment returns. Stable, low inflation provides a more predictable environment for business growth.

-

Track Foreign Direct Investment (FDI): High FDI indicates confidence in the market. Significant inflows of FDI suggest that international investors see the region as a promising investment destination, further validating its potential.

-

Assess consumer spending: Robust consumer spending indicates a strong economy. A thriving consumer market provides a solid foundation for businesses to flourish, offering increased opportunities for growth and profitability.

For example, the rapid growth of Silicon Valley was initially fueled by high GDP growth, low unemployment, manageable inflation, and significant FDI, all creating a fertile ground for new business ventures and attracting substantial investments.

Identifying Regions with Thriving Startup Ecosystems

A thriving startup ecosystem is a powerful predictor of future economic growth and attractive investment opportunities. The presence of innovation, entrepreneurial spirit, and supportive infrastructure significantly increases the chances of success for new businesses.

-

Look for areas with numerous incubator programs and accelerators: These programs provide crucial support, mentorship, and resources for startups, fostering innovation and increasing their chances of survival.

-

Investigate the presence of venture capital and angel investors: Access to funding is critical for startups. A strong presence of venture capital firms and angel investors signals a vibrant and supportive investment environment.

-

Assess the level of technological innovation and digital infrastructure: Regions with advanced digital infrastructure and a focus on technological innovation tend to attract tech-focused startups and generate significant economic activity.

-

Examine the overall startup culture and entrepreneurial spirit: A region's culture plays a crucial role. A supportive environment that encourages risk-taking and innovation is more likely to produce successful startups.

-

Research government support initiatives for startups: Government support, in the form of grants, tax breaks, and regulatory assistance, significantly boosts the startup ecosystem.

Consider the success stories emerging from regions like Tel Aviv, known for its robust startup ecosystem, strong venture capital presence, and supportive government policies. These factors contribute significantly to its status as a global business hotspot.

Assessing Infrastructure and Access to Resources

Robust infrastructure is crucial for supporting business growth and attracting investment. Efficient transportation networks, reliable utilities, and access to skilled labor are all key components of a successful business environment.

-

Analyze transportation networks (roads, railways, ports, airports): Efficient transportation is vital for the movement of goods and people, directly impacting business efficiency and logistics costs.

-

Evaluate the reliability of utilities (electricity, water, internet): Consistent and reliable access to essential utilities is non-negotiable for businesses to operate smoothly.

-

Assess the availability of skilled labor and talent pools: Access to a skilled workforce is crucial for attracting businesses and supporting their growth.

-

Determine access to funding and financial resources: Easy access to capital is essential for startups and established businesses alike.

-

Examine the availability of necessary raw materials: For many industries, the availability of raw materials within a region is a significant factor determining its suitability for business development.

Underdeveloped infrastructure can significantly hinder economic growth. Regions with strong infrastructure tend to attract more investment and create more job opportunities, further fueling economic expansion.

Understanding Regulatory Environments and Government Policies

Government policies and regulations play a significant role in shaping the business environment. Business-friendly regulations, tax incentives, and government support can attract investment and stimulate economic activity.

-

Research business-friendly regulations and ease of starting a business: Simplified regulatory processes and clear guidelines make it easier for entrepreneurs to establish and operate businesses.

-

Investigate available tax incentives and government grants: Financial incentives offered by governments can significantly reduce the cost of doing business and stimulate investment.

-

Assess government support for specific industries: Government initiatives targeting specific sectors can foster growth and create specialized clusters.

-

Consider the overall stability and predictability of the political environment: Political stability and predictable regulations are essential for attracting long-term investments.

For instance, countries with favorable tax policies and streamlined regulatory processes often attract significantly more foreign direct investment than those with complex and burdensome regulations.

Conclusion

Identifying the country's newest business hotspots requires a multifaceted approach, incorporating economic indicators, startup ecosystem analysis, infrastructure assessment, and regulatory environment review. By carefully evaluating these factors, investors can significantly increase their chances of successful investments and participation in the country's economic future. Understanding these key elements allows for informed decision-making, minimizing risk, and maximizing returns. Start exploring the exciting investment opportunities in these emerging business hotspots today! Don't miss out on the chance to be a part of the next wave of economic growth. Begin your research into the country's newest business hotspots now and secure your future investments wisely.

Featured Posts

-

Chat Gpt Creator Open Ai Under Ftc Investigation

Apr 26, 2025

Chat Gpt Creator Open Ai Under Ftc Investigation

Apr 26, 2025 -

Karen Read A Chronological Overview Of Legal Proceedings

Apr 26, 2025

Karen Read A Chronological Overview Of Legal Proceedings

Apr 26, 2025 -

Anchor Brewing Company Closes After 127 Years The End Of An Era

Apr 26, 2025

Anchor Brewing Company Closes After 127 Years The End Of An Era

Apr 26, 2025 -

American Battleground The Ultimate Fight For Influence

Apr 26, 2025

American Battleground The Ultimate Fight For Influence

Apr 26, 2025 -

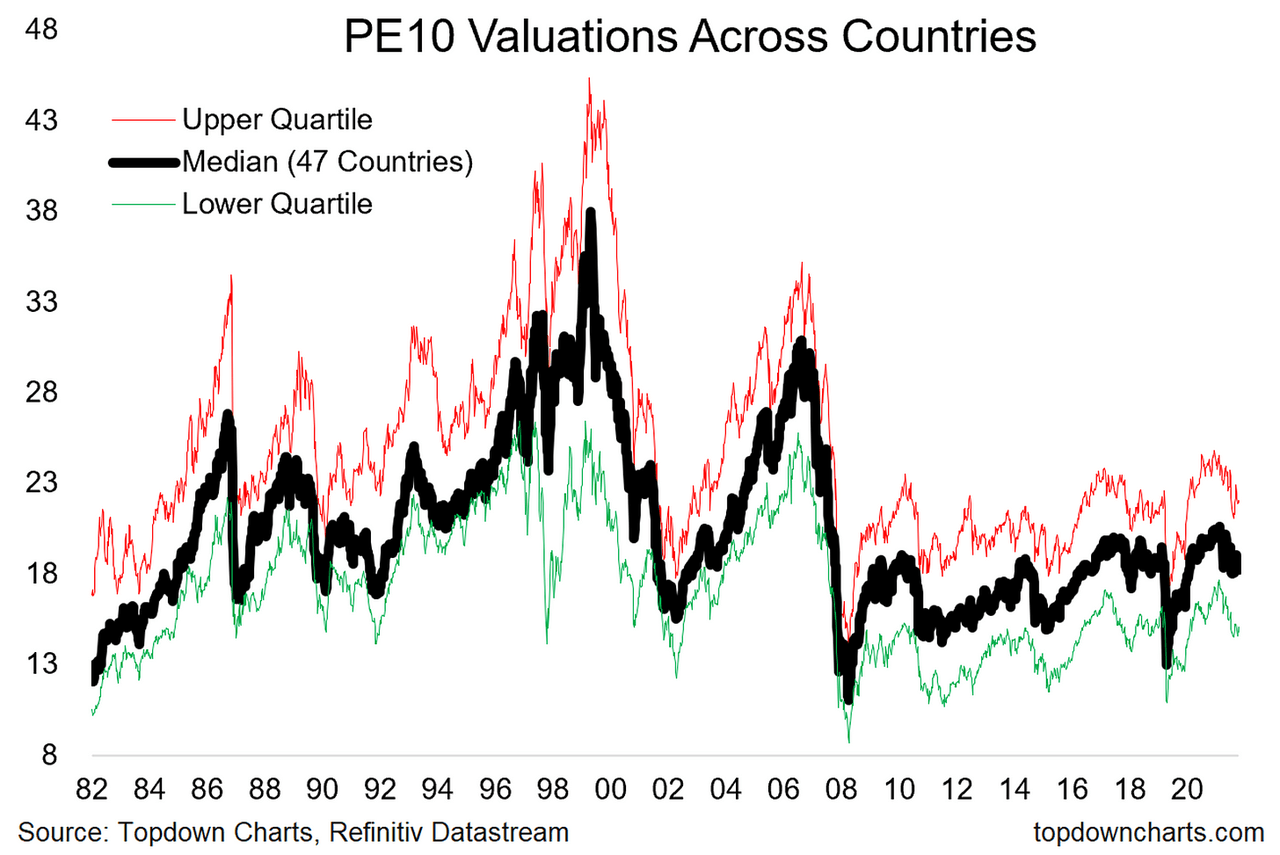

Why Investors Shouldnt Fear High Stock Market Valuations A Bof A Perspective

Apr 26, 2025

Why Investors Shouldnt Fear High Stock Market Valuations A Bof A Perspective

Apr 26, 2025