Analyzing Ripple's (XRP) Potential: Can It Break Through To $3.40?

Table of Contents

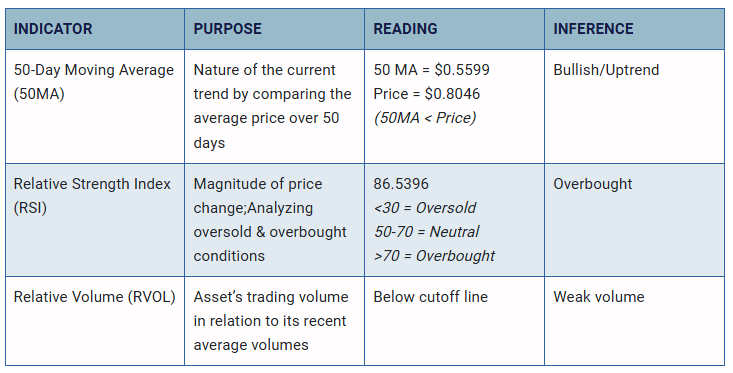

Analyzing XRP's Current Market Position

XRP, Ripple's native cryptocurrency, operates within a complex and dynamic ecosystem. Understanding its current market standing is crucial to predicting its future price trajectory.

Market Capitalization and Trading Volume: Currently, XRP holds a significant position within the cryptocurrency market, though its market capitalization fluctuates considerably. Comparing its market cap and 24-hour trading volume to giants like Bitcoin (BTC) and Ethereum (ETH) provides valuable context.

- Comparison to BTC and ETH: XRP's market cap is generally smaller than BTC and ETH, indicating a lower overall market valuation. However, its trading volume often demonstrates significant activity, particularly on exchanges like Binance, Coinbase, and Kraken.

- Significant Trends: Monitoring trends in XRP trading volume can reveal shifts in investor sentiment and market demand. A sustained increase in trading volume could signal growing interest and potentially drive price appreciation.

- High XRP Trading Volume Exchanges: Focusing on exchanges with high XRP trading volumes helps gauge market liquidity and potential price volatility.

Adoption by Financial Institutions: Ripple's success hinges on the adoption of its technology, RippleNet, by financial institutions. Progress in this area is a crucial indicator of XRP's long-term potential.

- Key Partnerships: Ripple boasts partnerships with several major banks and payment providers globally, enabling cross-border transactions. These partnerships are vital for driving XRP adoption and demand.

- Successful Use Cases: Real-world use cases of RippleNet demonstrate the practicality and efficiency of XRP in facilitating fast and cost-effective international payments. The more successful implementations, the stronger the case for XRP adoption.

- Limitations and Challenges: Challenges remain, including regulatory hurdles and the need for wider acceptance among financial institutions. Addressing these challenges is critical for XRP's future growth.

Regulatory Landscape and Legal Battles: The ongoing legal battle between Ripple and the SEC significantly impacts XRP's price and overall outlook.

- Key Arguments in the Case: The SEC alleges that XRP is an unregistered security, while Ripple maintains that it is a utility token. The outcome of this case holds significant implications for XRP's future.

- Potential Outcomes and Impact on XRP Price: A favorable ruling could significantly boost XRP's price, while an unfavorable outcome could lead to a sharp decline.

- Positive Developments: Any positive developments in the case, such as favorable court rulings or settlements, will have a positive effect on investor confidence and XRP’s price.

Factors Contributing to Potential Price Increase

Several factors could contribute to a potential surge in XRP's price, driving it towards $3.40 or higher.

Increased Institutional Adoption: Wider adoption by institutional investors could significantly boost demand.

- Potential Future Partnerships: Future partnerships with major financial institutions could increase legitimacy and propel XRP's price.

- Impact of Increased Institutional Investment: Large-scale institutional investment often leads to increased price stability and higher valuations.

Technological Advancements and Scalability: Improvements to Ripple's technology enhance its appeal and potential for wider adoption.

- Features Like Speed and Low Transaction Fees: XRP boasts fast transaction speeds and low fees, making it attractive for cross-border payments.

- Potential Future Developments: Continuous technological advancements and upgrades to RippleNet could further improve its efficiency and scalability.

Growing Demand for Cross-Border Payments: The increasing need for efficient and cost-effective cross-border payments presents a significant opportunity for XRP.

- Market Trends and XRP's Role: The global demand for efficient cross-border payment solutions is constantly growing, creating a favorable environment for XRP's adoption.

- Potential Competitors and XRP's Competitive Advantage: While XRP faces competition from other cryptocurrencies and payment solutions, its speed, low cost, and established partnerships provide a competitive edge.

Challenges and Risks to Reaching $3.40

Despite the potential for growth, significant challenges and risks could hinder XRP's journey to $3.40.

SEC Lawsuit and Regulatory Uncertainty: The ongoing legal battle with the SEC creates uncertainty and poses a substantial risk to XRP's price.

- Worst-Case Scenarios and Impact on Price: An unfavorable ruling could severely impact XRP’s price and investor confidence.

- Uncertainty and its Effect on Investor Sentiment: Regulatory uncertainty can deter investors and lead to price volatility.

Market Volatility and Crypto Market Sentiment: The cryptocurrency market is inherently volatile, influenced by various factors.

- Potential Macroeconomic Factors: Global economic events and market sentiment can significantly influence cryptocurrency prices.

- Correlation Between Bitcoin's Price and XRP's Price: XRP's price is often correlated with Bitcoin's price, meaning that a downturn in Bitcoin could negatively impact XRP.

Competition from Other Cryptocurrencies: XRP faces competition from other cryptocurrencies offering similar functionalities.

- Key Competitors and Their Advantages and Disadvantages: Understanding the competitive landscape is crucial for assessing XRP's long-term prospects.

XRP's Path to $3.40 – A Realistic Assessment?

Reaching $3.40 for XRP is a significant goal, contingent upon a confluence of favorable factors. While the potential for increased institutional adoption, technological advancements, and growing demand for cross-border payments exists, the ongoing SEC lawsuit and inherent market volatility pose considerable challenges. A balanced perspective is essential; optimism must be tempered with realism regarding the risks involved.

Conduct your own thorough research on Ripple (XRP) before making any investment decisions. Learn more about Ripple (XRP) and its potential, and stay informed about the latest developments in the Ripple (XRP) ecosystem. Remember that cryptocurrency investments are inherently risky, and past performance is not indicative of future results.

Featured Posts

-

Kripto Varlik Piyasasinda Yeni Bir Doenem Spk Nin Getirdigi Duezenlemeler

May 08, 2025

Kripto Varlik Piyasasinda Yeni Bir Doenem Spk Nin Getirdigi Duezenlemeler

May 08, 2025 -

Is This Cryptocurrency Immune To Trade War Effects

May 08, 2025

Is This Cryptocurrency Immune To Trade War Effects

May 08, 2025 -

Could Xrp Reach 5 In 2025 A Realistic Analysis

May 08, 2025

Could Xrp Reach 5 In 2025 A Realistic Analysis

May 08, 2025 -

Unscripted Moments In Saving Private Ryan Impact And Legacy

May 08, 2025

Unscripted Moments In Saving Private Ryan Impact And Legacy

May 08, 2025 -

Debate Reignites Has Saving Private Ryan Been Overtaken As The Best War Film

May 08, 2025

Debate Reignites Has Saving Private Ryan Been Overtaken As The Best War Film

May 08, 2025

Latest Posts

-

Aj Aym Aym Ealm Ky 12 Wyn Brsy Pakstan Bhr Myn Khraj Eqydt

May 08, 2025

Aj Aym Aym Ealm Ky 12 Wyn Brsy Pakstan Bhr Myn Khraj Eqydt

May 08, 2025 -

2025 Ptt Personel Alim Tarihleri Kpss Li Ve Kpss Siz Pozisyonlar

May 08, 2025

2025 Ptt Personel Alim Tarihleri Kpss Li Ve Kpss Siz Pozisyonlar

May 08, 2025 -

Qwmy Hyrw Aym Aym Ealm Ky 12 Wyn Brsy Yadgar Tqaryb Ka Aneqad

May 08, 2025

Qwmy Hyrw Aym Aym Ealm Ky 12 Wyn Brsy Yadgar Tqaryb Ka Aneqad

May 08, 2025 -

Postane Alimlari 2025 Kpss Ile Personel Secimi Ve Basvuru Tarihleri

May 08, 2025

Postane Alimlari 2025 Kpss Ile Personel Secimi Ve Basvuru Tarihleri

May 08, 2025 -

Ptt Personel Alimi 2025 Basvuru Tarihleri Ve Kpss Sartlari

May 08, 2025

Ptt Personel Alimi 2025 Basvuru Tarihleri Ve Kpss Sartlari

May 08, 2025