Analyzing The Costs Of Trump's Economic Goals

Table of Contents

The Impact of Tax Cuts on the National Debt

The 2017 Tax Cuts and Jobs Act, a cornerstone of Trump's economic agenda, significantly lowered both corporate and individual income tax rates. While proponents argued this would stimulate economic growth through increased investment and job creation, critics warned of its potential to exacerbate the national debt. The Act reduced the top corporate tax rate from 35% to 21% and adjusted individual tax brackets, resulting in substantial tax cuts for many Americans.

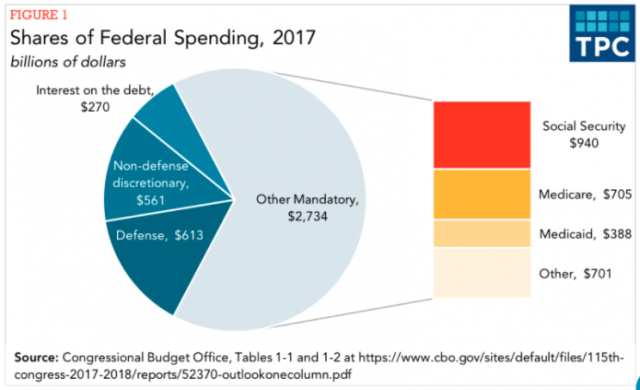

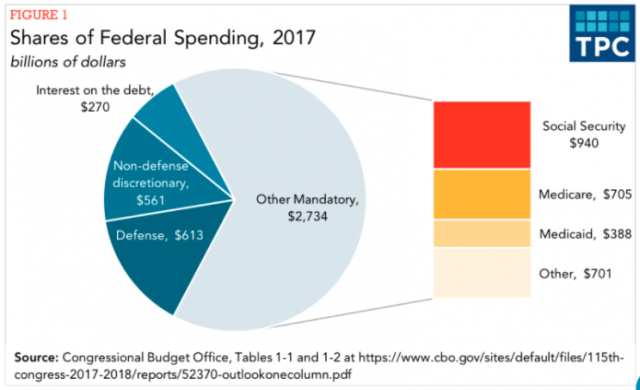

Analyzing the effect on the national debt reveals a stark increase following the implementation of these tax cuts. Charts and graphs illustrating this rise are readily available from sources like the Congressional Budget Office (CBO) and the Treasury Department. The resulting increased budget deficits represent a substantial cost, raising concerns about long-term fiscal sustainability.

- Increased budget deficits: The tax cuts led to a significant widening of the federal budget deficit, adding trillions to the national debt.

- Long-term implications for future generations: The increased debt burden will likely necessitate future tax increases or spending cuts, impacting future generations.

- Arguments for and against the tax cuts' effectiveness in stimulating economic growth: While some argue the tax cuts fueled economic growth, others maintain that the stimulus was minimal compared to the debt incurred. Empirical evidence on this point remains contested.

Related Keywords: Trump tax cuts, national debt, fiscal policy, budget deficit, economic stimulus, tax reform.

The Economic Costs of Trump's Trade Wars

The Trump administration initiated several high-profile trade disputes, most notably with China, Mexico, and the European Union. These "trade wars," characterized by the imposition of tariffs on imported goods, aimed to protect American industries and reduce trade deficits. However, the economic costs were substantial.

The impact on American businesses and consumers was largely negative. Increased tariffs on imported goods led to higher prices for consumers, while retaliatory tariffs from other countries harmed American exporters, particularly in agriculture. Supply chains were disrupted, leading to production delays and increased costs for businesses.

- Increased prices for imported goods: Tariffs directly increased the cost of many imported goods, impacting consumers' purchasing power.

- Damage to US agricultural exports: Retaliatory tariffs from other countries significantly reduced demand for US agricultural products.

- Job losses in certain sectors: Some sectors heavily reliant on international trade experienced job losses due to reduced exports and increased import costs.

- Negative impacts on global trade relations: The trade wars strained relationships with key trading partners, creating uncertainty and undermining global economic cooperation.

Related Keywords: Trump trade wars, tariffs, trade deficits, protectionism, globalization, trade disputes.

Deregulation and its Economic Consequences

The Trump administration pursued a significant deregulation agenda, affecting various sectors including environmental protection, financial regulation, and labor laws. While proponents argued that deregulation stimulates economic activity by reducing burdens on businesses, critics warned of potential long-term economic risks.

The potential long-term economic risks associated with this deregulation are significant. Relaxed environmental regulations could lead to increased pollution and environmental damage, imposing long-term costs on society and public health. Reduced financial regulation may increase the risk of future financial crises, while weakened labor laws could lead to worker exploitation and increased inequality.

- Environmental damage and its economic costs: Reduced environmental protections can result in increased pollution, climate change impacts, and associated economic costs.

- Increased risk of financial crises: Less stringent financial regulations may increase systemic risk and the likelihood of another financial crisis.

- Impact on worker safety and wages: Weakened labor laws could lead to unsafe working conditions and suppressed wages for workers.

- Potential for increased inequality: Deregulation can exacerbate income inequality by disproportionately benefiting large corporations and wealthy individuals.

Related Keywords: Deregulation, environmental protection, financial regulation, labor laws, economic risk, environmental costs.

The Unintended Consequences of Trump's Economic Policies

Analyzing the costs of Trump's economic goals also requires considering the unintended consequences – unforeseen challenges and complexities that emerged during and after the implementation of these policies. Some of these unforeseen impacts include shifting global economic power dynamics, increased political polarization, and long-term implications for infrastructure and investments.

The long-term economic sustainability of the Trump administration's approach is a key question. The trade wars, for example, altered global trade relationships in unpredictable ways, with long-term consequences still unfolding. The level of political polarization during this period also played a significant role, influencing economic policy decisions and potentially hindering long-term economic planning and infrastructure development.

- Shifting global economic power dynamics: The trade wars contributed to a shift in global economic power, potentially undermining US economic influence.

- Increased political polarization and its economic effects: The highly divisive political climate hampered effective economic policymaking and long-term planning.

- Long-term impact on infrastructure and investments: The focus on tax cuts may have diverted resources from crucial investments in infrastructure and human capital.

Related Keywords: Economic sustainability, global economy, long-term economic impact, political economy, unintended consequences.

Conclusion: A Critical Assessment of Trump's Economic Legacy

In conclusion, analyzing the costs of Trump's economic goals reveals a mixed legacy. While certain policies may have yielded short-term benefits, the long-term costs associated with increased national debt, trade wars, and deregulation raise serious concerns about economic sustainability and future prosperity. The unintended consequences further complicate the picture, highlighting the complexities of large-scale economic policy interventions. To gain a more comprehensive understanding of the long-term implications of these policies, further research into the areas discussed above is recommended, focusing on the detailed impacts of specific policies and their long-term effects on different sectors of the US economy.

Featured Posts

-

How Trumps Trade Actions Jeopardized Americas Financial Hegemony

Apr 22, 2025

How Trumps Trade Actions Jeopardized Americas Financial Hegemony

Apr 22, 2025 -

Lab Owners Guilty Plea Faking Covid Test Results During Pandemic

Apr 22, 2025

Lab Owners Guilty Plea Faking Covid Test Results During Pandemic

Apr 22, 2025 -

Rallying Against Trump Protester Sentiment Across The Us

Apr 22, 2025

Rallying Against Trump Protester Sentiment Across The Us

Apr 22, 2025 -

Why Robots Struggle To Create Nike Shoes Technological Hurdles

Apr 22, 2025

Why Robots Struggle To Create Nike Shoes Technological Hurdles

Apr 22, 2025 -

Statement On The Passing Of Pope Francis At 88

Apr 22, 2025

Statement On The Passing Of Pope Francis At 88

Apr 22, 2025