Analyzing The Federal Reserve's Next Move: Interest Rate Outlook Uncertain

Table of Contents

Inflation's Persistent Grip

Core Inflation Remains Elevated

Core inflation, which excludes volatile food and energy prices, remains a significant concern for the Federal Reserve. This persistent upward pressure on prices indicates that inflationary pressures are deeply embedded in the economy, posing a challenge to the Fed's efforts to bring inflation down to its 2% target.

- CPI (Consumer Price Index): While headline inflation may show some moderation, the core CPI remains elevated, signaling underlying inflationary pressures.

- PCE (Personal Consumption Expenditures): The Fed closely monitors the PCE index, which is its preferred inflation measure. Sustained increases in PCE indicate persistent inflation.

- Fed's Inflation Target: The Fed's 2% inflation target remains elusive, underscoring the need for continued monetary policy tightening.

The persistence of core inflation highlights the complexity of the current situation. Simply lowering energy prices won't solve the underlying problem of broad-based price increases. The Fed needs to address these deeper inflationary pressures to achieve its mandate of price stability.

Wage Growth and its Impact

Strong wage growth, while positive for workers, also contributes to inflationary pressures. When wages rise faster than productivity, businesses often pass these increased costs onto consumers in the form of higher prices, potentially creating a wage-price spiral.

- Wage growth statistics: Recent data shows a significant increase in average hourly earnings, exceeding the pace of productivity growth.

- Relationship between wage growth and inflation: The correlation between robust wage growth and inflation is a key concern for the Fed.

- Wage-price spiral: The Fed is actively trying to avoid a self-reinforcing cycle where rising wages lead to higher prices, further fueling wage demands.

The Fed's challenge is to cool down wage growth without triggering a significant increase in unemployment. This delicate balancing act is a key factor in determining the future path of interest rates.

Economic Growth Slowdown and Recession Risks

GDP Growth and its Uncertain Trajectory

Recent GDP figures indicate a slowdown in economic growth, raising concerns about the possibility of a recession. While the economy has shown some resilience, several indicators suggest a weakening outlook.

- Recent GDP figures: Quarterly GDP growth has slowed considerably, raising concerns about the future trajectory of economic expansion.

- Projections for future growth: Forecasts for future GDP growth vary widely, reflecting the uncertainty surrounding the economic outlook.

- Consumer spending and business investment: A decline in consumer confidence and reduced business investment could further dampen economic growth.

Predicting recessions is notoriously difficult, and the current situation is marked by considerable uncertainty. The Fed's policy decisions will significantly impact the likelihood and severity of a potential recession.

Labor Market Dynamics

Despite the slowing economic growth, the labor market remains relatively strong, with unemployment rates near historic lows and a high number of job openings. This strength presents a mixed signal for the Fed.

- Unemployment rates: Low unemployment rates indicate a healthy labor market, but also contribute to wage pressures.

- Job creation figures: While job creation has slowed, it remains positive, suggesting a resilient labor market.

- Impact of interest rate hikes on employment: Further interest rate hikes could lead to job losses and increased unemployment, potentially dampening economic growth.

The Fed's dual mandate – price stability and maximum employment – requires careful consideration of these competing factors. Balancing the need to curb inflation with the risk of triggering a recession is a central challenge.

The Fed's Policy Tools and Their Limitations

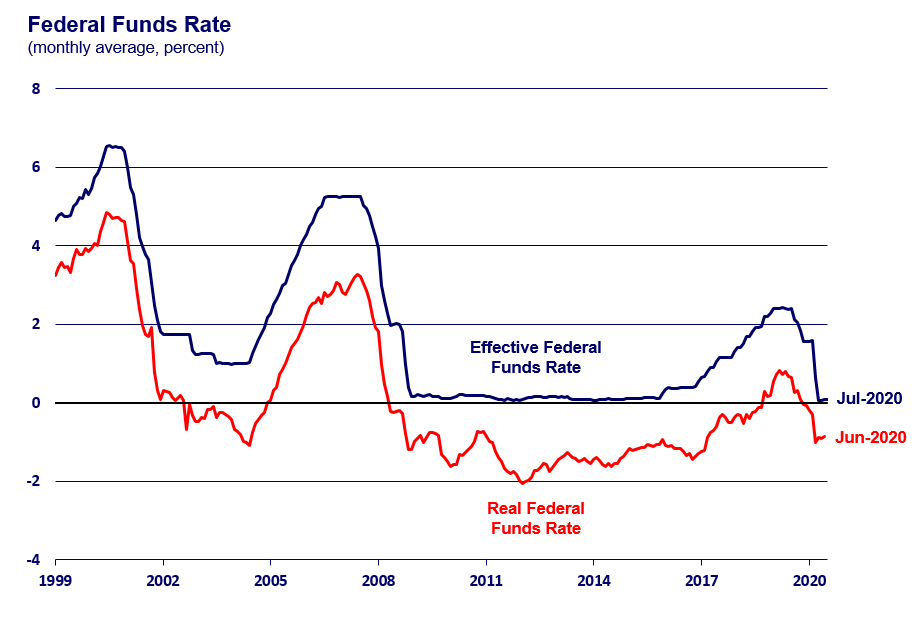

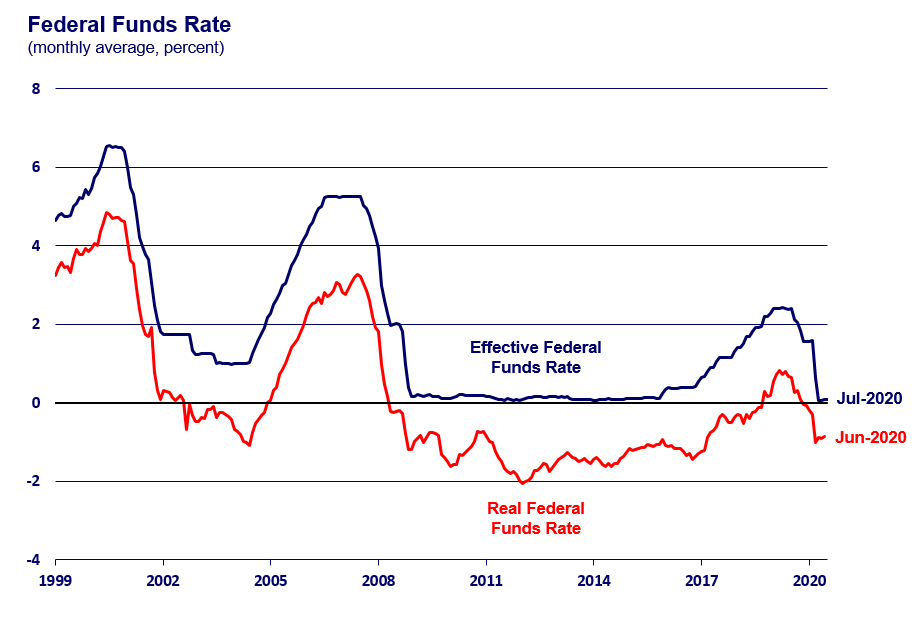

Federal Funds Rate Adjustments

The Federal Funds rate is the primary tool the Fed uses to influence interest rates throughout the economy. Further increases or pauses in the Fed Funds rate will significantly shape the future economic trajectory.

- Current Fed Funds rate: The current Fed Funds rate reflects past rate hikes and indicates the current stance of monetary policy.

- Potential future rate hikes: The possibility of further rate hikes depends on the evolving economic data and the Fed's assessment of inflation and growth.

- Impact on borrowing costs: Changes in the Fed Funds rate directly impact borrowing costs for consumers and businesses, influencing investment and spending decisions.

The Fed's decisions regarding the Fed Funds rate are closely watched by financial markets worldwide, impacting everything from mortgage rates to corporate borrowing costs.

Quantitative Tightening and its Effects

Quantitative tightening (QT) involves reducing the Fed's balance sheet by allowing Treasury securities and agency mortgage-backed securities to mature without replacement. This reduces the money supply and aims to curb inflation.

- QT and its role in reducing the money supply: QT helps remove excess liquidity from the financial system, putting downward pressure on inflation.

- Impact on bond yields and market liquidity: QT can increase bond yields and potentially reduce market liquidity.

- Potential risks and benefits associated with QT: While QT can help control inflation, it also carries risks of disrupting financial markets and slowing economic growth.

The Fed's approach to QT, including the pace and scale of reductions, will be crucial in determining its overall impact on the economy.

Conclusion

The Federal Reserve's next move regarding interest rates remains shrouded in uncertainty, contingent on evolving economic data and the interplay of inflation, economic growth, and labor market conditions. The Fed’s balancing act between curbing inflation and avoiding a recession requires careful consideration of its policy tools, including the Federal Funds rate and quantitative tightening. While predicting the future is inherently difficult, understanding the factors influencing the Fed's decision-making is crucial for investors and businesses alike. Stay informed on the latest developments surrounding the Federal Reserve's interest rate outlook to make informed decisions about your financial strategy. Continuously monitoring the economic indicators and the Fed's communications is key to navigating this period of uncertainty. Understanding the nuances of monetary policy and the Federal Reserve's actions is essential for effectively managing financial risk in this volatile environment.

Featured Posts

-

Inters Champions League Win A Shock Defeat For Bayern Munich

May 09, 2025

Inters Champions League Win A Shock Defeat For Bayern Munich

May 09, 2025 -

Proposed Changes To Bond Forward Rules For Indian Insurers

May 09, 2025

Proposed Changes To Bond Forward Rules For Indian Insurers

May 09, 2025 -

Stephen Kings 2024 Movie Slate The Monkey And Two Even More Promising Films

May 09, 2025

Stephen Kings 2024 Movie Slate The Monkey And Two Even More Promising Films

May 09, 2025 -

Indian Stock Market Soars 5 Key Factors Behind Sensex And Nifty Gains

May 09, 2025

Indian Stock Market Soars 5 Key Factors Behind Sensex And Nifty Gains

May 09, 2025 -

Is Palantir Stock A Buy After Its 30 Decline

May 09, 2025

Is Palantir Stock A Buy After Its 30 Decline

May 09, 2025

Latest Posts

-

Bbc Strictly Come Dancing Wynne Evans Clarifies Return Rumours

May 09, 2025

Bbc Strictly Come Dancing Wynne Evans Clarifies Return Rumours

May 09, 2025 -

Maldives Vacation Elizabeth Hurleys Bikini Style

May 09, 2025

Maldives Vacation Elizabeth Hurleys Bikini Style

May 09, 2025 -

Wynne Evans A Post Strictly Come Dancing Career Announcement

May 09, 2025

Wynne Evans A Post Strictly Come Dancing Career Announcement

May 09, 2025 -

Elizabeth Hurley Rocks Bikinis On Luxurious Maldives Holiday

May 09, 2025

Elizabeth Hurley Rocks Bikinis On Luxurious Maldives Holiday

May 09, 2025 -

Strictly Come Dancing Wynne Evans Addresses Return Speculation

May 09, 2025

Strictly Come Dancing Wynne Evans Addresses Return Speculation

May 09, 2025