Is Palantir Stock A Buy After Its 30% Decline?

Table of Contents

Analyzing Palantir's Recent Stock Performance

The Causes of the 30% Decline

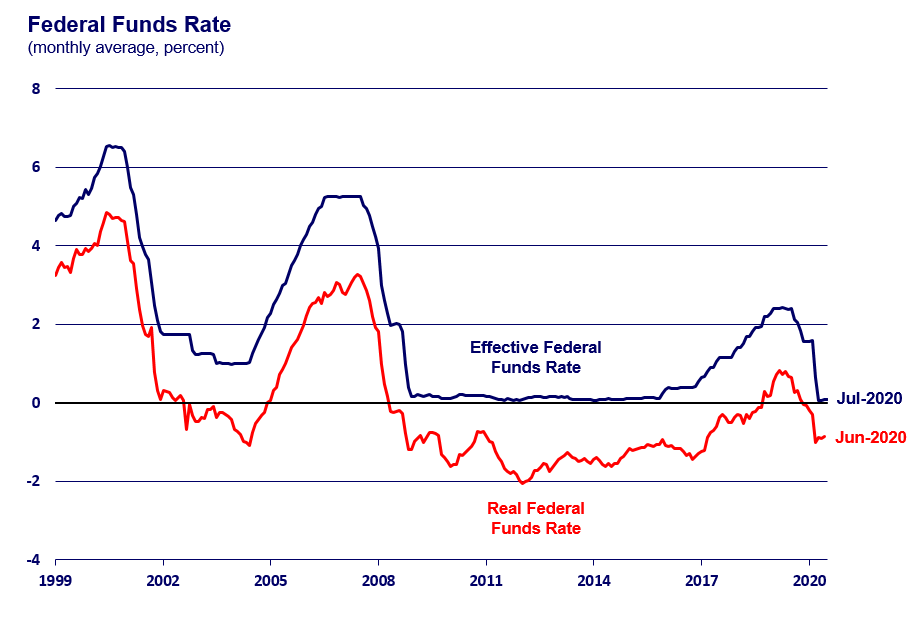

Several factors have contributed to the recent slump in Palantir stock price. Macroeconomic headwinds, including persistently high inflation and the Federal Reserve's aggressive interest rate hikes, have dampened investor sentiment across the tech sector, impacting high-growth companies like Palantir.

- Macroeconomic Factors: Rising interest rates increase borrowing costs for companies, potentially impacting Palantir's expansion plans and profitability. Inflation also erodes purchasing power and can lead to reduced spending on discretionary technology solutions.

- Company-Specific Factors: While Palantir has demonstrated consistent revenue growth, recent earnings reports and guidance may have fallen short of market expectations, leading to a sell-off. Close scrutiny of Palantir's financials, including revenue growth rates, operating margins, and cash flow, is crucial for understanding the current situation. Keywords: Palantir stock price, Palantir earnings, Palantir financials.

- Negative News and Analyst Downgrades: Negative news coverage or analyst downgrades can trigger a cascade of selling pressure, exacerbating existing price declines. Any negative sentiment surrounding Palantir's contracts, competition, or future prospects should be carefully considered.

Technical Analysis of Palantir Stock

A technical analysis of Palantir stock charts provides further insights. Examining support and resistance levels can help identify potential buying opportunities or predict further declines.

- Support and Resistance Levels: Identifying key support levels (where buying pressure may outweigh selling pressure) is critical. If the price breaks below a crucial support level, it could signal further downside potential. Conversely, resistance levels (where selling pressure may dominate) could indicate a ceiling on price increases. Keywords: Palantir stock chart, Palantir technical analysis, Palantir stock support.

- Technical Indicators: Indicators like the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) can help assess the stock's momentum and potential for trend reversals. Overbought or oversold conditions indicated by these indicators can signal potential buying or selling opportunities.

- Price Breakouts and Reversals: Significant price breakouts above resistance levels or reversals from downward trends could indicate a change in market sentiment, potentially signaling a bullish trend.

Evaluating Palantir's Long-Term Growth Potential

Palantir's Government and Commercial Contracts

Palantir's revenue is derived from both government and commercial contracts. The size and growth of these contracts are pivotal to the company's long-term prospects.

- Government Contracts: Palantir holds significant contracts with various government agencies, including the US government and international clients. The continued expansion into new government contracts and the renewal of existing agreements are crucial for consistent revenue streams. Keywords: Palantir government contracts, Palantir revenue growth.

- Commercial Contracts: Palantir is actively expanding its commercial client base, targeting businesses across various industries. Success in securing and expanding commercial contracts is vital for diversifying its revenue streams and reducing reliance on government contracts. Keywords: Palantir commercial clients.

- Business Model Viability: The long-term viability and profitability of Palantir's business model depend on its ability to consistently win new contracts, expand its existing relationships, and maintain operational efficiency.

Competitive Landscape and Innovation

Palantir operates in a competitive data analytics and artificial intelligence (AI) market. Its competitive advantages, innovation efforts, and ability to adapt to market changes are critical factors to consider.

- Competitive Advantages: Palantir's proprietary data analytics platform and advanced AI capabilities provide a significant competitive advantage. Its focus on data integration and sophisticated analytics sets it apart from competitors. Keywords: Palantir competitors, Palantir AI, Palantir innovation.

- Competitive Threats: The emergence of new competitors and technological advancements pose a threat to Palantir's market position. Analyzing the competitive landscape and Palantir's ability to maintain its edge is crucial.

- R&D and Future Roadmap: Palantir's investment in research and development (R&D) and its future product roadmap are indicators of its commitment to innovation and future growth.

Assessing the Risk and Reward of Investing in Palantir Stock

Risk Factors

Investing in Palantir stock carries significant risks, inherent to any high-growth technology company.

- High-Growth Company Risks: High-growth companies often experience greater volatility than established, mature companies. Palantir's stock price is susceptible to significant swings based on market sentiment and company performance. Keywords: Palantir risk, Palantir volatility.

- Regulatory and Geopolitical Risks: Palantir operates in a sector with evolving regulatory landscapes and geopolitical considerations, both of which could impact its business operations and financial performance. Keywords: Palantir investment risks.

- Stock Price Volatility: Palantir’s stock price has historically demonstrated considerable volatility, meaning potential for both significant gains and significant losses.

Potential Rewards

Despite the risks, investing in Palantir offers considerable potential rewards.

- Data Analytics Market Growth: The data analytics market is experiencing substantial growth, providing opportunities for Palantir to expand its market share and capture significant revenue. Keywords: Palantir growth potential, Palantir future outlook.

- Dominant Player Potential: Palantir has the potential to become a dominant player in the data analytics and AI space, leading to significant long-term value creation. Keywords: Palantir return on investment.

- Capital Appreciation: Successful execution of its strategy could lead to substantial capital appreciation for investors.

Conclusion: Should You Buy Palantir Stock Now?

The decision of whether to buy Palantir stock is complex and depends heavily on your individual risk tolerance and investment horizon. While the recent 30% decline presents a potentially attractive entry point for long-term investors, significant risks remain. The macroeconomic environment, competitive pressures, and the inherent volatility of Palantir's stock price must be carefully weighed against its significant growth potential and the possibility of becoming a major player in the data analytics industry.

Our analysis suggests a cautiously optimistic stance. While the current price may present a compelling opportunity for those with a higher risk tolerance and a long-term investment horizon, thorough due diligence is crucial before making any investment decisions. Consider your personal risk tolerance and investment strategy before adding Palantir shares to your portfolio. Conduct your own research and consult with a financial advisor before investing in Palantir stock or revisiting your current holdings. Remember, this analysis is not financial advice.

Featured Posts

-

Analyzing The Federal Reserves Next Move Interest Rate Outlook Uncertain

May 09, 2025

Analyzing The Federal Reserves Next Move Interest Rate Outlook Uncertain

May 09, 2025 -

Stiven King Vernulsya V X I Naekhal Na Ilona Maska

May 09, 2025

Stiven King Vernulsya V X I Naekhal Na Ilona Maska

May 09, 2025 -

Manchester Uniteds De Ligt Inter Milans Shock Loan Pursuit

May 09, 2025

Manchester Uniteds De Ligt Inter Milans Shock Loan Pursuit

May 09, 2025 -

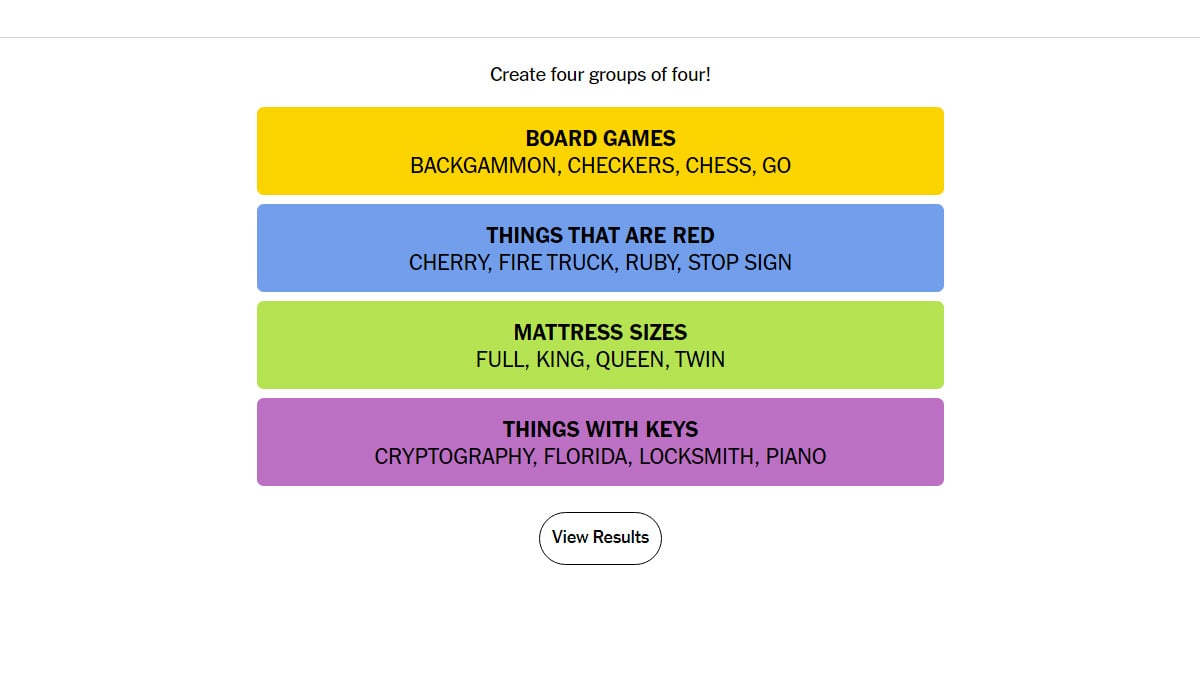

Solve Nyt Strands Hints And Answers For Thursday April 10 Game 403

May 09, 2025

Solve Nyt Strands Hints And Answers For Thursday April 10 Game 403

May 09, 2025 -

Nyt Strands Hints And Answers Wednesday March 12 Game 374

May 09, 2025

Nyt Strands Hints And Answers Wednesday March 12 Game 374

May 09, 2025

Latest Posts

-

News From The Bangkok Post The Push For Better Transgender Rights

May 10, 2025

News From The Bangkok Post The Push For Better Transgender Rights

May 10, 2025 -

The Bangkok Post And The Ongoing Struggle For Transgender Equality

May 10, 2025

The Bangkok Post And The Ongoing Struggle For Transgender Equality

May 10, 2025 -

The Impact Of Trumps Executive Orders On The Transgender Community A Call For Stories

May 10, 2025

The Impact Of Trumps Executive Orders On The Transgender Community A Call For Stories

May 10, 2025 -

Examining Transgender Equality Issues Highlighted By The Bangkok Post

May 10, 2025

Examining Transgender Equality Issues Highlighted By The Bangkok Post

May 10, 2025 -

The Bangkok Post And The Fight For Transgender Equality In Thailand

May 10, 2025

The Bangkok Post And The Fight For Transgender Equality In Thailand

May 10, 2025