Analyzing The Potential For Bitcoin To Reach $100,000 Under Trump's Presidency

Table of Contents

Trump's Economic Policies and their Impact on Bitcoin

Trump's economic policies, characterized by deregulation and fiscal stimulus, could have had a significant, albeit complex, impact on Bitcoin's price.

Deregulation and its Effect on Cryptocurrencies

Trump's administration, while not explicitly pro-cryptocurrency, pursued a generally deregulatory approach. This lack of heavy-handed regulation could be seen as positive for crypto adoption. Less stringent regulatory frameworks can foster innovation and attract investment, potentially boosting Bitcoin's price.

- Examples of deregulation: Reduced emphasis on specific regulations targeting cryptocurrency exchanges and Initial Coin Offerings (ICOs).

- Potential benefits for Bitcoin: Increased accessibility, higher trading volume, potential for more institutional investment.

- Risks associated with deregulation: Increased risk of scams and fraud, potential for market manipulation.

Fiscal Stimulus and Inflationary Pressures

Trump's significant fiscal stimulus packages aimed to boost economic growth. However, such measures can also lead to inflationary pressures. In times of inflation, investors often seek alternative assets to preserve their purchasing power. Bitcoin, with its limited supply, has been viewed by some as a hedge against inflation.

- Examples of fiscal stimulus: Tax cuts, increased government spending.

- Potential inflationary effects: Increased demand for goods and services, devaluation of the US dollar.

- Bitcoin's role as a hedge: Its fixed supply of 21 million coins makes it a potential store of value during inflationary periods.

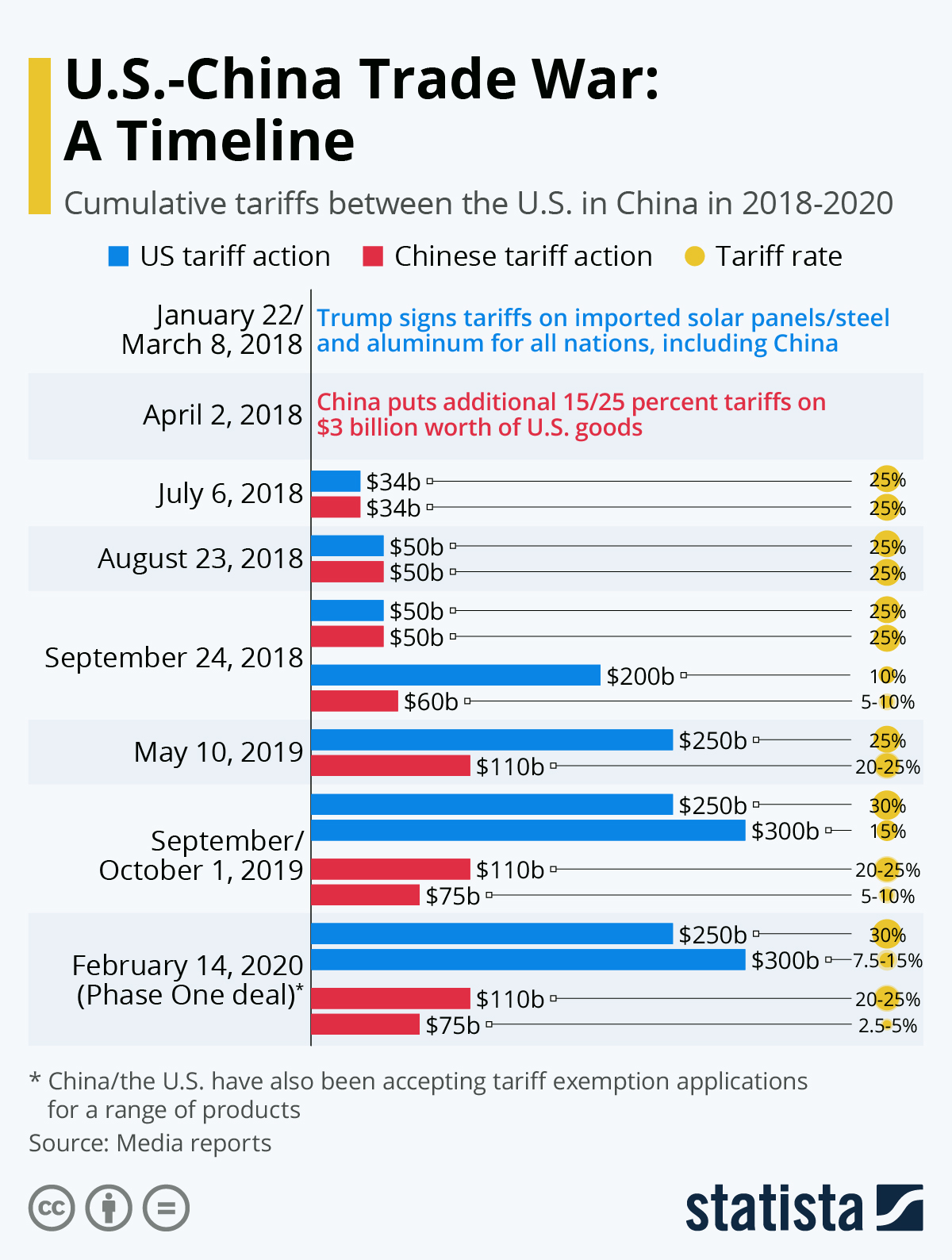

Trade Wars and Bitcoin's Safe Haven Status

Trump's trade policies, including tariffs and trade wars, created global economic uncertainty. During times of geopolitical instability, investors often seek safe haven assets – assets that maintain value despite market turmoil. Bitcoin's decentralized nature and resistance to government control make it an appealing safe haven for some.

- Examples of trade conflicts: Trade disputes with China and other countries.

- Their impact on global markets: Increased volatility, uncertainty about future economic growth.

- Bitcoin's role as a safe haven: Its decentralization and lack of susceptibility to political influence can attract investors seeking refuge from market instability.

Bitcoin's Intrinsic Value and Market Adoption

Beyond external factors, Bitcoin's intrinsic value and increasing market adoption play a crucial role in determining its price.

Technological Advancements and Network Effects

Advancements in Bitcoin's underlying technology, such as the Lightning Network, enhance scalability and transaction speed. This improves usability and encourages broader adoption, strengthening network effects (where the value of a network increases with the number of users).

- Examples of technological advancements: The Lightning Network, SegWit.

- Impact on scalability and usability: Faster transactions, lower fees.

- Strengthening of network effects: Increased user base leads to a more valuable and resilient network.

Institutional Investment and Mainstream Adoption

Growing acceptance by institutional investors (large financial institutions) and increasing mainstream awareness are critical factors influencing Bitcoin's price. As more institutional players enter the market and media coverage increases, the demand for Bitcoin is likely to rise.

- Examples of institutional investments: Purchases of Bitcoin by companies like MicroStrategy.

- Increased media coverage: More frequent and positive news stories about Bitcoin.

- Growing public awareness: Increased understanding and acceptance of Bitcoin as a legitimate asset class.

Halving Events and Supply Dynamics

Bitcoin's supply is programmed to halve approximately every four years. This predictable reduction in the rate of new Bitcoin creation creates scarcity and potentially fuels price increases. Past halving events have often been followed by significant price rises, making future halvings a key element in potential price predictions.

- Dates of past and future halvings: 2012, 2016, 2020, 2024, and so on.

- Their historical impact on price: Often followed by periods of increased price appreciation.

- Prediction for future price movements: While not guaranteed, future halvings are expected to influence price, albeit the magnitude remains uncertain.

Factors Against Bitcoin Reaching $100,000 Under Trump's Presidency

While several factors could have contributed to a Bitcoin price surge, countervailing forces must also be considered.

Regulatory Uncertainty and Government Intervention

Despite a relatively hands-off approach under Trump, future administrations could introduce stricter regulations, impacting Bitcoin's price negatively. Increased regulatory scrutiny can dampen market enthusiasm and reduce investment.

- Examples of potential regulatory challenges: Increased KYC/AML requirements, outright bans on cryptocurrency trading.

- Impact on market sentiment: Regulatory uncertainty can create fear and uncertainty among investors.

- Risks associated with government intervention: Could lead to reduced market liquidity and a decrease in price.

Market Volatility and Price Corrections

The cryptocurrency market is notoriously volatile. Significant price corrections (sharp drops in price) are common, and the possibility of a major crash remains a significant risk. Speculative bubbles can inflate prices unrealistically, leading to eventual, dramatic collapses.

- Examples of past price crashes: The Bitcoin price crashes of 2018 and 2022.

- Factors contributing to volatility: Speculative trading, regulatory uncertainty, macroeconomic factors.

- Risks associated with speculative bubbles: High risk of significant losses for investors if the bubble bursts.

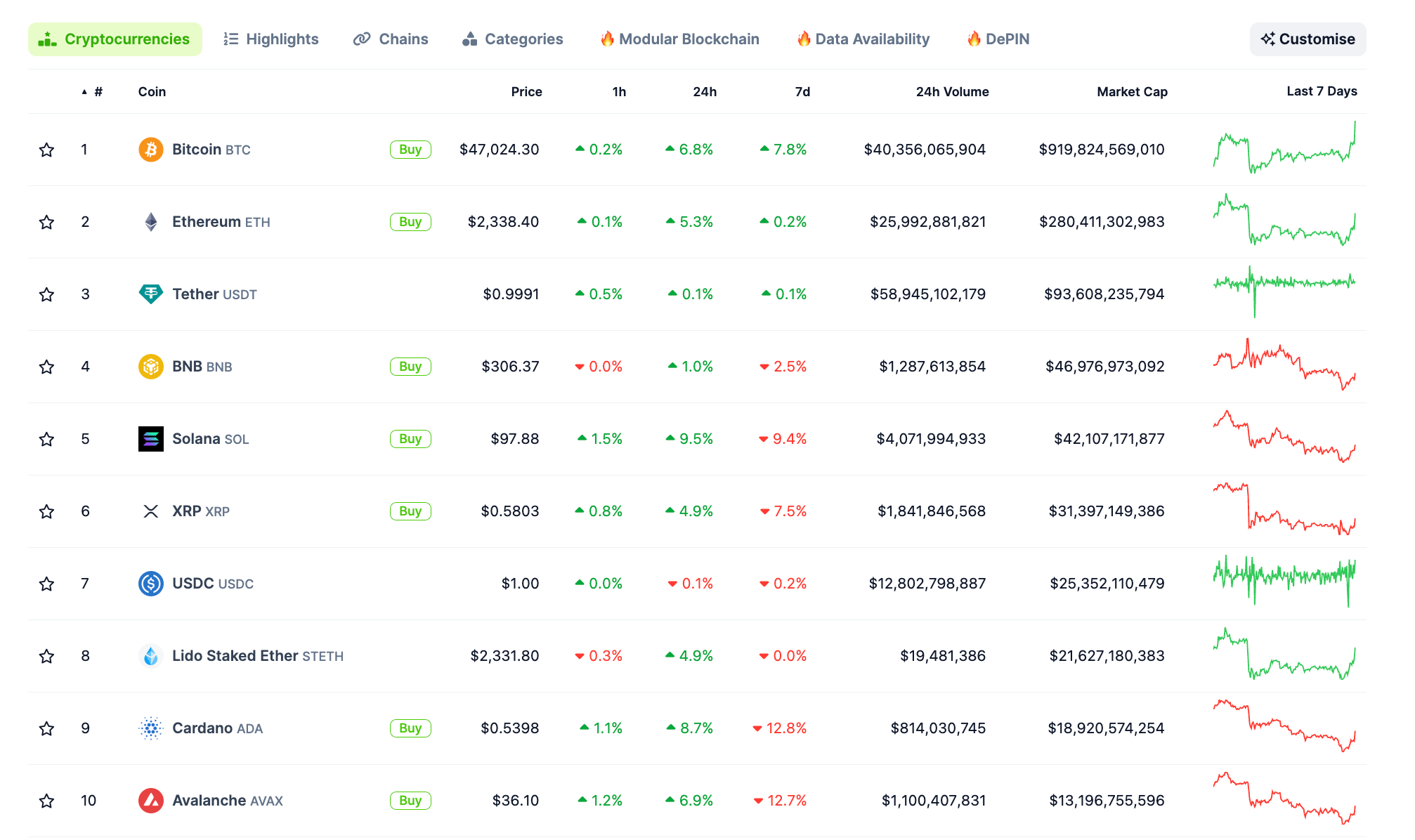

Competition from Other Cryptocurrencies

Bitcoin faces competition from a growing number of alternative cryptocurrencies (altcoins), each with unique features and functionalities. The emergence of more efficient or innovative cryptocurrencies could potentially erode Bitcoin's market dominance and impact its price.

- Examples of competing cryptocurrencies: Ethereum, Solana, Cardano.

- Their strengths and weaknesses: Each altcoin offers different advantages and disadvantages compared to Bitcoin.

- Their potential impact on Bitcoin's market share: Competition from altcoins could limit Bitcoin's growth and price appreciation.

Conclusion: The Likelihood of Bitcoin Reaching $100,000 Under Trump's Presidency

The potential for Bitcoin to reach $100,000 under Trump's Presidency (or even subsequently) is a complex question with no easy answer. While Trump's economic policies, technological advancements, and growing institutional adoption could have contributed positively, factors such as regulatory uncertainty, market volatility, and competition from other cryptocurrencies introduce considerable downside risk. Ultimately, the likelihood of reaching this price target depends on the interplay of these various forces. Therefore, while certain policies could have created a favorable environment, a definitive prediction remains impossible. Further research into Bitcoin’s price drivers, including macroeconomic conditions and evolving regulatory landscapes, is crucial for a more comprehensive understanding. Continue monitoring Bitcoin's price and market trends to stay informed about its potential to reach $100,000 or even surpass that figure.

Featured Posts

-

Chinese Goods And The Trade War Examining The Impact On Bubble Blasters And Beyond

May 09, 2025

Chinese Goods And The Trade War Examining The Impact On Bubble Blasters And Beyond

May 09, 2025 -

Colapinto Rumors Williams Team Principals Statement On Doohans Future

May 09, 2025

Colapinto Rumors Williams Team Principals Statement On Doohans Future

May 09, 2025 -

U S And China Seek Trade De Escalation A Look At This Weeks Discussions

May 09, 2025

U S And China Seek Trade De Escalation A Look At This Weeks Discussions

May 09, 2025 -

Black Rock Etf A Billionaire Investment Predicted To Soar 110 By 2025

May 09, 2025

Black Rock Etf A Billionaire Investment Predicted To Soar 110 By 2025

May 09, 2025 -

From 3 000 Babysitter To 3 600 Daycare A Fathers Financial Struggle

May 09, 2025

From 3 000 Babysitter To 3 600 Daycare A Fathers Financial Struggle

May 09, 2025

Latest Posts

-

How Federal Riding Redistribution Will Impact Edmonton Voters

May 09, 2025

How Federal Riding Redistribution Will Impact Edmonton Voters

May 09, 2025 -

Oilers Vs Kings Series Betting Odds And Predictions

May 09, 2025

Oilers Vs Kings Series Betting Odds And Predictions

May 09, 2025 -

Edmonton Oilers Favored Betting Odds For Kings Series Finale

May 09, 2025

Edmonton Oilers Favored Betting Odds For Kings Series Finale

May 09, 2025 -

6 Sanrio

May 09, 2025

6 Sanrio

May 09, 2025 -

6

May 09, 2025

6

May 09, 2025