U.S. And China Seek Trade De-escalation: A Look At This Week's Discussions

Table of Contents

Key Discussion Points in This Week's Talks

This week’s bilateral talks between U.S. and Chinese negotiators focused on several key areas impacting trade negotiations. While specifics remain limited, reports suggest the following were central discussion points:

- Tariff Reduction: Discussions likely centered around the possibility of reducing existing tariffs imposed by both countries, a key element in any meaningful trade de-escalation. Specific mentions of reducing tariffs on certain agricultural products and manufactured goods were rumored.

- Technology Transfer: The forced transfer of technology from U.S. companies operating in China remains a major sticking point. The talks likely addressed concerns over intellectual property rights (IPR) and fair competition within the Chinese market.

- Intellectual Property Rights (IPR) Protection: Strengthening IPR protection in China is paramount for U.S. businesses. Discussions likely involved mechanisms to enforce existing laws and prevent further theft of patented technologies and designs.

- Agricultural Trade: The trade war significantly impacted agricultural exports from the U.S. to China. Reopening and expanding agricultural trade was likely a significant focus of the discussions, impacting soybean and other agricultural commodity markets.

Key figures involved included high-ranking officials from both governments, signaling the importance placed on these trade negotiations and economic diplomacy efforts.

Obstacles to Reaching a Trade De-escalation Agreement

Despite the stated desire for de-escalation, significant obstacles stand in the way of a comprehensive trade agreement:

- Differing Political Ideologies: Fundamental differences in political and economic systems create deep-seated mistrust between the two nations. These ideological differences often overshadow purely economic considerations.

- National Security Concerns: The U.S. has expressed concerns about China's technological advancements and their potential implications for national security, leading to restrictions on technology exports and investment. This adds a layer of complexity to purely economic negotiations.

- Technological Rivalry: The intense competition in key technological sectors, including 5G, artificial intelligence, and semiconductors, fuels geopolitical tensions and makes reaching a compromise more challenging. Economic sanctions and export controls are often used as tools in this rivalry, further hindering trade de-escalation.

- Trade Barriers and Non-Tariff Barriers: China's extensive use of non-tariff barriers, such as regulatory hurdles and opaque approval processes, remains a major concern for U.S. businesses seeking access to the Chinese market. These barriers often outweigh the effects of tariff reduction.

Potential Outcomes and Scenarios

Several scenarios could emerge from these discussions:

- Partial Agreement: A limited agreement focusing on specific areas, like agricultural trade or tariff reductions on a limited range of products, is the most likely outcome given the significant obstacles.

- Complete Standstill: A failure to reach any agreement could lead to a prolonged period of uncertainty, potentially harming investor confidence and impacting global markets.

- Renewed Escalation: If negotiations fail and tensions worsen, a renewed escalation of the trade war, including new tariffs or trade restrictions, is possible, leading to further market volatility.

The likelihood of each scenario depends on the willingness of both sides to compromise and address the underlying geopolitical and economic tensions.

The Impact on Global Markets

The outcome of these U.S.-China trade discussions will have far-reaching implications for global markets:

- Stock Markets: Increased uncertainty could lead to market volatility, with significant impacts on both U.S. and Chinese stock markets, along with global indices.

- Commodity Prices: The prices of agricultural commodities, such as soybeans and corn, and industrial metals will be heavily influenced by the outcome of trade negotiations.

- Supply Chain Disruptions: Continued trade tensions could further disrupt global supply chains, leading to increased costs and shortages of certain goods.

- Investor Confidence: A positive outcome could boost investor confidence, while a negative outcome could trigger a sell-off in global markets.

Industries heavily reliant on trade between the U.S. and China, such as technology, manufacturing, and agriculture, will be particularly vulnerable to the effects of these discussions.

Conclusion

Achieving U.S.-China trade de-escalation is a complex undertaking, fraught with significant obstacles stemming from differing political ideologies, national security concerns, and fierce technological competition. While a complete resolution seems unlikely in the short term, a partial agreement addressing specific areas of concern remains a possibility. However, the risk of a complete standstill or even renewed escalation remains significant. The impact on global markets will be substantial, affecting stock prices, commodity markets, and global supply chains. Staying informed about further developments in U.S.-China trade relations is crucial for businesses and investors alike. Stay updated on the progress of U.S.-China trade de-escalation by following our blog and subscribing to our newsletter.

Featured Posts

-

Infineon Ifx Sales Forecast Misses Mark Uncertainty Around Tariffs

May 09, 2025

Infineon Ifx Sales Forecast Misses Mark Uncertainty Around Tariffs

May 09, 2025 -

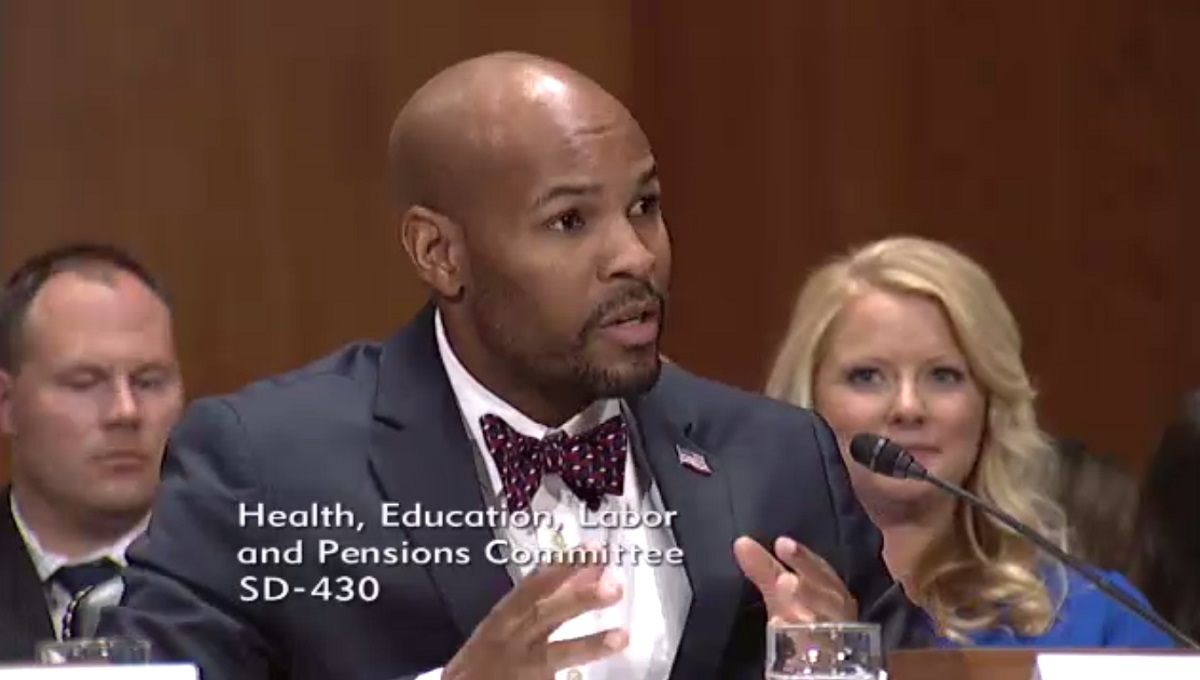

White Houses Unexpected Choice Maha Influencer Replaces Withdrawn Surgeon General Nominee

May 09, 2025

White Houses Unexpected Choice Maha Influencer Replaces Withdrawn Surgeon General Nominee

May 09, 2025 -

Pam Bondi Accused Of Concealing Epstein Records Senate Democrats Speak Out

May 09, 2025

Pam Bondi Accused Of Concealing Epstein Records Senate Democrats Speak Out

May 09, 2025 -

High Potential Still A Psych Spiritual Powerhouse 11 Years On

May 09, 2025

High Potential Still A Psych Spiritual Powerhouse 11 Years On

May 09, 2025 -

Snegopad V Permi Aeroport Vremenno Priostanovil Rabotu

May 09, 2025

Snegopad V Permi Aeroport Vremenno Priostanovil Rabotu

May 09, 2025

Latest Posts

-

Nottingham Attacks Inquiry Judge Who Jailed Boris Becker Appointed Chair

May 09, 2025

Nottingham Attacks Inquiry Judge Who Jailed Boris Becker Appointed Chair

May 09, 2025 -

Judge Who Jailed Boris Becker Appointed To Chair Nottingham Inquiry

May 09, 2025

Judge Who Jailed Boris Becker Appointed To Chair Nottingham Inquiry

May 09, 2025 -

Nottingham Survivors Recount Experiences After Devastating Attacks

May 09, 2025

Nottingham Survivors Recount Experiences After Devastating Attacks

May 09, 2025 -

Nottingham Attack Survivors Speak Out Their Stories Of Resilience

May 09, 2025

Nottingham Attack Survivors Speak Out Their Stories Of Resilience

May 09, 2025 -

Nottingham Attacks Survivors Share Their Stories

May 09, 2025

Nottingham Attacks Survivors Share Their Stories

May 09, 2025