Analyzing XRP's 400% Rise: Further Price Predictions

Table of Contents

XRP's recent surge has captivated the crypto community. A 400% price increase has many asking: what fuels this rally, and what does the future hold for XRP price predictions? This article delves into the factors driving this remarkable growth and explores potential future price movements. We'll examine technical analysis, fundamental factors, and market sentiment to offer informed insights into XRP's trajectory.

Factors Contributing to XRP's 400% Rise

The Ripple v. SEC Lawsuit

The positive implications of the recent court ruling on the Ripple v. SEC lawsuit have significantly impacted XRP's price. The reduced uncertainty surrounding XRP's regulatory status has boosted investor confidence and attracted new capital.

- Reduced Regulatory Uncertainty: The court's decision brought much-needed clarity, lessening the fear of regulatory crackdowns. This legal clarity is a major catalyst for the price surge.

- Increased Investor Confidence: The positive outcome restored faith in XRP, encouraging both individual and institutional investors to enter the market.

- Improved Market Sentiment: News of the favorable ruling spread rapidly, generating positive sentiment and driving up demand. Keywords: Ripple lawsuit, SEC lawsuit, court ruling, legal clarity, XRP price

Increased Institutional Adoption

Growing interest from institutional investors is another key factor in XRP's price appreciation. Several financial institutions are increasingly exploring XRP for its utility in cross-border payments.

- Strategic Partnerships: Ripple, the company behind XRP, has forged partnerships with various financial institutions, facilitating the adoption of XRP in their payment systems.

- High Transaction Volume: On-chain analysis reveals a significant increase in XRP transaction volume, indicating growing usage and adoption.

- Institutional Investment Strategies: Some institutional investors see XRP as a strategic asset in their diversified portfolios, contributing to increased demand. Keywords: institutional investment, on-chain analysis, transaction volume, XRP adoption

Growing Utility and Ecosystem

XRP's increasing use cases in cross-border payments and other applications have fueled its price increase. Improvements to the XRP Ledger have also enhanced its efficiency and scalability.

- Cross-Border Payments: XRP's speed and low transaction costs make it an attractive option for facilitating fast and efficient cross-border payments.

- Enhanced XRP Ledger: Upgrades to the XRP Ledger have improved its performance, security, and scalability, making it more appealing to developers and businesses.

- Growing Ecosystem: A thriving ecosystem of developers and businesses is building applications on top of the XRP Ledger, further expanding its utility. Keywords: XRP Ledger, cross-border payments, utility token, blockchain technology, XRP ecosystem

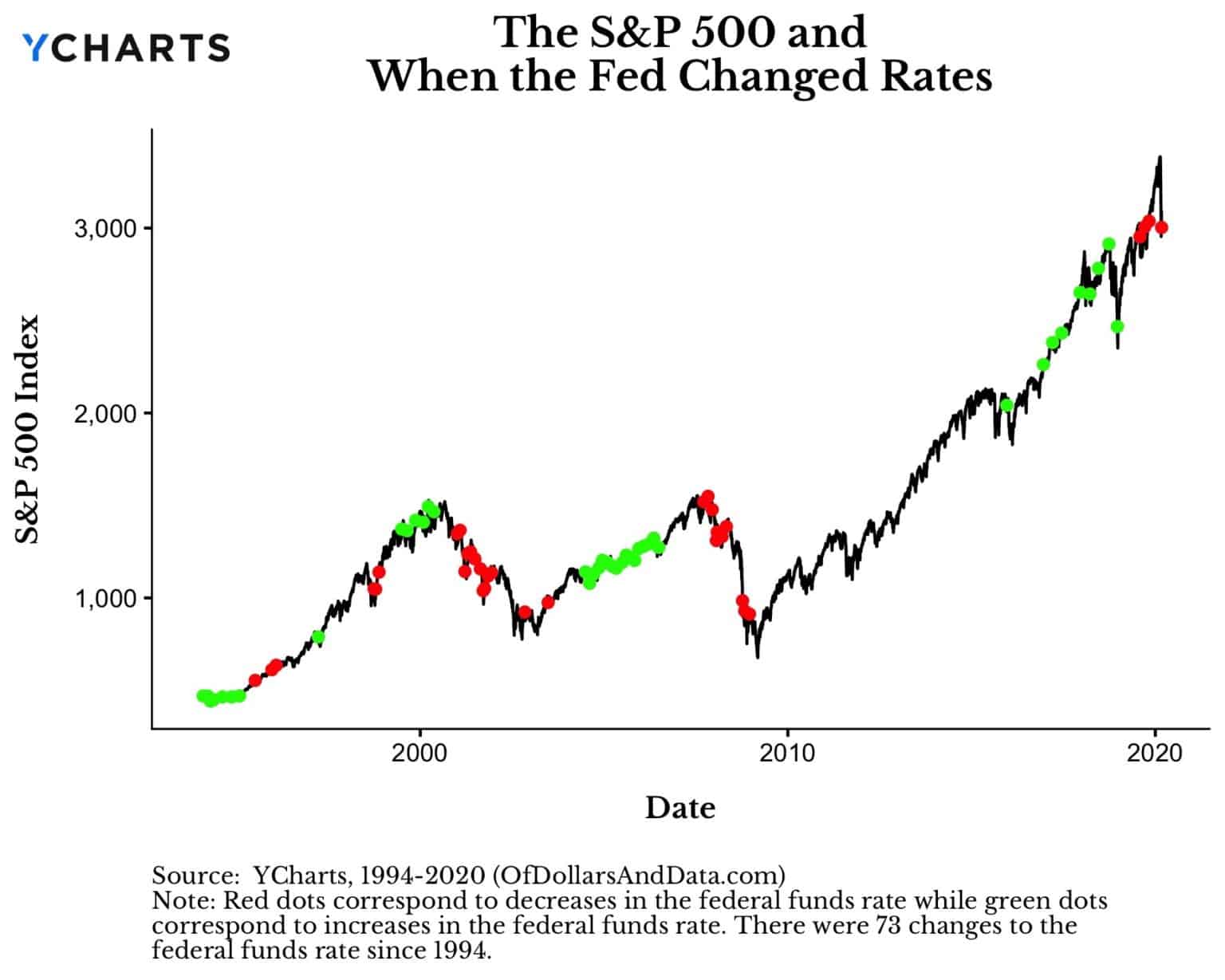

Technical Analysis and Chart Patterns

Price Action and Support/Resistance Levels

Analyzing XRP's price action reveals key support and resistance levels. Technical indicators such as moving averages and RSI provide further insights into potential price movements.

- Support Levels: Identifying key support levels helps determine potential price floors.

- Resistance Levels: Resistance levels indicate potential price ceilings.

- Moving Averages: Analyzing moving averages (e.g., 50-day, 200-day) helps gauge the overall trend.

- RSI (Relative Strength Index): The RSI indicator helps assess whether XRP is overbought or oversold. Keywords: technical analysis, support levels, resistance levels, moving averages, RSI, chart patterns, XRP price chart

Predictive Modeling and Forecasting

Various forecasting methods can be used to predict future XRP price movements. However, it's crucial to understand the limitations of these models and the inherent volatility of the cryptocurrency market.

- Statistical Models: These models use historical data to predict future price movements.

- Machine Learning Algorithms: Advanced algorithms can identify patterns and predict future trends.

- Market Sentiment Analysis: Analyzing market sentiment can help gauge investor confidence and predict potential price changes. Keywords: price prediction, forecasting, predictive modeling, market volatility, XRP price forecast

Market Sentiment and Future Outlook

Social Media Sentiment and News Coverage

Analyzing social media sentiment and news coverage provides valuable insights into market sentiment towards XRP.

- Positive Sentiment: Positive news and social media buzz can drive up demand and prices.

- Negative Sentiment (FUD): Fear, uncertainty, and doubt (FUD) can lead to price drops.

- News Events: Significant news events, such as regulatory updates or partnerships, can significantly impact XRP's price. Keywords: market sentiment, social media analysis, news sentiment, FUD, hype, XRP news

Potential Risks and Challenges

Despite the recent price surge, several risks and challenges could impact XRP's future price.

- Regulatory Uncertainty: Regulatory landscapes can change, creating uncertainty for cryptocurrencies.

- Market Competition: Competition from other cryptocurrencies could affect XRP's market share.

- Market Volatility: The cryptocurrency market is inherently volatile, subject to sudden price swings. Keywords: regulatory risk, market competition, cryptocurrency market, volatility, XRP risks

Conclusion

XRP's recent 400% price rise is attributable to several factors, including the positive outcome of the Ripple lawsuit, increased institutional adoption, and the growing utility of the XRP Ledger. Technical analysis reveals key support and resistance levels, while market sentiment analysis helps gauge investor confidence. However, potential risks remain, including regulatory uncertainty and market competition. While some forecasting models suggest potential future price increases, it's crucial to remember that these are speculative and not financial advice. Remember, always conduct your own thorough research before making any investment decisions related to XRP price predictions. Stay informed about XRP price predictions and navigate the crypto market wisely.

Featured Posts

-

The Bank Of England And A Half Point Rate Cut Economic Analysis

May 08, 2025

The Bank Of England And A Half Point Rate Cut Economic Analysis

May 08, 2025 -

Ray Epps V Fox News A Deep Dive Into The January 6th Defamation Case

May 08, 2025

Ray Epps V Fox News A Deep Dive Into The January 6th Defamation Case

May 08, 2025 -

Bitcoin And Ethereum Options Expiration Billions At Stake Market Braces For Volatility

May 08, 2025

Bitcoin And Ethereum Options Expiration Billions At Stake Market Braces For Volatility

May 08, 2025 -

Saturday Night Live And Counting Crows A Defining Moment

May 08, 2025

Saturday Night Live And Counting Crows A Defining Moment

May 08, 2025 -

Lahwr Myn Ahtsab Edaltwn Ky Tedad Myn 50 Kmy Tshwysh Nak Swrthal

May 08, 2025

Lahwr Myn Ahtsab Edaltwn Ky Tedad Myn 50 Kmy Tshwysh Nak Swrthal

May 08, 2025

Latest Posts

-

Dwp Announces Major Universal Credit Claim Verification Changes

May 08, 2025

Dwp Announces Major Universal Credit Claim Verification Changes

May 08, 2025 -

Significant Rise In Dwp Home Visits Concerns For Benefit System

May 08, 2025

Significant Rise In Dwp Home Visits Concerns For Benefit System

May 08, 2025 -

Dwp Increases Home Visits Impact On Benefit Claimants

May 08, 2025

Dwp Increases Home Visits Impact On Benefit Claimants

May 08, 2025 -

Dwp Doubles Home Visits For Benefit Recipients Thousands Affected

May 08, 2025

Dwp Doubles Home Visits For Benefit Recipients Thousands Affected

May 08, 2025 -

3 Month Warning Dwp To Stop Benefits For 355 000 People

May 08, 2025

3 Month Warning Dwp To Stop Benefits For 355 000 People

May 08, 2025