Bitcoin And Ethereum Options Expiration: Billions At Stake, Market Braces For Volatility

Table of Contents

Understanding Bitcoin and Ethereum Options Expiration

Bitcoin and Ethereum options are derivative contracts that grant the holder the right, but not the obligation, to buy (call option) or sell (put option) a specified amount of Bitcoin or Ethereum at a predetermined price (strike price) on or before a specific date (expiration date). Options expiration marks the final day these contracts can be exercised. The significance lies in the potential for massive price swings as traders simultaneously buy, sell, or let their options expire worthless.

Open interest, representing the total number of outstanding options contracts, plays a crucial role in determining market volatility during expiration. High open interest indicates a large number of contracts about to expire, potentially leading to substantial price movements as traders scramble to manage their positions.

- Call Option: Gives the buyer the right to buy the underlying asset (Bitcoin or Ethereum) at the strike price.

- Put Option: Gives the buyer the right to sell the underlying asset at the strike price.

- Mechanism of Options Trading: Options are traded on various cryptocurrency exchanges, allowing traders to speculate on the future price movements of Bitcoin and Ethereum.

- Impact of High Open Interest: High open interest often amplifies price volatility during expiration due to the simultaneous need for many traders to either exercise, assign, or close their positions.

Billions at Stake: The Magnitude of the Expiring Contracts

The sheer scale of expiring Bitcoin and Ethereum options contracts is staggering, potentially involving billions of dollars. This massive sum makes the upcoming expiration a significant event with the potential for substantial market impact. Large-scale liquidation events, where traders are forced to sell their assets to cover losses, could exacerbate price volatility and create cascading effects across the market.

Historical examples demonstrate that previous options expirations have often been associated with considerable price swings in Bitcoin and Ethereum. Understanding these historical precedents is vital for assessing the potential range of price movements during the upcoming expiration.

- Specific Figures: The exact figures vary depending on the exchange and the specific date, but it's not uncommon to see billions of dollars' worth of options contracts expiring simultaneously.

- Potential Scenarios: Price movements could be significantly upward, downward, or remain relatively sideways, depending on the balance of buying and selling pressure during the expiration period.

- Reference to Previous Events: Analyzing past option expiration events in Bitcoin and Ethereum can provide valuable insights into potential price behavior. For example, significant price drops have been witnessed historically after periods of high open interest.

Factors Influencing Market Volatility During Expiration

Several factors beyond the options market itself significantly impact volatility during expiration. Macroeconomic conditions, regulatory announcements, and the activities of large market players (whales and institutional investors) all contribute to the overall market sentiment and price fluctuations.

- Impact of Inflation Rates and Interest Rate Hikes: Changes in monetary policy can influence investor sentiment and capital flows into the cryptocurrency market, affecting Bitcoin and Ethereum prices.

- Influence of Regulatory Changes: New regulations or announcements from regulatory bodies in major jurisdictions can dramatically impact the price of cryptocurrencies.

- Effect of Large Institutional Trades: Large buy or sell orders from institutional investors can cause significant short-term price swings.

Strategies for Navigating the Volatility

Navigating the heightened volatility during Bitcoin and Ethereum options expiration requires a robust risk management strategy. Traders should prioritize careful planning and risk mitigation to protect their capital.

- Risk Management Recommendations: Thorough research, position sizing based on risk tolerance, and setting stop-loss orders are crucial. Avoid overleveraging during periods of high volatility.

- Hedging Strategies: Covered call writing and protective put buying are potential strategies to hedge against potential price fluctuations.

- Importance of Diversification: Diversifying your cryptocurrency portfolio across different assets can help reduce risk and lessen the impact of volatility in any single asset.

Conclusion

The upcoming Bitcoin and Ethereum options expiration presents a critical juncture for the cryptocurrency market, with billions of dollars at stake and the potential for significant volatility. Understanding the underlying mechanics of options trading, the scale of expiring contracts, and the various factors influencing price movements is crucial for navigating this period successfully.

Call to Action: Stay informed about the latest developments in the crypto market and prepare your trading strategy accordingly. Thoroughly research Bitcoin and Ethereum options before participating, and always prioritize risk management during this period of heightened volatility surrounding Bitcoin and Ethereum options expiration. Remember, informed decision-making is key to successfully managing risk and potentially capitalizing on opportunities during this pivotal event in the crypto market.

Featured Posts

-

Izjava Pavla Grbovica Komentar O Predlozima Za Prelaznu Vladu

May 08, 2025

Izjava Pavla Grbovica Komentar O Predlozima Za Prelaznu Vladu

May 08, 2025 -

Ryujinx Emulator Development Halted Official Nintendo Statement

May 08, 2025

Ryujinx Emulator Development Halted Official Nintendo Statement

May 08, 2025 -

The Long Walk Movie Adaptation Release Date Announced At Cinema Con

May 08, 2025

The Long Walk Movie Adaptation Release Date Announced At Cinema Con

May 08, 2025 -

Rogue The Savage Land 2 Preview Ka Zars Urgent Need For A Hero

May 08, 2025

Rogue The Savage Land 2 Preview Ka Zars Urgent Need For A Hero

May 08, 2025 -

Dodger Mookie Betts Misses Freeway Series Opener Due To Illness

May 08, 2025

Dodger Mookie Betts Misses Freeway Series Opener Due To Illness

May 08, 2025

Latest Posts

-

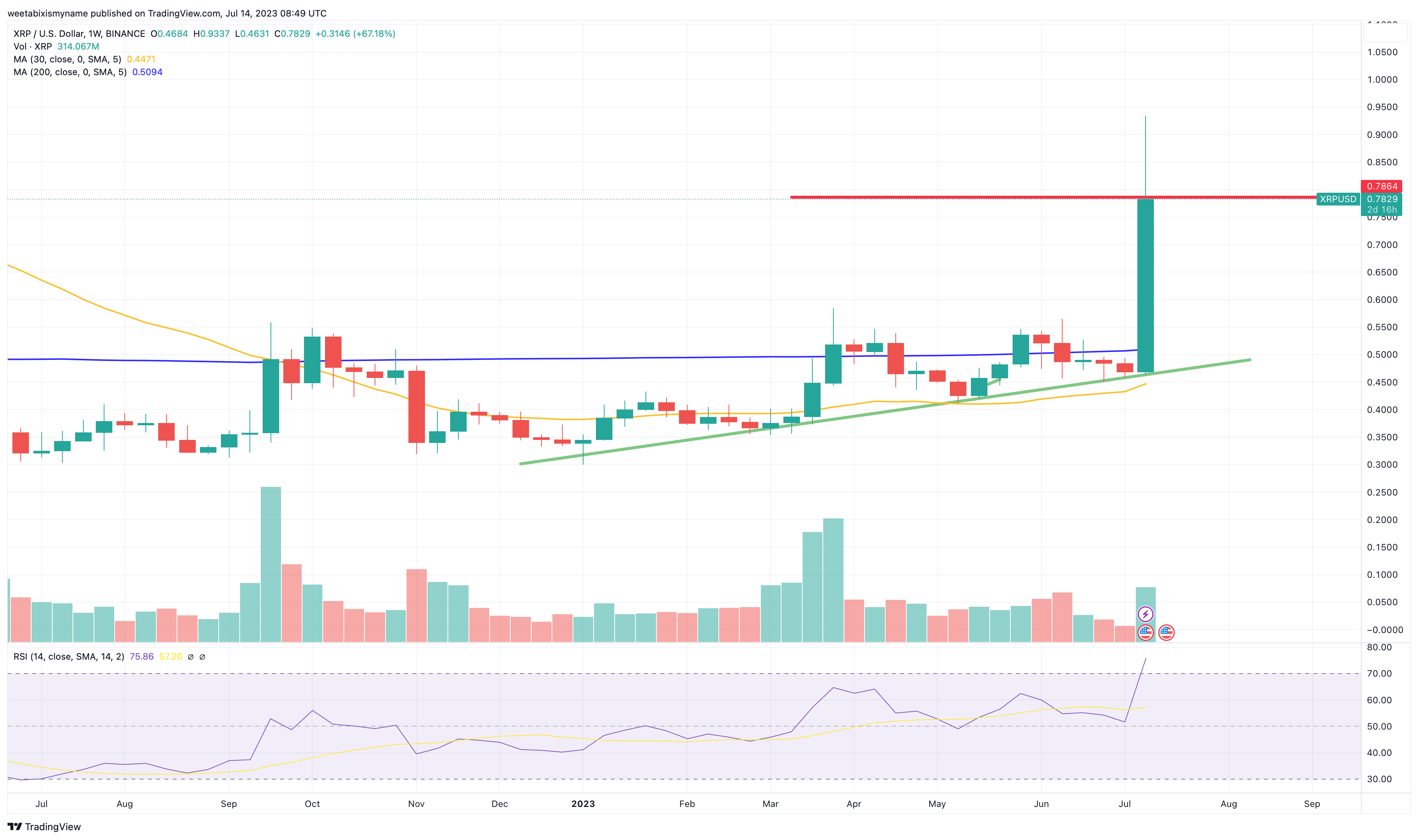

Xrp Market Analysis 3 Reasons Why Xrp Could Experience A Parabolic Rally

May 08, 2025

Xrp Market Analysis 3 Reasons Why Xrp Could Experience A Parabolic Rally

May 08, 2025 -

Xrp Price Prediction Is A Parabolic Rise On The Horizon

May 08, 2025

Xrp Price Prediction Is A Parabolic Rise On The Horizon

May 08, 2025 -

3 Key Factors Suggesting A Possible Parabolic Xrp Move

May 08, 2025

3 Key Factors Suggesting A Possible Parabolic Xrp Move

May 08, 2025 -

Xrp News 3 Reasons For A Potential Xrp Price Surge

May 08, 2025

Xrp News 3 Reasons For A Potential Xrp Price Surge

May 08, 2025 -

Investing In Xrp After Its 400 Increase A Prudent Approach

May 08, 2025

Investing In Xrp After Its 400 Increase A Prudent Approach

May 08, 2025