Analyzing XRP's Price Action: Derivatives Market Implications

Table of Contents

The price of XRP, Ripple's native cryptocurrency, is known for its volatility. Understanding these price fluctuations is crucial for anyone involved in the XRP market, whether as an investor, trader, or analyst. While many factors influence XRP's price action, one often overlooked element is the significant impact of the XRP derivatives market. This article delves into analyzing XRP's price action, focusing on how derivatives trading shapes its volatility and overall trajectory.

Understanding XRP Derivatives

Types of XRP Derivatives

The XRP derivatives market offers various instruments that allow traders to speculate on XRP's price movements or hedge against potential losses. The most common types include:

-

Futures Contracts: These contracts obligate the buyer to purchase XRP at a predetermined price on a specific future date. Futures contracts offer leverage, amplifying price movements, and are widely used for speculation and hedging. The high leverage inherent in futures contracts significantly impacts XRP's price action, often magnifying both upward and downward swings.

-

Options Contracts: These contracts grant the buyer the right, but not the obligation, to buy (call option) or sell (put option) XRP at a specific price on or before a certain date. Options contracts provide flexibility and are often used for hedging against price risk or for generating income through selling options premiums. They allow for more sophisticated trading strategies than futures and contribute to a more complex XRP price action landscape.

-

Other Derivatives: While futures and options are dominant, other, more complex derivatives might exist or emerge in the XRP market, further influencing price dynamics. These could include swaps, forwards, and other structured products designed for institutional investors. The emergence of these more sophisticated instruments can significantly alter the dynamics of XRP's price action, increasing liquidity and attracting different types of traders.

Market Size and Liquidity

The size and liquidity of the XRP derivatives market are constantly evolving. While it's smaller than the derivatives markets for Bitcoin or Ethereum, its growth is notable. A large and liquid market generally leads to smoother price movements, reducing volatility. However, a less liquid market can make it difficult to enter or exit positions quickly, potentially exacerbating price swings.

-

Comparison to Other Crypto Derivatives Markets: The XRP derivatives market's liquidity is significantly smaller than Bitcoin's or Ethereum's. This difference in liquidity directly impacts the magnitude of price fluctuations. A smaller market is more susceptible to larger price swings based on relatively smaller trading volumes.

-

Data and Statistics: Tracking the open interest (number of outstanding contracts) and trading volume in XRP derivatives is crucial to assess market size and liquidity. These data points, available through various exchanges and analytics platforms, can be used to gauge current market sentiment and potential future price movements. The higher the open interest and trading volume, the more significant the derivatives market's influence on XRP's price.

XRP Price Action Analysis

Identifying Key Price Drivers

Numerous factors outside the derivatives market drive XRP's price. These include:

-

Regulatory News: Positive regulatory developments regarding Ripple and XRP often lead to significant price increases, while negative news can trigger substantial drops. This is especially true as Ripple navigates its ongoing legal battle with the SEC.

-

Technological Advancements: Improvements to Ripple's technology, such as enhancements to its speed, scalability, or security, can positively affect investor sentiment and drive up the price. Conversely, setbacks or vulnerabilities revealed can negatively impact the price.

-

Market Sentiment: Overall market sentiment toward cryptocurrencies generally affects XRP's price. Periods of broader market enthusiasm or fear can lead to substantial price swings independent of the derivatives market's activities.

-

Adoption and Partnerships: Widespread adoption of RippleNet by banks and financial institutions fuels a positive narrative, driving increased demand and potentially influencing XRP's price.

Correlation Between Derivatives and Spot Prices

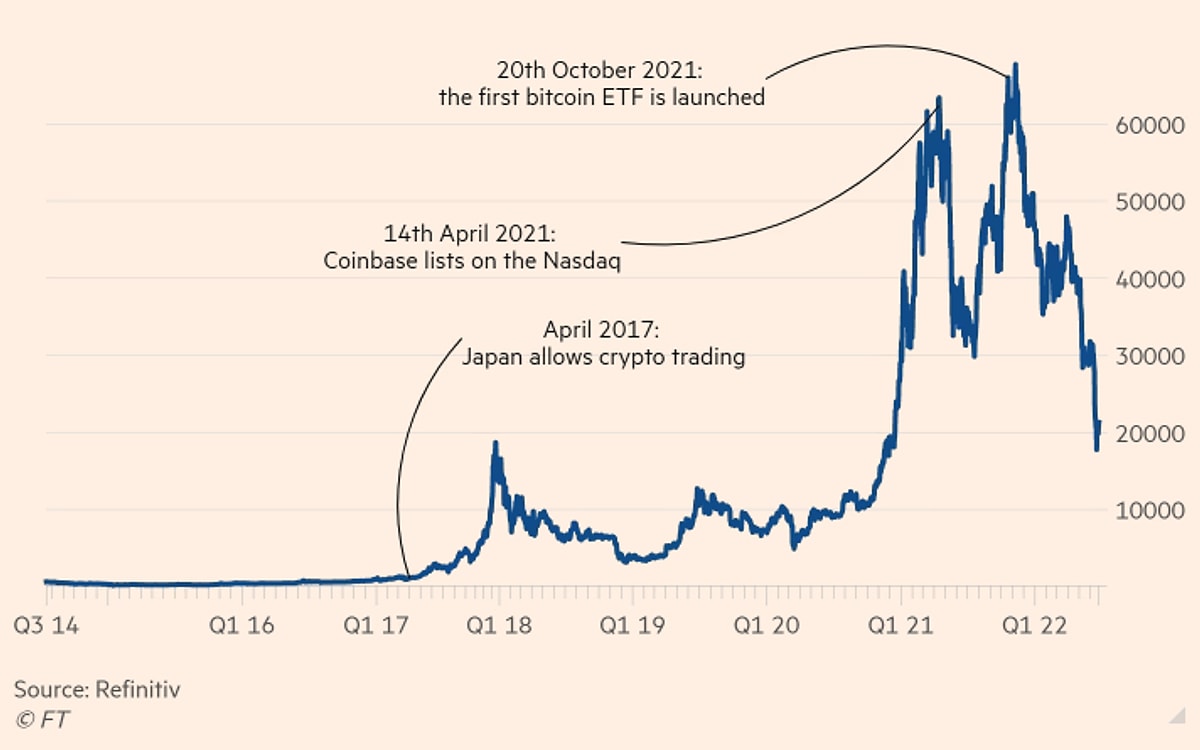

Analyzing the correlation between XRP's spot price (the price on exchanges) and its price in the derivatives market reveals valuable insights. Generally, a strong positive correlation indicates that the derivatives market closely tracks the spot market. However, discrepancies can occur, highlighting opportunities for arbitrage or speculation. This correlation analysis is best represented using charts and graphs comparing spot price and derivatives prices (like futures or options). For instance, futures prices consistently above spot prices might suggest bullish expectations.

Volatility and Its Impact on Derivatives Trading

XRP's inherent volatility significantly influences the pricing and trading of its derivatives. High volatility creates opportunities for profit but also increases the risk of substantial losses.

-

Managing Risk: Traders use derivatives like options to hedge against volatility and manage risk. Strategies such as buying put options can protect against potential price drops, while selling call options can generate income when prices remain relatively stable.

-

Volatility and Trading Strategies: High volatility can lead to increased trading volume and higher premiums for options contracts. Understanding volatility is vital for selecting appropriate trading strategies. Sophisticated traders can use options spreads to define risk and target specific price movements, which could include both volatility and directional plays.

Predictive Modeling and Forecasting

Utilizing Derivatives Data for Price Prediction

Derivatives data, such as open interest, implied volatility from options, and futures prices, can be incorporated into predictive models to enhance forecasting accuracy. Analyzing these indicators can offer insights into market sentiment and potential future price movements.

-

Open Interest: High open interest in futures contracts can suggest significant market anticipation of price movement, either up or down.

-

Implied Volatility: Options prices reflect the market's expectation of future price volatility. High implied volatility suggests traders anticipate significant price swings.

Challenges and Limitations

While derivatives data can be useful, it's crucial to acknowledge challenges and limitations:

-

Market Manipulation: The possibility of market manipulation by large players affects the reliability of derivatives data.

-

Information Asymmetry: Some traders may have access to information unavailable to others, making prediction models susceptible to biases.

-

Model Limitations: Predictive models are not perfect. They simplify complex market dynamics, and unexpected events can render them inaccurate.

Conclusion

Analyzing XRP's price action necessitates understanding the significant influence of its derivatives market. We've examined the various types of XRP derivatives, their impact on price volatility, and the correlation between spot and derivatives prices. Furthermore, we've discussed the use of derivatives for risk management and the challenges in using derivatives data for accurate price prediction.

Understanding the intricate relationship between XRP price action and its derivatives market is crucial for navigating the complexities of this dynamic cryptocurrency. Further research and careful analysis of XRP derivatives trading are essential for informed investment decisions in the XRP market. Continue your research into XRP price action and derivatives market implications to make well-informed choices.

Featured Posts

-

Nuggets Vs Bulls De Andre Jordans Historic Night

May 08, 2025

Nuggets Vs Bulls De Andre Jordans Historic Night

May 08, 2025 -

Bitcoin In Buguenkue Durumu Fiyat Hareketleri Ve Gelecek Tahminleri

May 08, 2025

Bitcoin In Buguenkue Durumu Fiyat Hareketleri Ve Gelecek Tahminleri

May 08, 2025 -

Analyzing Ripples Xrp Potential Can It Break Through To 3 40

May 08, 2025

Analyzing Ripples Xrp Potential Can It Break Through To 3 40

May 08, 2025 -

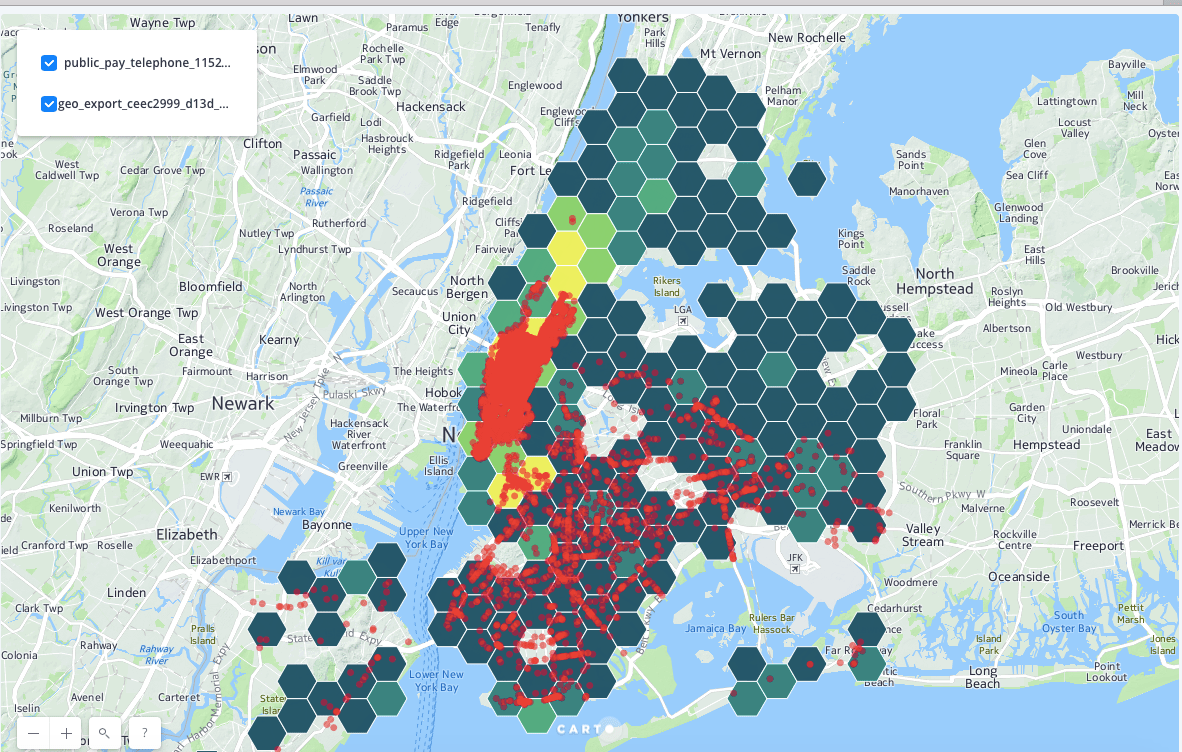

New Business Hotspots A Map Of The Countrys Fastest Growing Areas

May 08, 2025

New Business Hotspots A Map Of The Countrys Fastest Growing Areas

May 08, 2025 -

Rain Delayed Victory For Angels Paris Late Homer The Difference

May 08, 2025

Rain Delayed Victory For Angels Paris Late Homer The Difference

May 08, 2025

Latest Posts

-

Universal Credit Recipients Face Benefit Cuts Under Dwp Reforms

May 08, 2025

Universal Credit Recipients Face Benefit Cuts Under Dwp Reforms

May 08, 2025 -

Dwp To Axe Two Benefits Final Payments Incoming

May 08, 2025

Dwp To Axe Two Benefits Final Payments Incoming

May 08, 2025 -

Dwp Overhaul Universal Credit Changes And Potential Loss Of Benefits

May 08, 2025

Dwp Overhaul Universal Credit Changes And Potential Loss Of Benefits

May 08, 2025 -

Dwp Increases Home Visits For Benefit Claimants Impact And Concerns

May 08, 2025

Dwp Increases Home Visits For Benefit Claimants Impact And Concerns

May 08, 2025 -

Dwp Doubles Home Visits Thousands Of Benefit Claimants Affected

May 08, 2025

Dwp Doubles Home Visits Thousands Of Benefit Claimants Affected

May 08, 2025