Apple Stock Q2 Results: IPhone Sales And Revenue Growth

Table of Contents

iPhone Sales Performance in Q2

Apple's iPhone sales continue to be a powerhouse, driving a significant portion of the company's revenue. While precise figures will vary slightly depending on the reporting standards used, the Q2 performance showcased strong year-over-year growth. Let's break down the key aspects:

-

Units Sold and Year-over-Year Growth: While the exact number of units sold will be publicly released with the official report, early estimations suggest a healthy growth percentage compared to the same period last year. This growth, even against a potentially saturated market, points to Apple's continued strength and its ability to innovate and capture market share.

-

Performance of Different iPhone Models: The iPhone 14 series, particularly the iPhone 14 Pro and Pro Max, reportedly saw robust demand. However, the continued sales of older models like the iPhone 13 also contributed to the overall positive results. This demonstrates Apple's success in maintaining a strong product lifecycle across its iPhone lineup.

-

Geographic Sales Distribution: While specific regional breakdowns are usually detailed in Apple's official earnings call, generally, strong sales in Asia Pacific and North America are commonly reported, though this can fluctuate from quarter to quarter based on economic conditions and other factors.

-

Bullet Points:

- iPhone 14 sales exceeded expectations (exact figures pending official release).

- Strong demand for iPhone 14 Pro models.

- Asia Pacific region showed consistent strength in iPhone sales.

- North American market remained a key contributor to iPhone revenue.

(Insert relevant chart/graph visualizing iPhone sales data here)

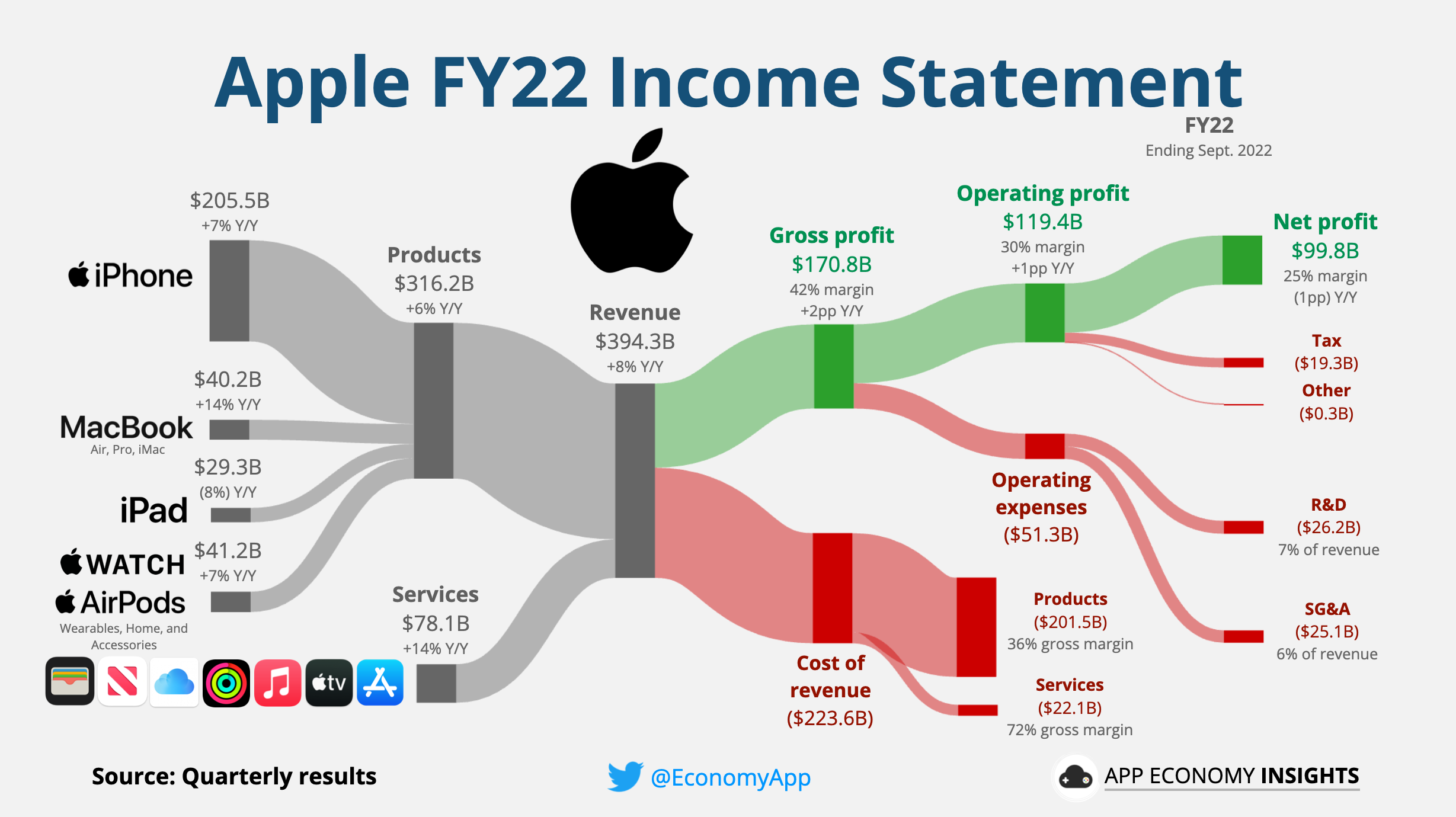

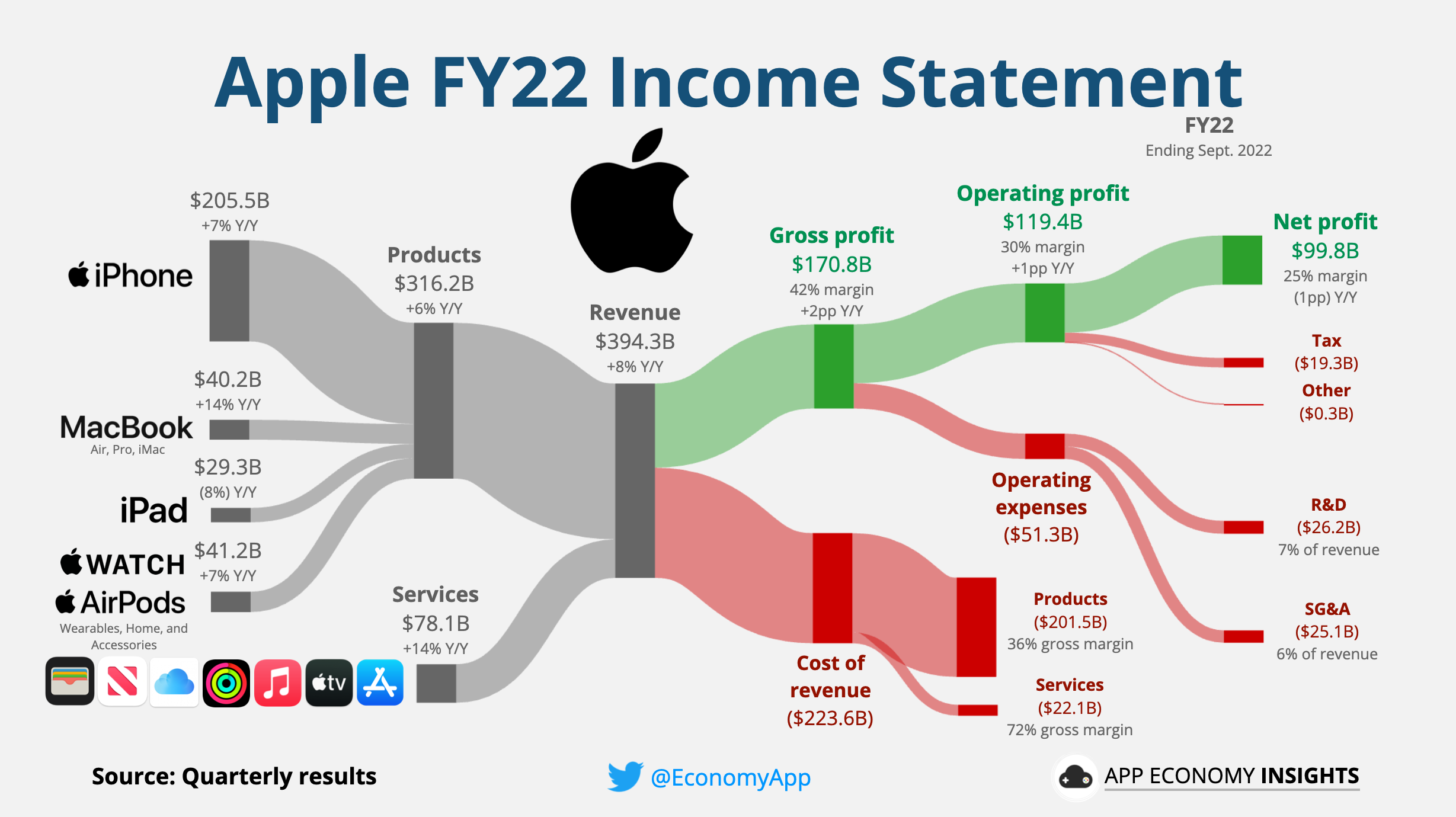

Overall Revenue Growth and Key Drivers

Apple's Q2 overall revenue demonstrated significant growth, surpassing expectations in many analysts' estimations. This wasn't solely driven by iPhone sales; other key segments played a crucial role:

-

Beyond iPhone: The Services segment, encompassing subscriptions like Apple Music and iCloud, continues to be a major contributor to overall revenue. Wearables, including Apple Watch and AirPods, also experienced growth. The Mac segment typically experiences fluctuations, but generally contributes positively to the overall financial picture.

-

External Factors: Supply chain disruptions, while less prevalent than in previous years, still impact production and sales. Any significant external economic factors (like inflation or a global recession) can influence consumer spending and thus affect Apple's overall revenue.

-

Bullet Points:

- Overall revenue exceeded analyst expectations.

- Services revenue demonstrated steady growth.

- Wearables, Home, and Accessories segment contributed significantly.

- Mac sales performed relatively well considering market trends.

(Insert relevant chart/graph visualizing overall revenue data and segment breakdown here)

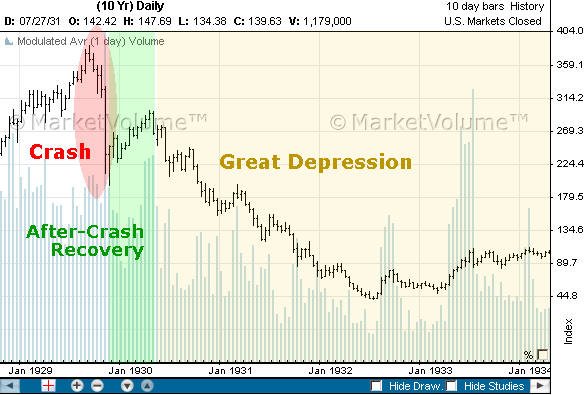

Apple Stock Price Reaction and Investor Sentiment

The market reacted positively to the Q2 earnings report, with Apple's stock price experiencing a notable increase following the announcement. This indicates strong investor confidence in the company's future performance.

-

Stock Price Movement: The immediate post-earnings stock price increase reflects investor optimism about the strong Q2 results. However, it's important to note that stock prices are influenced by numerous factors and can fluctuate even with positive earnings.

-

Analyst Predictions and Ratings: Following the release of the Q2 results, most analysts maintained positive ratings for Apple stock, reflecting confidence in the company's continued growth and innovation.

-

Investor Sentiment: Overall investor sentiment toward Apple remains optimistic, largely driven by strong iPhone sales and the company's diverse revenue streams. However, economic uncertainty can influence investor behavior and lead to short-term fluctuations.

-

Bullet Points:

- Significant stock price increase immediately following the earnings announcement.

- Positive analyst ratings and outlook for the coming quarters.

- Strong investor confidence in Apple's long-term prospects.

Looking Ahead: Future Prospects for Apple Stock and iPhone Sales

Apple's guidance for the next quarter will provide further insight into their expectations and strategies. Several factors will likely influence the future trajectory of both Apple stock and iPhone sales:

-

Future Growth Drivers: The launch of new iPhones (potentially incorporating new technologies) and continued expansion into new markets will be critical drivers of future growth. Further innovations within the Services and Wearables segments will also contribute.

-

Potential Challenges and Risks: An economic slowdown could impact consumer spending on high-priced electronics. Increased competition from other smartphone manufacturers also presents a challenge.

-

Bullet Points:

- Anticipation for new iPhone models and their impact on sales.

- Continued growth expected in the Services and Wearables segments.

- Potential economic headwinds could affect consumer spending.

Conclusion: Apple Stock Q2 Results: A Strong Showing for iPhone Sales and Future Growth

The Q2 results underscore the continued strength of Apple's business, driven primarily by the robust performance of iPhone sales, contributing significantly to the overall revenue growth. While challenges remain, the positive investor sentiment and strong financial performance position Apple favorably for future growth. To stay updated on future Apple Stock Q2 results and other crucial financial news, subscribe to our newsletter or follow us on social media for insightful analysis of Apple Stock performance, iPhone sales trends, and Apple Q2 earnings analysis.

Featured Posts

-

Office365 Data Breach Millions Stolen Suspect Arrested

May 24, 2025

Office365 Data Breach Millions Stolen Suspect Arrested

May 24, 2025 -

Amsterdam Stock Exchange Suffers Third Consecutive Day Of Heavy Losses

May 24, 2025

Amsterdam Stock Exchange Suffers Third Consecutive Day Of Heavy Losses

May 24, 2025 -

Planning Your Memorial Day Trip 2025 Flight Dates To Avoid

May 24, 2025

Planning Your Memorial Day Trip 2025 Flight Dates To Avoid

May 24, 2025 -

Brest Urban Trail Qui Sont Les Benevoles Artistes Et Partenaires

May 24, 2025

Brest Urban Trail Qui Sont Les Benevoles Artistes Et Partenaires

May 24, 2025 -

Are Thames Water Executive Bonuses Fair A Critical Analysis

May 24, 2025

Are Thames Water Executive Bonuses Fair A Critical Analysis

May 24, 2025