Are BMW And Porsche Losing Ground In China? A Comprehensive Analysis Of Market Trends

Table of Contents

Declining Sales Figures and Market Share

The Chinese luxury car market, while still substantial, is showing signs of a changing power dynamic. Let's examine the performance of BMW and Porsche individually.

BMW's Performance in China

BMW's recent sales data in China reveals a mixed picture. While still a major player, year-over-year growth has slowed significantly.

- 2022 Sales: [Insert actual sales figures here – source needed]. This represents a [percentage]% decrease compared to 2021.

- Market Share: BMW's market share in the luxury segment has dropped from [previous year percentage]% to [current year percentage]%.

- Reasons for Decline: The slowdown can be attributed to several factors, including increased competition from both domestic and international brands, a slight economic slowdown affecting luxury purchases, and the growing preference for electric vehicles.

Porsche's Position in the Chinese Luxury Market

Porsche, despite its strong brand image, is also facing increased pressure. While still a desirable brand, its growth trajectory in China is not as steep as it once was.

- 2022 Sales: [Insert actual sales figures here – source needed]. Showing a [percentage]% increase/decrease compared to 2021.

- Market Share Comparison: Compared to rivals like Audi, Mercedes-Benz, and rapidly expanding Chinese brands, Porsche's market share is holding steady but not significantly expanding.

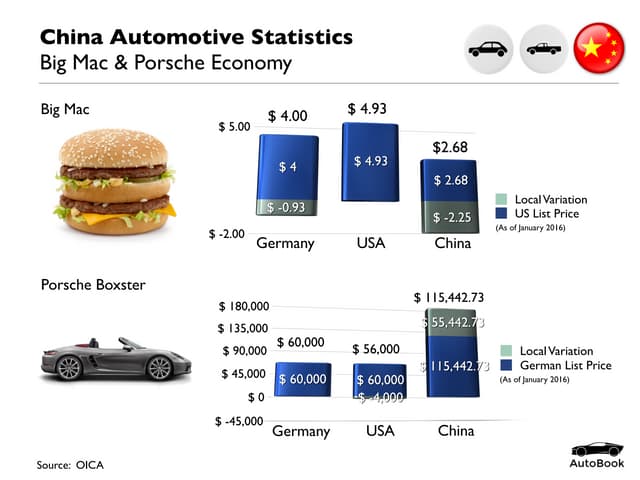

- Influencing Factors: Pricing strategies, model availability tailored to the Chinese market, and maintaining a strong brand image are crucial for Porsche's continued success. The perception of value for money in a competitive landscape is key.

Rising Competition from Domestic and International Brands

The competitive landscape in China is intensifying, with both domestic and international brands posing significant challenges to established luxury players like BMW and Porsche.

The Rise of Chinese Automakers

Chinese automakers like BYD, NIO, and XPeng are rapidly gaining market share, leveraging several advantages:

- Technological Advancements: These brands are investing heavily in electric vehicle technology, autonomous driving features, and advanced connectivity.

- Competitive Pricing: They offer attractive pricing strategies, often undercutting established luxury brands.

- Government Support: Government incentives and policies favor domestic brands, boosting their competitiveness.

- Targeted Marketing: Their marketing campaigns resonate strongly with Chinese consumers, focusing on national pride and technological innovation.

Increased Pressure from Other International Luxury Brands

BMW and Porsche also face intense competition from other international luxury brands:

- Mercedes-Benz and Audi: These German rivals maintain strong market positions and continuously introduce new models and technologies.

- Tesla: Tesla's success in the Chinese EV market significantly impacts the luxury segment, particularly with its focus on technology and efficiency.

- Competitive Strategies: All these brands are engaging in aggressive pricing strategies, technological innovation, and targeted marketing campaigns, creating a highly competitive environment.

Shifting Consumer Preferences and Market Trends

China's automotive market is not static; consumer preferences are evolving rapidly.

The Growing Demand for Electric Vehicles (EVs)

The demand for electric vehicles is soaring in China, prompting a crucial shift for luxury brands.

- BMW and Porsche's EV Offerings: Both BMW and Porsche are expanding their EV portfolios, but their market share in the EV segment still lags behind some competitors.

- Competition in the EV Sector: Chinese EV manufacturers are leading the charge with innovative and affordable models, challenging the traditional luxury brands' dominance.

Evolving Consumer Preferences

Beyond EVs, broader changes are impacting purchasing decisions:

- Technology and Connectivity: Chinese consumers place high value on advanced technology features, connectivity, and seamless integration with their digital lives.

- Brand Image: While brand prestige remains important, consumers also consider value for money and technological innovation when making luxury purchases.

- Adaptability: BMW and Porsche's success hinges on their ability to adapt quickly to evolving consumer expectations and preferences.

Economic Factors and Government Policies

Macroeconomic conditions and government policies significantly influence the automotive market in China.

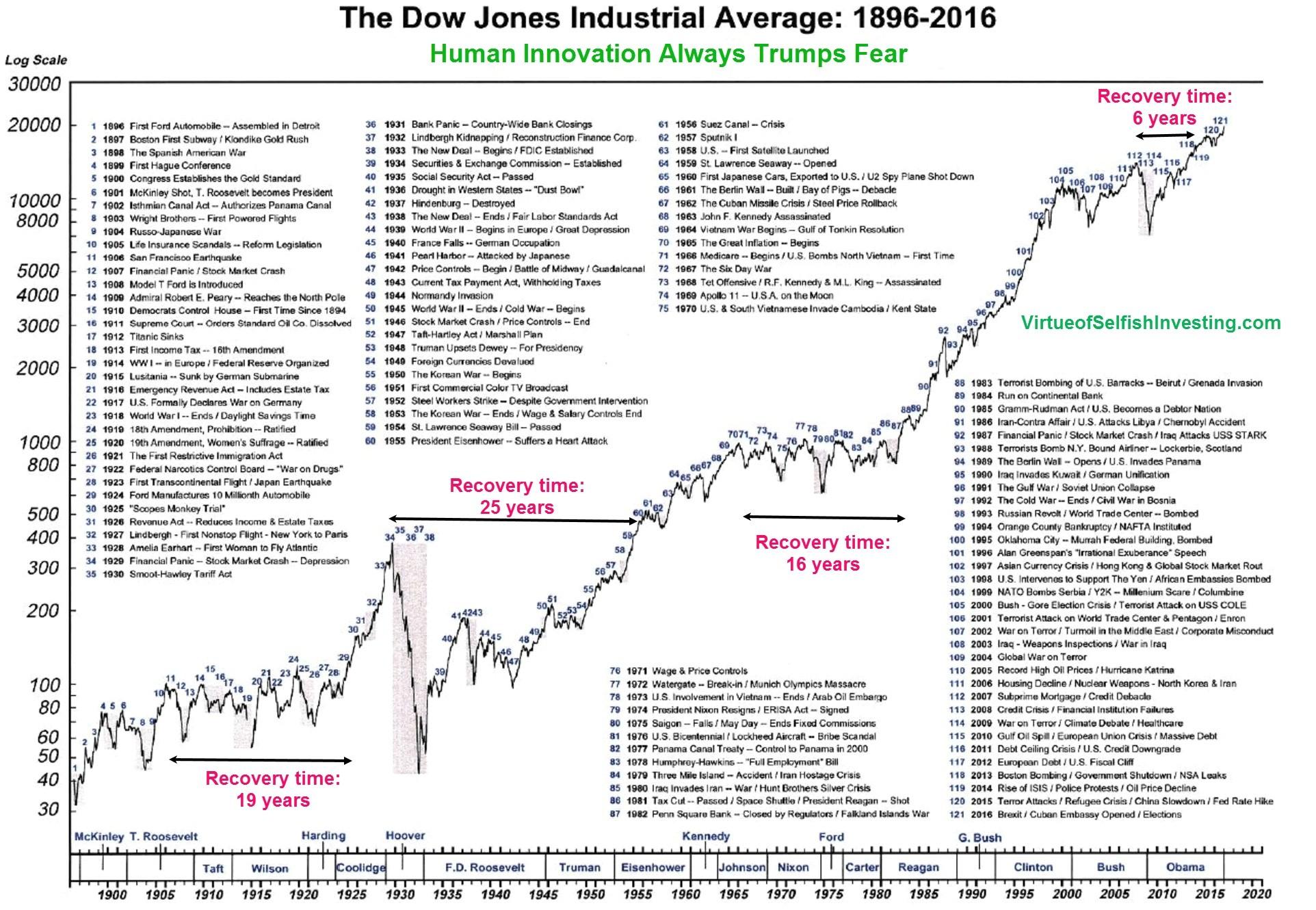

The Impact of Economic Slowdown

Any economic slowdown in China directly impacts luxury car sales, as these are discretionary purchases.

- Consumer Spending: Economic uncertainty can lead to reduced consumer spending on luxury goods, including high-end vehicles.

- Sales Volatility: Economic fluctuations translate into volatility in the luxury car market, making it crucial for brands to have robust strategies to weather economic downturns.

Government Regulations and Incentives

Government policies, particularly those related to emissions and EV subsidies, significantly shape the market.

- Emission Standards: Stringent emission regulations push manufacturers to invest in cleaner technologies, impacting production costs and vehicle design.

- EV Subsidies: Government incentives for EV purchases influence consumer preferences and market demand, forcing brands to prioritize EV development.

Conclusion

This analysis reveals the complex challenges facing BMW and Porsche in the Chinese automotive market. While they maintain significant brand recognition and market presence, their dominance is under pressure from rising domestic competitors, the burgeoning EV sector, and evolving consumer expectations. Declining sales figures and intensified competition necessitate a proactive and adaptive approach to maintain market share. Both brands must focus on technological innovation, tailored pricing strategies, and adapting to the evolving preferences of Chinese consumers to secure their future success.

Call to Action: To stay informed on the dynamic shifts in the Chinese luxury car market and how BMW and Porsche are adapting, continue following our in-depth analysis of the BMW and Porsche market in China. Subscribe to our newsletter for regular updates on this ever-evolving landscape.

Featured Posts

-

Jogador Do Palmeiras Estevao Vomita Na Altitude E Deixa O Campo

Apr 30, 2025

Jogador Do Palmeiras Estevao Vomita Na Altitude E Deixa O Campo

Apr 30, 2025 -

Beyonces Revealing Levis Ad Sparks Online Buzz

Apr 30, 2025

Beyonces Revealing Levis Ad Sparks Online Buzz

Apr 30, 2025 -

Stuttgart Ta Atff Altyapi Secmelerine Katilin

Apr 30, 2025

Stuttgart Ta Atff Altyapi Secmelerine Katilin

Apr 30, 2025 -

Zwierzeta Bezdomne Pamietajmy O Nich 4 Kwietnia

Apr 30, 2025

Zwierzeta Bezdomne Pamietajmy O Nich 4 Kwietnia

Apr 30, 2025 -

Stock Market News Dow Futures Earnings Season And Current Market Conditions

Apr 30, 2025

Stock Market News Dow Futures Earnings Season And Current Market Conditions

Apr 30, 2025