Assessing The Overvalued Canadian Dollar: Challenges And Opportunities

Table of Contents

Factors Contributing to an Overvalued Canadian Dollar

Several factors contribute to the perception of an overvalued Canadian dollar. Understanding these elements is crucial for anticipating future trends and mitigating potential risks.

Strong Commodity Prices

High global demand for Canadian resources like oil, gas, and other raw materials often strengthens the CAD. This is because increased exports lead to higher demand for the Canadian dollar, pushing its value upwards.

- Increased exports lead to higher demand for the Canadian dollar. A robust global market for Canadian commodities translates directly into increased foreign currency inflows, boosting the CAD's exchange rate.

- Fluctuations in global energy markets directly impact the CAD's value. Oil prices, in particular, have a significant correlation with the CAD. Periods of high oil prices tend to strengthen the Canadian dollar, while price drops weaken it.

- Analysis of recent commodity price trends and their correlation with the CAD. Tracking commodity indices and comparing them to CAD exchange rates reveals a clear relationship, highlighting the impact of commodity markets on currency valuation. For example, a surge in oil prices usually leads to an appreciation of the CAD.

Interest Rate Differentials

Higher interest rates in Canada compared to other countries can attract foreign investment, increasing CAD demand. This inflow of capital seeking higher returns strengthens the currency.

- Comparison of Canadian interest rates with key global economies (e.g., US, EU). The Bank of Canada's monetary policy decisions influence interest rate differentials, making Canada a more or less attractive investment destination. Higher rates relative to competitors typically support a stronger CAD.

- Impact of Bank of Canada monetary policy on the CAD's value. Changes in the Bank of Canada's benchmark interest rate directly affect the attractiveness of Canadian assets to foreign investors, influencing the CAD's exchange rate.

- Discussion of the relationship between interest rate differentials and currency valuation. The higher the interest rate differential between Canada and other countries, the greater the incentive for foreign capital to flow into Canada, thereby increasing demand for the CAD.

Geopolitical Factors

Global instability can drive investors towards safe-haven currencies like the CAD, boosting its value. During periods of international uncertainty, investors often seek refuge in stable, low-risk currencies.

- Examples of geopolitical events affecting the CAD's strength. Times of global uncertainty, such as political upheavals or major economic crises, often see a flight to safety, benefiting the Canadian dollar due to Canada's perceived political and economic stability.

- Analysis of the CAD's performance during periods of global uncertainty. Historical data demonstrates a consistent pattern of the CAD strengthening during periods of global instability, illustrating its safe-haven status.

- The role of investor sentiment and risk aversion in CAD valuation. Investor confidence and risk appetite significantly influence currency valuations. In times of heightened risk aversion, the CAD often benefits as investors seek the relative safety of Canadian assets.

Challenges of an Overvalued Canadian Dollar

While a strong Canadian dollar might seem beneficial, an overvalued CAD presents several significant challenges.

Impact on Exports

A strong CAD makes Canadian exports more expensive in international markets, hindering competitiveness. This can lead to decreased sales and reduced profitability for Canadian businesses.

- Case studies of Canadian industries affected by a strong CAD. Sectors heavily reliant on exports, such as manufacturing and resource extraction, are particularly vulnerable to the negative impacts of an overvalued Canadian dollar.

- Strategies for Canadian businesses to mitigate the impact of an overvalued CAD on exports. Businesses can explore strategies like diversification of markets, cost reduction, and product innovation to offset the impact of a strong CAD.

- Discussion of the impact on trade balances and economic growth. A persistently overvalued CAD can lead to a widening trade deficit and slower economic growth, as exports become less competitive and imports become relatively cheaper.

Impact on Inflation

Increased import costs due to a strong CAD can contribute to inflation, impacting consumer spending. While consumers benefit from cheaper imports, a significant price increase in imported goods can counteract this advantage.

- Analysis of the relationship between CAD value and inflation rates. There's a complex relationship between currency valuation and inflation; while a strong CAD can reduce the price of imports, it can also hurt export-oriented businesses, indirectly impacting prices.

- Discussion of the Bank of Canada's response to inflation pressures. The Bank of Canada's monetary policy responses to inflation, including interest rate adjustments, can further impact the CAD's value.

- Potential policy responses to manage inflation related to CAD valuation. Government policies addressing inflation related to CAD valuation may involve measures aimed at boosting domestic production or mitigating the impact of import price changes.

Opportunities Presented by an Overvalued Canadian Dollar

Despite the challenges, an overvalued Canadian dollar also presents certain opportunities.

Increased Purchasing Power

Consumers benefit from lower import prices, leading to increased purchasing power. This can stimulate domestic consumption and overall economic activity.

- Examples of goods and services whose prices are affected by a strong CAD. Imported goods, especially consumer electronics, clothing, and certain food items, become cheaper for Canadian consumers with a strong CAD.

- The impact on consumer spending and economic growth. Increased purchasing power can boost consumer confidence and spending, contributing positively to economic growth.

- Analysis of the overall benefits to consumers. A strong CAD translates to greater affordability for consumers, improving their standard of living.

Investment Opportunities

The overvalued CAD might present opportunities for strategic investments in foreign markets. Canadian investors can potentially leverage the stronger CAD to acquire assets in other countries at a lower cost.

- Examples of investment strategies to capitalize on an overvalued CAD. Investing in foreign equities or real estate can benefit from a strong CAD, as the cost of acquiring these assets is effectively reduced.

- Discussion of diversification strategies for minimizing risk. Diversifying investments across multiple markets and asset classes helps mitigate the risks associated with currency fluctuations.

- Importance of professional financial advice for investment decisions. Seeking guidance from experienced financial advisors is crucial when making investment decisions based on currency valuation changes.

Conclusion

Assessing the overvalued Canadian dollar requires a nuanced understanding of the complex interplay between global economic conditions, domestic policy, and market sentiment. While a strong CAD presents challenges for exporters and potentially contributes to inflation, it also offers opportunities for consumers through increased purchasing power and strategic investments abroad. Careful monitoring of commodity prices, interest rate differentials, and geopolitical factors is crucial for both businesses and individuals navigating this fluctuating currency landscape. Understanding the implications of an overvalued Canadian dollar is vital for making informed decisions in today's dynamic economic environment. Continuously monitoring the factors affecting the overvalued Canadian dollar and adapting strategies accordingly is essential for success.

Featured Posts

-

Bitcoin Or Micro Strategy Stock The Better Investment Strategy For 2025

May 08, 2025

Bitcoin Or Micro Strategy Stock The Better Investment Strategy For 2025

May 08, 2025 -

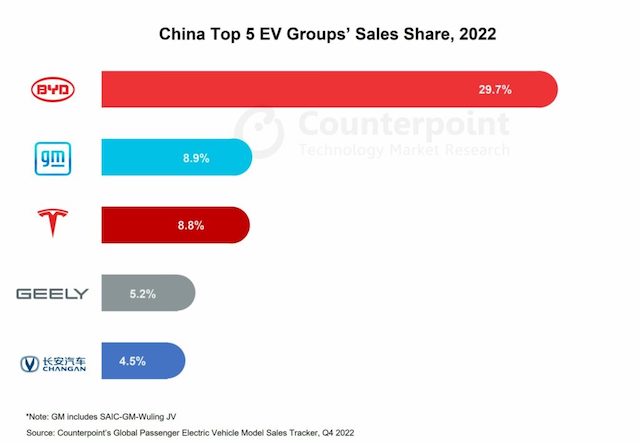

Chinas Automotive Market Opportunities And Obstacles For Premium Brands Like Bmw And Porsche

May 08, 2025

Chinas Automotive Market Opportunities And Obstacles For Premium Brands Like Bmw And Porsche

May 08, 2025 -

Jokics Birthday Westbrook And The Nuggets Heartfelt Tribute

May 08, 2025

Jokics Birthday Westbrook And The Nuggets Heartfelt Tribute

May 08, 2025 -

Bitcoin Price Golden Cross What It Means For Investors

May 08, 2025

Bitcoin Price Golden Cross What It Means For Investors

May 08, 2025 -

March 29th Thunder Vs Pacers Injury Report And Game Preview

May 08, 2025

March 29th Thunder Vs Pacers Injury Report And Game Preview

May 08, 2025

Latest Posts

-

Saturday Night Live And Counting Crows A Career Defining Moment

May 08, 2025

Saturday Night Live And Counting Crows A Career Defining Moment

May 08, 2025 -

The Unexpected Rise Of Counting Crows After Saturday Night Live

May 08, 2025

The Unexpected Rise Of Counting Crows After Saturday Night Live

May 08, 2025 -

Counting Crows The Saturday Night Live Effect

May 08, 2025

Counting Crows The Saturday Night Live Effect

May 08, 2025 -

Saturday Night Live And Counting Crows A Defining Moment

May 08, 2025

Saturday Night Live And Counting Crows A Defining Moment

May 08, 2025 -

The Unexpected Rise Of Counting Crows The Snl Factor

May 08, 2025

The Unexpected Rise Of Counting Crows The Snl Factor

May 08, 2025