AT&T Sounds Alarm On Broadcom's VMware Deal: 1,050% Price Surge

Table of Contents

The 1,050% Price Surge: Understanding the Numbers

The proposed Broadcom-VMware merger has experienced a significant increase in VMware's stock price. While the claim of a 1050% surge might be an exaggeration or based on a specific metric not widely reported, the actual increase is still substantial. Let's break down the numbers:

- Initial Offer Price: Broadcom initially offered $61 per share for VMware.

- Current Valuation (as of [Insert Date and Source]): [Insert the current accurate valuation per share. Make sure to cite the source].

- Percentage Increase: [Calculate the accurate percentage increase based on the initial offer and current valuation].

This dramatic increase reflects investor confidence in the deal's potential, but it also highlights the market's anticipation of significant changes in the tech landscape. This price surge is likely due to several factors, including:

- Synergies and Market Consolidation: The merger promises significant synergies between Broadcom's infrastructure offerings and VMware's virtualization technology, potentially leading to a more dominant player in the market.

- Investor Optimism: Investors believe the combined entity will generate substantial revenue growth and efficiency gains.

- Strategic Importance: VMware's position in the enterprise software market makes it a highly desirable acquisition target.

The market reaction to this price change has been mixed, with some analysts expressing concerns about potential overvaluation and antitrust challenges.

AT&T's Concerns and Potential Antitrust Implications

AT&T's alarm is rooted in several key concerns regarding the Broadcom-VMware merger. Their worries primarily center on:

- Increased Market Dominance: The combined entity would control a significant portion of the enterprise software and networking markets, potentially leading to less competition and higher prices for AT&T and its customers.

- Potential Anti-Competitive Practices: AT&T fears the merged company could engage in anti-competitive practices, such as favoring its own products and services over those of competitors.

- Higher Prices for AT&T's Services: This increased market dominance could translate to higher costs for the services AT&T relies on, impacting its own operations and potentially resulting in increased prices for its customers.

These concerns raise significant antitrust implications, and the deal is likely to face rigorous regulatory scrutiny from authorities globally. [Insert any official statements released by AT&T regarding their concerns here].

Impact on the Tech Industry and Consumers

The Broadcom-VMware merger holds significant implications for the tech industry and consumers alike.

- Ripple Effects: The acquisition could trigger a wave of mergers and acquisitions in the tech sector, further consolidating the market and potentially leading to less innovation and competition.

- Consumer Impact: Consumers could face higher prices for software and services as the merged entity gains greater market power. This is particularly concerning for businesses that rely heavily on VMware's virtualization technology.

- Job Market: While the merger might initially lead to some job losses due to redundancies, it could also create new opportunities in areas like integration and development.

This massive acquisition highlights the ongoing consolidation trend within the tech industry and emphasizes the importance of antitrust regulations.

Alternative Scenarios and Future Predictions

Several possible outcomes exist for the Broadcom-VMware deal:

- Successful Merger: The deal could proceed as planned after regulatory approvals.

- Regulatory Blocks: Antitrust authorities might block the merger, citing concerns about market dominance and anti-competitive practices.

- Renegotiation of Terms: Broadcom might need to renegotiate the terms of the acquisition to address regulatory concerns.

- Alternative Acquisition: Another company could emerge as a potential buyer for VMware if the Broadcom deal fails.

Expert opinions are divided. Some believe the deal will eventually be approved with minor modifications, while others foresee significant regulatory hurdles. The future of this deal will heavily depend on the outcome of the antitrust review process.

Conclusion: The Future of AT&T, Broadcom, and VMware

AT&T's concerns regarding the Broadcom-VMware deal and the dramatic price surge highlight the potential ramifications of this massive merger. The potential impact on the tech industry and consumers is significant, ranging from increased prices to reduced competition. Whether the deal ultimately succeeds will hinge on the regulatory hurdles ahead. While predicting the exact outcome remains challenging, keeping a close eye on developments is crucial. Keep an eye on this developing story as we continue to monitor the implications of this unprecedented AT&T Broadcom VMware deal and its impact on the tech landscape.

Featured Posts

-

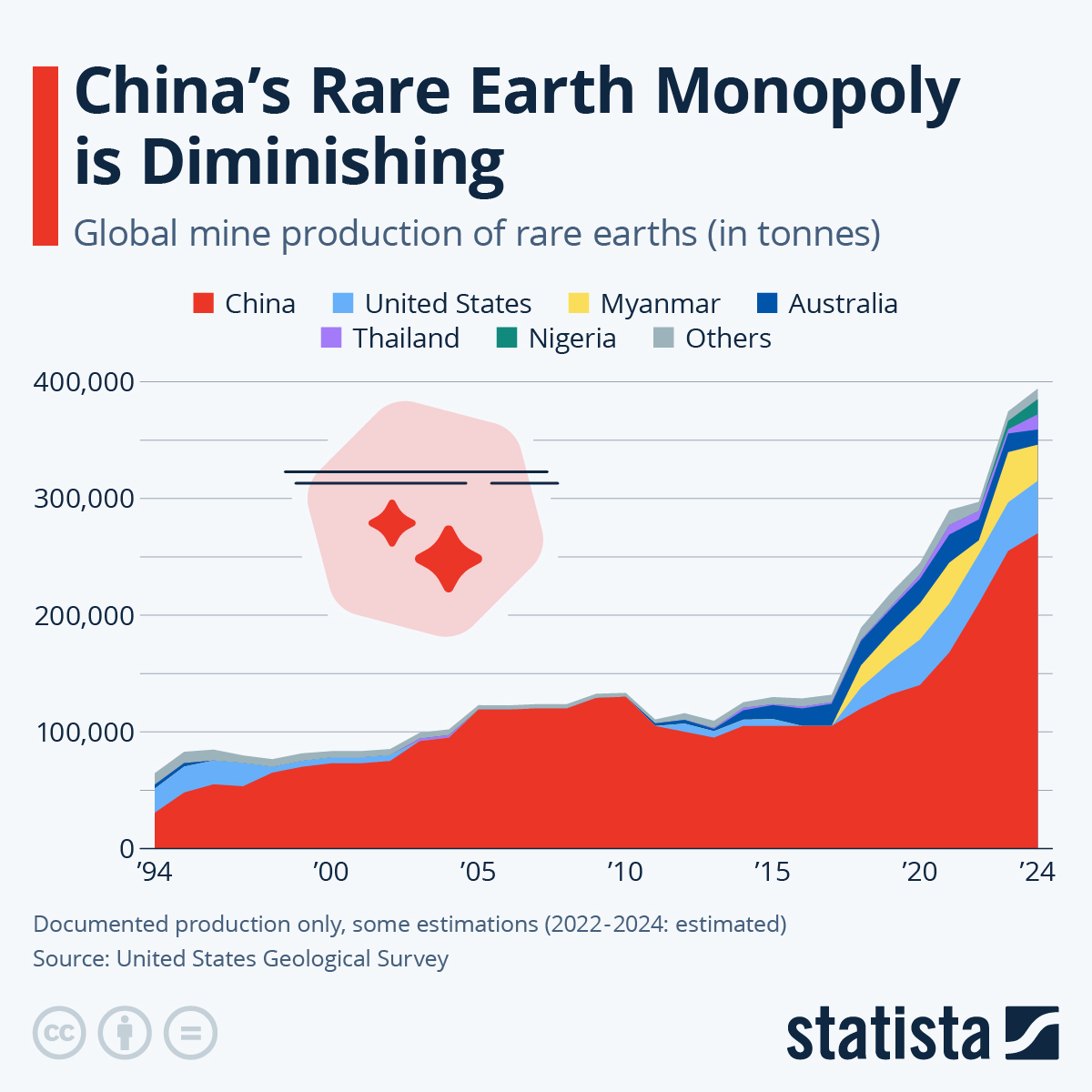

Teslas Optimus Robot Chinas Rare Earth Restrictions Cause Delays

Apr 24, 2025

Teslas Optimus Robot Chinas Rare Earth Restrictions Cause Delays

Apr 24, 2025 -

B And B April 3 Recap Liams Dramatic Collapse After A Row With Bill

Apr 24, 2025

B And B April 3 Recap Liams Dramatic Collapse After A Row With Bill

Apr 24, 2025 -

The Bold And The Beautiful Liam Steffy And Hope What To Expect In The Next Two Weeks

Apr 24, 2025

The Bold And The Beautiful Liam Steffy And Hope What To Expect In The Next Two Weeks

Apr 24, 2025 -

John Travolta Addresses Fan Concerns After Sharing Intimate Bedroom Photo

Apr 24, 2025

John Travolta Addresses Fan Concerns After Sharing Intimate Bedroom Photo

Apr 24, 2025 -

Rep Nancy Mace And Constituent Engage In Public Confrontation In South Carolina

Apr 24, 2025

Rep Nancy Mace And Constituent Engage In Public Confrontation In South Carolina

Apr 24, 2025