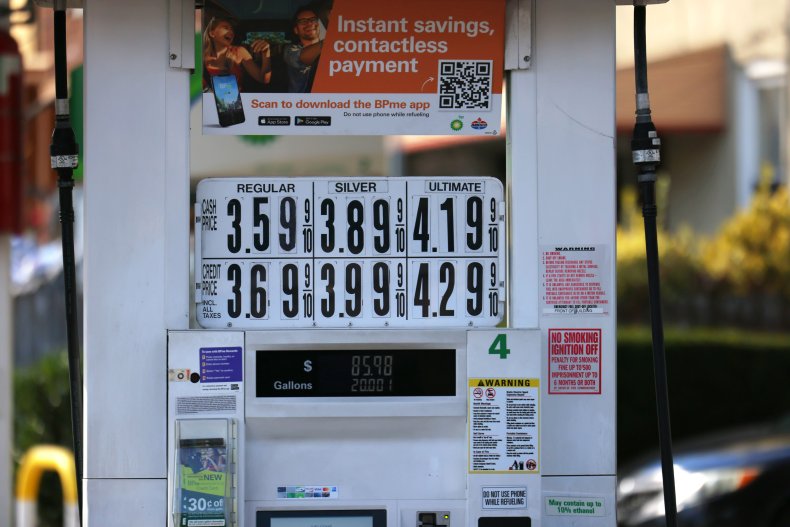

Average Gas Price Hike: Up Nearly 20 Cents A Gallon

Table of Contents

Reasons Behind the Average Gas Price Hike

Several interconnected factors contribute to the recent surge in gas prices. Understanding these elements is crucial to navigating the current economic climate and predicting future trends.

Increased Crude Oil Prices

The price of gasoline is intrinsically linked to the price of crude oil, its primary component. Geopolitical instability, OPEC decisions, and supply chain disruptions significantly influence crude oil prices, directly impacting what we pay at the pump.

- Geopolitical Events: The ongoing conflict in Ukraine, sanctions against Russia (a major oil producer), and tensions in other oil-rich regions create uncertainty and volatility in the global oil market, driving prices up.

- OPEC Decisions: The Organization of the Petroleum Exporting Countries (OPEC) plays a significant role in regulating global oil supply. Decisions regarding production quotas can directly impact crude oil prices and consequently, gasoline prices.

- Supply Chain Disruptions: Global supply chain issues, including logistical bottlenecks and reduced refinery capacity, exacerbate the impact of increased demand, leading to higher prices. Speculation within the oil futures market also contributes to price fluctuations. For example, a recent report indicated a 15% increase in oil futures contracts, reflecting market anxieties.

Refinery Capacity and Output

The efficiency and capacity of oil refineries are critical to meeting gasoline demand. Any disruption to refinery operations directly impacts supply and, subsequently, prices.

- Refinery Shutdowns: Unexpected refinery shutdowns due to maintenance, accidents, or unforeseen circumstances can significantly reduce gasoline production, leading to shortages and price increases. A major refinery shutdown in the Midwest earlier this year is a prime example.

- Reduced Refinery Capacity: Even without complete shutdowns, reduced refinery capacity due to aging infrastructure or planned maintenance can contribute to higher gas prices. Many older refineries are operating below optimal capacity, leading to supply constraints.

- Statistics on Refinery Output: Data from the Energy Information Administration (EIA) shows a consistent decline in refinery output in recent months, further supporting the link between reduced production and higher gas prices.

Seasonal Demand

Gasoline demand typically increases during peak driving seasons, such as summer vacations and holidays. This surge in demand often outpaces supply, resulting in higher prices.

- Peak Driving Seasons: Gas prices historically rise during the summer months (June-August) and around major holidays like Thanksgiving and Christmas, when travel is at its peak.

- Upcoming Events: The upcoming summer travel season and other significant holidays will likely further exacerbate the average gas price hike, putting additional pressure on consumer budgets. Data from previous years shows a clear correlation between holiday travel and increased gasoline prices.

Impact of the Average Gas Price Hike on Consumers

The average gas price hike has far-reaching consequences for consumers and the economy as a whole.

Increased Transportation Costs

Higher gas prices directly impact the cost of commuting, travel, and the transportation of goods and services.

- Commuting Expenses: Increased fuel costs add significant strain on household budgets, particularly for individuals with long commutes. Many are already making difficult choices regarding their transportation.

- Travel Costs: Higher gasoline prices make vacations, road trips, and other forms of travel more expensive, potentially discouraging leisure travel and impacting tourism.

- Cost of Goods and Services: The increased cost of transporting goods directly impacts the prices of everyday items, including groceries and other consumer goods. This inflationary effect disproportionately burdens lower-income households.

Budgetary Strain

The rising fuel costs create a significant budgetary strain for both households and businesses.

- Household Budgets: A significant portion of household income is often allocated to transportation costs, and the increase in gas prices directly reduces disposable income. This can lead to reduced spending in other areas and limit economic growth.

- Business Operations: Businesses, particularly those involved in transportation and logistics, face increased operational costs, potentially leading to higher prices for consumers.

Alternative Transportation Considerations

To mitigate the impact of higher fuel costs, consumers are increasingly exploring alternative transportation options.

- Public Transportation: Public transit systems, including buses and trains, offer a more affordable alternative for commuting, particularly for those living in urban areas.

- Cycling and Walking: For shorter distances, cycling and walking are cost-effective and environmentally friendly options.

- Carpooling: Sharing rides with colleagues or friends can significantly reduce individual transportation costs.

- Electric Vehicles: While the upfront cost of electric vehicles is higher, the long-term savings on fuel can be substantial, although charging infrastructure availability remains a concern.

Predicting Future Trends in Average Gas Prices

Predicting future gas prices is challenging due to the inherent volatility of the global energy market.

Market Volatility and Uncertainty

Several factors contribute to the unpredictability of the market.

- Geopolitical Instability: Ongoing geopolitical tensions and conflicts remain major sources of uncertainty, which can significantly influence oil prices.

- Unexpected Global Events: Unforeseen events, such as natural disasters or major supply chain disruptions, can further impact gas prices.

- Technological Advancements: The development and adoption of alternative energy sources and fuel-efficient technologies can affect future demand for gasoline.

Government Intervention and Policies

Government policies and regulations play a significant role in shaping energy markets.

- Energy Policies: Government initiatives promoting energy efficiency, alternative energy sources, and fuel diversification can indirectly influence gasoline prices.

- Taxation and Subsidies: Changes in fuel taxes or subsidies can significantly impact gas prices.

Conclusion

The recent average gas price hike is a result of a confluence of factors, including increased crude oil prices driven by geopolitical instability, reduced refinery capacity, and seasonal demand. This increase places a significant burden on consumers' budgets and necessitates a reassessment of transportation options. To mitigate the effects of this average gas price hike and future price fluctuations, it's crucial to monitor fuel price trends closely and explore alternative transportation methods. Monitor the average gas price hike closely and plan accordingly! Learn more about fuel-efficient driving techniques and alternative transportation options to combat rising average gas prices.

Featured Posts

-

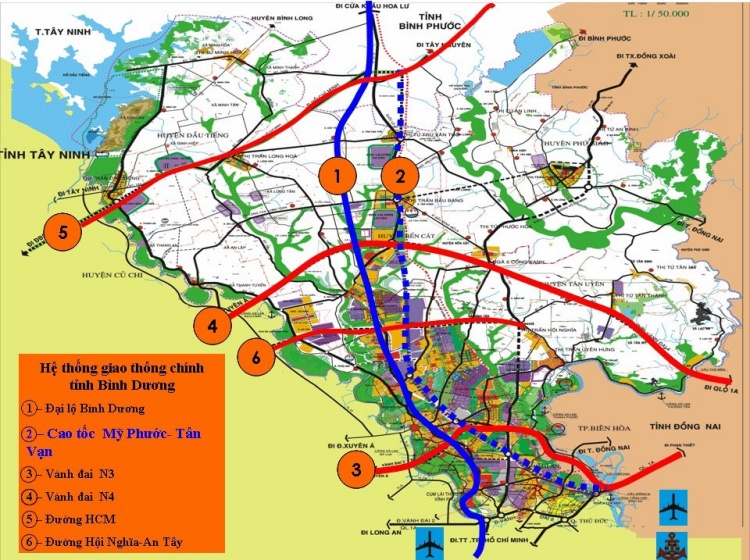

Cau Va Duong Noi Binh Duong Tay Ninh Ten Goi Va Thong Tin Chi Tiet

May 22, 2025

Cau Va Duong Noi Binh Duong Tay Ninh Ten Goi Va Thong Tin Chi Tiet

May 22, 2025 -

National Average Gas Price Drops Below 3 Amid Economic Uncertainty

May 22, 2025

National Average Gas Price Drops Below 3 Amid Economic Uncertainty

May 22, 2025 -

Netflix Ridica Stacheta Noul Serial Promite O Distributie Stelara

May 22, 2025

Netflix Ridica Stacheta Noul Serial Promite O Distributie Stelara

May 22, 2025 -

Uk News Jail Term Confirmed For Tory Politicians Wife Over Migrant Remarks

May 22, 2025

Uk News Jail Term Confirmed For Tory Politicians Wife Over Migrant Remarks

May 22, 2025 -

Vapors Of Morphine Northcote Concert Date And Ticket Info

May 22, 2025

Vapors Of Morphine Northcote Concert Date And Ticket Info

May 22, 2025