Bank Of Canada Rate Cuts: A Response To Dismal Retail Sales Figures?

Table of Contents

The Dismal State of Canadian Retail Sales

Recent data paints a concerning picture of the Canadian retail landscape. Canadian retail sales have experienced a significant decline, signaling a potential weakening in consumer spending and overall economic health. For example, [insert specific statistic, e.g., a percentage drop compared to the previous month or year]. This represents a substantial year-over-year decrease, raising serious concerns about the strength of the Canadian economy. This weak consumer spending is impacting various sectors across the country.

-

Impact on Consumer Confidence: The decline in retail sales directly reflects weakening consumer confidence. Canadians are becoming more cautious with their spending, potentially due to factors such as inflation, rising interest rates, and uncertainty in the global economy.

-

Sectors Hit Hardest: The automotive sector and durable goods sales have been particularly hard hit, indicating a decrease in big-ticket purchases. This suggests consumers are delaying major purchases, prioritizing essential spending instead.

-

Geographical Variations: While the decline is nationwide, certain regions of Canada are experiencing more pronounced drops in retail sales than others. [Insert details about regional variations if available, referencing specific provinces or territories]. This uneven impact highlights the varied economic realities across the country. Analyzing these regional disparities is crucial to understanding the overall health of the Canadian economy and informing potential policy responses. The phrase "Canadian retail sales decline" accurately summarizes this troubling trend.

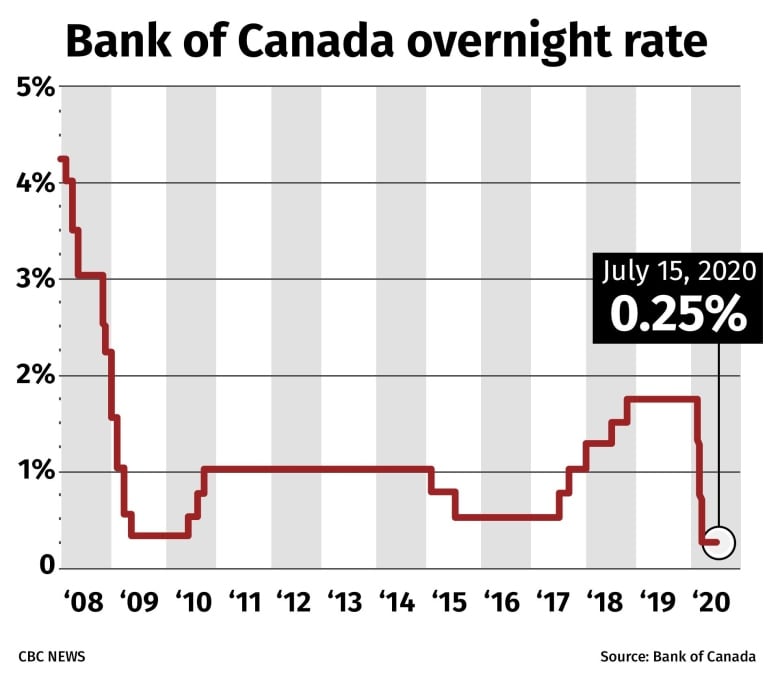

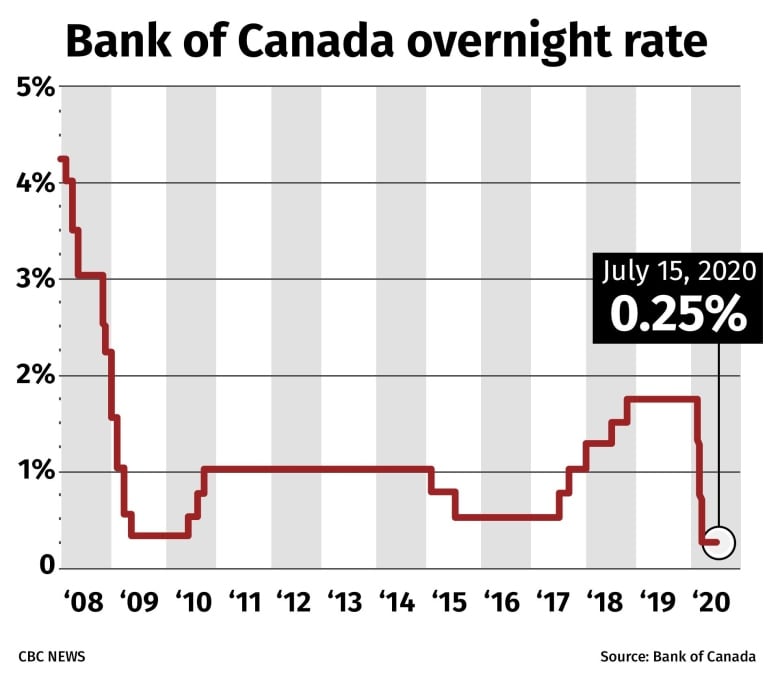

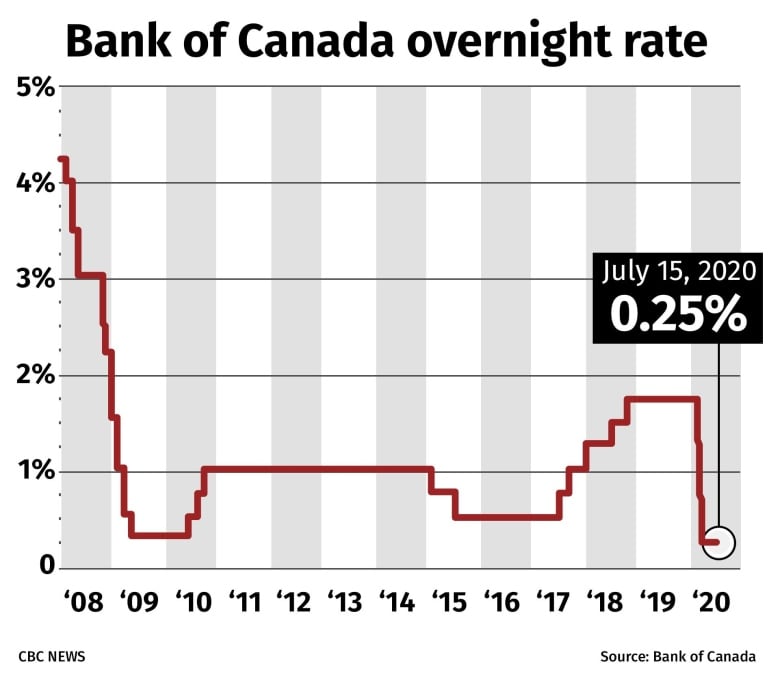

The Bank of Canada's Current Monetary Policy Stance

The Bank of Canada's current interest rate target is [insert current interest rate target]. Their recent statements reflect a cautious approach, acknowledging the slowing economic growth but also emphasizing concerns about inflation. The Bank of Canada's mandate is to maintain price stability and promote sustainable economic growth. Their decisions are carefully weighed against these dual objectives.

-

Current Inflation Rate: Inflation currently sits at [insert current inflation rate], which is [above/below/at] the Bank of Canada's target of [insert inflation target percentage]. The trajectory of inflation will be a key factor in their decision-making process.

-

Inflation Targeting: The Bank of Canada's commitment to inflation targeting means they are closely monitoring inflationary pressures. Any policy decision, including potential interest rate cuts, will need to consider the potential impact on inflation.

-

Influencing Economic Indicators: Beyond retail sales, other economic indicators like employment data, manufacturing output, and housing starts significantly influence the Bank of Canada's monetary policy decisions. A holistic view of the Canadian economy informs their actions.

The Potential for Bank of Canada Rate Cuts

Given the weak retail sales figures and the broader economic slowdown, the question of whether the Bank of Canada will cut interest rates is paramount. While a rate cut could stimulate consumer spending and potentially prevent a deeper recession, it also carries potential risks.

-

Arguments for Rate Cuts: Lowering interest rates could make borrowing cheaper, encouraging consumers and businesses to increase spending and investment, thereby boosting economic activity. This could help prevent a more severe economic downturn.

-

Arguments against Rate Cuts: Cutting rates too aggressively could exacerbate inflationary pressures, undermining the Bank of Canada's primary mandate of price stability. Furthermore, it could potentially weaken the Canadian dollar, impacting import costs and overall economic stability.

-

Historical Precedents: The Bank of Canada has historically used interest rate cuts to respond to economic downturns. Examining previous instances of rate cuts in response to similar economic situations could provide valuable insights into potential outcomes. Studying these historical precedents and comparing them with the current economic situation is crucial for accurate predictions.

Alternative Policy Responses

Besides outright interest rate cuts, the Bank of Canada has other policy tools at its disposal:

-

Quantitative Easing (QE): QE involves the Bank of Canada purchasing government bonds to increase the money supply and lower long-term interest rates. This is a less direct method of stimulating the economy than rate cuts.

-

Forward Guidance: The Bank of Canada could provide clear communication about its future intentions regarding monetary policy. This can influence market expectations and shape economic behavior.

-

Other Measures: The Bank of Canada may consider other supportive measures, depending on the evolving economic situation. These could involve collaborations with the federal government on fiscal stimulus packages or other initiatives to support specific sectors.

Conclusion

The relationship between weak Canadian retail sales and the potential for Bank of Canada rate cuts is complex. While declining retail sales certainly point towards a weakening economy, the Bank of Canada's response will depend on a careful assessment of various factors, including the inflation rate, overall economic outlook, and potential risks associated with rate cuts. The key arguments for rate cuts center on stimulating consumer spending and preventing a deeper recession, while arguments against focus on the risks of fueling inflation and weakening the Canadian dollar. The Bank of Canada may also consider alternative policy responses like quantitative easing or forward guidance.

To stay informed about the Bank of Canada's decisions regarding interest rates, monitor the latest economic indicators and follow our updates on the potential impact of Bank of Canada Rate Cuts on the Canadian economy. Regularly check back for further analysis and insights into the evolving situation.

Featured Posts

-

Williams Implosion Key Factor In Yankees Loss To Blue Jays

Apr 28, 2025

Williams Implosion Key Factor In Yankees Loss To Blue Jays

Apr 28, 2025 -

Red Sox Blue Jays Game Lineups Buehlers Start And Outfielders Return

Apr 28, 2025

Red Sox Blue Jays Game Lineups Buehlers Start And Outfielders Return

Apr 28, 2025 -

Yukon Legislature Mine Managers Testimony Sparks Contempt Threat

Apr 28, 2025

Yukon Legislature Mine Managers Testimony Sparks Contempt Threat

Apr 28, 2025 -

Identifying The Countrys Fastest Growing Business Areas

Apr 28, 2025

Identifying The Countrys Fastest Growing Business Areas

Apr 28, 2025 -

Bank Of Canada Rate Cuts A Response To Dismal Retail Sales Figures

Apr 28, 2025

Bank Of Canada Rate Cuts A Response To Dismal Retail Sales Figures

Apr 28, 2025

Latest Posts

-

75

Apr 28, 2025

75

Apr 28, 2025 -

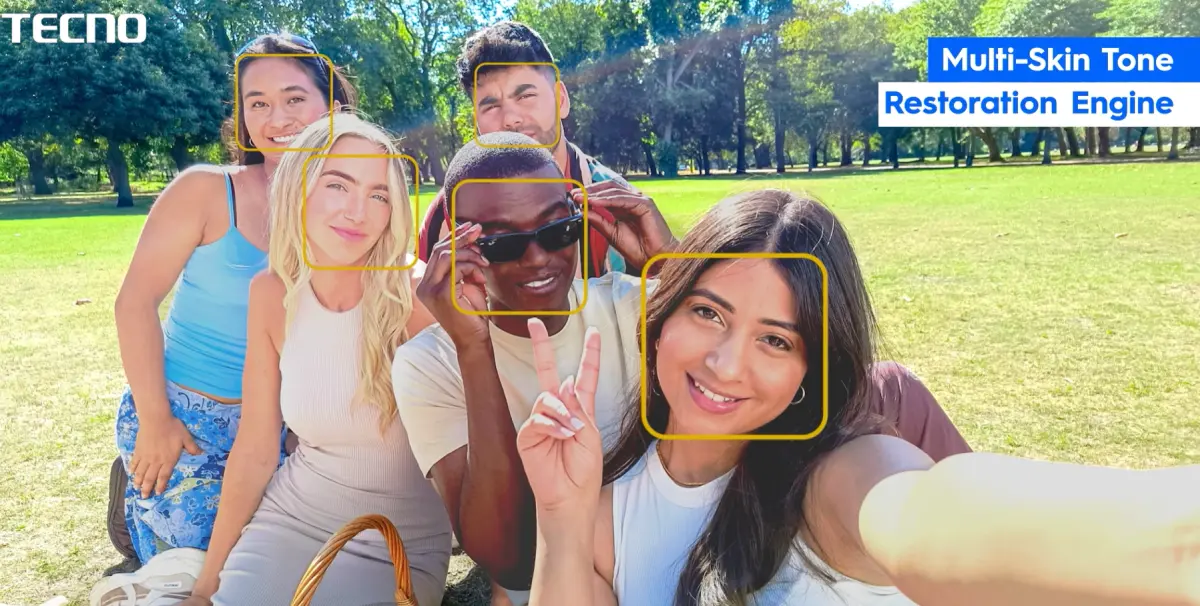

Universal Tone Tecno

Apr 28, 2025

Universal Tone Tecno

Apr 28, 2025 -

Tecno Universal Tone

Apr 28, 2025

Tecno Universal Tone

Apr 28, 2025 -

Boston Red Sox Lineup Modifications For Doubleheaders First Game

Apr 28, 2025

Boston Red Sox Lineup Modifications For Doubleheaders First Game

Apr 28, 2025 -

Red Sox Game 1 Lineup Coras Minor Adjustments

Apr 28, 2025

Red Sox Game 1 Lineup Coras Minor Adjustments

Apr 28, 2025