Bank Of England's Potential Half-Point Rate Cut: Ahead Of The Curve?

Table of Contents

Economic Indicators Pointing Towards a Rate Cut

The UK economy is currently facing a confluence of challenges. Understanding the current economic landscape is crucial to assessing the probability of a Bank of England interest rate cut.

Inflation and its Impact

Inflation remains a significant concern. While recent figures may show a slight easing, they still sit considerably above the BoE's target of 2%.

- Current inflation figures: (Insert latest official inflation data here, citing source).

- Comparison to historical inflation rates: (Compare current rates to historical averages, highlighting significant deviations and trends).

- Impact of inflation on consumer spending and business investment: High inflation erodes purchasing power, dampening consumer spending and discouraging business investment, creating a negative feedback loop that threatens economic growth.

GDP Growth and Recessionary Fears

Recent GDP growth figures have been sluggish, fueling concerns about a potential recession.

- Recent GDP growth data: (Insert latest GDP growth figures, citing source).

- Predictions for future economic growth: (Include forecasts from reputable economic institutions, highlighting the range of predictions and the uncertainty surrounding future growth).

- Likelihood of a recession: (Analyze the probability of a recession based on current economic indicators and expert predictions).

- Impact of global economic slowdown on the UK: The UK's economy is intertwined with the global economy; a global slowdown exacerbates the challenges faced domestically.

Unemployment Rates and Labour Market Dynamics

While unemployment remains relatively low, shifts in the labour market warrant attention.

- Current unemployment figures: (Insert latest unemployment figures, citing source).

- Job creation and job losses: Analyze trends in job creation and losses across various sectors.

- Impact on consumer confidence: High unemployment or uncertainty about job security can significantly impact consumer confidence and spending.

Arguments For and Against a Half-Point Rate Cut

The decision to implement such a significant interest rate cut is fraught with complexities, involving a careful balancing act between risks and potential benefits.

Arguments in Favor

Proponents argue a half-point cut is necessary to avert a deeper economic downturn.

- Stimulating economic growth: A rate cut makes borrowing cheaper, encouraging investment and consumer spending, potentially stimulating economic growth.

- Boosting consumer spending: Lower interest rates can free up disposable income, leading to increased consumer spending and supporting businesses.

- Preventing a deeper recession: A proactive rate cut could help prevent a more severe recession by injecting much-needed stimulus into the economy.

- Supporting struggling businesses: Lower borrowing costs can ease the financial burden on businesses struggling with high inflation and reduced demand.

Arguments Against

Conversely, critics warn of potential negative consequences.

- Increased inflation: A rate cut risks further fueling inflation, potentially creating a spiral of rising prices.

- Weakening of the Pound: A rate cut could weaken the Pound Sterling against other currencies, making imports more expensive.

- Potential for asset bubbles: Lower interest rates can inflate asset prices, potentially creating unsustainable bubbles in the housing market or other sectors.

- Long-term economic consequences: The long-term implications of a significant rate cut, including potential inflationary pressures and distortions in the financial markets, need careful consideration.

Market Reactions and Investor Sentiment

Financial markets are closely watching the BoE's deliberations, with significant implications for various assets.

Stock Market Performance

The FTSE 100 and other UK indices are likely to react positively to news of a rate cut, reflecting investor optimism about potential economic stimulus. (Include data or analysis on recent stock market performance in anticipation of a potential rate cut).

Pound Sterling Exchange Rate

The Pound Sterling is expected to weaken against other major currencies following a rate cut. (Include forecasts or analysis of potential impacts on the exchange rate).

Government Bond Yields

Government bond yields are likely to decline following a rate cut, as investors seek lower-yielding safe haven assets. (Include data or analysis on recent trends in government bond yields).

- Illustrative Market Response: (Include bullet points detailing potential market reactions such as increased volatility, shifts in investor sentiment, and speculation in financial markets.)

Alternative Monetary Policy Options

The BoE isn't limited to interest rate adjustments. Other tools are available.

- Quantitative easing (QE): The BoE could increase QE to inject liquidity into the financial system.

- Forward guidance: Clear communication about the BoE's intentions could influence market expectations and steer economic activity.

- Other unconventional monetary policies: The BoE might explore other less conventional policies depending on the evolving economic situation.

Conclusion

The decision regarding a Bank of England interest rate cut is complex and uncertain. While a half-point cut could stimulate economic growth and prevent a deeper recession, it also carries significant risks, including increased inflation and a weaker Pound. The market's reaction will depend on a variety of factors including the timing and magnitude of the cut. Alternative monetary policy tools may also be deployed to influence the economic trajectory. Staying informed about the Bank of England's upcoming announcements and the evolving economic landscape surrounding the potential Bank of England interest rate cut is crucial. Monitor financial news sources for updates on the BoE's monetary policy decisions and their impact on your investments and financial planning. Understanding the implications of a potential Bank of England interest rate cut is crucial for navigating the current economic climate.

Featured Posts

-

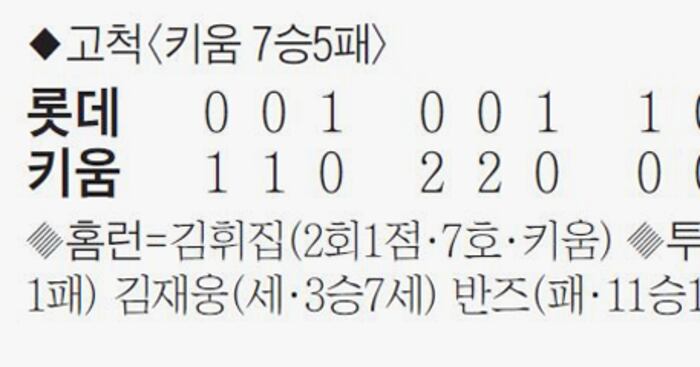

5 0 355 Nl 3

May 08, 2025

5 0 355 Nl 3

May 08, 2025 -

Unscripted Moments In Saving Private Ryan Impact And Legacy

May 08, 2025

Unscripted Moments In Saving Private Ryan Impact And Legacy

May 08, 2025 -

400 Xrp Price Jump Investment Opportunities And Risks

May 08, 2025

400 Xrp Price Jump Investment Opportunities And Risks

May 08, 2025 -

Liga Chempionov 2024 2025 Predvaritelniy Obzor Polufinalov Arsenal Ps Zh Barselona Inter

May 08, 2025

Liga Chempionov 2024 2025 Predvaritelniy Obzor Polufinalov Arsenal Ps Zh Barselona Inter

May 08, 2025 -

Ai Digest Creating A Podcast From Repetitive Scatological Documents

May 08, 2025

Ai Digest Creating A Podcast From Repetitive Scatological Documents

May 08, 2025

Latest Posts

-

Colin Cowherds Continued Criticism Of Jayson Tatum

May 08, 2025

Colin Cowherds Continued Criticism Of Jayson Tatum

May 08, 2025 -

Universal Credit Understanding And Reclaiming Hardship Payment Overpayments

May 08, 2025

Universal Credit Understanding And Reclaiming Hardship Payment Overpayments

May 08, 2025 -

Celtics Vs Nets Latest Injury Report And Tatums Playing Status

May 08, 2025

Celtics Vs Nets Latest Injury Report And Tatums Playing Status

May 08, 2025 -

Abc Promo Features Tnt Announcers Hilarious Take On Jayson Tatum

May 08, 2025

Abc Promo Features Tnt Announcers Hilarious Take On Jayson Tatum

May 08, 2025 -

Dwp Universal Credit Claiming Back Overpaid Hardship Payments

May 08, 2025

Dwp Universal Credit Claiming Back Overpaid Hardship Payments

May 08, 2025