Bank Of Japan's Revised Growth Forecast Reflects Trade War Concerns

Table of Contents

Reasons Behind the Downgraded Forecast

The downward revision in the Bank of Japan's growth forecast stems from a confluence of factors, both external and domestic. The escalating trade tensions, weakening global demand, and persistent domestic challenges have all contributed to a dimmer economic outlook.

Impact of the US-China Trade War

The protracted US-China trade war has dealt a significant blow to the Japanese economy, impacting both exports and supply chains. Japan, heavily reliant on global trade, is particularly vulnerable to the disruptions caused by tariffs and trade barriers. The "US-China trade war," "export slowdown," and "supply chain disruption" are all key factors impacting Japan's growth prospects.

- Decreased demand for Japanese goods: Tariffs and retaliatory measures have reduced demand for Japanese products in both the US and China, two of Japan's largest trading partners. This is especially true for sectors like automobiles and technology, which are heavily integrated into global supply chains.

- Increased production costs: Tariffs imposed by the US and China have increased the cost of production for Japanese companies, impacting their competitiveness in the global market. This has led to a squeeze on profit margins and reduced investment.

- Uncertainty about future trade policies: The unpredictable nature of the trade war has created significant uncertainty among Japanese businesses, leading to hesitancy in investment and expansion plans. This lack of confidence is a major drag on economic growth.

Weakening Global Demand

Beyond the US-China trade war, a broader weakening of global demand is also contributing to the downgraded forecast. The global economic slowdown, exacerbated by factors like Brexit and geopolitical risks, is reducing export opportunities for Japanese companies. Keywords like "global economic slowdown," "weak global demand," and "Brexit impact" highlight the interconnectedness of the global economy.

- Reduced consumer spending: Lower economic growth in key export markets has led to reduced consumer spending, impacting demand for Japanese goods and services.

- Decline in foreign direct investment: Uncertainty about the global economic outlook has discouraged foreign direct investment in Japan, further dampening growth.

- Increased risk aversion among businesses: Companies are becoming more risk-averse, delaying investment decisions and prioritizing cost-cutting measures.

Domestic Factors Affecting Growth

In addition to external headwinds, several domestic factors are also hindering Japan's economic growth. These include slow growth in consumer spending, cautious business investment, and the effectiveness (or lack thereof) of government stimulus packages. Keywords such as "domestic consumption," "capital expenditure," and "fiscal policy" are crucial to understanding the internal dynamics.

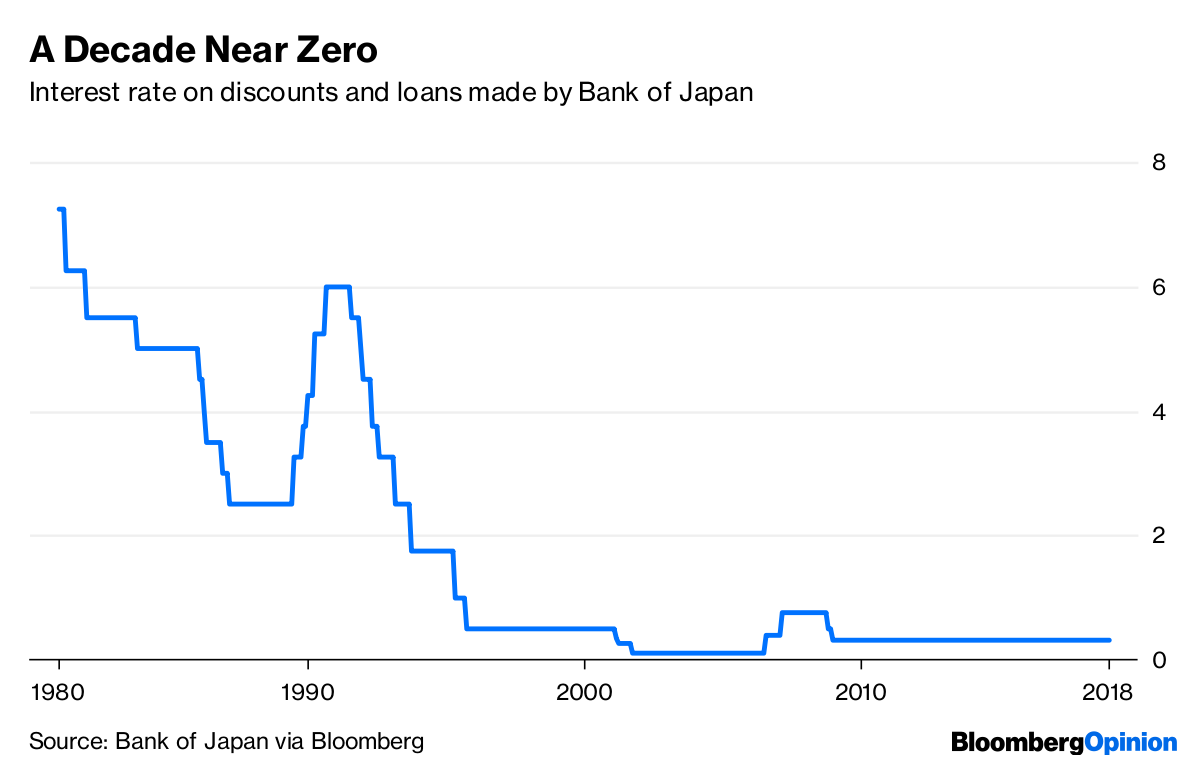

- Slow growth in consumer spending: Despite low interest rates, consumer spending remains sluggish, reflecting concerns about future economic prospects.

- Cautious business investment: Uncertainty about the economic outlook has led businesses to adopt a cautious approach to investment, delaying expansion and modernization plans.

- Effectiveness of government stimulus packages: The impact of recent government stimulus packages has been debated, with some questioning their effectiveness in boosting overall economic activity.

BOJ's Response to the Downgraded Forecast

In response to the weakened economic outlook, the BOJ is likely to consider further monetary policy adjustments. The coordination between the BOJ and the Japanese government will also play a significant role in shaping the response to the downgraded growth forecast.

Potential Monetary Policy Adjustments

The BOJ may resort to further easing measures to stimulate economic activity. This could involve further interest rate cuts or an expansion of quantitative easing (QE) programs. Understanding terms like "monetary policy," "interest rate cuts," "quantitative easing," and "yield curve control" is vital.

- Probability of further easing measures: Given the severity of the economic slowdown, further monetary easing remains a distinct possibility.

- Limitations of monetary policy: However, monetary policy alone may not be sufficient to address underlying structural issues in the Japanese economy.

- Potential side effects of aggressive monetary easing: Aggressive monetary easing also carries the risk of unintended consequences, such as asset bubbles and increased financial instability.

Government Collaboration and Fiscal Policy

Close collaboration between the BOJ and the Japanese government is essential in navigating the current economic challenges. This could involve increased government spending or tax cuts to boost demand and stimulate economic activity. Analyzing terms like "fiscal stimulus," "government spending," and "tax cuts" is important.

- Likelihood of supplemental budgets: The government might introduce supplemental budgets to fund increased public investment in infrastructure and other key sectors.

- Focus areas for government spending: Priority areas for government spending could include infrastructure projects aimed at boosting productivity and improving the business environment.

- Political challenges to implementing fiscal measures: However, implementing significant fiscal measures may face political hurdles and budgetary constraints.

Conclusion: Navigating Uncertainty – The Bank of Japan's Growth Forecast and the Path Ahead

The Bank of Japan's revised growth forecast underscores the significant challenges facing the Japanese economy. The combination of the US-China trade war, weakening global demand, and domestic factors has created a challenging environment. The BOJ's response, likely involving a combination of monetary and fiscal policy adjustments, will be crucial in determining the future trajectory of Japan's economic growth. Staying informed about the Bank of Japan's actions and the evolving global economic landscape is essential for understanding the future of Japan's economy. Stay informed about future updates on the Bank of Japan's growth forecast and its implications for the Japanese economy by following reputable financial news sources like the Financial Times or Bloomberg.

Featured Posts

-

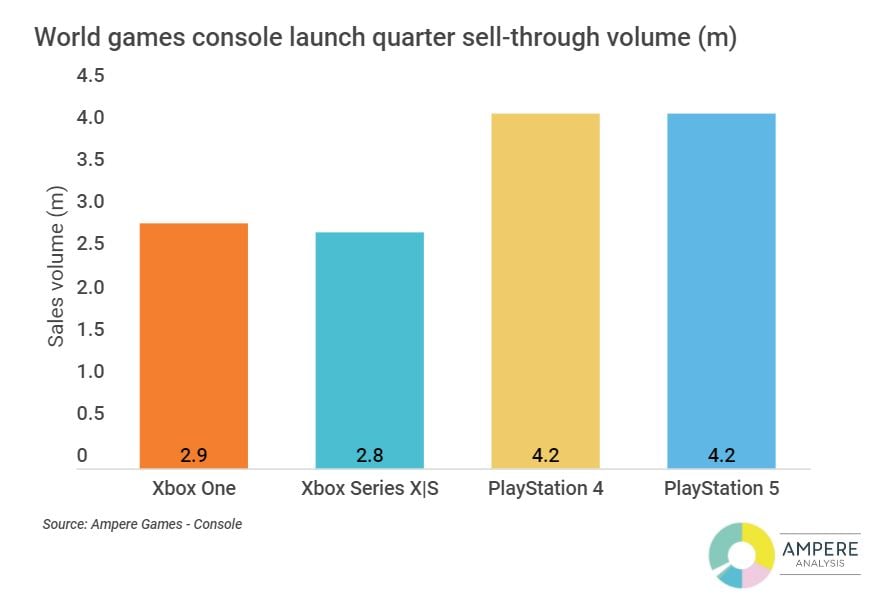

Comparing Ps 5 And Xbox Series X S Sales Performance In The United States

May 03, 2025

Comparing Ps 5 And Xbox Series X S Sales Performance In The United States

May 03, 2025 -

Funeral Service For Poppy Atkinson Manchester United Supporter

May 03, 2025

Funeral Service For Poppy Atkinson Manchester United Supporter

May 03, 2025 -

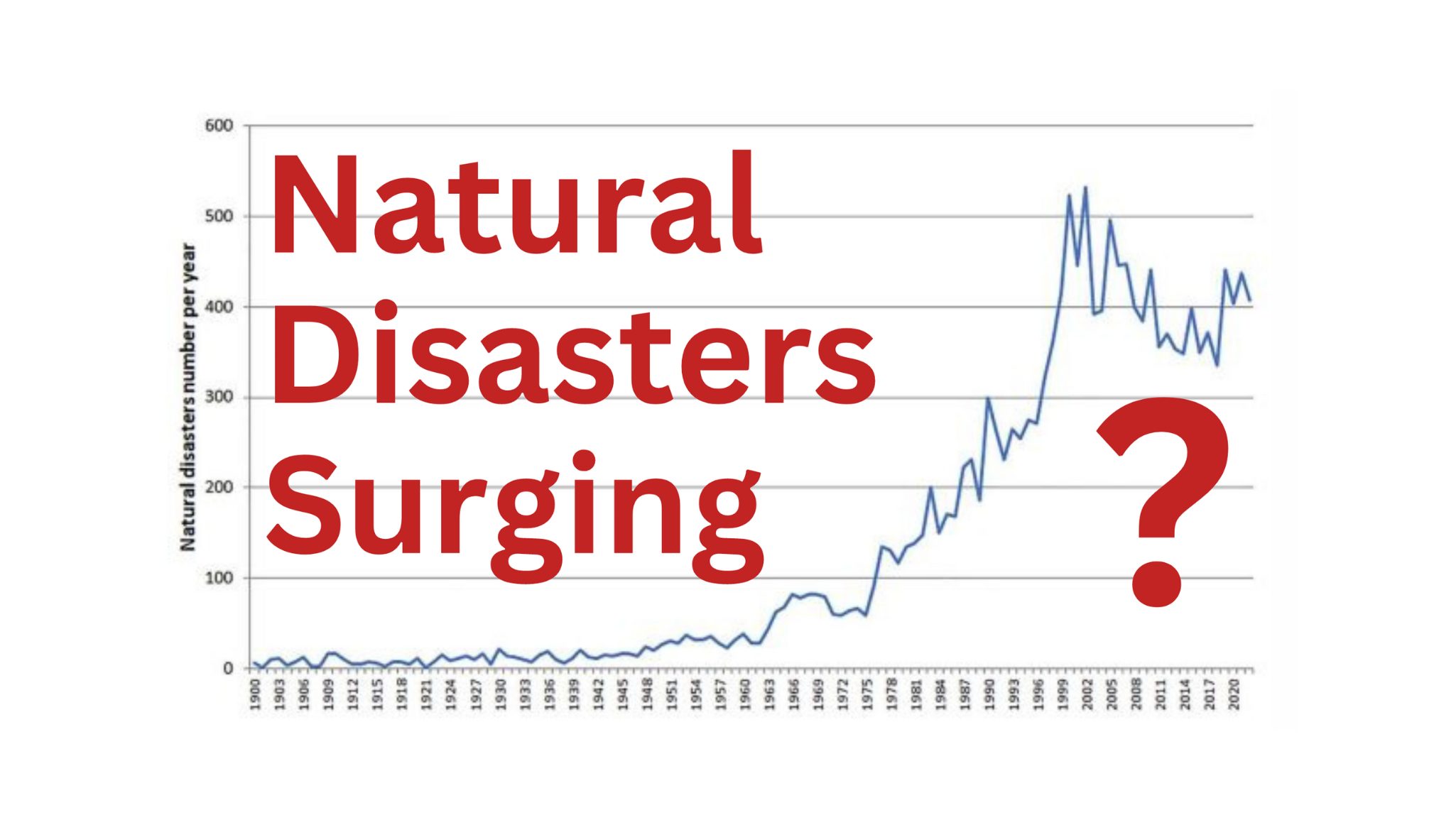

Is Betting On Natural Disasters Like The La Wildfires The New Normal

May 03, 2025

Is Betting On Natural Disasters Like The La Wildfires The New Normal

May 03, 2025 -

Hjwm Israyyly Ela Sfynt Astwl Alhryt Tfasyl Jdydt En Asthdafha Qbalt Ghzt

May 03, 2025

Hjwm Israyyly Ela Sfynt Astwl Alhryt Tfasyl Jdydt En Asthdafha Qbalt Ghzt

May 03, 2025 -

Celebrity Traitors On Bbc Famous Siblings Pull Out Throwing Filming Into Disarray

May 03, 2025

Celebrity Traitors On Bbc Famous Siblings Pull Out Throwing Filming Into Disarray

May 03, 2025