Is Betting On Natural Disasters Like The LA Wildfires The New Normal?

Table of Contents

The Rise of Disaster Betting Markets

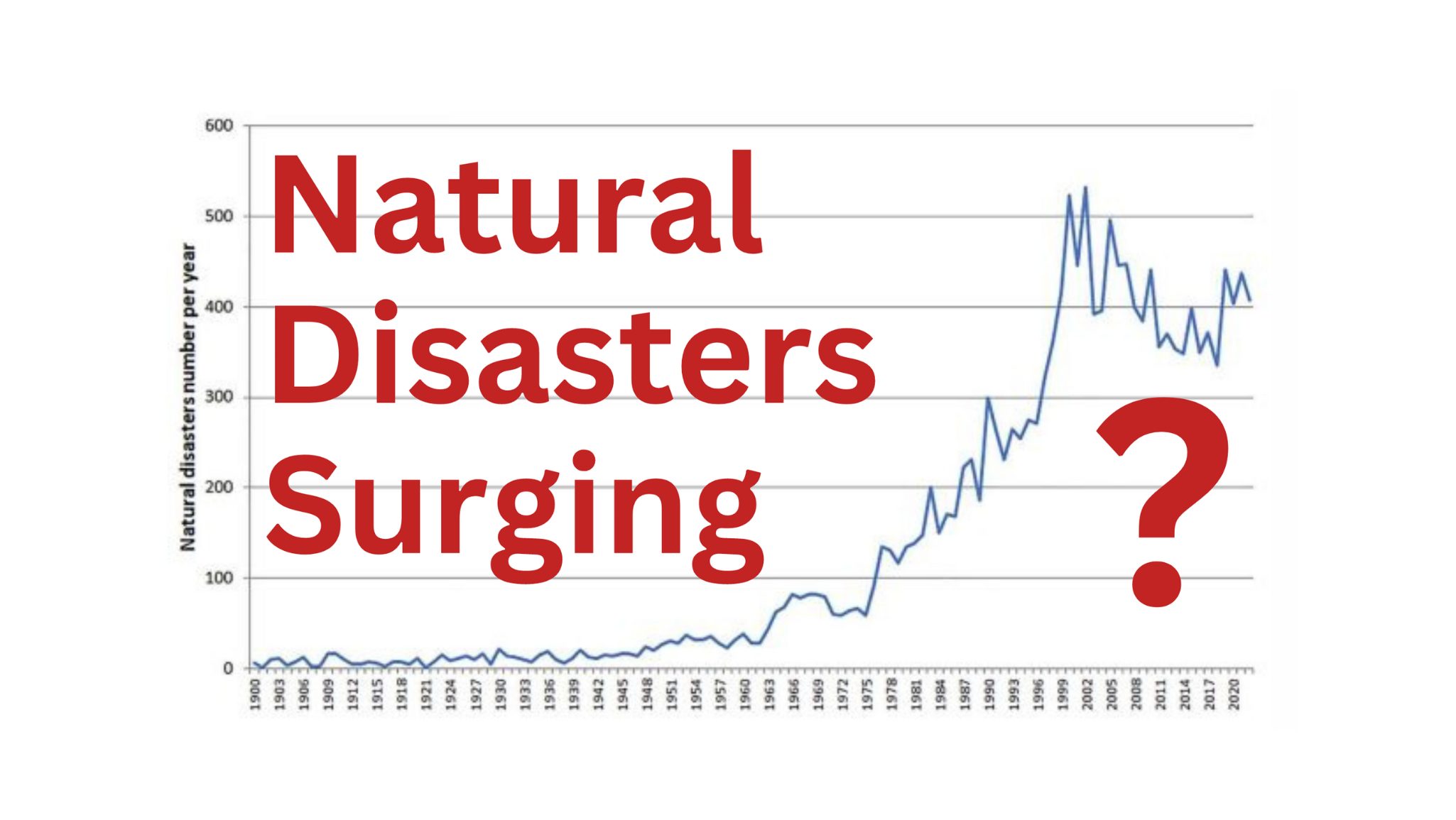

The concept of betting on natural disasters might seem shocking, but specialized markets are developing, driven by sophisticated data analysis and predictive modeling.

Understanding the Mechanics

These markets function by leveraging vast amounts of data, including historical weather patterns, climate models, and real-time satellite imagery. Insurance companies, reinsurance firms, and even specialized investment funds utilize these predictions to assess and manage risk.

- Examples of platforms: While many platforms remain opaque, indices like those tracking hurricane intensity or wildfire risk are becoming increasingly common. These provide data points for financial instruments.

- Bet types: The types of bets vary, from simple binary options (will a hurricane hit a specific area?) to more complex spread betting (predicting the intensity or economic impact of a disaster).

- Role of AI and algorithms: Artificial intelligence and machine learning play a crucial role in analyzing vast datasets and creating predictive models, improving the accuracy of risk assessments for disaster betting.

Ethical and Societal Concerns

The emergence of disaster betting markets raises serious ethical concerns.

Profiting from Suffering

The most significant critique is the inherent insensitivity of profiting from human suffering. The very act of betting on a natural disaster, where lives are lost and communities are devastated, is viewed by many as morally reprehensible.

- Arguments against: Critics argue that such markets trivialize the immense human cost of natural disasters, focusing solely on financial gain.

- Market manipulation: The potential for manipulation is significant. False information or skewed data could artificially inflate or deflate the odds, resulting in unfair profits for some and devastating losses for others.

- Impact on relief efforts: The focus on financial speculation could potentially divert resources away from vital disaster relief efforts and reconstruction. Increased insurance premiums could further burden affected communities.

The Role of Insurance and Reinsurance

While ethically problematic for some, betting on natural disasters plays a crucial role in the insurance and reinsurance industries.

Hedging Against Risk

Insurance and reinsurance companies use these markets to hedge against catastrophic losses. By participating in these markets, they can offset some of their financial exposure to major disasters.

- Catastrophe bonds: These are a key example of financial instruments used to transfer risk. Investors essentially bet against a disaster occurring, receiving a return if the event doesn't materialize.

- Capital for disaster response: The capital generated through these markets can ultimately contribute to disaster relief efforts and aid in post-disaster recovery.

- Influence on preparedness: The data and predictive models used in these markets can potentially inform disaster preparedness strategies, leading to better mitigation efforts.

Regulation and Legal Frameworks

The legal landscape surrounding betting on natural disasters is complex and rapidly evolving.

The Current Landscape

Currently, there is no unified global regulatory framework governing these markets. Legal and ethical considerations vary widely across jurisdictions.

- Jurisdictional differences: Some countries may outright ban such activities, while others might permit them under strict regulations.

- Regulatory challenges: The complexity of these markets, the use of sophisticated algorithms, and the potential for cross-border transactions present significant challenges for regulators.

- International cooperation: Effective regulation requires international cooperation to ensure consistent standards and prevent market manipulation.

The Future of Disaster Betting

Technological advancements will significantly shape the future of disaster betting markets.

Predictive Modeling and Technological Advancements

Improvements in weather forecasting, satellite technology, and risk assessment models are likely to increase the accuracy of predictions, influencing market behavior and potentially leading to more sophisticated betting strategies.

- Impact of improved forecasting: More accurate predictions could reduce uncertainty and potentially make these markets more efficient in risk management.

- Increased accuracy: Enhanced data analysis and AI could lead to a significant increase in the accuracy of predicting disaster events, altering the risk profiles and the nature of the bets.

- Ethical considerations: As predictive models become more sophisticated, ethical considerations surrounding data privacy, biases, and the potential for misuse become even more crucial.

Conclusion

The question of whether betting on natural disasters is becoming the new normal remains complex. While these markets offer a mechanism for risk management and potentially contribute to disaster relief, the ethical implications of profiting from human suffering cannot be ignored. The lack of comprehensive global regulation highlights the urgent need for discussion and critical analysis. Is betting on natural disasters, especially events like the LA Wildfires, a necessary evil, or an unacceptable exploitation? We encourage further research and discussion on this vital and increasingly relevant topic. Explore resources on responsible gambling and the ethical considerations of disaster relief to form your informed opinion on disaster betting and its future.

Featured Posts

-

Winning Numbers Daily Lotto Wednesday 16th April 2025

May 03, 2025

Winning Numbers Daily Lotto Wednesday 16th April 2025

May 03, 2025 -

Riot Platforms Stock Price Analysis Factors Influencing Riots Performance

May 03, 2025

Riot Platforms Stock Price Analysis Factors Influencing Riots Performance

May 03, 2025 -

A Place In The Sun Your Guide To Finding The Perfect Property Abroad

May 03, 2025

A Place In The Sun Your Guide To Finding The Perfect Property Abroad

May 03, 2025 -

Mohamed Salahs Liverpool Future Uncertain Amid Contract Negotiations

May 03, 2025

Mohamed Salahs Liverpool Future Uncertain Amid Contract Negotiations

May 03, 2025 -

Zakharova Prokommentirovala Otnosheniya Emmanuelya I Brizhit Makron

May 03, 2025

Zakharova Prokommentirovala Otnosheniya Emmanuelya I Brizhit Makron

May 03, 2025