BigBear.ai (BBAI) Stock: Is It Right For Your Portfolio?

Table of Contents

Understanding BigBear.ai's Business Model and Financial Performance

BigBear.ai provides advanced AI-powered solutions to government and commercial clients. Its business model hinges on delivering cutting-edge technology to address complex challenges across various sectors. Analyzing its financial performance is crucial to understanding the potential of a BBAI stock investment.

Revenue Streams and Growth Prospects

BigBear.ai's revenue streams primarily consist of government contracts and commercial partnerships. While government contracts often provide a steady revenue base, their renewal isn't always guaranteed. Commercial clients offer growth potential but can be more susceptible to market fluctuations. The company's growth trajectory is closely tied to its ability to secure and maintain these contracts.

- Recent Contract Wins: [Insert specific examples of recent significant contract wins, quantifying their value and impact on revenue]. Highlighting recent success stories can showcase a positive growth outlook.

- Market Share Analysis: [Analyze BigBear.ai's market share within its target sectors. Compare its market position to its competitors. Identify areas where it holds a strong position and areas needing improvement]. This analysis helps contextualize the company's growth potential.

- International Expansion: [Discuss BigBear.ai's plans for international expansion, if any. Analyze the potential for growth in new markets and the challenges involved]. Potential for global reach adds another layer to growth projections.

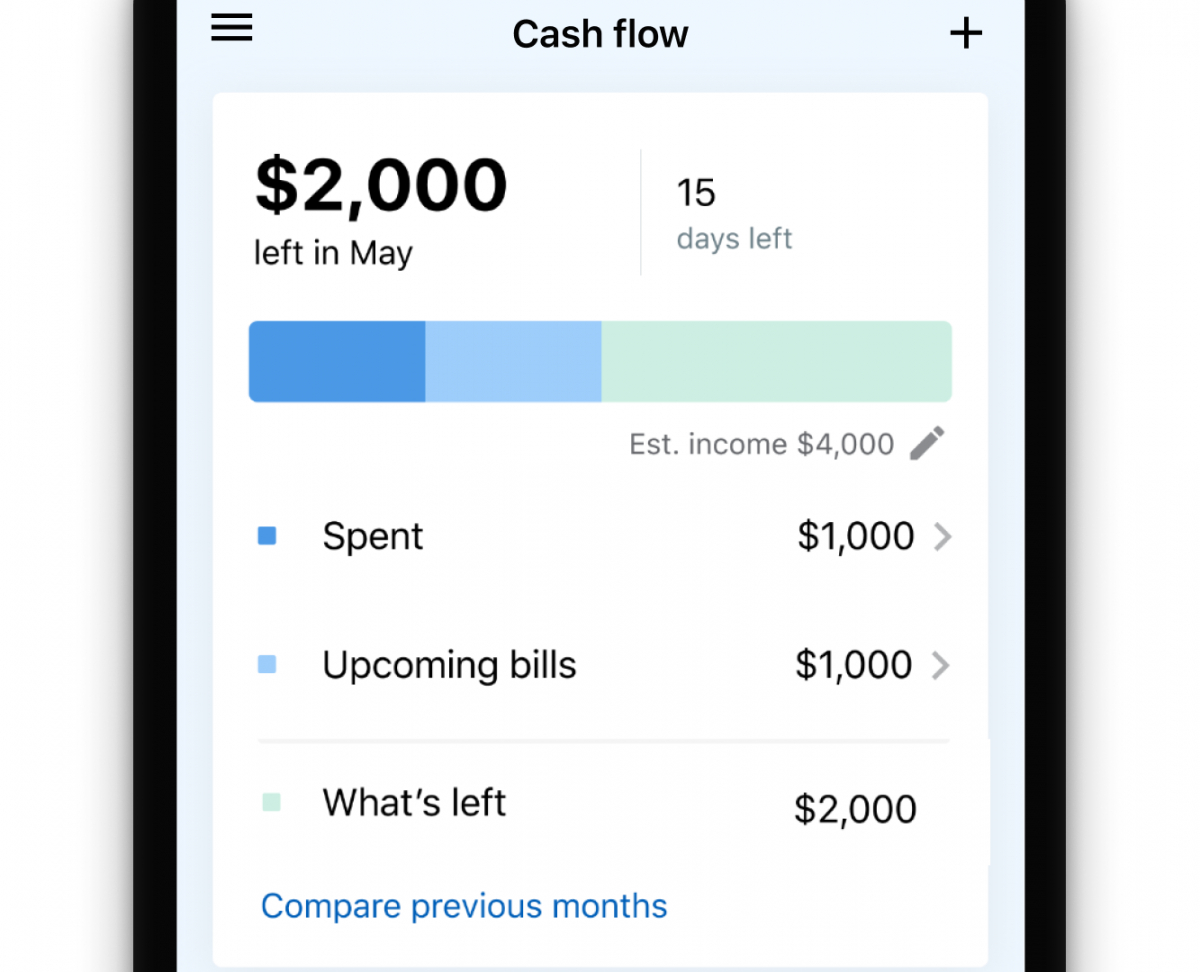

Profitability and Financial Stability

Examining BigBear.ai's profitability and financial health is crucial for any potential investor. Analyzing key financial metrics provides a clearer picture of its stability.

- Key Financial Ratios: [Include and analyze relevant financial ratios such as debt-to-equity ratio, profit margins, and revenue growth rate. Compare these figures to industry averages and competitors.] Numbers provide tangible insights into financial health.

- Competitor Comparison: [Compare BigBear.ai's financial performance with its major competitors. Identify areas where it excels and areas where it lags behind.] Benchmarking against peers allows for a more informed assessment.

- Potential Red Flags: [Discuss any potential financial red flags, such as high debt levels, inconsistent profitability, or cash flow issues. Transparency about potential risks is essential]. Addressing concerns upfront builds credibility and transparency.

BigBear.ai's Competitive Landscape and Market Position

Understanding BigBear.ai's position within the broader AI market is essential for assessing the viability of a BBAI stock investment.

Key Competitors and Market Share

BigBear.ai competes with a range of established players and emerging startups in the AI sector. Identifying its key competitors and analyzing their market share helps determine BigBear.ai's competitive advantages.

- Major Competitors: [List BigBear.ai's major competitors, including publicly traded companies and private entities. Briefly describe their offerings and market positions.] Identifying the competitive landscape is key.

- Technology and Service Comparison: [Compare BigBear.ai's technology and services to those of its main competitors. Highlight its unique selling propositions (USPs) and areas where it might need to improve]. This comparative analysis unveils competitive advantages and disadvantages.

- Strengths and Weaknesses: [Analyze BigBear.ai's strengths and weaknesses in the market. Identify factors that contribute to its competitive edge and areas where it faces challenges.] Honest self-assessment provides a realistic outlook.

Future Market Trends and Opportunities

The AI market is dynamic and rapidly evolving. BigBear.ai's ability to adapt to future market trends and capitalize on emerging opportunities will significantly impact its future performance and the value of BBAI stock.

- Emerging AI Technologies: [Discuss emerging AI technologies like generative AI, machine learning advancements, and their potential impact on BigBear.ai's business model.] Forecasting future technological impact is crucial for assessing long-term potential.

- Regulatory Environment: [Analyze the regulatory environment surrounding AI and its potential impact on BigBear.ai's operations and growth. Consider government policies and their implications]. Regulatory changes can profoundly affect business operations.

- Future Market Opportunities: [Identify potential future market opportunities for BigBear.ai, such as expansion into new sectors, development of new products, or strategic partnerships]. Foresight into future growth avenues adds to the investment thesis.

Assessing the Risks and Rewards of Investing in BBAI Stock

Investing in any stock carries inherent risks. A thorough assessment of both the potential risks and rewards is crucial before making a decision on BBAI stock.

Potential Risks

Investing in BBAI stock involves several potential risks:

- Reliance on Government Contracts: BigBear.ai's reliance on government contracts exposes it to the risk of contract cancellations or delays. This dependence constitutes a significant risk.

- Technological Disruption: Rapid technological advancements in the AI field could render BigBear.ai's technology obsolete, impacting its competitiveness and profitability. This is an ever-present risk in the tech sector.

- Market Volatility: The AI sector is known for its volatility, and BBAI stock price is likely to fluctuate significantly. This inherent volatility must be factored into investment decisions.

Potential Rewards

Despite the risks, investing in BBAI stock also presents substantial potential rewards:

- High Growth Potential: The AI market is expected to experience significant growth in the coming years, offering the potential for high returns on investment for BBAI stock.

- Strong Market Position: BigBear.ai holds a strong position in specialized areas of the AI market, providing it with a competitive advantage.

- Significant Returns: Successful execution of its business strategy and favorable market conditions could lead to significant returns on investment.

Conclusion

BigBear.ai (BBAI) stock presents a compelling but risky investment opportunity. Its business model, while promising, hinges on securing and retaining government contracts and adapting to the rapidly evolving AI landscape. While the potential for high growth is undeniable, considerable risks also exist. The financial health of the company, its competitive position, and the inherent volatility of the AI market should be carefully considered. Whether BigBear.ai stock is right for your portfolio depends on your risk tolerance and investment goals. Remember to conduct your own thorough due diligence before considering investing in BigBear.ai stock (BBAI). Learn more about BigBear.ai investment opportunities and make informed decisions about adding BBAI stock to your portfolio. Always consult with a qualified financial advisor before making any investment decisions.

Featured Posts

-

Fremantle Q1 Revenue Down 5 6 Impact Of Buyer Budget Cuts

May 21, 2025

Fremantle Q1 Revenue Down 5 6 Impact Of Buyer Budget Cuts

May 21, 2025 -

The Rise Of Femicide Causes And Consequences

May 21, 2025

The Rise Of Femicide Causes And Consequences

May 21, 2025 -

The Critical Role Of Middle Management In Todays Workplace

May 21, 2025

The Critical Role Of Middle Management In Todays Workplace

May 21, 2025 -

Investing In Big Bear Ai Bbai Risks And Rewards Of A Penny Stock

May 21, 2025

Investing In Big Bear Ai Bbai Risks And Rewards Of A Penny Stock

May 21, 2025 -

Adios Enfermedades Cronicas El Superalimento Que Promueve El Envejecimiento Saludable

May 21, 2025

Adios Enfermedades Cronicas El Superalimento Que Promueve El Envejecimiento Saludable

May 21, 2025