Investing In XRP After Its 400% Increase: A Prudent Approach

Table of Contents

Understanding XRP's Recent Price Surge

Factors Contributing to the Rise

Several factors contributed to XRP's impressive price surge. Increased adoption by financial institutions, leveraging its speed and low transaction costs for cross-border payments, played a significant role. Ripple's ongoing legal battle with the SEC, while presenting risks (discussed later), also fueled speculation and volatility. Positive developments in the case, however incremental, often triggered price increases.

- Increased institutional adoption: Several financial institutions are exploring and implementing XRP for faster, cheaper international transactions. This increased demand directly impacts its price.

- Ripple's legal battle: While uncertain, positive developments in Ripple's case against the SEC have boosted investor confidence, leading to price spikes. [Link to reputable news source on Ripple's legal battle]

- Growing interest in blockchain and digital assets: The broader cryptocurrency market's positive sentiment has also contributed to XRP's price appreciation. Increased interest in blockchain technology overall translates into higher demand for cryptocurrencies like XRP.

- Speculative trading and market sentiment: The cryptocurrency market is highly susceptible to speculation. Positive news, social media trends, and general market optimism can significantly influence XRP's price, often leading to rapid increases.

Analyzing Market Volatility

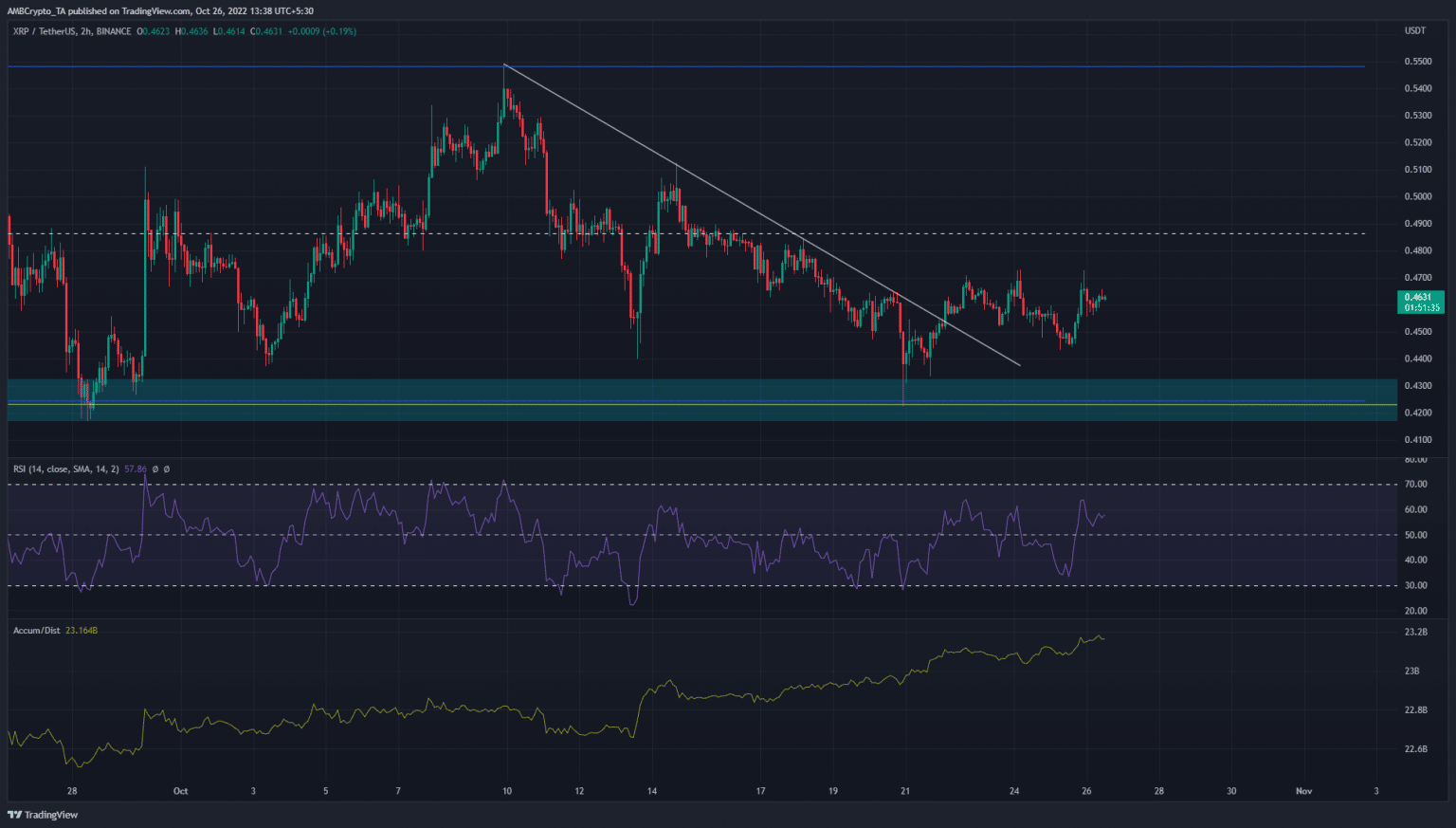

Cryptocurrencies, including XRP, are notoriously volatile. The 400% increase is a testament to this volatility, and it's crucial to understand that such rapid growth is often followed by significant price corrections. Analyzing technical indicators can provide insights, but they are not foolproof.

- Inherent Volatility: The decentralized nature of cryptocurrencies and their susceptibility to market sentiment mean sharp price swings are the norm, not the exception.

- Risk of Correction: After such a dramatic price increase, a correction is highly probable. Investors should brace for potential price drops and not panic sell.

- Technical Analysis: Tools like moving averages and the Relative Strength Index (RSI) can offer insights into potential price trends, but should be used cautiously in conjunction with fundamental analysis. [Link to a resource explaining technical analysis indicators]

- Price History Chart: [Insert a chart illustrating XRP's price history, highlighting the recent surge and potential correction points.]

Assessing the Risks of Investing in XRP

Regulatory Uncertainty

The ongoing legal battle between Ripple Labs and the SEC casts a significant shadow over XRP's future. The SEC's classification of XRP as a security could severely impact its price and adoption.

- SEC Lawsuit: The SEC's lawsuit alleges that Ripple sold XRP as an unregistered security. The outcome of this case is highly uncertain and will significantly impact XRP's price. [Link to reputable news source on the SEC lawsuit]

- Regulatory Impact: A ruling against Ripple could lead to delisting from major exchanges, significantly reducing XRP's liquidity and price.

- Broader Regulatory Risks: The cryptocurrency market is still largely unregulated in many jurisdictions. Future regulations could impose restrictions on XRP, affecting its price and use.

Market Competition

XRP faces stiff competition from other cryptocurrencies and blockchain platforms. Its success depends on maintaining its competitive edge in terms of speed, cost, and adoption.

- Competitor Analysis: Other cryptocurrencies like Stellar Lumens (XLM) and Bitcoin (BTC) offer similar functionalities, posing competition to XRP.

- Technological Advancement: Continuous innovation in the blockchain space means that new technologies could render XRP obsolete.

- Diversification: To mitigate risk, investors should diversify their cryptocurrency portfolios rather than focusing solely on XRP.

Technological Risks

While the XRP Ledger is relatively robust, technological risks always exist. Software bugs, security vulnerabilities, or scalability issues could negatively impact XRP's functionality and price.

- Ledger Security: The security of the XRP Ledger is paramount. Any significant security breach could have devastating consequences.

- Scalability Challenges: As adoption increases, the XRP Ledger needs to handle a larger transaction volume without compromising speed or efficiency.

- Due Diligence: Before investing in any cryptocurrency, thorough research and due diligence are crucial. Understanding the technology and its limitations is essential.

Developing a Prudent Investment Strategy for XRP

Risk Tolerance and Diversification

Investing in XRP, or any cryptocurrency, requires careful consideration of your risk tolerance. Diversification is key to mitigating losses.

- Assess Your Risk: Only invest an amount you can afford to lose completely. Cryptocurrency investments are highly speculative.

- Portfolio Diversification: Don't put all your eggs in one basket. Diversify across different asset classes, including stocks, bonds, and other cryptocurrencies.

- Allocate Wisely: A prudent approach would involve allocating only a small percentage of your overall investment portfolio to XRP.

Dollar-Cost Averaging

Dollar-cost averaging (DCA) is a strategy where you invest a fixed amount of money at regular intervals, regardless of price fluctuations. This helps mitigate the risk of investing a large sum at a market peak.

- DCA Explained: Instead of investing a lump sum, you might invest $100 per week, for example. This smooths out the average cost per unit over time.

- Risk Reduction: DCA reduces the risk of buying high and selling low.

Setting Realistic Expectations

Avoid chasing quick profits. Cryptocurrency investments are long-term plays. Expect volatility and don't base your investment decisions on short-term price movements.

- Long-Term Perspective: A long-term investment horizon is essential for weathering the inevitable price fluctuations in the cryptocurrency market.

- Avoid Emotional Decisions: Don't let fear or greed dictate your investment decisions. Stick to your strategy.

Conclusion

Investing in XRP after its recent 400% increase requires a careful and prudent approach. While the potential for further growth exists, significant risks remain, including regulatory uncertainty and market volatility. By understanding these risks, diversifying your investments, and employing strategies like dollar-cost averaging, you can make informed decisions about incorporating XRP into your portfolio. Remember to conduct thorough research and only invest what you can afford to lose. Don't miss out on the potential of XRP, but approach XRP investment with a balanced and cautious strategy. Consider your own risk tolerance and financial goals before making any XRP investment decisions. Learn more about prudent XRP investment strategies and stay informed about market trends.

Featured Posts

-

Should You Buy Xrp After Its 400 Increase A Comprehensive Guide

May 08, 2025

Should You Buy Xrp After Its 400 Increase A Comprehensive Guide

May 08, 2025 -

Inter Milans Stunning Champions League Victory Over Bayern Munich

May 08, 2025

Inter Milans Stunning Champions League Victory Over Bayern Munich

May 08, 2025 -

7 Best Undiscovered Paramount Movies You Should Watch

May 08, 2025

7 Best Undiscovered Paramount Movies You Should Watch

May 08, 2025 -

Arsenal Psg Macin Yayinlandigi Kanal Ve Saat Bilgisi

May 08, 2025

Arsenal Psg Macin Yayinlandigi Kanal Ve Saat Bilgisi

May 08, 2025 -

The Complicated Case Of Rogue Avenger Or X Man

May 08, 2025

The Complicated Case Of Rogue Avenger Or X Man

May 08, 2025

Latest Posts

-

Dwp Benefit Claim Update Important Information For April 5th

May 08, 2025

Dwp Benefit Claim Update Important Information For April 5th

May 08, 2025 -

Dwps New Approach To Universal Credit Claim Verification

May 08, 2025

Dwps New Approach To Universal Credit Claim Verification

May 08, 2025 -

Jayson Tatum And Ella Mai Commercial Hints At New Baby

May 08, 2025

Jayson Tatum And Ella Mai Commercial Hints At New Baby

May 08, 2025 -

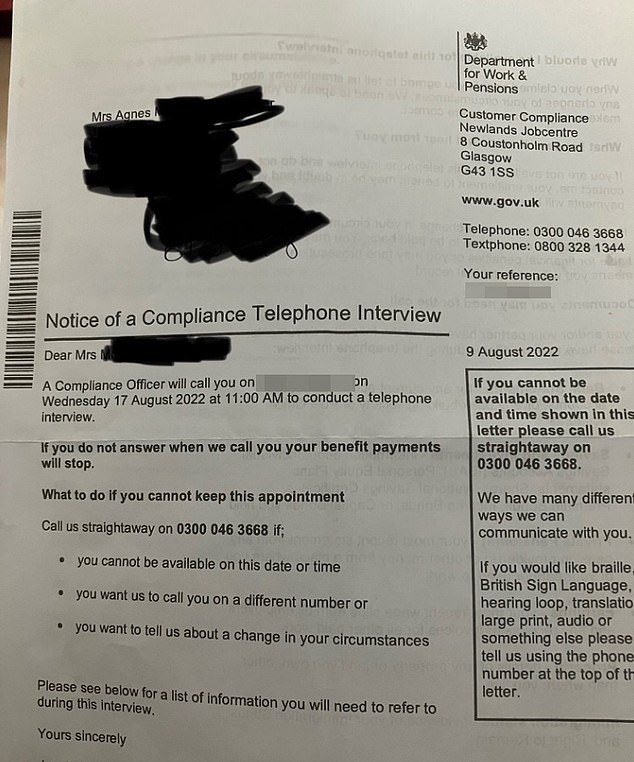

Dwp Cuts Benefits Letter Notifications And Next Steps For Claimants

May 08, 2025

Dwp Cuts Benefits Letter Notifications And Next Steps For Claimants

May 08, 2025 -

Universal Credit Overhaul Dwp Alters Claim Verification Process

May 08, 2025

Universal Credit Overhaul Dwp Alters Claim Verification Process

May 08, 2025