Bitcoin (BTC) Rally: Trade Easing And Reduced Fed Tension

Table of Contents

Easing Trade Tensions and Their Impact on Bitcoin

The ongoing US-China trade war has created considerable market uncertainty, impacting global investment flows. Recent positive developments in trade negotiations, however, have injected a much-needed dose of optimism. This reduced uncertainty directly benefits riskier assets, including Bitcoin. The correlation between Bitcoin price and trade sentiment is well-documented.

- Decreased uncertainty encourages investment in riskier assets. When investors feel more confident about the global economic outlook, they are more willing to allocate funds to assets with higher growth potential, even if they carry more risk. Bitcoin, often perceived as a high-risk, high-reward investment, directly benefits from this shift in sentiment.

- Reduced tariffs lead to improved global economic outlook. Lower tariffs stimulate international trade, boosting economic activity and fostering greater confidence among investors. This positive economic environment tends to spill over into the cryptocurrency market.

- Positive trade news boosts investor confidence in the cryptocurrency market. Positive headlines about trade agreements often lead to a surge in Bitcoin price, suggesting a strong correlation between the two.

- Correlation between trade negotiations and Bitcoin price fluctuations. Historical data clearly shows a relationship between major trade developments and Bitcoin price movements. Periods of increased trade tension are often associated with Bitcoin price drops, while positive trade news tends to result in price increases.

The Federal Reserve's Influence on Bitcoin's Price

The Federal Reserve's monetary policy significantly impacts global financial markets, and Bitcoin is no exception. A less hawkish stance from the Fed, potentially indicated by rate cuts or pauses in rate hikes, can influence the value of the dollar and subsequently, Bitcoin's price.

- Lower interest rates decrease the appeal of traditional investments. When interest rates are low, traditional investments like bonds become less attractive. This encourages investors to explore alternative assets, including Bitcoin, in search of higher returns.

- Potential for quantitative easing increases money supply, potentially driving up Bitcoin’s value. Quantitative easing (QE), a monetary policy tool used by central banks to inject liquidity into the market, can lead to inflation. Bitcoin, often seen as a hedge against inflation and fiat currency devaluation, may see increased demand in such an environment.

- Bitcoin's role as a hedge against inflation and fiat currency devaluation. Many investors view Bitcoin as a safe haven asset, believing its limited supply protects it from inflationary pressures that can erode the value of traditional currencies.

- Analysis of historical correlation between Fed actions and Bitcoin price movements. Studying past Fed actions and their impact on Bitcoin's price provides valuable insights into the potential influence of future monetary policy decisions.

Increased Institutional Interest in Bitcoin

The growing adoption of Bitcoin by institutional investors is a major factor contributing to the current rally. Large-scale investment brings price stability and attracts further investment. Regulatory developments are also playing a crucial role in fostering this growth.

- Growing number of institutional investors allocating funds to Bitcoin. Hedge funds, pension funds, and other institutional investors are increasingly recognizing Bitcoin's potential as a valuable asset.

- Impact of Grayscale and other investment vehicles on Bitcoin demand. The rise of regulated investment vehicles like Grayscale Bitcoin Trust has made it easier for institutional investors to gain exposure to Bitcoin.

- Regulatory clarity in certain jurisdictions boosts institutional confidence. Increased regulatory clarity in key markets reduces uncertainty and encourages institutional involvement in the Bitcoin market.

- Future outlook for institutional Bitcoin adoption. The trend towards institutional adoption is expected to continue, potentially further stabilizing Bitcoin's price and driving long-term growth.

Technical Analysis of the Bitcoin Rally

(Optional Section: Include only if appropriate for your audience) While fundamental factors are crucial, a technical analysis of Bitcoin's price charts reveals supportive indicators such as strong trading volume and the emergence of bullish chart patterns, suggesting further upward momentum. However, this section requires specific technical knowledge to interpret correctly.

Conclusion

The recent Bitcoin (BTC) rally is a confluence of factors. Easing trade tensions have reduced market uncertainty, encouraging investment in riskier assets. A less hawkish Federal Reserve, with potential rate cuts or pauses, is also contributing to the surge. Finally, increased institutional adoption is bringing greater price stability and attracting further investment. These elements, combined with positive technical indicators (for those who delve into technical analysis), contribute to a bullish outlook for Bitcoin. Learn more about Bitcoin (BTC) and its potential for growth and start your Bitcoin (BTC) investment journey today!

Featured Posts

-

Stock Market Rally Futures Soar On Trumps Commitment To Powell

Apr 24, 2025

Stock Market Rally Futures Soar On Trumps Commitment To Powell

Apr 24, 2025 -

Trump Denies Intentions To Fire Federal Reserve Chair Jerome Powell

Apr 24, 2025

Trump Denies Intentions To Fire Federal Reserve Chair Jerome Powell

Apr 24, 2025 -

Rethinking Middle Management Their Impact On Company Culture And Performance

Apr 24, 2025

Rethinking Middle Management Their Impact On Company Culture And Performance

Apr 24, 2025 -

Chinas Lpg Reliance Shifts East Impact Of Us Tariffs On Energy Imports

Apr 24, 2025

Chinas Lpg Reliance Shifts East Impact Of Us Tariffs On Energy Imports

Apr 24, 2025 -

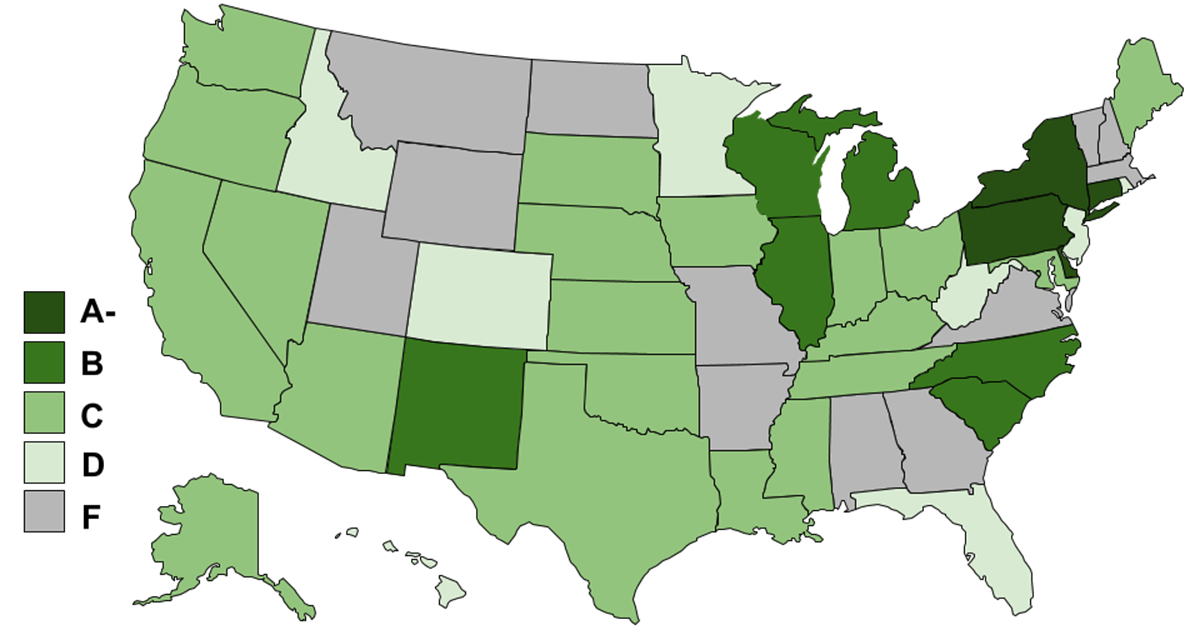

New Business Hot Spots Across The Nation An Interactive Map

Apr 24, 2025

New Business Hot Spots Across The Nation An Interactive Map

Apr 24, 2025