Bitcoin Buying Volume Surges Past Selling On Binance After Six Months

Table of Contents

Analyzing the Surge in Bitcoin Buying Volume on Binance

Data and Figures:

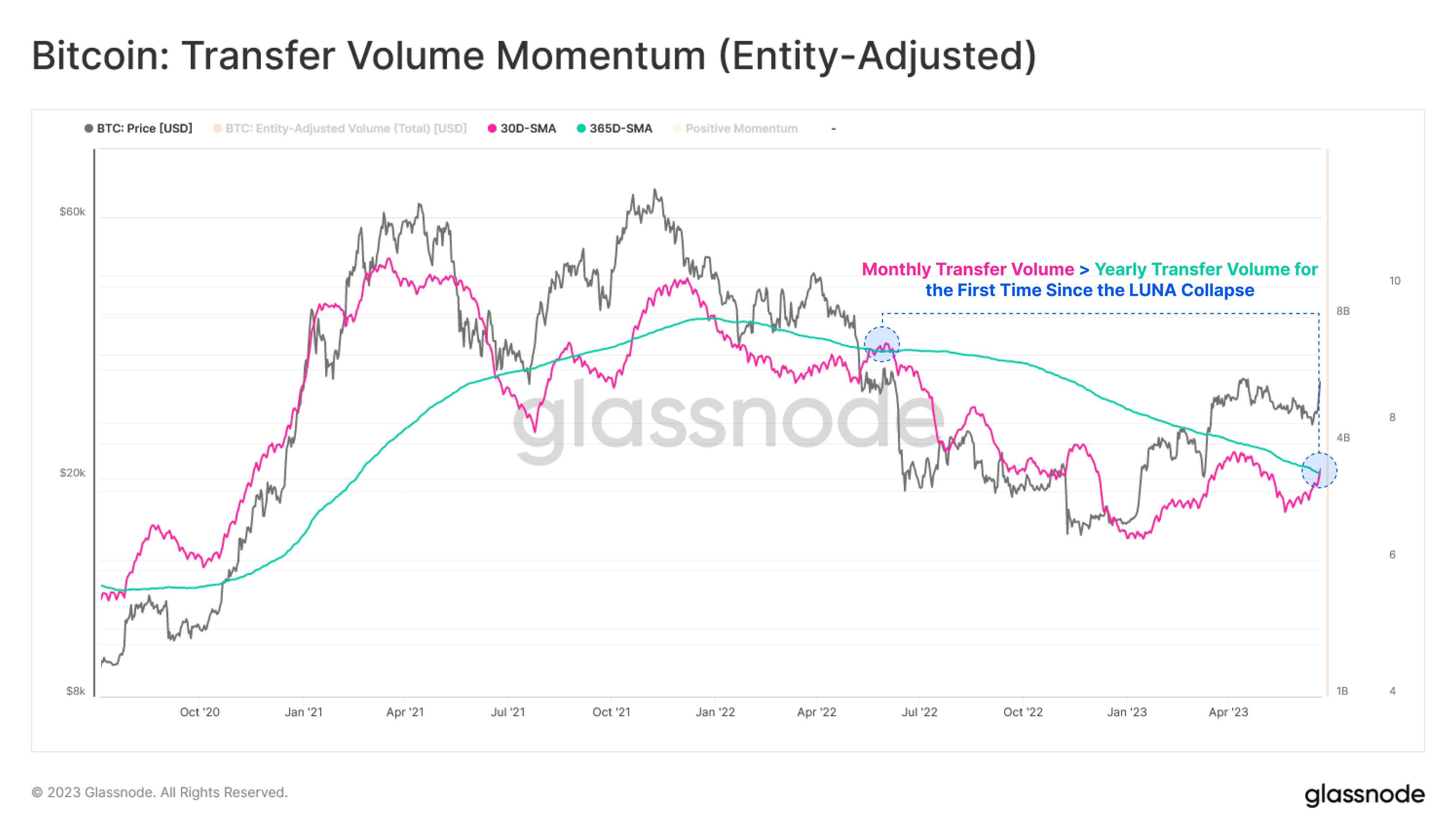

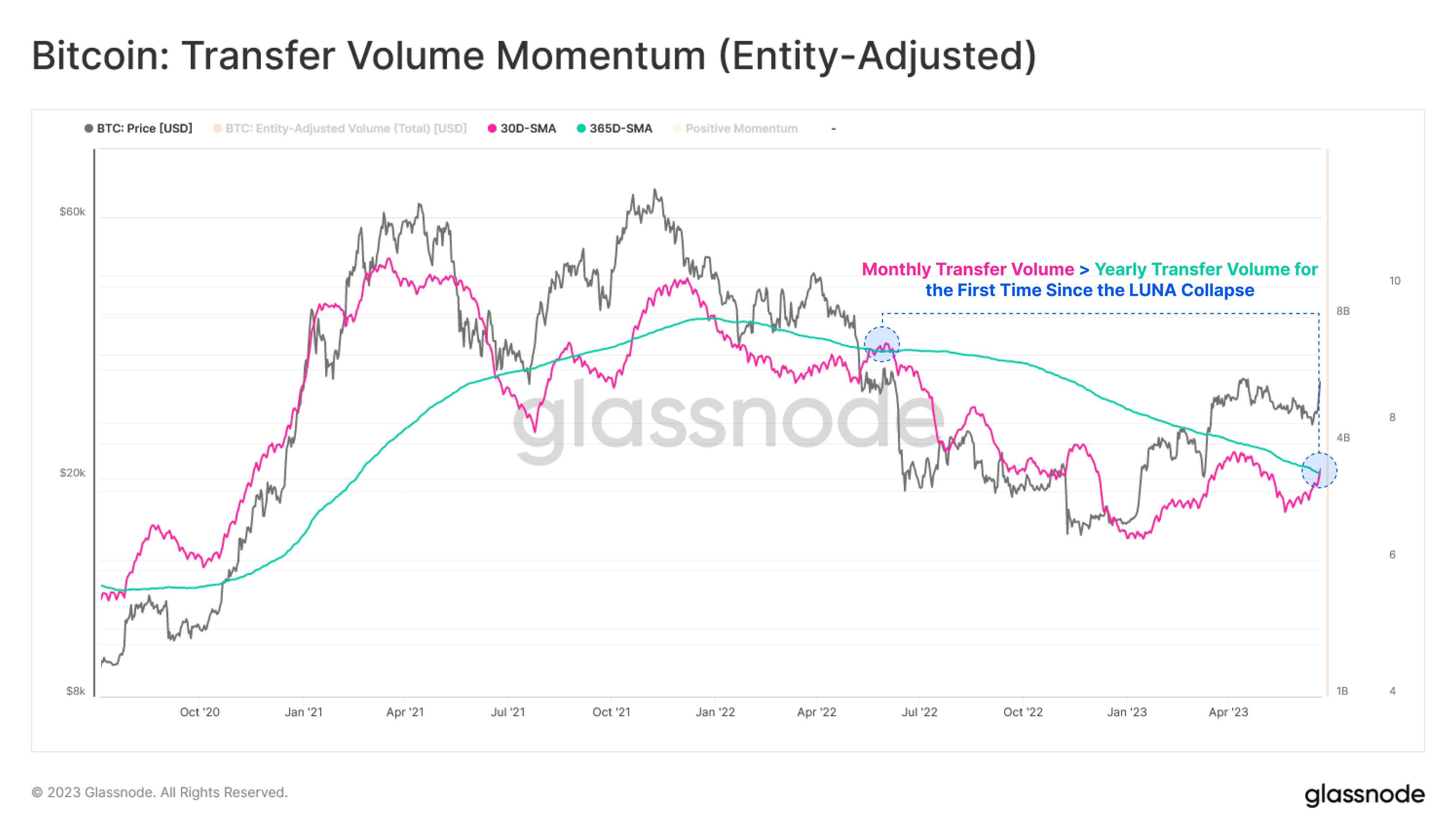

The data paints a clear picture. For the past six months, Binance, one of the world's largest cryptocurrency exchanges, had consistently shown higher Bitcoin selling volume than buying volume. However, this trend dramatically reversed on [Insert Date], with a [Insert Percentage]% increase in buying volume compared to the previous day. [Insert Chart/Graph visually representing the data]. This significant shift indicates a substantial change in market dynamics, with a clear increase in buying pressure. This is further supported by [Insert Link to data source if available] Keywords: Bitcoin trading data, Binance trading volume, chart analysis, price action.

Possible Factors Contributing to the Surge:

Several factors could have contributed to this sudden surge in Bitcoin buying volume on Binance:

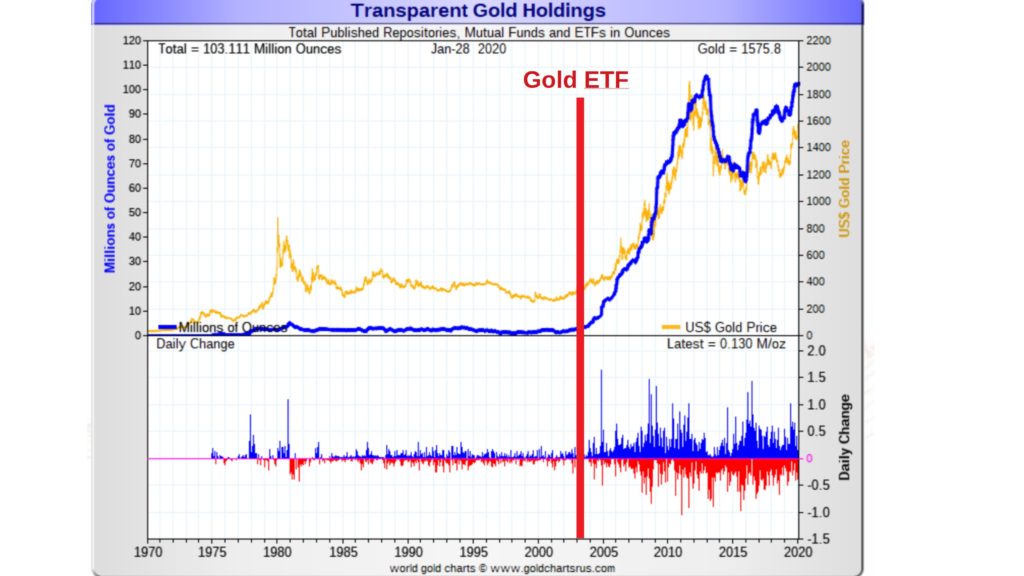

- Increased Institutional Investment: Large institutional investors, such as hedge funds and asset management firms, may have increased their Bitcoin holdings, contributing significantly to the buying volume. The growing acceptance of Bitcoin as a legitimate asset class by institutional players is a key driver of this trend.

- Retail Investor FOMO (Fear Of Missing Out): The recent positive price action, coupled with increasing media coverage, could have triggered FOMO amongst retail investors, leading to a rush to buy Bitcoin before a potential further price increase.

- Positive News Related to Bitcoin Regulations or Adoption: Positive regulatory developments or announcements regarding Bitcoin adoption by major corporations could have boosted investor confidence and fueled buying pressure. Specific examples include [mention specific news if any].

- Technical Indicators Suggesting a Bullish Trend: Several technical indicators, such as the Relative Strength Index (RSI) and moving averages, may have signaled a potential bullish trend, prompting traders to enter long positions and increase buying volume.

- Competitor Exchange Issues Driving Users to Binance: Problems or issues with other cryptocurrency exchanges could have driven users to Binance, leading to a temporary increase in trading volume on the platform.

Keywords: Institutional investors, retail investors, Bitcoin regulations, technical analysis, market trends.

Implications for Bitcoin Price and Market Sentiment

Short-Term Price Predictions:

The increased buying volume on Binance strongly suggests a potential short-term upward trend in Bitcoin's price. However, it's crucial to remain cautious, as market volatility can quickly reverse these trends. We might see a price increase in the range of [Insert cautious price prediction range] in the coming weeks, but this is purely speculative based on the current data. Keywords: Bitcoin price prediction, short-term outlook, market volatility.

Long-Term Market Outlook:

The sustained increase in buying volume could signify a shift in long-term market sentiment towards Bitcoin. If this trend continues, it could lead to a sustained price increase and solidify Bitcoin's position as a dominant cryptocurrency. However, external factors like macroeconomic conditions and regulatory changes could still significantly influence the long-term outlook. Keywords: Long-term Bitcoin forecast, market analysis, cryptocurrency investment.

Overall Market Sentiment Shift:

The surge in buying volume reflects a notable shift in market sentiment. Investor confidence in Bitcoin appears to be growing, indicated by the increased willingness to buy despite recent bearish periods. This positive sentiment could attract further investment and drive the price upwards. Keywords: Market sentiment, investor confidence, Bitcoin future.

Comparing Binance's Bitcoin Trading Volume to Other Exchanges

Cross-Exchange Analysis:

Comparing Binance's Bitcoin trading volume to other major exchanges like Coinbase, Kraken, and OKEx is crucial for understanding the broader market context. While Binance experienced a significant surge, it's important to analyze whether similar trends are observable on other platforms. [Include a comparative analysis if data is available]. Keywords: Cryptocurrency exchanges, market share, trading volume comparison, competitive analysis.

Market Dominance and Liquidity:

This surge in Bitcoin buying volume further strengthens Binance's position as a leading cryptocurrency exchange. The increased trading activity enhances liquidity, making it easier for buyers and sellers to execute trades efficiently. However, it's vital to continuously monitor the competitive landscape to assess the long-term impact on Binance's market dominance. Keywords: Market share, liquidity, trading platform comparison.

Conclusion: The Significance of Increased Bitcoin Buying Volume on Binance

The significant increase in Bitcoin buying volume on Binance after six months of selling pressure is a noteworthy event with potentially far-reaching implications. The surge suggests a shift in market sentiment, increased investor confidence, and a possible upward trend in Bitcoin's price. While the short-term outlook remains somewhat uncertain due to inherent market volatility, the long-term implications could be significant for Bitcoin's market position and overall adoption. It's important to remain vigilant and monitor market trends closely.

Stay informed on the latest Bitcoin price movements and trading volume fluctuations by following our blog. Understanding the dynamics of Bitcoin buying volume on Binance and other exchanges is crucial for navigating the volatile cryptocurrency market. Keywords: Bitcoin investment, market trends, cryptocurrency trading.

Featured Posts

-

Veteran Wide Receiver Joins Browns Bolstering Receiving Corps Report Details

May 08, 2025

Veteran Wide Receiver Joins Browns Bolstering Receiving Corps Report Details

May 08, 2025 -

Could A 10x Bitcoin Multiplier Reshape Wall Street A Weekly Market Chart Analysis

May 08, 2025

Could A 10x Bitcoin Multiplier Reshape Wall Street A Weekly Market Chart Analysis

May 08, 2025 -

Crook Accused Of Millions In Office365 Executive Account Hacks

May 08, 2025

Crook Accused Of Millions In Office365 Executive Account Hacks

May 08, 2025 -

Andors Showrunner Hints At Rogue Ones Recut Version

May 08, 2025

Andors Showrunner Hints At Rogue Ones Recut Version

May 08, 2025 -

Famitsu Top 10 Dragon Quest I And Ii Hd 2 D Remake Claims 1 March 9 2025

May 08, 2025

Famitsu Top 10 Dragon Quest I And Ii Hd 2 D Remake Claims 1 March 9 2025

May 08, 2025

Latest Posts

-

Top Cryptocurrency Investment Van Ecks 185 Prediction

May 08, 2025

Top Cryptocurrency Investment Van Ecks 185 Prediction

May 08, 2025 -

Trump Media And Crypto Coms Etf Partnership Sends Cro Price Higher

May 08, 2025

Trump Media And Crypto Coms Etf Partnership Sends Cro Price Higher

May 08, 2025 -

Van Eck Predicts 185 Surge Top Cryptocurrency To Buy Now

May 08, 2025

Van Eck Predicts 185 Surge Top Cryptocurrency To Buy Now

May 08, 2025 -

Trump Media And Crypto Com Partner For Etf Launch Cro Price Soars

May 08, 2025

Trump Media And Crypto Com Partner For Etf Launch Cro Price Soars

May 08, 2025 -

Bitcoin Fiyati Son Dakika Guencellemeleri Ve Analizler

May 08, 2025

Bitcoin Fiyati Son Dakika Guencellemeleri Ve Analizler

May 08, 2025