Top Cryptocurrency Investment: VanEck's 185% Prediction

Table of Contents

The cryptocurrency market is known for its volatility, but recent predictions from financial giants like VanEck are causing a ripple effect. Their bold forecast of a 185% increase in cryptocurrency value has sparked intense interest, leaving many wondering: which cryptocurrencies are poised for explosive growth? This article delves into VanEck's prediction, examines potential top cryptocurrency investments, and provides insights to help you navigate this potentially lucrative market. We'll explore the factors driving this predicted surge and highlight key considerations for savvy investors.

VanEck's 185% Prediction: Understanding the Forecast

VanEck's prediction, stemming from a recent research report and analyst statements, suggests a significant bullish outlook for the cryptocurrency market. While the exact source document may vary, the core message remains consistent: a substantial increase in cryptocurrency value is anticipated. The timeframe for this projected 185% increase isn't explicitly stated in all reports, but analysts generally point towards a multi-year horizon, rather than a short-term spike.

VanEck's prediction is based on several key factors, including:

- Increased Institutional Adoption: More established financial institutions are embracing cryptocurrencies, increasing liquidity and market stability.

- Growing Global Demand: Adoption of cryptocurrencies is expanding worldwide, fueled by technological advancements and increasing awareness.

- Technological Innovation: Continuous development and innovation within the blockchain space are driving further adoption and utility.

- Deflationary Nature of Some Cryptocurrencies: The limited supply of certain cryptocurrencies contributes to potential price appreciation over time.

However, it's crucial to acknowledge the inherent risks and caveats:

- Market Volatility: The cryptocurrency market remains notoriously volatile and susceptible to sudden price swings.

- Regulatory Uncertainty: Government regulations around the world continue to evolve, impacting the market's stability.

- Security Risks: Cryptocurrency exchanges and wallets are potential targets for hacking and theft.

- Unpredictability of Market Sentiment: Investor sentiment can shift rapidly, impacting cryptocurrency prices significantly.

Comparing this prediction to previous market forecasts reveals varying degrees of accuracy. While past predictions haven't always been perfectly aligned with reality, the increasing institutional interest and technological advancements suggest a greater potential for accuracy in this current projection.

Top Cryptocurrency Investment Candidates Based on VanEck's Prediction

Based on VanEck's positive outlook and broader market trends, several cryptocurrencies emerge as potential top investment candidates.

Bitcoin (BTC): The King Remains a Contender

Bitcoin, often called "digital gold," maintains its position as the dominant cryptocurrency. VanEck's prediction likely incorporates Bitcoin's continued growth, fueled by its established market dominance and scarcity. Its long-term potential stems from its first-mover advantage, strong brand recognition, and growing acceptance as a store of value.

- Advantages of Investing in Bitcoin: Store of value, limited supply, established infrastructure.

- Risks associated with Bitcoin investment: Volatility, regulatory uncertainty, security risks.

- Strategies for mitigating risk in Bitcoin investment: Dollar-cost averaging, long-term holding, diversification.

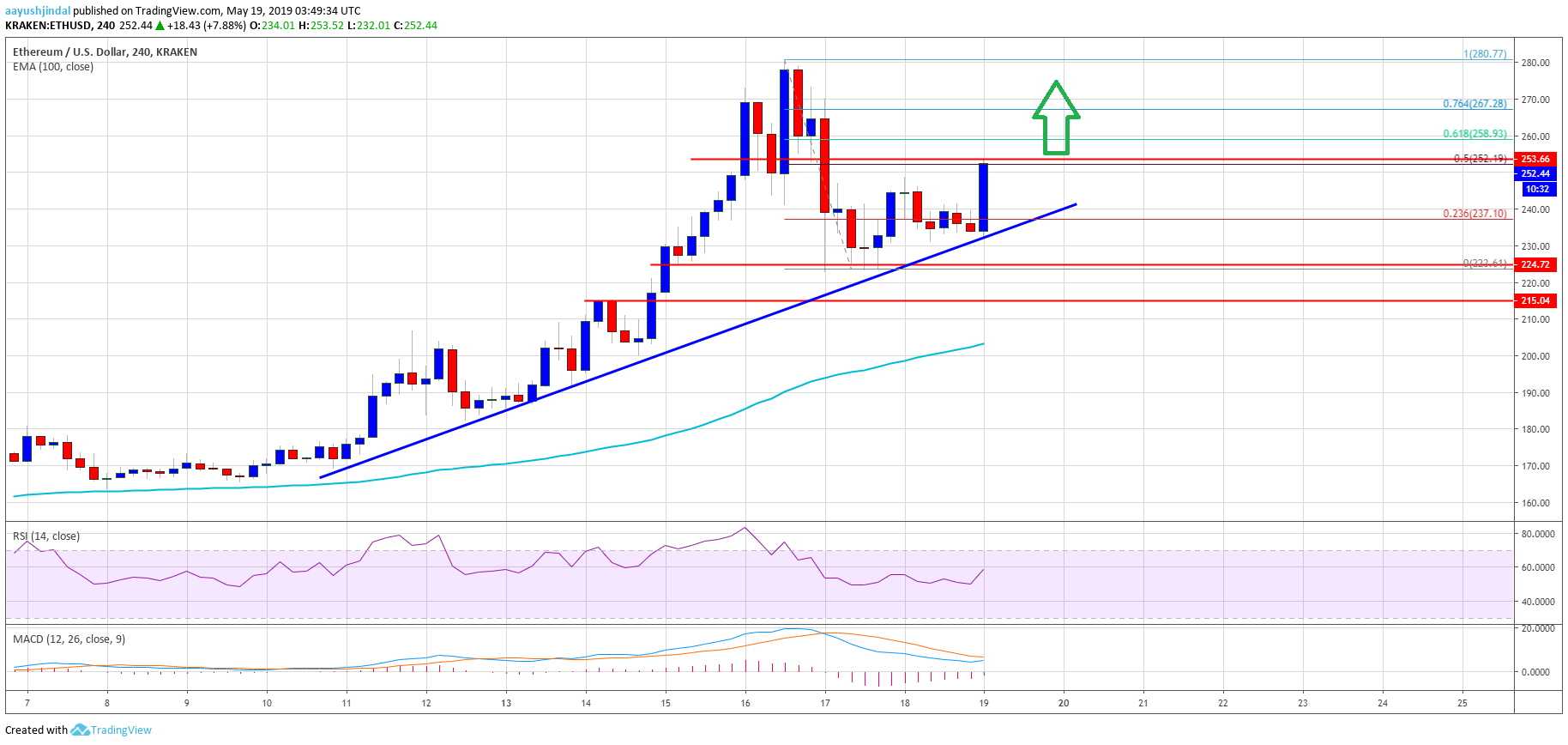

Ethereum (ETH): The Smart Contract Powerhouse

Ethereum, known for its smart contract capabilities, plays a pivotal role in the rapidly expanding decentralized finance (DeFi) and non-fungible token (NFT) markets. VanEck's prediction likely factors in Ethereum's continued growth driven by its significant role in these innovative sectors. The upcoming Ethereum 2.0 upgrade is anticipated to further enhance its scalability and efficiency, potentially boosting its value.

- Advantages of investing in Ethereum: Role in DeFi and NFT ecosystems, technological innovation, potential for scalability improvements.

- Risks associated with Ethereum investment: Volatility, competition from other smart contract platforms, technological challenges.

- Strategies for mitigating risk in Ethereum investment: Diversification, research into competing platforms, understanding technological developments.

Altcoins with High Growth Potential

Beyond Bitcoin and Ethereum, several altcoins show promise based on their unique features and market traction. Solana, with its high transaction speed, and Cardano, emphasizing its focus on scalability and sustainability, are examples of altcoins with potential for substantial growth. However, it's crucial to remember that altcoins carry higher risk due to their often smaller market capitalization and less established track records.

- Potential benefits and risks of investing in altcoins: High potential returns, but also significantly higher risk of loss.

- Due diligence steps to take before investing in altcoins: Thorough research into the project's technology, team, and community.

- Diversification strategies for altcoin investments: Spread investments across multiple altcoins with diverse functionalities.

Navigating the Cryptocurrency Market: Risk Management and Investment Strategies

Investing in cryptocurrencies involves significant risk. Diversification is key to mitigating this risk. Don't put all your eggs in one basket. Spread investments across various cryptocurrencies to reduce the impact of any single asset's price fluctuations.

Thorough research and due diligence are paramount. Understand the underlying technology, the project's team, and the overall market conditions before investing. Consider employing strategies like dollar-cost averaging (DCA), investing a fixed amount regularly regardless of price, to reduce the impact of volatility. Long-term holding can also be a viable strategy, as the cryptocurrency market has historically shown periods of significant growth over time.

- Key risk factors in cryptocurrency investing: Volatility, regulatory uncertainty, security breaches, scams, market manipulation.

- Strategies for mitigating investment risk: Diversification, dollar-cost averaging, long-term investing, secure storage practices.

- Importance of staying informed about market trends: Regularly monitor market news, technological developments, and regulatory changes.

Conclusion

VanEck's 185% prediction for cryptocurrency growth represents a significant opportunity, but it's crucial to approach the market with caution and a well-defined investment strategy. While Bitcoin and Ethereum remain strong contenders, exploring promising altcoins can also yield substantial returns. However, remember that cryptocurrency investments are inherently risky, so thorough research and risk management are paramount.

Call to Action: Ready to explore the potential of top cryptocurrency investments based on VanEck's prediction? Do your research, manage your risk effectively, and seize this exciting opportunity to potentially capitalize on the predicted surge in the cryptocurrency market. Remember to always conduct thorough due diligence before investing in any cryptocurrency.

Featured Posts

-

Top Ps 5 Pro Enhanced Games A Must Play List For Owners

May 08, 2025

Top Ps 5 Pro Enhanced Games A Must Play List For Owners

May 08, 2025 -

K Or

May 08, 2025

K Or

May 08, 2025 -

Could Bitcoin Reach New Heights A 1 500 Price Surge Predicted

May 08, 2025

Could Bitcoin Reach New Heights A 1 500 Price Surge Predicted

May 08, 2025 -

Ethereum Price Strength Bulls In Control Upside Potential High

May 08, 2025

Ethereum Price Strength Bulls In Control Upside Potential High

May 08, 2025 -

Raphaels Departure A Blow To Nc State Football

May 08, 2025

Raphaels Departure A Blow To Nc State Football

May 08, 2025

Latest Posts

-

Recent Political Developments And The Xrp Price A Correlation Analysis

May 08, 2025

Recent Political Developments And The Xrp Price A Correlation Analysis

May 08, 2025 -

The Trump Effect On Cryptocurrency Analyzing The Xrp Price Movement

May 08, 2025

The Trump Effect On Cryptocurrency Analyzing The Xrp Price Movement

May 08, 2025 -

Xrps Unexpected Rally Exploring The Trump Administrations Role

May 08, 2025

Xrps Unexpected Rally Exploring The Trump Administrations Role

May 08, 2025 -

Is President Trumps Involvement Driving Xrps Rise

May 08, 2025

Is President Trumps Involvement Driving Xrps Rise

May 08, 2025 -

Understanding The Xrp Price Increase The Trump Connection

May 08, 2025

Understanding The Xrp Price Increase The Trump Connection

May 08, 2025