Bitcoin Price At A Crossroads: Crucial Levels To Monitor

Table of Contents

Key Support and Resistance Levels

Analyzing Bitcoin price movements requires understanding support and resistance levels – price points where buying or selling pressure is historically strong. These act as potential barriers to price fluctuations. Identifying these crucial levels is essential for any Bitcoin price prediction.

-

Crucial Support Levels:

- $20,000: This level has acted as a significant support zone in the past, witnessing strong buying pressure. Breaching this level could trigger further downward momentum.

- Strong buying pressure observed historically near $20,000, suggesting a potential floor.

- Technical indicators like the 200-day moving average often align with this level, adding to its significance.

- $25,000: Another key support level, often acting as a psychological barrier for investors. A sustained break below this level could signal a bearish trend.

- This level represents a significant psychological barrier for many investors.

- Bollinger Bands often show increased volatility around this price point.

- $18,000 (Potential): While not as historically significant as the previous levels, a potential further support level might emerge if the market experiences an extreme downturn. The strength of any potential support will depend on overall market sentiment and macroeconomic factors.

- $20,000: This level has acted as a significant support zone in the past, witnessing strong buying pressure. Breaching this level could trigger further downward momentum.

-

Crucial Resistance Levels:

- $30,000: A significant resistance level that has repeatedly capped Bitcoin's upward trajectory. Overcoming this barrier would likely indicate a bullish sentiment and could trigger further price increases.

- Regulatory uncertainty and macroeconomic headwinds could prevent a sustained breakout above $30,000.

- RSI (Relative Strength Index) often shows overbought conditions near this level, suggesting a potential pullback.

- $40,000: A major psychological resistance level that represents a significant hurdle for the Bitcoin price. Breaking through this level could signal a strong bull market.

- Institutional investors' profit-taking could contribute to resistance around this price.

- The moving average convergence divergence (MACD) might indicate bearish divergence near this level.

- $30,000: A significant resistance level that has repeatedly capped Bitcoin's upward trajectory. Overcoming this barrier would likely indicate a bullish sentiment and could trigger further price increases.

Impact of Macroeconomic Factors on Bitcoin Price

Bitcoin's price is not immune to macroeconomic conditions. Broader economic trends significantly influence investor sentiment and trading activity.

- Inflation and Interest Rates: High inflation and rising interest rates typically lead to risk-aversion, potentially impacting Bitcoin's price negatively as investors move towards safer assets.

- Historically, periods of high inflation have seen decreased Bitcoin investment.

- Increased interest rates reduce the attractiveness of Bitcoin as an investment compared to yield-bearing assets.

- Recession Fears: Economic uncertainty and recession fears often trigger a flight to safety, impacting Bitcoin's price. This can lead to decreased investment and increased volatility.

- Examples such as the 2008 financial crisis show a correlation between economic uncertainty and Bitcoin's volatility.

- Potential scenarios including a prolonged recession could push Bitcoin's price down further towards the support levels identified above.

Analyzing Bitcoin's On-Chain Metrics

Analyzing on-chain metrics provides valuable insights into market sentiment and potential price movements. These metrics offer a different perspective compared to traditional technical analysis.

- Transaction Volume and Active Addresses: High transaction volume and active addresses generally indicate increased market activity and potential bullish pressure. Low volumes may suggest decreased interest.

- Increased transaction volume with growing active addresses is generally a positive indicator.

- Conversely, declining transaction volume and active addresses could signify weakening interest in Bitcoin.

- Mining Hash Rate: The mining hash rate reflects the computational power securing the Bitcoin network. A higher hash rate generally suggests a more secure and robust network, potentially supporting price stability.

- A high hash rate indicates a healthy and secure network, often linked to a relatively stable price.

- Sudden drops in hash rate can indicate potential issues within the Bitcoin ecosystem and might affect investor confidence.

- We recommend consulting resources like Glassnode or CoinMetrics for reliable on-chain data.

The Role of Bitcoin Adoption and Institutional Investment

Growing adoption by individuals and institutions significantly impacts Bitcoin's price.

- Increased Adoption: Wider adoption increases demand, potentially pushing the price upward.

- Examples of increasing adoption include the growing number of Bitcoin ATMs and the expansion of Bitcoin payment options.

- The continued development and improvement of Bitcoin infrastructure further enhance adoption.

- Institutional Investment: Large institutional investments can inject significant liquidity into the market, creating upward pressure on the price. Regulatory changes also play a vital role.

- Recent investments by major corporations have shown increasing institutional confidence in Bitcoin.

- Positive regulatory developments could further attract institutional investment and fuel price growth.

Conclusion

Bitcoin's price at a crossroads is dependent on several critical factors. Monitoring key support and resistance levels ($20,000, $25,000, $30,000, $40,000), understanding the impact of macroeconomic conditions, and analyzing on-chain metrics are crucial for informed investment decisions. The increasing adoption of Bitcoin and institutional investment will also influence the price. Stay ahead of the curve and continue monitoring these crucial levels to make informed decisions on your Bitcoin investments. Understanding the Bitcoin price at a crossroads is key to successful trading.

Featured Posts

-

The Closure Of Anchor Brewing Company A Look Back At Its History

May 08, 2025

The Closure Of Anchor Brewing Company A Look Back At Its History

May 08, 2025 -

Luis Enrique Largoi Pese Yje Nga Psg

May 08, 2025

Luis Enrique Largoi Pese Yje Nga Psg

May 08, 2025 -

Canadian Dollar Overvalued Economists Urge Swift Action

May 08, 2025

Canadian Dollar Overvalued Economists Urge Swift Action

May 08, 2025 -

Diego Luna On Andor Season 2 A Departure From Disneys Star Wars Formula

May 08, 2025

Diego Luna On Andor Season 2 A Departure From Disneys Star Wars Formula

May 08, 2025 -

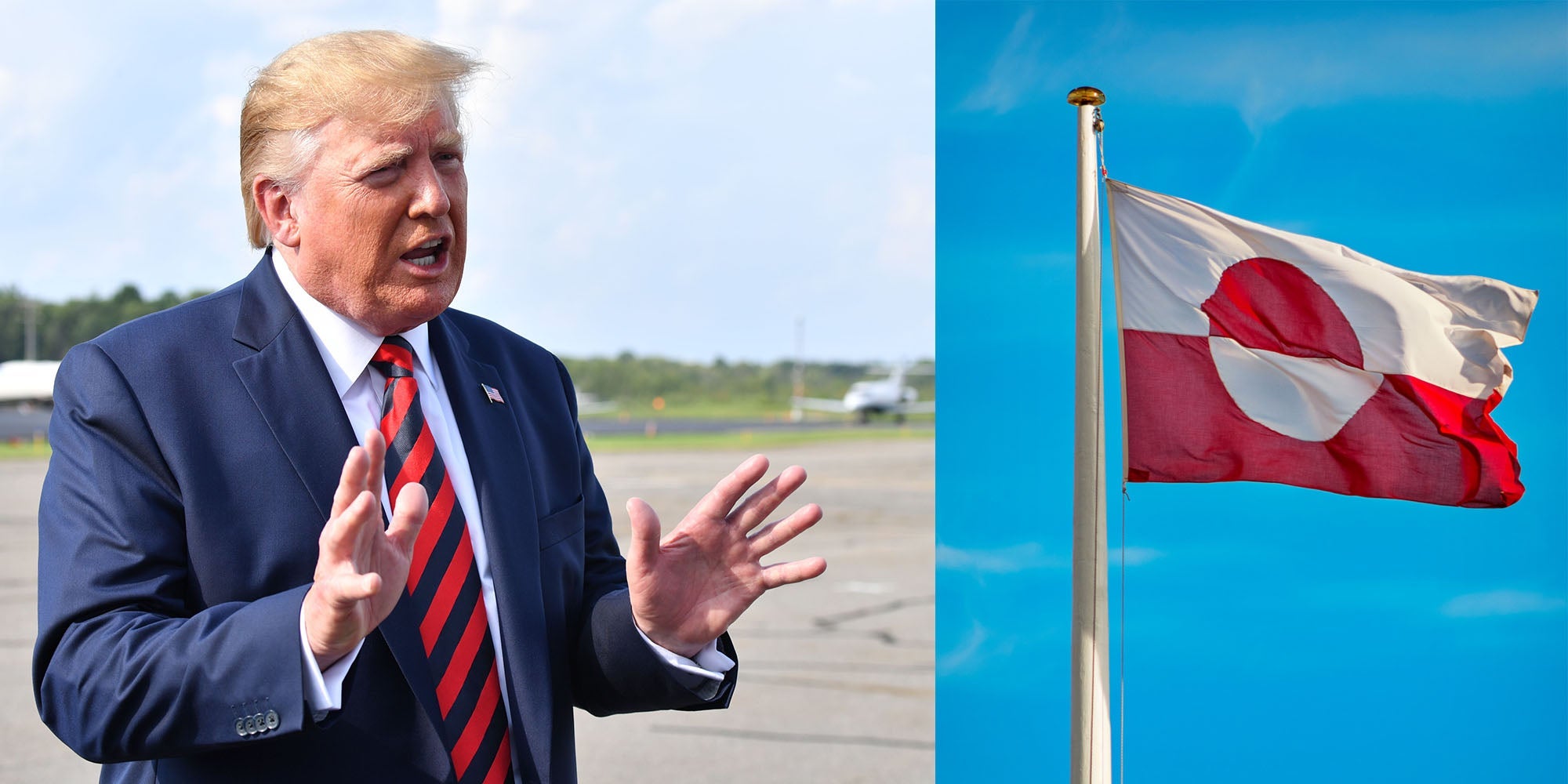

The Greenland Question Examining Trumps Claims About China

May 08, 2025

The Greenland Question Examining Trumps Claims About China

May 08, 2025

Latest Posts

-

The Academy Awards Biggest Oversights Iconic Snubs

May 08, 2025

The Academy Awards Biggest Oversights Iconic Snubs

May 08, 2025 -

Historys Biggest Oscars Snubs Justice Denied At The Academy Awards

May 08, 2025

Historys Biggest Oscars Snubs Justice Denied At The Academy Awards

May 08, 2025 -

Unforgettable Oscars Snubs Moments That Still Spark Debate

May 08, 2025

Unforgettable Oscars Snubs Moments That Still Spark Debate

May 08, 2025 -

The Method Behind Matt Damons Success Ben Afflecks Observations

May 08, 2025

The Method Behind Matt Damons Success Ben Afflecks Observations

May 08, 2025 -

Oscars Biggest Snubs Films And Performances That Deserved Better

May 08, 2025

Oscars Biggest Snubs Films And Performances That Deserved Better

May 08, 2025