Bitcoin Price Prediction: Trump's 100-Day Speech And The $100,000 Target

Table of Contents

Trump's 100-Day Speech and its Economic Implications

Trump's 100-day speech laid out a bold economic agenda, with potential ramifications for Bitcoin's price. Let's delve into its key aspects and their potential influence.

Fiscal Policy and Bitcoin

Trump's proposed fiscal policies, including substantial tax cuts and increased government spending, could lead to increased inflation.

- Increased Inflation: A surge in inflation could erode the value of fiat currencies, potentially driving investors towards Bitcoin as a hedge against inflation. Historically, Bitcoin has shown some correlation with inflationary periods.

- Bitcoin as an Inflation Hedge: Bitcoin's fixed supply of 21 million coins makes it a deflationary asset, contrasting sharply with potentially inflationary fiat currencies. This inherent scarcity could boost its appeal during inflationary periods.

- Expert Opinions: While some economists believe inflation will benefit Bitcoin, others warn of potential negative regulatory responses to combat inflation, which could impact Bitcoin's price negatively.

Regulatory Uncertainty and Bitcoin

Trump's administration's stance on cryptocurrency regulation remained a significant source of uncertainty.

- Positive Regulatory Scenarios: Clear and favorable regulations could boost investor confidence, leading to increased investment and higher prices.

- Negative Regulatory Scenarios: Conversely, overly restrictive regulations could stifle innovation and dampen investor enthusiasm, potentially suppressing Bitcoin's price.

- Regulatory Clarity: The lack of clear regulatory frameworks creates volatility. Increased clarity, regardless of its specific nature, could lead to greater price stability, though not necessarily a higher price immediately.

Geopolitical Factors and Bitcoin

Global political events and Trump's foreign policy significantly influence Bitcoin's price.

- Geopolitical Instability: Periods of geopolitical uncertainty often see investors flock to safe-haven assets, including Bitcoin. Trump's foreign policy decisions could create such periods, potentially driving up Bitcoin's price.

- Bitcoin as a Safe Haven: Bitcoin's decentralized nature and independence from government control make it attractive during times of political or economic instability.

- Trump's Impact: Trump's unpredictable approach to foreign policy created periods of both stability and volatility, each potentially impacting Bitcoin's role as a safe haven asset.

Technical Analysis: Bitcoin's Path to $100,000

Technical analysis offers another perspective on Bitcoin's potential price trajectory.

Chart Patterns and Indicators

Examining Bitcoin's historical price charts using technical indicators like moving averages and the Relative Strength Index (RSI) can provide insights.

- Moving Averages: Analyzing long-term and short-term moving averages can help identify potential trend reversals and support/resistance levels.

- RSI: The RSI indicator helps gauge the strength of price movements and identify overbought or oversold conditions.

- $100,000 Target: While technical analysis can suggest potential price movements, predicting a specific price like $100,000 requires caution, as numerous unforeseen events can influence price significantly.

Market Sentiment and Adoption

Market sentiment and the rate of Bitcoin adoption are crucial drivers of its price.

- Bullish vs. Bearish Sentiment: Strong positive sentiment from both retail and institutional investors fuels price increases, while bearish sentiment can lead to price drops.

- Adoption Rates: Widespread adoption by businesses and individuals increases demand, putting upward pressure on the price.

- Institutional Investment: Increased investment from institutional players like hedge funds and corporations validates Bitcoin as an asset class, potentially driving price appreciation.

Bitcoin Halving and its Effect

The Bitcoin halving event, which cuts the rate of new Bitcoin creation in half, plays a significant role in its price trajectory.

- Historical Data: Past halving events have historically been followed by significant price increases due to the reduced supply.

- Scarcity Factor: The halving reinforces Bitcoin's scarcity, creating anticipation and potentially driving up demand.

- Impact on $100,000 Target: The halving is a significant factor that could contribute to a price increase, but it doesn't guarantee reaching the $100,000 mark.

Factors Beyond Trump's Influence

Beyond Trump's policies, several other factors influence Bitcoin's price.

Technological Advancements in Bitcoin

Technological improvements enhance the Bitcoin network's efficiency and scalability.

- Lightning Network: The Lightning Network speeds up transactions and reduces fees, making Bitcoin more usable for everyday transactions.

- Taproot Upgrade: Taproot enhances the network's privacy and efficiency.

- Impact on Price: These improvements increase Bitcoin's utility and appeal, potentially contributing to price increases.

Competition from Altcoins

The emergence of competing cryptocurrencies impacts Bitcoin's dominance and price.

- Market Share of Altcoins: The rise of altcoins could potentially divert investment away from Bitcoin, impacting its market share and price.

- Threat to Bitcoin's Dominance: The increasing number of altcoins offering unique functionalities presents a challenge to Bitcoin's position.

- Price Influence: While competition exists, Bitcoin's established position and first-mover advantage still give it a significant edge.

Global Economic Conditions

Macroeconomic factors like interest rates and global economic growth influence Bitcoin's value.

- Correlation with Macroeconomic Factors: Bitcoin's price can be influenced by broader economic trends, such as recessions or periods of rapid economic growth.

- Interest Rates: Changes in interest rates can impact investor appetite for riskier assets like Bitcoin.

- Global Economic Growth: Strong global economic growth could lead to increased investment in riskier assets, including Bitcoin.

Conclusion: Bitcoin Price Prediction: The Verdict on the $100,000 Target

Trump's policies, while potentially influential, are just one piece of the complex puzzle shaping Bitcoin's price. Technical factors, market sentiment, competition, and global economic conditions all play critical roles. While a $100,000 Bitcoin is possible, it's not guaranteed. Numerous variables could accelerate or impede its progress. The journey to this milestone depends on the interplay of numerous factors and remains highly uncertain.

Disclaimer: Investing in cryptocurrencies involves significant risk. The value of Bitcoin can fluctuate dramatically, and you could lose your entire investment.

Call to Action: Conduct your own thorough research before investing in Bitcoin. Stay informed about Bitcoin price predictions, technological advancements, and relevant news to make informed investment decisions. Understanding the intricacies of Bitcoin's future and potential $100,000 target requires continuous learning and diligent monitoring of the market.

Featured Posts

-

Credit Suisse Whistleblower Settlement Up To 150 Million Awarded

May 09, 2025

Credit Suisse Whistleblower Settlement Up To 150 Million Awarded

May 09, 2025 -

Doohans Development Palmers Perspective On Alpines Reserve Driver Situation

May 09, 2025

Doohans Development Palmers Perspective On Alpines Reserve Driver Situation

May 09, 2025 -

De Indiase Strategie Van Brekelmans Doelen En Methoden

May 09, 2025

De Indiase Strategie Van Brekelmans Doelen En Methoden

May 09, 2025 -

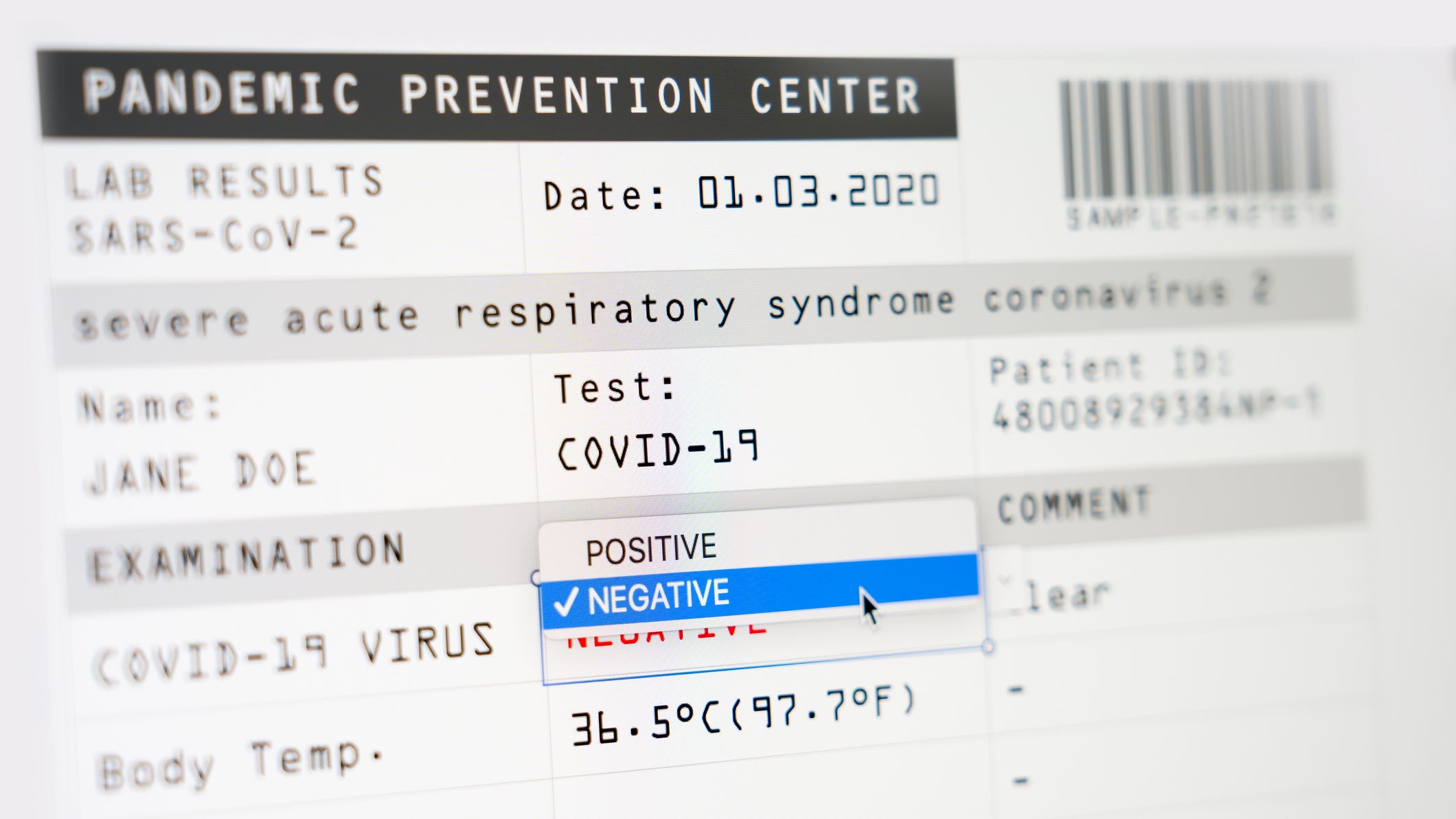

Lab Owner Convicted For Falsified Covid Test Results During Pandemic

May 09, 2025

Lab Owner Convicted For Falsified Covid Test Results During Pandemic

May 09, 2025 -

Planning Your Summer Trip Understanding Real Id Compliance

May 09, 2025

Planning Your Summer Trip Understanding Real Id Compliance

May 09, 2025

Latest Posts

-

Public Access To Jeffrey Epstein Files Evaluating Ag Pam Bondis Choice

May 09, 2025

Public Access To Jeffrey Epstein Files Evaluating Ag Pam Bondis Choice

May 09, 2025 -

Pam Bondi And James Comer Clash Over Epstein Files

May 09, 2025

Pam Bondi And James Comer Clash Over Epstein Files

May 09, 2025 -

Should We See The Epstein Files Examining Ag Pam Bondis Decision

May 09, 2025

Should We See The Epstein Files Examining Ag Pam Bondis Decision

May 09, 2025 -

Attorney General Pam Bondis Amusement At James Comers Epstein Claims

May 09, 2025

Attorney General Pam Bondis Amusement At James Comers Epstein Claims

May 09, 2025 -

Pam Bondi Laughs Comers Epstein Files Tirade Sparks Controversy

May 09, 2025

Pam Bondi Laughs Comers Epstein Files Tirade Sparks Controversy

May 09, 2025