Bitcoin Price Prediction: Will Trump's 100-Day Speech Push BTC Past $100,000?

Table of Contents

Trump's Policies and Their Potential Effect on Bitcoin

Economic Policies and Bitcoin's Correlation

Trump's economic policies, whether focusing on fiscal stimulus or monetary adjustments, could significantly influence Bitcoin's value. For instance:

- Fiscal Policy Impacts: Large-scale infrastructure spending could lead to inflation, potentially driving investors towards Bitcoin as an inflation hedge. Conversely, significant tax cuts could boost economic growth, potentially reducing Bitcoin's appeal as a safe haven asset.

- Monetary Policy Impacts: Changes in interest rates directly impact the value of traditional assets. A rise in interest rates might draw investors away from riskier assets like Bitcoin, while lower rates could increase its attractiveness.

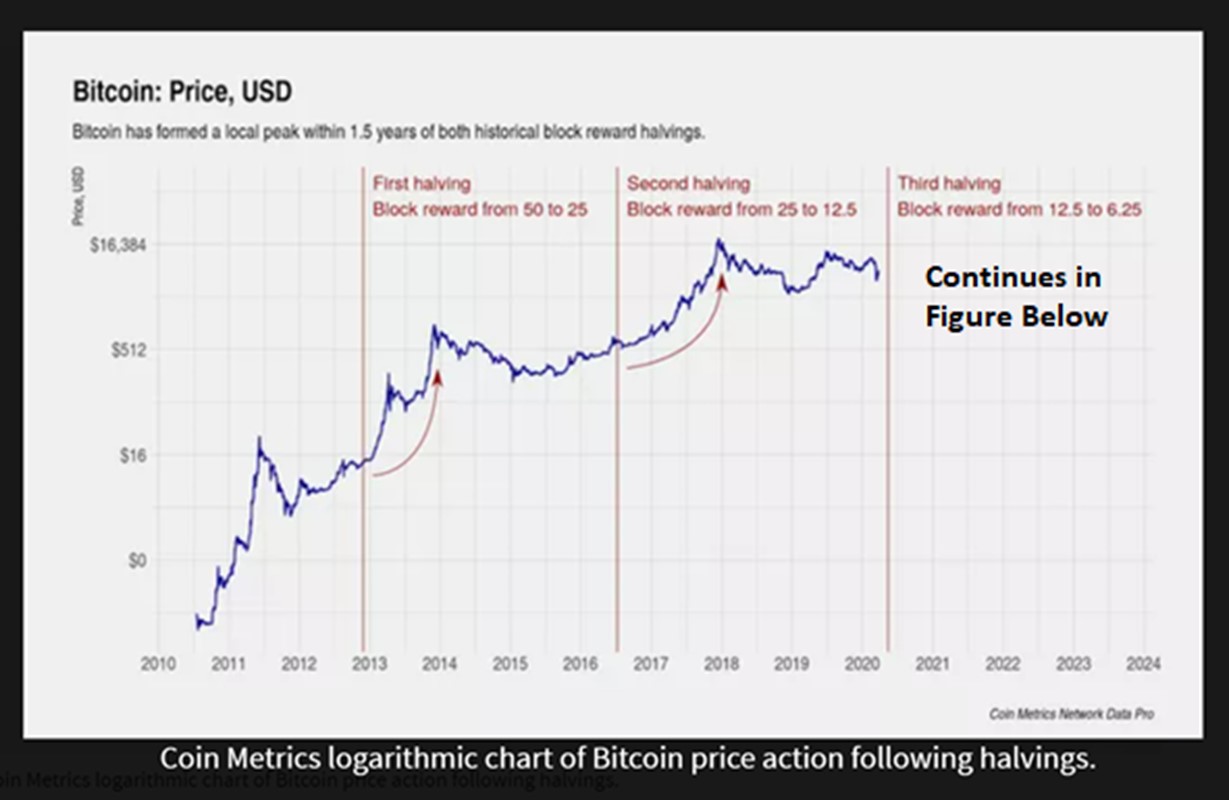

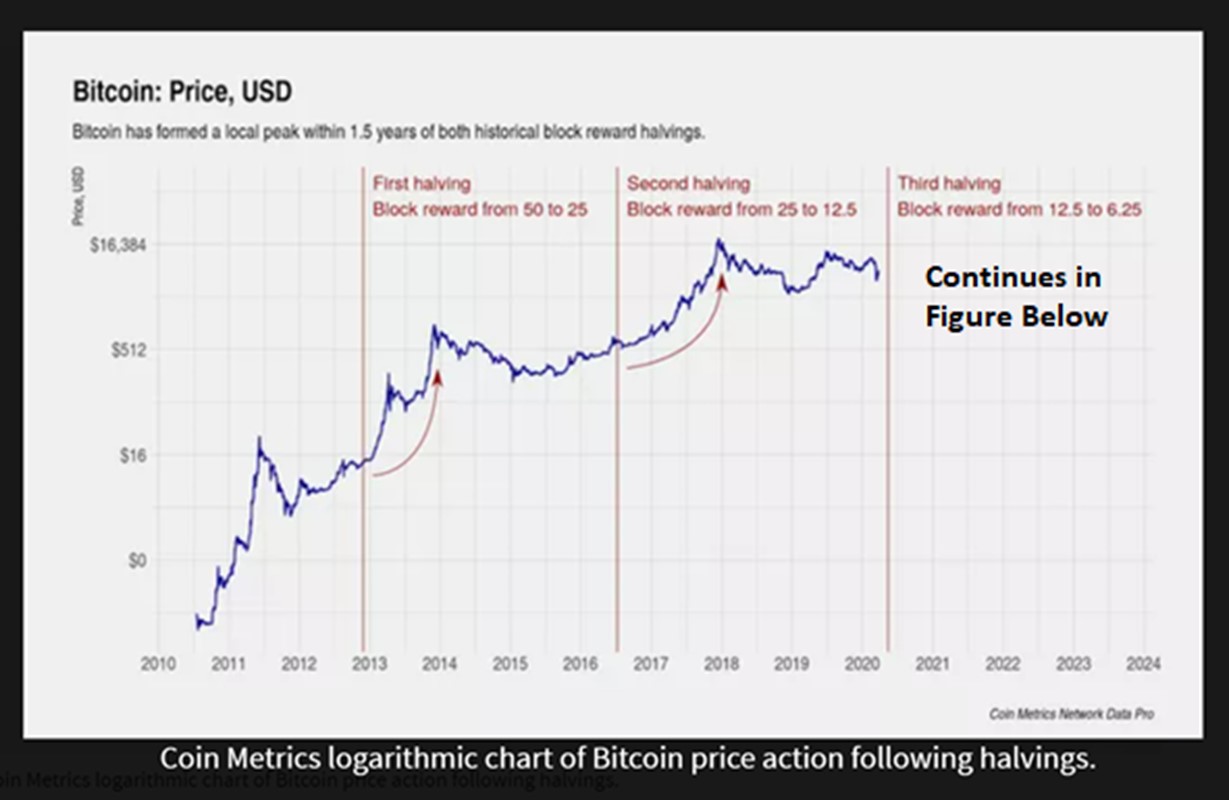

- Historical Correlation: Examining historical data on Bitcoin price movements alongside past economic policy shifts can offer valuable insights, though correlation doesn't equal causation. We need to carefully analyze any observed relationships to understand the underlying mechanisms.

Keywords: Bitcoin inflation hedge, Bitcoin safe haven, fiscal policy, monetary policy, economic stimulus.

Regulatory Landscape and Bitcoin's Future

Any regulatory changes mentioned in a hypothetical Trump speech could dramatically alter the Bitcoin landscape:

- Positive Regulatory Scenarios: Clearer regulatory frameworks could attract institutional investors, boosting Bitcoin's legitimacy and price. This could increase liquidity and market stability, leading to higher valuations.

- Negative Regulatory Scenarios: Overly restrictive regulations could stifle innovation and adoption, potentially driving the price down. Uncertainty regarding regulatory direction often leads to market volatility.

- Key Regulatory Bodies: The SEC (Securities and Exchange Commission) and CFTC (Commodity Futures Trading Commission) play crucial roles in shaping the regulatory environment for cryptocurrencies in the US. Their stance is key to any price prediction.

Keywords: Bitcoin regulation, crypto regulation, SEC, CFTC, regulatory uncertainty.

Market Sentiment and Bitcoin's Price Volatility

The Psychology of Investing and Bitcoin

Bitcoin's price is highly susceptible to market sentiment. Fear, uncertainty, and doubt (FUD) can lead to sharp price drops, while periods of optimism and increased investor confidence fuel price rallies.

- Trump's Speech Impact: A positive speech could boost investor confidence, driving Bitcoin's price upwards. Conversely, a negative speech could trigger a sell-off driven by fear and uncertainty.

- Social Media Sentiment: The influence of social media on Bitcoin price is undeniable. News and opinions shared on platforms like Twitter can significantly impact market sentiment.

Keywords: Bitcoin volatility, market sentiment, investor confidence, FUD, fear and greed.

Technical Analysis and Bitcoin Price Predictions

Technical analysis, using indicators like moving averages and RSI, can offer insights into potential price movements. However, it's crucial to understand its limitations:

- Technical Indicators: Moving averages help identify trends, while RSI gauges momentum. These tools, along with chart patterns, can provide potential support and resistance levels.

- Past Performance is Not Indicative of Future Results: Technical analysis relies on past data, which may not accurately reflect future price behavior, especially in a volatile market like Bitcoin's.

Keywords: Bitcoin technical analysis, chart patterns, moving average, RSI, technical indicators.

Alternative Factors Influencing Bitcoin's Price

Global Macroeconomic Conditions

Global macroeconomic factors play a significant role in shaping Bitcoin's price:

- Inflation and Interest Rates: High inflation often pushes investors toward Bitcoin as a hedge against currency devaluation. Similarly, interest rate changes affect the relative attractiveness of Bitcoin versus traditional assets.

- Geopolitical Events: Global instability or geopolitical risks can drive investors towards Bitcoin, perceived as a decentralized and relatively secure store of value.

Keywords: global macroeconomics, inflation, interest rates, geopolitical risk, macroeconomic factors.

Bitcoin Adoption and Technological Developments

Independent of any Trump speech, Bitcoin's price is influenced by its adoption rate and technological advancements:

- Increased Adoption: Wider adoption by businesses and individuals increases demand, pushing the price up. Growing institutional investment also plays a significant role.

- Technological Advancements: Improvements like the Lightning Network enhance Bitcoin's scalability and transaction speed, potentially boosting its appeal and value.

Keywords: Bitcoin adoption, Lightning Network, Bitcoin scalability, Bitcoin technology, crypto adoption.

Conclusion: Bitcoin Price Prediction – The Verdict

Predicting Bitcoin's price with certainty is impossible. While a hypothetical Trump speech could significantly impact market sentiment and potentially influence the price, various other factors—economic policies, regulatory changes, global macroeconomic conditions, and technological developments—play equally crucial roles. The potential scenarios range from substantial price increases (if the speech is positive and supportive of crypto) to considerable drops (if negative or uncertain). A reasonable Bitcoin price prediction would therefore involve considering a range of possibilities rather than a single point prediction. This makes thorough research and diversified investment strategies crucial.

Stay informed on the latest developments to refine your own Bitcoin price prediction. Remember to conduct thorough research and understand the inherent risks before making any investment decisions. Responsible investment in Bitcoin is key to navigating its volatile market.

Featured Posts

-

Dyshime Te Medha Rrethojne Arsenalin Pas Ndeshjes Me Psg Akuza Per Shkelje Te Rregullave Te Uefa S

May 08, 2025

Dyshime Te Medha Rrethojne Arsenalin Pas Ndeshjes Me Psg Akuza Per Shkelje Te Rregullave Te Uefa S

May 08, 2025 -

Preview Rogue The Savage Land 2 Will Ka Zar Survive

May 08, 2025

Preview Rogue The Savage Land 2 Will Ka Zar Survive

May 08, 2025 -

Knee Injury Forces Mike Trout Out Angels Extend Losing Streak To Five Games

May 08, 2025

Knee Injury Forces Mike Trout Out Angels Extend Losing Streak To Five Games

May 08, 2025 -

Ousmane Dembele Injury Worrying News For Arsenal And Arteta

May 08, 2025

Ousmane Dembele Injury Worrying News For Arsenal And Arteta

May 08, 2025 -

Cantina Canalla Malaga El Restaurante Mexicano De Moda

May 08, 2025

Cantina Canalla Malaga El Restaurante Mexicano De Moda

May 08, 2025

Latest Posts

-

Superman Footage Analysis More Than Just Krypto A Critical Scene Discussion

May 08, 2025

Superman Footage Analysis More Than Just Krypto A Critical Scene Discussion

May 08, 2025 -

I Just Watched The New Superman Footage Krypto Steals The Show But This Moment Is Bigger

May 08, 2025

I Just Watched The New Superman Footage Krypto Steals The Show But This Moment Is Bigger

May 08, 2025 -

Exploring The Top Krypto Stories And Their Impact

May 08, 2025

Exploring The Top Krypto Stories And Their Impact

May 08, 2025 -

A Comprehensive Look At The Best Krypto Stories

May 08, 2025

A Comprehensive Look At The Best Krypto Stories

May 08, 2025 -

Reviewing The Best Krypto Stories In Comic Book History

May 08, 2025

Reviewing The Best Krypto Stories In Comic Book History

May 08, 2025