Exploring The Top Krypto Stories And Their Impact

Table of Contents

The Rise and Fall of TerraUSD (UST) and Luna

The TerraUSD (UST) and Luna saga is arguably one of the most dramatic Krypto Stories in recent history. UST was an algorithmic stablecoin pegged to the US dollar, designed to maintain its $1 value through its relationship with Luna, a sister cryptocurrency. The intended functionality was that if UST's price dipped below $1, users could burn UST to mint Luna, increasing Luna's scarcity and theoretically pushing UST back up. Conversely, if UST rose above $1, users could burn Luna to mint UST.

However, in May 2022, this mechanism spectacularly failed. A significant sell-off of UST triggered a de-pegging, leading to a catastrophic collapse. The price of UST plummeted, dragging Luna down with it, resulting in billions of dollars in losses for investors.

- Key Consequences of the Terra/Luna Collapse:

- Massive losses for investors: Countless individuals and institutions suffered significant financial losses.

- Increased regulatory scrutiny of stablecoins: The event sparked intense debate and investigation into the regulation of stablecoins globally.

- Impact on the overall cryptocurrency market sentiment: The collapse shook investor confidence and contributed to a broader market downturn.

The Terra/Luna Krypto Story serves as a stark reminder of the risks associated with algorithmic stablecoins and the importance of thorough due diligence before investing in any cryptocurrency project. The lessons learned highlight the need for robust mechanisms to maintain price stability and transparency within the crypto ecosystem.

The FTX Bankruptcy Saga

The FTX bankruptcy is another significant Krypto Story, showcasing the dangers of unchecked growth and fraudulent activities within the cryptocurrency industry. FTX, once one of the largest cryptocurrency exchanges globally, experienced a spectacular downfall in late 2022. Its founder, Sam Bankman-Fried (SBF), was accused of misusing billions of dollars in customer funds and engaging in various fraudulent activities.

The mismanagement and alleged fraudulent activities led to the bankruptcy of FTX and its affiliated companies, causing a massive loss of investor confidence.

- Effects of the FTX Bankruptcy:

- Billions of dollars in losses for investors and creditors: The collapse resulted in enormous financial losses for countless individuals and institutions.

- Erosion of trust in centralized cryptocurrency exchanges: The event significantly damaged the reputation of centralized exchanges and raised concerns about their security and transparency.

- Increased calls for stricter regulation within the crypto industry: The debacle intensified calls for greater regulatory oversight of cryptocurrency exchanges and other players in the ecosystem.

The ongoing legal ramifications of the FTX collapse are still unfolding, but the Krypto Story serves as a cautionary tale about the importance of robust risk management, transparency, and ethical conduct within the cryptocurrency industry. It highlights the need for stronger regulatory frameworks to protect investors and maintain market integrity.

Bitcoin's Continued Dominance and Adoption

Despite the volatility and numerous Krypto Stories involving altcoins, Bitcoin continues to hold its position as the leading cryptocurrency. Its sustained dominance is attributed to several factors, including its first-mover advantage, brand recognition, and strong network effects. The longer Bitcoin exists and the more widely adopted it becomes, the more secure and valuable it becomes.

Bitcoin's growing adoption is evident in several key areas:

- Growing adoption of Bitcoin:

- Increasing institutional investment: Major corporations and financial institutions are increasingly incorporating Bitcoin into their investment portfolios.

- Growing acceptance by businesses and merchants: More and more businesses are accepting Bitcoin as a form of payment.

- Integration into financial services: Several financial institutions are integrating Bitcoin-related services into their offerings.

Bitcoin's future prospects remain strong, driven by its established position, growing adoption, and potential as a store of value and a hedge against inflation. Its continued dominance in the cryptocurrency market is a significant Krypto Story in itself, showcasing the resilience and enduring appeal of this pioneering cryptocurrency.

The Emergence of Decentralized Finance (DeFi)

The rise of Decentralized Finance (DeFi) represents a significant Krypto Story, marking a major shift in the financial landscape. DeFi leverages blockchain technology to offer alternative financial services, cutting out intermediaries and empowering users with greater control over their funds. Core principles include transparency, permissionlessness, and composability.

DeFi protocols provide a range of services, including lending, borrowing, yield farming, and decentralized exchanges (DEXs). Key developments in DeFi include:

- Significant DeFi developments:

- Growth in total value locked (TVL): The total value of assets locked in DeFi protocols has grown exponentially.

- Emergence of innovative DeFi applications: New and innovative DeFi applications are constantly being developed.

- Increasing regulatory attention to DeFi platforms: Regulators are increasingly focusing their attention on DeFi platforms and their regulatory implications.

The potential impact of DeFi on the future of finance is vast. Its ability to offer more efficient, transparent, and accessible financial services has the potential to revolutionize the way we interact with money and financial systems. The DeFi Krypto Story is still unfolding, but it promises to be one of the most transformative narratives in the history of finance.

Conclusion

The Krypto Stories discussed above—the collapse of TerraUSD and Luna, the FTX bankruptcy, Bitcoin's continued dominance, and the emergence of DeFi—collectively illustrate the dynamic and volatile nature of the cryptocurrency landscape. Each narrative highlights the importance of understanding the inherent risks, the need for transparency and robust regulatory frameworks, and the potential for both extraordinary gains and devastating losses. By staying updated on the latest Krypto Stories, you can make more informed decisions and participate effectively in this dynamic and transformative space. Continue exploring the fascinating world of Krypto Stories and stay ahead of the curve!

Featured Posts

-

1 0

May 08, 2025

1 0

May 08, 2025 -

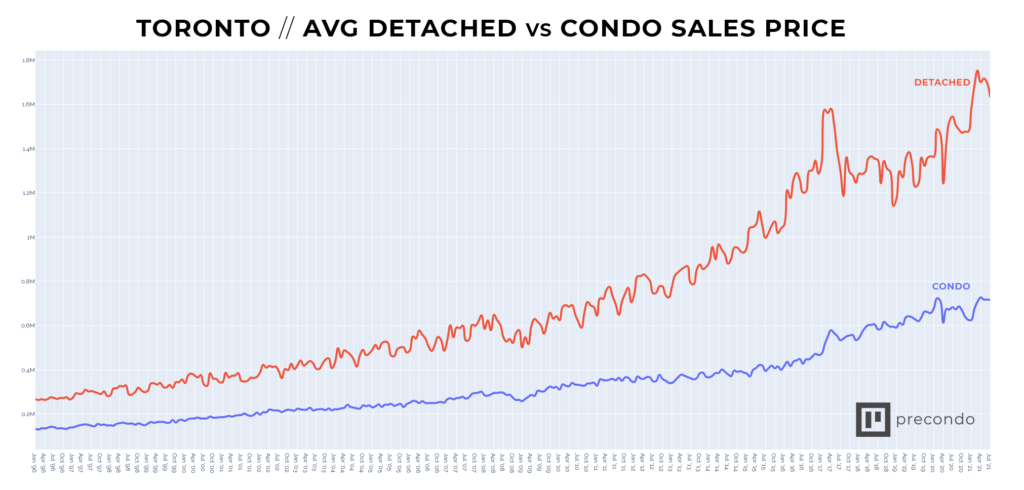

Toronto Home Sales And Prices A 23 And 4 Decline Respectively

May 08, 2025

Toronto Home Sales And Prices A 23 And 4 Decline Respectively

May 08, 2025 -

Bitcoins Critical Juncture Where To Look For Price Movement

May 08, 2025

Bitcoins Critical Juncture Where To Look For Price Movement

May 08, 2025 -

The Bitcoin Golden Cross Historical Context And Future Outlook

May 08, 2025

The Bitcoin Golden Cross Historical Context And Future Outlook

May 08, 2025 -

Gambits Heartbreaking New Weapon Revealed

May 08, 2025

Gambits Heartbreaking New Weapon Revealed

May 08, 2025

Latest Posts

-

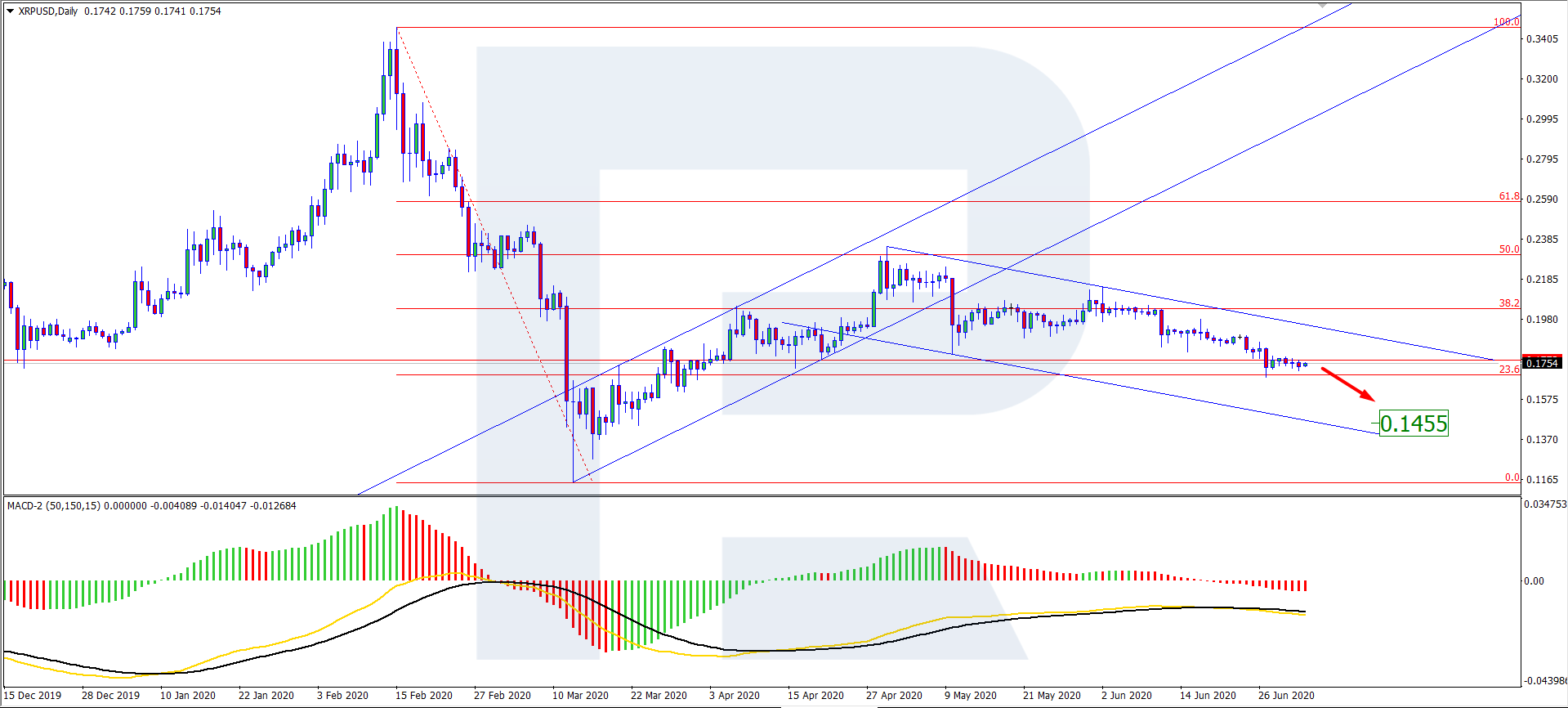

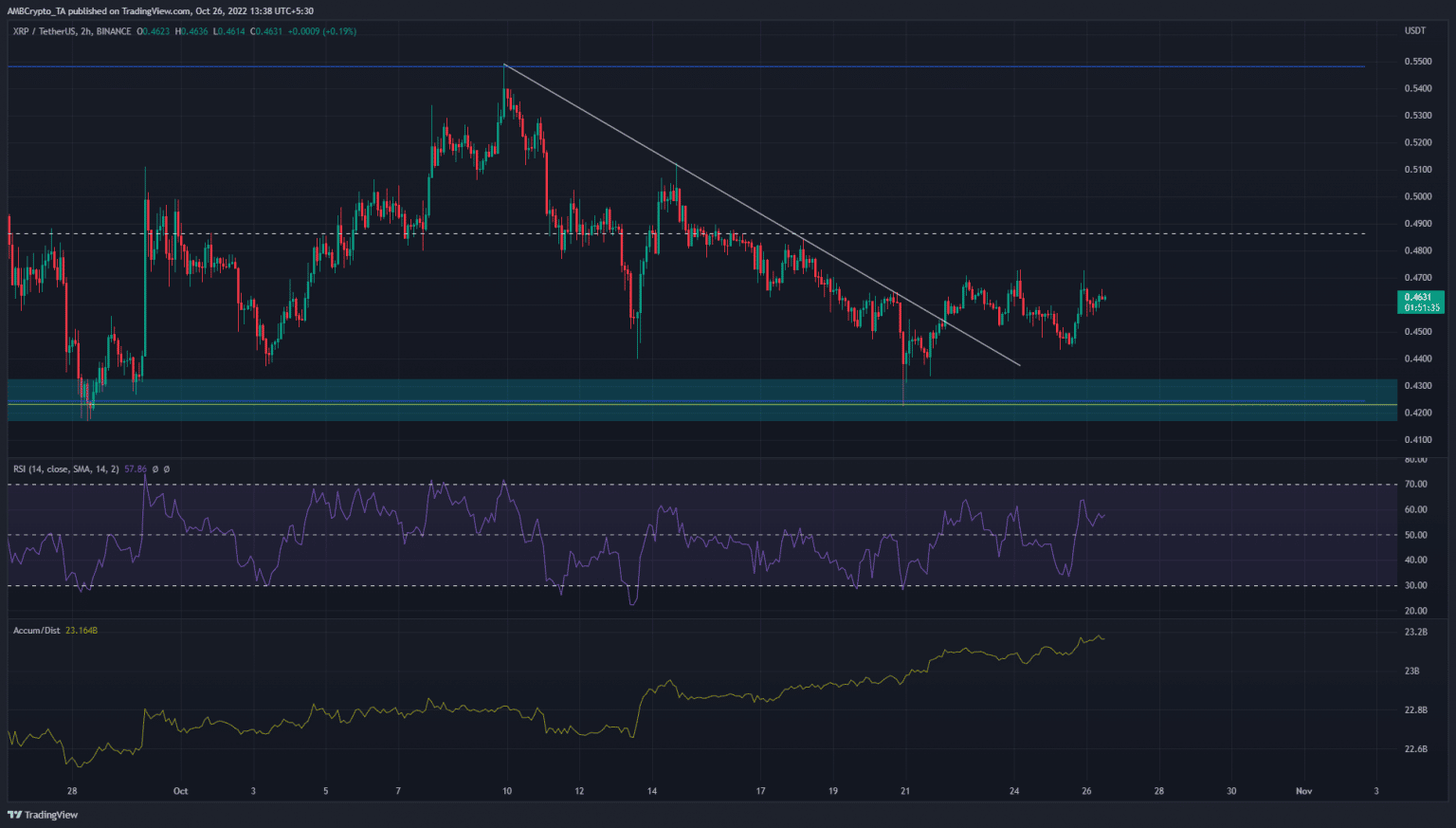

Investing In Xrp After Its 400 Increase A Prudent Approach

May 08, 2025

Investing In Xrp After Its 400 Increase A Prudent Approach

May 08, 2025 -

The Ripple Effect Analyzing Xrps 400 Growth And Future Potential

May 08, 2025

The Ripple Effect Analyzing Xrps 400 Growth And Future Potential

May 08, 2025 -

After A 400 Rise Where Does Xrp Go From Here A Market Analysis

May 08, 2025

After A 400 Rise Where Does Xrp Go From Here A Market Analysis

May 08, 2025 -

Understanding Xrps 400 Surge Future Price Prospects

May 08, 2025

Understanding Xrps 400 Surge Future Price Prospects

May 08, 2025 -

Can Xrp Continue Its Ascent After A 400 Increase

May 08, 2025

Can Xrp Continue Its Ascent After A 400 Increase

May 08, 2025