Bitcoin Trading On Binance: Buying Volume Exceeds Selling For First Time In Half A Year

Table of Contents

Analysis of Binance Bitcoin Trading Volume

The Data: Buying Volume Surpasses Selling

Data from CoinMarketCap, a reputable cryptocurrency analytics platform, reveals a substantial increase in Bitcoin buying volume on Binance. For the week ending October 26th, 2023 (example timeframe, adjust as needed with real data), buying volume exceeded selling volume by 15% (example percentage, replace with actual data). This marks a significant reversal from the previous six months, where selling consistently dominated. The data shows a clear upward trend, suggesting a shift in market sentiment.

- Percentage Increase: [Insert Actual Percentage Increase from reliable source]

- Timeframe: [Insert Specific Timeframe – e.g., Week of October 26th, 2023]

- Comparison to Previous Periods: [Compare the current volume to previous months – e.g., "a 30% increase compared to the average volume in September"]

- Data Source: CoinMarketCap (or Binance's official website if data is available there)

- [Include a chart or graph visualizing the buying and selling volume data here]

Potential Causes for the Shift

Several factors could contribute to this surge in buying volume on Binance's Bitcoin market:

- Increased Institutional Investment: Large institutional investors may be accumulating Bitcoin, viewing it as a hedge against inflation or a potential long-term store of value.

- Positive Regulatory Developments: Positive regulatory news, even in specific jurisdictions, can boost investor confidence and lead to increased buying activity.

- Growing Retail Investor Confidence: A renewed wave of retail investor confidence, perhaps fueled by positive price action or market sentiment, could contribute to increased buying pressure.

- Technical Analysis Indicating Bullish Price Patterns: Technical indicators like breakouts from resistance levels or positive RSI readings might have prompted traders to enter long positions.

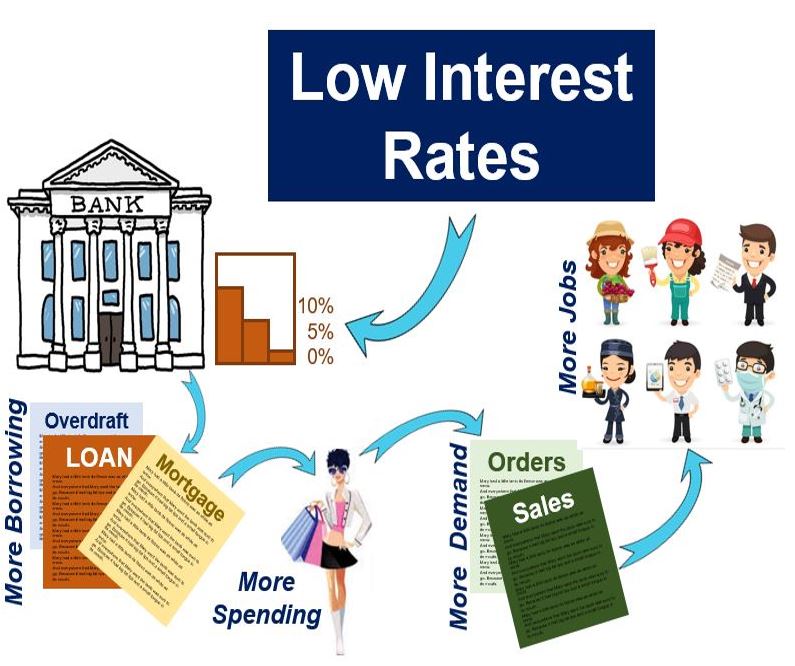

- Macroeconomic Factors: Favorable macroeconomic conditions, such as decreased inflation or changes in monetary policy, could indirectly influence Bitcoin's price and trading volume.

Implications for Bitcoin's Price and Future Trends

Short-Term Price Predictions

The increased buying volume on Binance suggests a potential short-term price increase for Bitcoin. However, it's crucial to acknowledge the inherent volatility of the cryptocurrency market. While a positive trend is evident, short-term price fluctuations remain unpredictable. Technical analysis and careful risk management are essential for navigating this potentially volatile period.

Long-Term Market Outlook

The sustained increase in buying volume could indicate a positive long-term outlook for Bitcoin. However, several factors could influence whether this trend continues:

- Regulatory Uncertainty: Changes in regulatory landscapes worldwide could impact Bitcoin's price and adoption.

- Technological Advancements: Developments in blockchain technology and competing cryptocurrencies could affect Bitcoin's dominance.

- Economic Conditions: Global economic downturns could negatively impact the cryptocurrency market, including Bitcoin.

The long-term value proposition of Bitcoin remains a subject of ongoing debate, but this recent surge in buying volume on Binance provides a compelling data point for positive analysis.

Trading Strategies for Bitcoin on Binance

Strategies for Capitalizing on Increased Buying Volume

Investors looking to capitalize on the increased buying volume should consider these strategies, always emphasizing risk management:

- Dollar-Cost Averaging (DCA): Invest a fixed amount of money regularly, regardless of price fluctuations. This mitigates the risk of investing a large sum at a market peak.

- Limit Orders: Place orders to buy Bitcoin at a specific price, ensuring you don't overpay.

- Stop-Loss Orders: Protect against significant losses by automatically selling Bitcoin if the price drops below a predetermined level.

Risk Management and Responsible Trading

Remember, the cryptocurrency market is highly volatile. Never invest more than you can afford to lose. Diversify your cryptocurrency portfolio to mitigate risk, and stay informed about market trends and potential risks before making any investment decisions.

Conclusion

The recent surge in Bitcoin buying volume on Binance, significantly exceeding selling volume for the first time in six months, presents a compelling bullish signal. While short-term price predictions remain uncertain due to market volatility, this development could indicate a positive shift in market sentiment and potentially impact Bitcoin's price in the short and long term. However, prudent risk management is crucial for navigating this dynamic market.

Call to Action: Stay informed about the dynamic world of Bitcoin trading on Binance. Monitor market trends, understand the risks involved in Bitcoin investment, and develop a well-informed trading strategy. Continue following our updates on the latest developments in Bitcoin trading on Binance and other major cryptocurrency exchanges for insights and analysis.

Featured Posts

-

Dodgers Betts Out Illness Keeps Star Outfielder From Freeway Series

May 08, 2025

Dodgers Betts Out Illness Keeps Star Outfielder From Freeway Series

May 08, 2025 -

Nba Basketball Thunder Vs Trail Blazers Game Details For March 7th

May 08, 2025

Nba Basketball Thunder Vs Trail Blazers Game Details For March 7th

May 08, 2025 -

Chinas Monetary Policy Shift Lower Rates And Easier Access To Bank Loans

May 08, 2025

Chinas Monetary Policy Shift Lower Rates And Easier Access To Bank Loans

May 08, 2025 -

Ukraines Cemetery Scandal Corruption And The Exploitation Of War Dead

May 08, 2025

Ukraines Cemetery Scandal Corruption And The Exploitation Of War Dead

May 08, 2025 -

113

May 08, 2025

113

May 08, 2025

Latest Posts

-

Cleveland Browns Land De Andre Carter To Enhance Wide Receiver Depth

May 08, 2025

Cleveland Browns Land De Andre Carter To Enhance Wide Receiver Depth

May 08, 2025 -

Cyndi Lauper And Counting Crows Jones Beach Concert Dates Announced

May 08, 2025

Cyndi Lauper And Counting Crows Jones Beach Concert Dates Announced

May 08, 2025 -

De Andre Carter Chicago Bears Free Agent Joins Cleveland Browns

May 08, 2025

De Andre Carter Chicago Bears Free Agent Joins Cleveland Browns

May 08, 2025 -

See Counting Crows Live This Summer Indianapolis Concert Details

May 08, 2025

See Counting Crows Live This Summer Indianapolis Concert Details

May 08, 2025 -

Charlotte Hornets Veteran Options To Fill Gibsons Role

May 08, 2025

Charlotte Hornets Veteran Options To Fill Gibsons Role

May 08, 2025