China's Monetary Policy Shift: Lower Rates And Easier Access To Bank Loans

Table of Contents

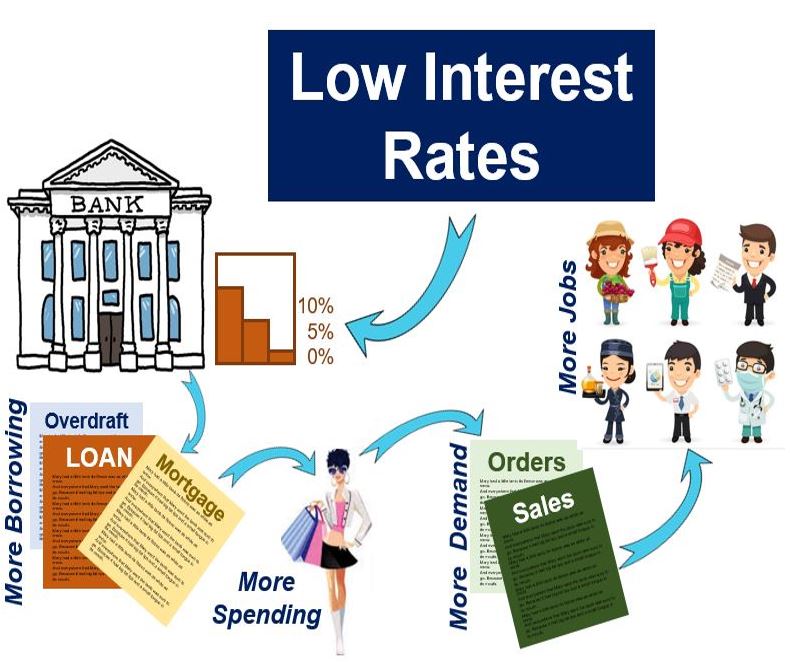

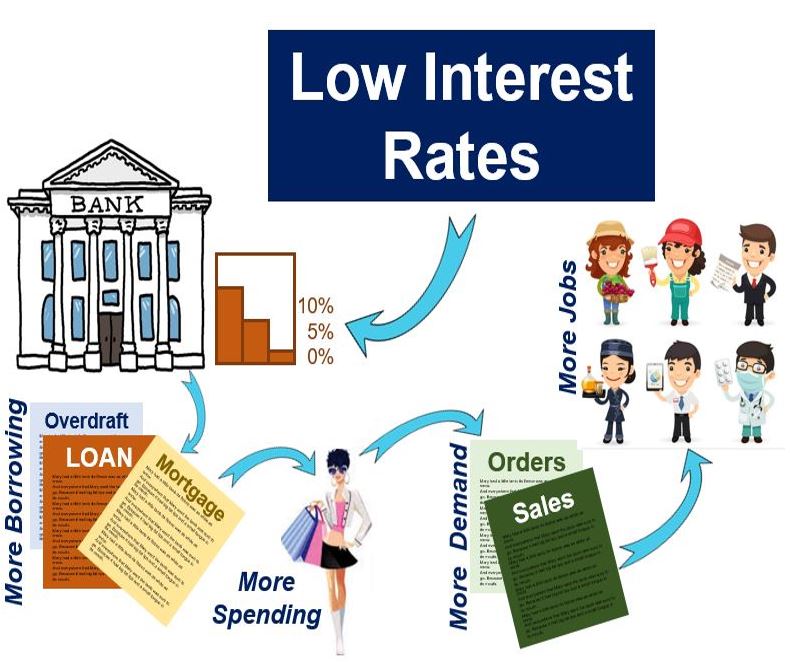

Lower Interest Rates: A Stimulus for Growth?

Facing slowing economic growth and navigating global economic uncertainties, the Chinese government has implemented a series of interest rate cuts. These reductions aim to stimulate investment, boost consumption, and counter the threat of deflation. The intended effect is a revitalization of economic activity, encouraging businesses to borrow and expand.

However, this strategy isn't without potential downsides. Lower interest rates can fuel inflation, potentially leading to asset bubbles and economic instability. A delicate balancing act is required to stimulate growth without triggering runaway price increases.

- Specific examples of recent interest rate reductions: The People's Bank of China (PBoC) has lowered the benchmark lending rate (LPR) multiple times in recent months, signaling a commitment to easing monetary conditions.

- Comparison to previous interest rate adjustments: These recent cuts are more aggressive than some previous adjustments, reflecting the urgency of the current economic situation.

- Impact on different sectors of the economy: While some sectors might benefit significantly from cheaper borrowing costs, others might be less responsive, depending on their access to credit and risk profiles. The real estate sector, for example, is particularly sensitive to interest rate changes.

Easier Access to Bank Loans: Fueling Investment and Business Activity

In conjunction with lower interest rates, the Chinese government has implemented measures to facilitate access to bank loans. This includes reducing the reserve requirement ratio (RRR) for commercial banks, freeing up capital for lending, and potentially relaxing lending standards to some degree. This injection of liquidity is designed to fuel investment and spur business activity.

For businesses, easier access to bank loans translates to increased investment opportunities, improved cash flow, and enhanced expansion possibilities. SMEs, often constrained by limited access to capital, stand to benefit particularly.

However, easing lending standards carries inherent risks. Increased non-performing loans (NPLs) are a major concern, potentially destabilizing the financial system. The potential for moral hazard also needs careful consideration.

- Specific examples of government initiatives to facilitate lending: Government-backed loan programs and guarantees for specific sectors are examples of initiatives aimed at boosting lending.

- Impact on small and medium-sized enterprises (SMEs): SMEs, often the backbone of the Chinese economy, are expected to benefit disproportionately from increased access to credit.

- Changes in lending practices by major Chinese banks: Major state-owned banks are under pressure to increase lending to support economic growth, potentially altering their lending practices.

Implications for Foreign Investors in China

China's Monetary Policy Shift significantly impacts foreign direct investment (FDI). Lower interest rates and increased liquidity can create attractive investment opportunities for foreign companies seeking expansion in China. The devaluation of the Yuan (RMB) against other major currencies could also incentivize foreign investment, making Chinese assets cheaper for foreign investors.

However, there are also challenges. Increased inflation or significant currency fluctuations could pose risks to foreign investors. Careful consideration of these factors is crucial for informed decision-making.

- Potential benefits for foreign companies seeking expansion in China: The improved investment climate and increased access to credit can enhance the attractiveness of the Chinese market for foreign companies.

- Risks associated with increased inflation or currency fluctuations: Inflation could erode the returns on investments, while unpredictable currency movements create uncertainty and potential losses for foreign investors.

- Government policies aimed at attracting foreign investment: The Chinese government continues to implement policies designed to attract and retain foreign investment, including tax incentives and streamlined regulatory processes.

Monitoring Key Economic Indicators

Monitoring key economic indicators is vital to assessing the effectiveness of China's monetary policy shift. Tracking GDP growth, inflation rates, and loan growth provides critical insights into the overall health of the Chinese economy and the success of the government's efforts. Deviations from projected targets necessitate adjustments to the monetary policy strategy. Analyzing these indicators allows for a more nuanced understanding of the impact of the policy changes and the potential need for further intervention.

Conclusion: Understanding and Navigating China's Monetary Policy Shift

China's monetary policy shift, characterized by lower interest rates and easier access to bank loans, presents both significant opportunities and potential risks. While the intended effects are to stimulate economic growth and boost investment, the potential for increased inflation and financial instability must be carefully managed. Monitoring key economic indicators is crucial for evaluating the effectiveness of these policy changes and for making informed investment decisions.

To navigate this evolving landscape successfully, staying informed about future developments in China's monetary policy is essential. Consult with financial experts and conduct thorough research to make informed decisions regarding investments and business operations within the Chinese market. Understanding the nuances of this policy shift is key to successfully participating in China's dynamic economic environment.

Featured Posts

-

Arsenal Vs Psg Champions League Final Hargreaves Prediction

May 08, 2025

Arsenal Vs Psg Champions League Final Hargreaves Prediction

May 08, 2025 -

Gms Canadian Production Cuts Blaming Us Tariffs

May 08, 2025

Gms Canadian Production Cuts Blaming Us Tariffs

May 08, 2025 -

Analyzing The Possibility Of Ps 5 And Ps 4 Game Announcements At The March 2025 Nintendo Direct

May 08, 2025

Analyzing The Possibility Of Ps 5 And Ps 4 Game Announcements At The March 2025 Nintendo Direct

May 08, 2025 -

Kripto Para Duezenlemesi Bakan Simsek In Uyarilari Ve Sektoeruen Gelecegi

May 08, 2025

Kripto Para Duezenlemesi Bakan Simsek In Uyarilari Ve Sektoeruen Gelecegi

May 08, 2025 -

The 10 Most Memorable Characters In Saving Private Ryan

May 08, 2025

The 10 Most Memorable Characters In Saving Private Ryan

May 08, 2025

Latest Posts

-

Investing In Xrp After Its 400 Increase A Prudent Approach

May 08, 2025

Investing In Xrp After Its 400 Increase A Prudent Approach

May 08, 2025 -

The Ripple Effect Analyzing Xrps 400 Growth And Future Potential

May 08, 2025

The Ripple Effect Analyzing Xrps 400 Growth And Future Potential

May 08, 2025 -

After A 400 Rise Where Does Xrp Go From Here A Market Analysis

May 08, 2025

After A 400 Rise Where Does Xrp Go From Here A Market Analysis

May 08, 2025 -

Understanding Xrps 400 Surge Future Price Prospects

May 08, 2025

Understanding Xrps 400 Surge Future Price Prospects

May 08, 2025 -

Can Xrp Continue Its Ascent After A 400 Increase

May 08, 2025

Can Xrp Continue Its Ascent After A 400 Increase

May 08, 2025