Bitcoin's Future: Analyzing The Critical Price Levels

Table of Contents

Historical Price Analysis: Identifying Past Support and Resistance Levels

Analyzing Bitcoin's historical price data reveals crucial support and resistance levels that have influenced past price movements and may offer clues about future trends. Understanding these levels is fundamental to predicting potential price reversals or breakouts.

Key Support Levels:

Past instances where the Bitcoin price found support and bounced back provide valuable insights. These support levels act as a floor, preventing further price decline (at least temporarily).

- $20,000 (Late 2020 - Early 2021): This level acted as significant support during a period of consolidation before the subsequent bull run.

- $30,000 (Mid-2021): This level marked a crucial support area before another significant price surge.

- $40,000 (Various instances throughout 2021-2022): This level acted as a recurring support area, showcasing its importance in price action.

- $60,000 (Late 2021): A key support level during the previous bull market before the correction that ensued.

- $29,000 (Late 2022): This level served as significant support before a recent price rebound.

(Note: Ideally, this section would include charts visualizing these support levels and their corresponding timeframes.)

Key Resistance Levels:

Similarly, identifying past resistance levels – price points where Bitcoin struggled to break through – helps anticipate potential price corrections or consolidations. These levels act as a ceiling, preventing further upward movement.

- $69,000 (Late 2021): This all-time high acted as significant resistance before the subsequent market correction.

- $50,000 (Various instances throughout 2021-2022): This level consistently hindered upward price momentum.

- $40,000 (Various instances throughout 2022): This level acted as significant resistance before significant dips.

- $35,000 (Early 2023): This level held back the price from continuing the upward momentum during the early parts of the year.

- $30,000 (Mid 2023): This level presented strong resistance to price rises during the first half of the year.

(Note: Ideally, this section would also include charts visualizing these resistance levels and their corresponding timeframes.)

Technical Indicators: Predicting Future Price Movements

Technical indicators provide additional tools to predict future Bitcoin price movements by analyzing price trends and momentum.

Moving Averages:

Moving averages, such as the 50-day and 200-day moving averages, smooth out price fluctuations, revealing underlying trends.

- 50-day MA: A shorter-term moving average, often used to identify short-term trends.

- 200-day MA: A longer-term moving average, often used to identify long-term trends.

- Crossovers: When the 50-day MA crosses above the 200-day MA (a "golden cross"), it's often considered a bullish signal. Conversely, a "death cross" (50-day MA crossing below the 200-day MA) is often considered bearish.

(Note: A chart illustrating moving average crossovers would be beneficial here.)

Relative Strength Index (RSI):

The RSI measures the magnitude of recent price changes to evaluate overbought or oversold conditions.

- Overbought: An RSI above 70 suggests the market is overbought, indicating a potential price correction.

- Oversold: An RSI below 30 suggests the market is oversold, indicating a potential price rebound.

(Note: A chart illustrating RSI levels and their interpretations would enhance this section.)

MACD (Moving Average Convergence Divergence):

The MACD indicator identifies momentum changes and potential trend reversals.

- MACD Crossover: A bullish crossover occurs when the MACD line crosses above the signal line, suggesting upward momentum. A bearish crossover happens when the MACD line crosses below the signal line.

- Divergence: Divergence occurs when price action and the MACD indicator show conflicting signals, which often precedes a trend reversal.

(Note: A chart showing MACD crossovers and divergence would be helpful here.)

Macroeconomic Factors Affecting Bitcoin's Price

Beyond technical analysis, macroeconomic factors significantly impact Bitcoin's price.

Regulatory Landscape:

Government regulations and policies concerning cryptocurrencies can drastically influence investor confidence and Bitcoin's price.

- Positive Regulations: Clearer regulatory frameworks can boost investor confidence and potentially drive up prices.

- Negative Regulations: Restrictive or unclear regulations can create uncertainty and lead to price drops.

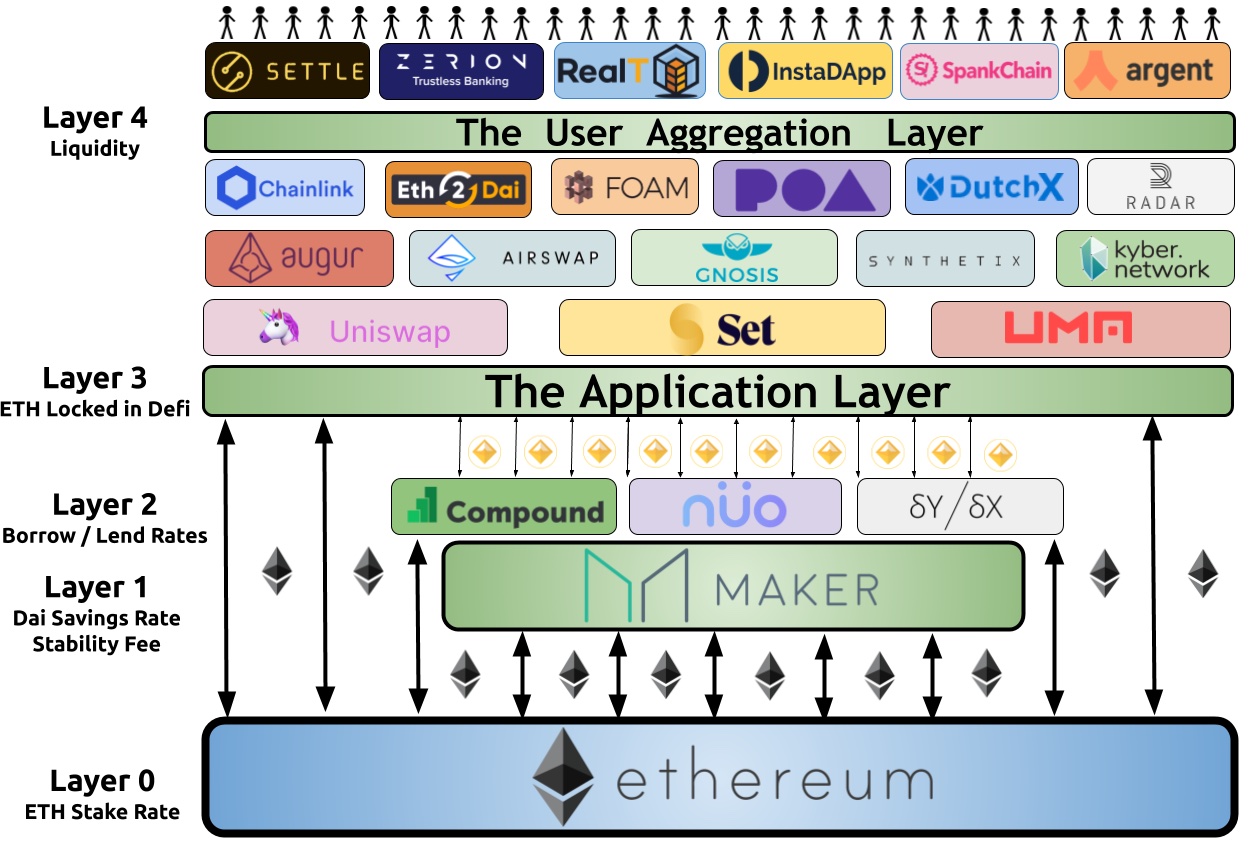

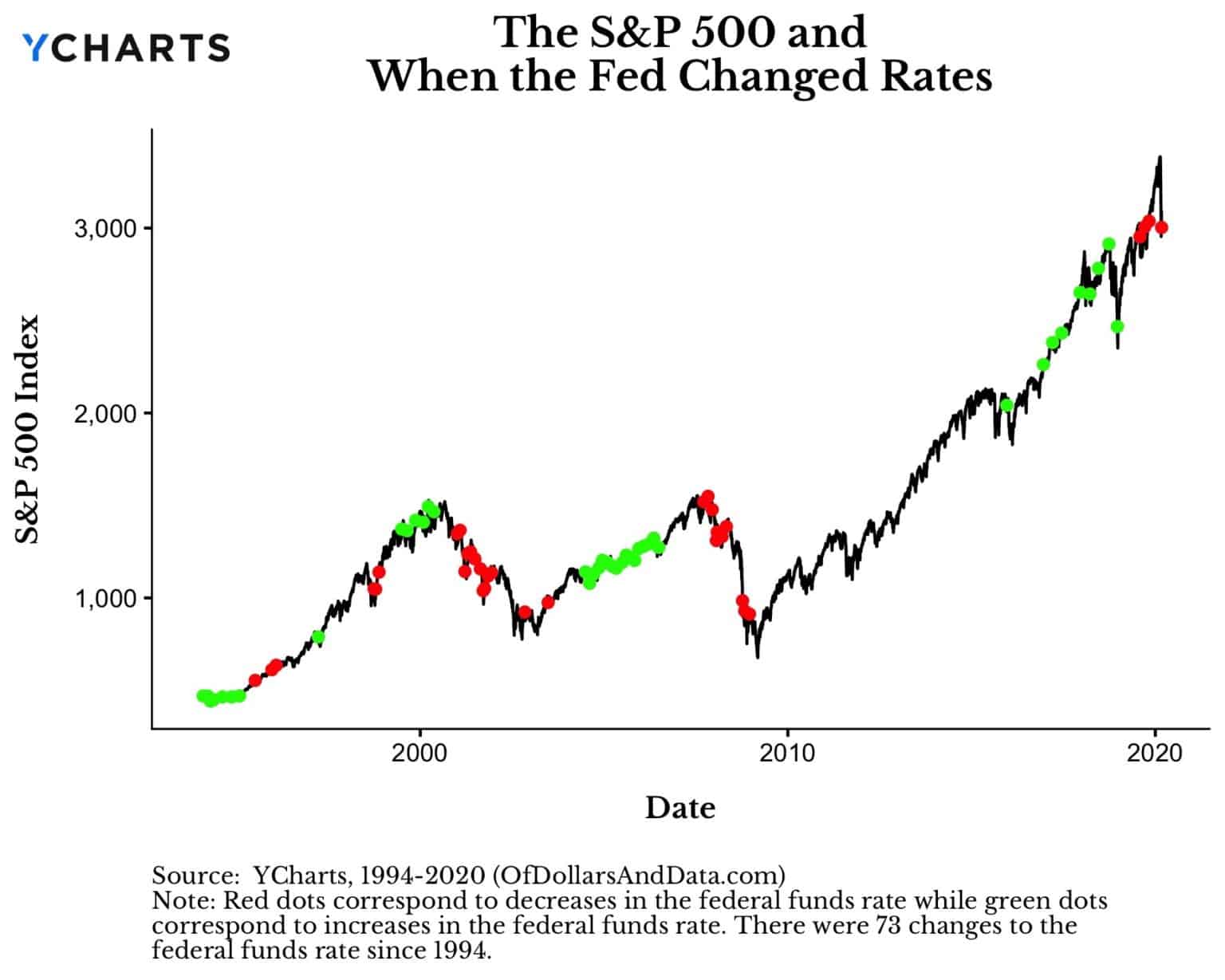

Inflation and Interest Rates:

Inflation and interest rates influence investor sentiment toward Bitcoin.

- High Inflation: High inflation can drive investors towards Bitcoin as a hedge against inflation.

- Rising Interest Rates: Rising interest rates can make traditional investments more attractive, potentially reducing Bitcoin's appeal.

Adoption and Market Sentiment:

Increasing adoption by businesses and institutions, coupled with positive market sentiment, can fuel Bitcoin's price appreciation.

- Institutional Adoption: Large-scale institutional investment significantly impacts market liquidity and price.

- Market Sentiment: Positive news and developments generally boost investor confidence and price, while negative news can trigger sell-offs.

Conclusion

Analyzing Bitcoin's critical price levels involves a multifaceted approach, incorporating historical price analysis, technical indicators, and a thorough understanding of macroeconomic factors. By studying past support and resistance levels, interpreting technical indicators like moving averages, RSI, and MACD, and considering the impact of regulatory changes, inflation, interest rates, and market sentiment, you can develop a more informed perspective on Bitcoin's potential price movements. Our key takeaways are the importance of identifying historical support and resistance, utilizing technical indicators for short and long-term trend analysis, and considering macroeconomic factors influencing investor sentiment.

By understanding and continuously monitoring these critical price levels, you can make more informed decisions in the volatile world of Bitcoin. Stay informed about Bitcoin's future and continue analyzing its critical price levels.

Featured Posts

-

Analyzing Ethereums Resilient Price Whats Next

May 08, 2025

Analyzing Ethereums Resilient Price Whats Next

May 08, 2025 -

Did Saturday Night Live Make Counting Crows Famous

May 08, 2025

Did Saturday Night Live Make Counting Crows Famous

May 08, 2025 -

Poor Performance Mlb Analysts Rate Angels Prospect Pipeline

May 08, 2025

Poor Performance Mlb Analysts Rate Angels Prospect Pipeline

May 08, 2025 -

The Bank Of England And A Half Point Rate Cut Economic Analysis

May 08, 2025

The Bank Of England And A Half Point Rate Cut Economic Analysis

May 08, 2025 -

5 Must See Military Films Where Action Meets Emotion

May 08, 2025

5 Must See Military Films Where Action Meets Emotion

May 08, 2025

Latest Posts

-

Updated Batman Costume And New 1 Comic Book Dc Comics Announcement

May 08, 2025

Updated Batman Costume And New 1 Comic Book Dc Comics Announcement

May 08, 2025 -

The Best War Movie Saving Private Ryans Legacy Challenged

May 08, 2025

The Best War Movie Saving Private Ryans Legacy Challenged

May 08, 2025 -

Batmans New Beginning Dc Comics Unveils 1 Issue And Updated Suit

May 08, 2025

Batmans New Beginning Dc Comics Unveils 1 Issue And Updated Suit

May 08, 2025 -

Pierce County Homes Transformation From Historic House To Public Park

May 08, 2025

Pierce County Homes Transformation From Historic House To Public Park

May 08, 2025 -

Demolition Makes Way For New Park In Pierce County

May 08, 2025

Demolition Makes Way For New Park In Pierce County

May 08, 2025