Analyzing Ethereum's Resilient Price: What's Next?

Table of Contents

Factors Contributing to Ethereum's Price Resilience

Several key factors have contributed to Ethereum's recent price strength and resilience against broader market headwinds.

Technological Advancements and Network Upgrades

Ethereum's ongoing development and significant network upgrades are major drivers of its price resilience. The highly anticipated Ethereum 2.0 (ETH 2.0 upgrade) is a multi-phase upgrade that dramatically improves the network's scalability, transaction speed, and energy efficiency.

- Sharding: This crucial element of ETH 2.0 drastically improves transaction throughput by dividing the network into smaller, more manageable shards.

- Proof-of-Stake (PoS): The shift from a proof-of-work to a proof-of-stake consensus mechanism significantly reduces energy consumption and increases network security.

- Improved Scalability: These upgrades together significantly boost the network's capacity to handle a growing number of transactions, reducing congestion and fees.

Beyond Ethereum 2.0, other upgrades and improvements continuously enhance the network's performance and functionality, further bolstering investor confidence and the Ethereum price.

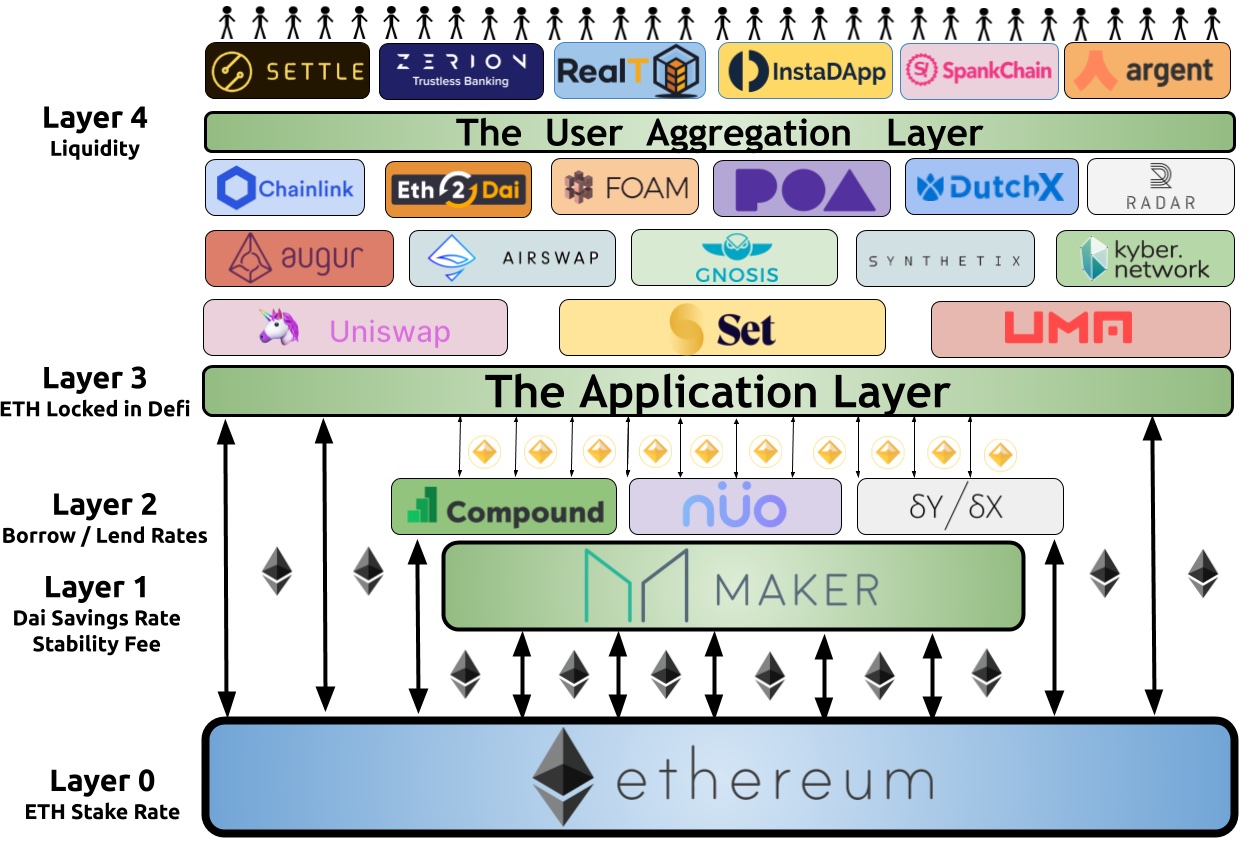

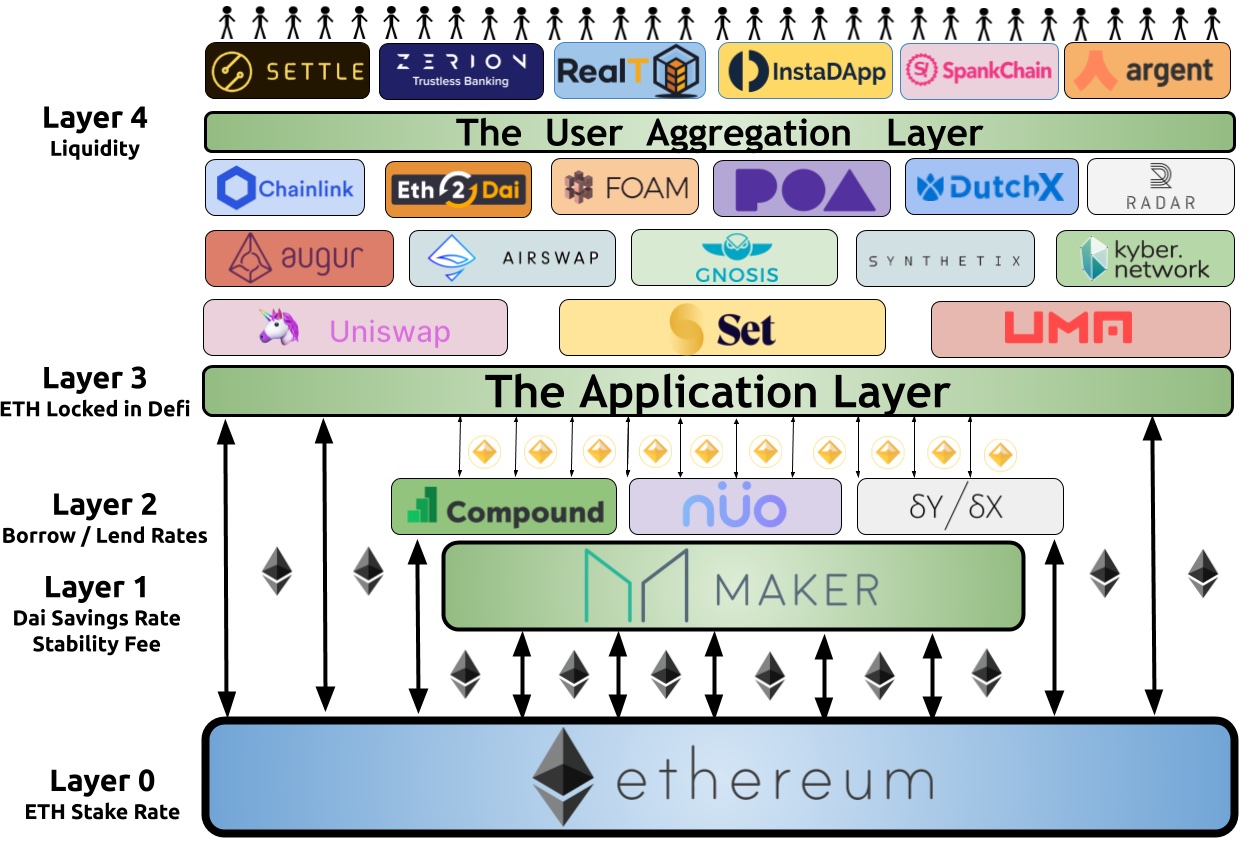

Growing DeFi Ecosystem

Ethereum's robust and thriving decentralized finance (DeFi) ecosystem plays a vital role in its price resilience. The Total Value Locked (TVL) in Ethereum-based DeFi protocols continues to grow, indicating increasing user adoption and confidence. This vibrant ecosystem attracts developers and investors alike, contributing to the overall value and demand for ETH.

- Aave: A leading decentralized lending and borrowing platform.

- Uniswap: A prominent decentralized exchange (DEX) facilitating token swaps.

- MakerDAO: A decentralized stablecoin platform creating and managing DAI.

The continued innovation and expansion within the Ethereum DeFi space solidify its position as a leading platform for decentralized financial applications.

NFT Market and Metaverse Integration

The explosive growth of the Non-Fungible Token (NFT) market and the burgeoning metaverse are significantly impacting Ethereum's price. Ethereum is the dominant blockchain for NFTs, hosting many popular marketplaces and projects. The increasing popularity of digital art, collectibles, and metaverse experiences drives demand for ETH, supporting its price.

- OpenSea: The largest NFT marketplace.

- Rarible: A popular NFT marketplace known for its creator-friendly features.

- Decentraland & The Sandbox: Leading metaverse platforms built on Ethereum.

Institutional Adoption and Investments

The increasing interest from institutional investors, including large-cap investors and hedge funds, has significantly contributed to Ethereum's price stability. Institutional adoption signals a growing level of trust and acceptance in Ethereum as a viable asset class, lessening volatility compared to solely retail-driven markets.

- Grayscale Investments holds significant amounts of ETH in its Grayscale Ethereum Trust.

- Several major financial institutions are exploring and investing in Ethereum-based projects.

Potential Challenges and Risks Affecting Ethereum's Price

While Ethereum exhibits resilience, it's crucial to acknowledge potential challenges that could affect its price.

Competition from Other Blockchains

The emergence of competing blockchain technologies like Solana, Cardano, and Avalanche presents a challenge to Ethereum's dominance. These platforms often offer faster transaction speeds or lower fees, potentially attracting developers and users away from Ethereum. However, Ethereum's established network effects and mature ecosystem remain significant advantages.

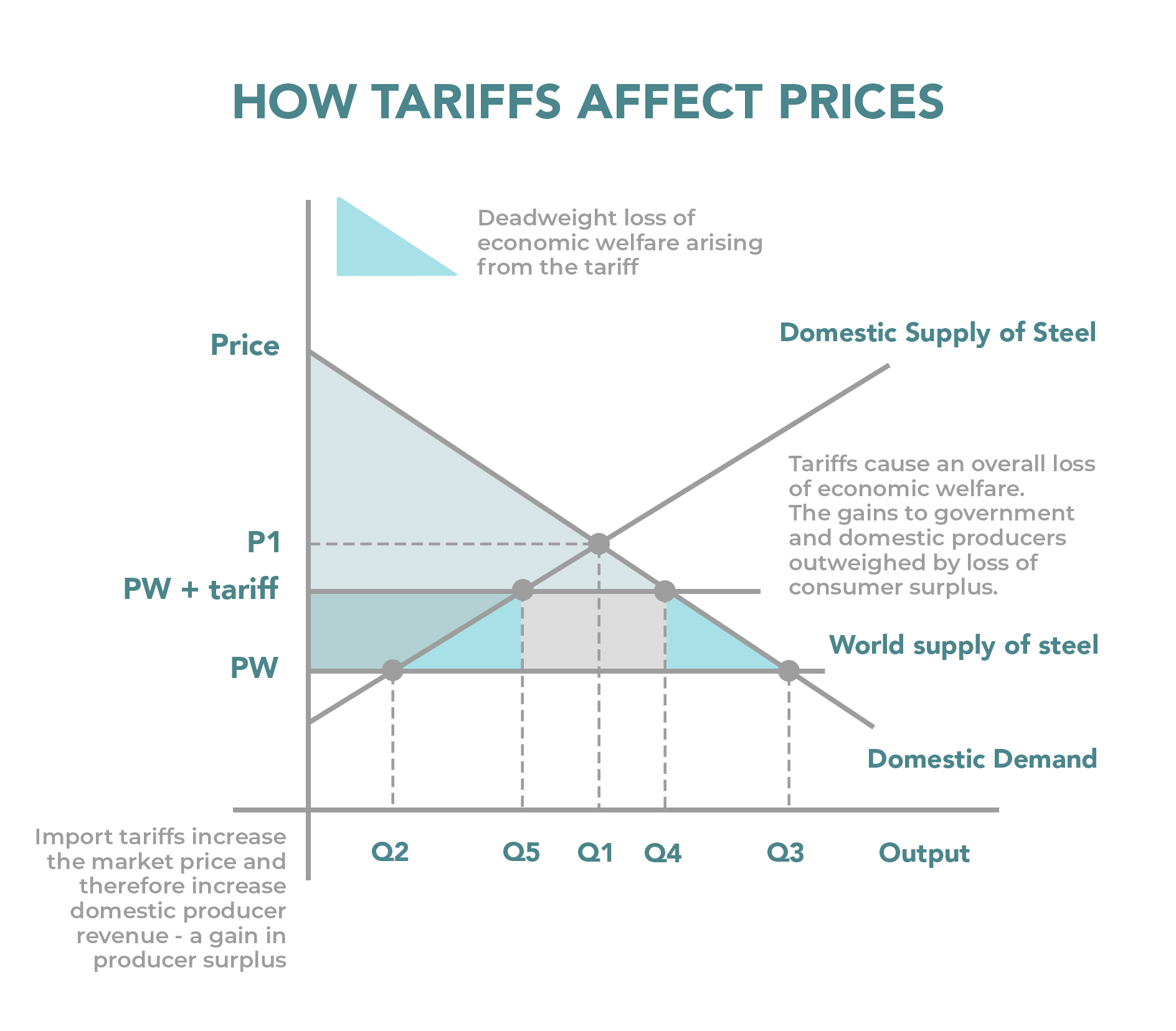

Regulatory Uncertainty

Evolving cryptocurrency regulations worldwide create uncertainty for the entire cryptocurrency market, including Ethereum. Regulatory clarity is vital for long-term growth and stability. Changes in regulatory landscapes can significantly impact investor sentiment and market activity.

Market Volatility and General Economic Conditions

Like all cryptocurrencies, Ethereum's price is subject to significant market volatility. Macroeconomic factors, such as inflation and overall market sentiment, also play a crucial role in influencing its price. Correlations with Bitcoin price also impact Ethereum's performance.

Predicting Ethereum's Future Price

Predicting Ethereum's future price with certainty is impossible. The factors discussed above, combined with unpredictable market forces, make accurate predictions highly challenging. While Ethereum shows significant strength and resilience due to technological advancements and growing adoption, risks such as regulatory uncertainty and competition remain. Therefore, any ETH price prediction should be considered with extreme caution.

Disclaimer: Investing in cryptocurrencies carries significant risk. This article is for informational purposes only and does not constitute financial advice. Always conduct your own thorough research before making any investment decisions.

Conclusion: Analyzing Ethereum's Resilient Price: A Look Ahead

Ethereum's resilience stems from its strong technological foundation, a thriving DeFi ecosystem, the growing NFT market, and increasing institutional adoption. However, competition, regulatory uncertainty, and general market volatility remain significant challenges. Before investing in Ethereum, conduct thorough research and understand the risks involved. Stay updated on Ethereum's development and market trends. Subscribe to receive further analyses on Ethereum's price and navigate the dynamic world of cryptocurrency investments wisely.

Featured Posts

-

Psg Opens Doha Labs A Global Innovation Expansion Begins

May 08, 2025

Psg Opens Doha Labs A Global Innovation Expansion Begins

May 08, 2025 -

Zielinskis Calf Injury Weeks Out For Inter Milan

May 08, 2025

Zielinskis Calf Injury Weeks Out For Inter Milan

May 08, 2025 -

De Andre Carter Chicago Bears Free Agent Joins Cleveland Browns

May 08, 2025

De Andre Carter Chicago Bears Free Agent Joins Cleveland Browns

May 08, 2025 -

Arsenal Vs Ps Zh Barselona Vs Inter Oglyad Pered Pivfinalnimi Matchami Ligi Chempioniv

May 08, 2025

Arsenal Vs Ps Zh Barselona Vs Inter Oglyad Pered Pivfinalnimi Matchami Ligi Chempioniv

May 08, 2025 -

China Responds To Tariffs Lower Interest Rates And Increased Bank Lending

May 08, 2025

China Responds To Tariffs Lower Interest Rates And Increased Bank Lending

May 08, 2025

Latest Posts

-

Xrps Future The Impact Of Secs Commodity Debate

May 08, 2025

Xrps Future The Impact Of Secs Commodity Debate

May 08, 2025 -

Daily Lotto Friday 18th April 2025 Results

May 08, 2025

Daily Lotto Friday 18th April 2025 Results

May 08, 2025 -

Winning Numbers Daily Lotto Wednesday April 16 2025

May 08, 2025

Winning Numbers Daily Lotto Wednesday April 16 2025

May 08, 2025 -

The Sec And Xrp Navigating The Uncertainty Around Commodity Classification

May 08, 2025

The Sec And Xrp Navigating The Uncertainty Around Commodity Classification

May 08, 2025 -

Xrp Regulatory Status Latest News And Analysis Of The Secs Position

May 08, 2025

Xrp Regulatory Status Latest News And Analysis Of The Secs Position

May 08, 2025