BofA's View: Are Stretched Stock Market Valuations A Cause For Concern?

Table of Contents

BofA's Valuation Metrics and Analysis

BofA employs a range of sophisticated valuation metrics to assess the current state of the market. These include traditional measures like Price-to-Earnings (P/E) ratios and Price-to-Sales (P/S) ratios, as well as the cyclically adjusted price-to-earnings ratio (Shiller PE), which provides a longer-term perspective. By comparing these metrics to historical averages and other market indicators, BofA generates a comprehensive picture of market valuation.

Their analysis reveals several key findings:

- Elevated P/E Ratios: Current P/E ratios for many sectors are significantly above their long-term historical averages, suggesting potentially overvalued stocks.

- Sectoral Disparities: While some sectors appear reasonably valued, others exhibit exceptionally high valuations, indicating potential pockets of risk. Technology, for example, has often shown high valuations in recent years.

- Comparison to Previous Peaks: BofA's research compares current valuations to previous market peaks, such as the dot-com bubble of the late 1990s and the financial crisis of 2008, providing context and highlighting potential parallels and divergences. This historical context is crucial for a nuanced understanding of current market risks. The comparison analyzes market capitalization and other key indicators.

BofA's research, using a combination of price-to-earnings ratio, Shiller PE ratio, price-to-sales ratio, and market capitalization analysis, provides a detailed understanding of the current stock market valuation landscape.

Potential Risks Associated with High Valuations

Investing in a market perceived as overvalued inherently carries significant risks. The potential for a market correction, or even a more severe crash, is a major concern. Several factors could trigger a downturn:

- Interest Rate Hikes: Aggressive interest rate increases by central banks aim to curb inflation, but can also negatively impact stock valuations by increasing borrowing costs for companies and reducing investor appetite for risk.

- Inflationary Pressures: Persistent high inflation erodes purchasing power and can lead to decreased consumer spending, impacting corporate earnings and stock prices. BofA closely monitors inflation indicators as a key risk factor.

- Geopolitical Instability: Global geopolitical events, such as conflicts or trade wars, introduce uncertainty and volatility into the market, potentially triggering sell-offs.

These factors, if they coalesce, could result in several negative consequences:

- Significant Portfolio Losses: Investors could experience substantial losses on their investments.

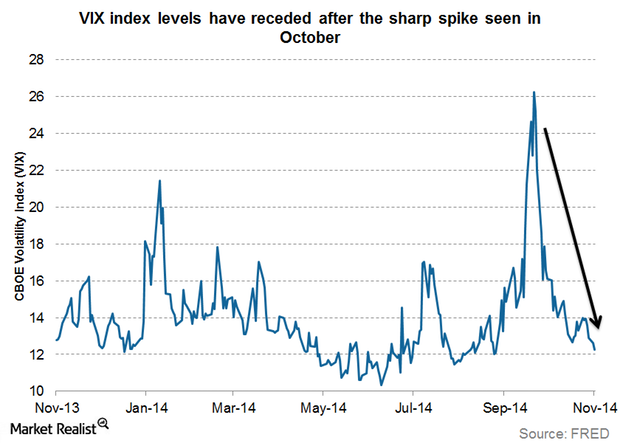

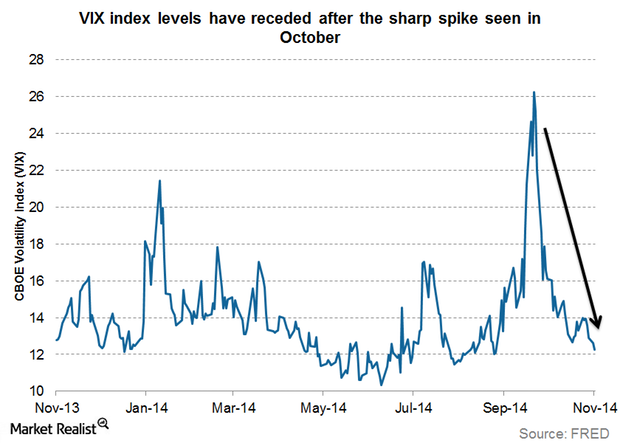

- Increased Market Volatility: The market could experience periods of heightened uncertainty and dramatic price swings.

- Reduced Investor Confidence: A market downturn can erode investor confidence, leading to further selling pressure. This risk assessment is a key part of BofA's analysis.

Counterarguments and Mitigating Factors

It's crucial to acknowledge arguments supporting the current valuations. Some analysts point to:

- Strong Earnings Growth: Robust corporate earnings growth in certain sectors can justify higher valuations, particularly if these earnings are expected to continue.

- Technological Innovation: Continued advancements in technology, driving productivity and creating new industries, might support higher valuations in the long term.

- Impact of Monetary Policy: While interest rate hikes pose a risk, central banks also use monetary policy to stimulate growth.

These counterarguments suggest that current valuations aren't entirely unjustified, and that other factors may offset some of the inherent risks.

BofA's Recommendations for Investors

Based on their valuation analysis, BofA likely advises investors to adopt a cautious approach. This could involve:

- Portfolio Diversification: Spreading investments across different asset classes reduces risk by mitigating the impact of losses in any single sector.

- Defensive Investing: Shifting towards more defensive investments, such as bonds or dividend-paying stocks, can provide relative stability during periods of market uncertainty.

- Re-evaluating Risk Tolerance: Investors should carefully reassess their risk tolerance and adjust their portfolios accordingly.

BofA likely recommends a detailed investment strategy focused on portfolio diversification and risk management, taking into account asset allocation strategies suited to individual investor profiles.

Conclusion: Navigating Stretched Stock Market Valuations with BofA's Insights

BofA's analysis indicates that current stock market valuations present both opportunities and risks. While strong corporate earnings and technological innovation offer some support, elevated P/E ratios and potential macroeconomic headwinds highlight the need for caution. Careful risk assessment and informed investment decisions are paramount. Stay informed about stock market valuations and mitigate potential risks by reviewing BofA's comprehensive market analysis and investment advice. Understanding these valuations is crucial for navigating the complexities of the current market environment.

Featured Posts

-

Guilty Plea Lab Owner Faked Covid 19 Test Results During Pandemic

Apr 26, 2025

Guilty Plea Lab Owner Faked Covid 19 Test Results During Pandemic

Apr 26, 2025 -

Investing In The Future Identifying The Countrys Newest Business Hotspots

Apr 26, 2025

Investing In The Future Identifying The Countrys Newest Business Hotspots

Apr 26, 2025 -

The Military Base At The Heart Of Us China Rivalry

Apr 26, 2025

The Military Base At The Heart Of Us China Rivalry

Apr 26, 2025 -

Thursday Night Football Nfl Draft First Round In Green Bay

Apr 26, 2025

Thursday Night Football Nfl Draft First Round In Green Bay

Apr 26, 2025 -

Trump Tariffs Ceo Concerns And Consumer Impact

Apr 26, 2025

Trump Tariffs Ceo Concerns And Consumer Impact

Apr 26, 2025