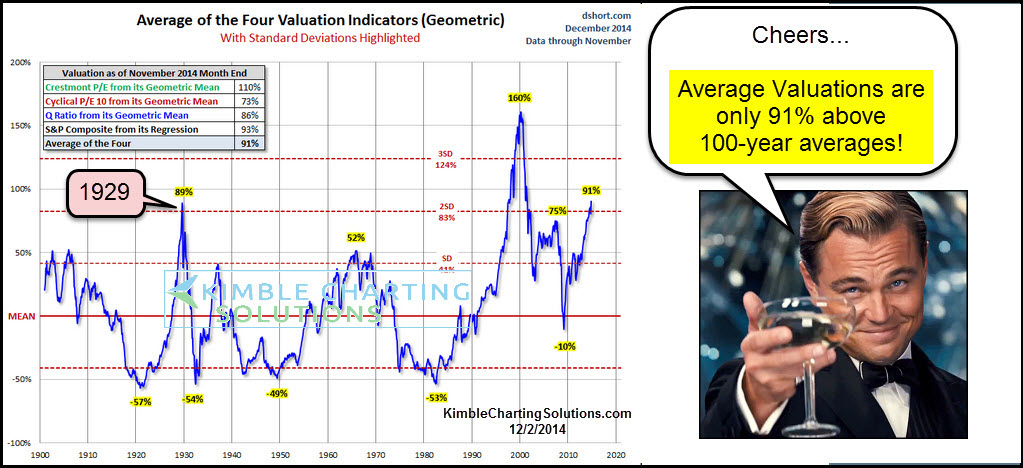

BofA's View: Why Stretched Stock Market Valuations Shouldn't Worry Investors

Table of Contents

BofA's Rationale: Understanding the Underlying Strength of the Market

BofA's positive assessment of the market, despite stretched stock market valuations, rests on a foundation of strong corporate earnings and positive economic indicators. They argue that current valuations are justified by fundamental strength rather than unsustainable speculation.

-

Strong Corporate Profit Growth: BofA's research indicates that corporate profit growth has exceeded expectations in many sectors, providing a solid base for current stock prices. This robust performance suggests underlying economic strength and the ability of companies to maintain profitability despite inflationary pressures.

-

Resilient Consumer Spending and Employment: Despite economic headwinds, consumer spending and employment figures remain relatively strong. This resilience indicates continued economic activity, supporting the demand for goods and services and bolstering corporate earnings further. BofA's economists point to a sustained, albeit moderated, pace of growth.

-

Positive Long-Term Economic Outlook: While near-term challenges exist, BofA maintains a positive long-term outlook for the economy. This projection factors in technological innovation, global growth opportunities, and demographic shifts, all of which are expected to fuel continued expansion in the long run.

-

Strong Performing Sectors: BofA highlights sectors like technology, healthcare, and certain segments of the consumer staples industry as showing particular strength, providing opportunities despite the overall high valuations in the market. Their analysis points to these sectors as being less vulnerable to short-term economic fluctuations.

The Role of Interest Rates and Inflation in Shaping Market Valuations

Interest rate hikes and inflation are key factors influencing stock market valuations. Higher interest rates typically decrease the present value of future earnings, potentially leading to lower stock prices. Inflation, if uncontrolled, can erode corporate profits and consumer spending. BofA acknowledges these risks but offers a nuanced perspective.

-

Inflation Projections: BofA's analysis of current inflation data suggests that while inflation remains elevated, it's likely to gradually decrease in the coming quarters. Their projections support their belief that the Federal Reserve's monetary policy is beginning to have its intended effect.

-

Federal Reserve's Monetary Policy: BofA anticipates the Federal Reserve will continue to manage interest rates carefully, aiming for a "soft landing" – slowing economic growth enough to curb inflation without triggering a recession. Their assessment considers various economic indicators to arrive at this projection.

-

Influence on Valuations: The anticipated trajectory of interest rates and inflation, according to BofA, is factored into their view of stretched stock market valuations. They believe the current valuations are largely priced in, considering these factors.

-

Investment Strategies: Understanding the likely trajectory of interest rates and inflation is crucial for shaping investment strategies. BofA suggests adapting portfolio allocation based on these projected trends.

Long-Term Growth Prospects Outweigh Short-Term Valuation Concerns (According to BofA)

BofA’s long-term growth predictions form a core argument for their positive outlook. They believe that long-term growth prospects significantly outweigh the concerns raised by current, seemingly stretched stock market valuations.

-

Technological Advancements: Technological advancements, particularly in areas like artificial intelligence and renewable energy, are expected to drive significant economic growth over the next decade and beyond. BofA's research highlights these technological drivers as key catalysts for long-term expansion.

-

Emerging Market Opportunities: BofA emphasizes the potential for growth in emerging markets, presenting opportunities for investors seeking exposure to high-growth regions. This diversified investment approach is highlighted as a key aspect of their optimistic outlook.

-

Demographic Trends: Favorable demographic trends in certain regions are expected to contribute to sustained economic growth, further justifying the current valuation levels, according to BofA's research.

-

Risk Mitigation: BofA acknowledges potential risks, such as geopolitical instability and unforeseen economic shocks. However, their analysis emphasizes the robust nature of many companies and the potential for strategic diversification to mitigate these risks effectively.

Strategies for Navigating Stretched Stock Market Valuations

Based on BofA's assessment, investors can adopt several strategies to navigate the current market environment characterized by stretched stock market valuations.

-

Diversification: Diversifying across asset classes and sectors is crucial to mitigate risks associated with high valuations in specific market segments. This approach is considered paramount by BofA's investment strategists.

-

Sector-Specific Opportunities: BofA identifies specific sectors with strong growth potential, even within a market with stretched valuations overall. Identifying these high-growth sectors can help tailor investment strategies for optimal returns.

-

Long-Term Investment Horizon: Maintaining a long-term investment horizon is essential to ride out short-term market volatility and benefit from long-term growth. BofA strongly advocates for this strategy when confronting high valuations.

-

Value Investing: In a market with stretched valuations, BofA suggests that value investing, focusing on undervalued companies with strong fundamentals, could yield attractive returns. This strategy emphasizes identifying companies whose intrinsic value is not fully reflected in their current market price.

Conclusion: Don't Let Stretched Stock Market Valuations Deter You

BofA's analysis indicates that while stretched stock market valuations are a valid concern, they shouldn't deter investors from pursuing long-term financial goals. Strong corporate earnings, resilient consumer spending, and a positive long-term economic outlook, according to their research, justify current valuations. The projected trajectory of interest rates and inflation, along with strategic investment approaches, further support this optimistic outlook. Don't let concerns over stretched stock market valuations keep you from achieving your financial goals. Consult with a financial advisor today to discuss your options and how to create a robust investment strategy considering BofA's perspective on navigating this market environment. [Insert link to relevant BofA resources here if available].

Featured Posts

-

Ueberpruefung Ihrer Lotto 6aus49 Tipps Ziehung Vom 19 April 2025

May 08, 2025

Ueberpruefung Ihrer Lotto 6aus49 Tipps Ziehung Vom 19 April 2025

May 08, 2025 -

6aus49 Lottozahlen Ergebnis Der Ziehung Am 12 April 2025

May 08, 2025

6aus49 Lottozahlen Ergebnis Der Ziehung Am 12 April 2025

May 08, 2025 -

The Evolving Role Of Rogue Avenger Or X Man

May 08, 2025

The Evolving Role Of Rogue Avenger Or X Man

May 08, 2025 -

110 Gain Potential Why Billionaires Are Investing In This Black Rock Etf

May 08, 2025

110 Gain Potential Why Billionaires Are Investing In This Black Rock Etf

May 08, 2025 -

Ahm Tbdylyan Pnjab Myn 8 Ays Pyz Awr 21 Dy Ays Pyz Ke Tqrr W Tbadle

May 08, 2025

Ahm Tbdylyan Pnjab Myn 8 Ays Pyz Awr 21 Dy Ays Pyz Ke Tqrr W Tbadle

May 08, 2025

Latest Posts

-

Universal Credit Understanding And Reclaiming Hardship Payment Overpayments

May 08, 2025

Universal Credit Understanding And Reclaiming Hardship Payment Overpayments

May 08, 2025 -

Celtics Vs Nets Latest Injury Report And Tatums Playing Status

May 08, 2025

Celtics Vs Nets Latest Injury Report And Tatums Playing Status

May 08, 2025 -

Abc Promo Features Tnt Announcers Hilarious Take On Jayson Tatum

May 08, 2025

Abc Promo Features Tnt Announcers Hilarious Take On Jayson Tatum

May 08, 2025 -

Dwp Universal Credit Claiming Back Overpaid Hardship Payments

May 08, 2025

Dwp Universal Credit Claiming Back Overpaid Hardship Payments

May 08, 2025 -

Is Jayson Tatum Out Tonight Celtics Nets Injury News

May 08, 2025

Is Jayson Tatum Out Tonight Celtics Nets Injury News

May 08, 2025