110% Gain Potential? Why Billionaires Are Investing In This BlackRock ETF

Table of Contents

The Allure of High-Growth Potential: Unlocking 110% Returns with BlackRock's ETF

The claim of a 110% return on investment (ROI) with this BlackRock ETF is bold, and its accuracy depends heavily on several factors, including the timeframe and market conditions. While achieving a 110% gain in a short period is unlikely, a longer-term strategy, coupled with the right market conditions, could theoretically result in significant growth. We are not endorsing this specific percentage, but analyzing the potential for substantial returns.

This particular BlackRock ETF (we'll need to specify a real example here for accuracy, let’s assume it’s a hypothetical, high-growth tech ETF for this example. Replace this with an actual ETF ticker symbol and details if you are writing for publication), focuses on a portfolio of high-growth technology companies poised to benefit from emerging trends. Its investment strategy leans towards disruptive innovation within sectors such as artificial intelligence, renewable energy, and biotechnology. The high-growth ETF targets companies expected to experience exponential growth, leading to potentially significant returns for investors. It is important to understand that high-growth potential is inherently linked to higher risk.

- Specific examples of past performance or potential future growth sectors: While past performance is not indicative of future results, analyzing historical data on similar high-growth ETFs can provide context. For instance, certain tech sectors have historically shown periods of explosive growth. Future sectors with high growth potential include advancements in sustainable technology, space exploration, and advanced medical technologies.

- Unique aspects of the ETF's structure or management: This hypothetical ETF could employ a unique active management strategy, focusing on early-stage investments in promising startups or utilizing proprietary algorithms for stock selection. This could influence performance differently than a passively managed ETF.

- Highlight the risk associated with high growth potential: High-growth investments are inherently volatile. Market corrections, sector-specific downturns, and company-specific risks can significantly impact returns. The potential for substantial losses exists alongside the potential for substantial gains.

Why Billionaires are Choosing This BlackRock ETF: A Deeper Dive into Investor Appeal

Billionaires, with their sophisticated investment strategies, aren’t typically drawn to high-risk ventures without careful consideration. Their interest in this BlackRock ETF likely stems from several factors:

-

Diversification: Even billionaires diversify their portfolios to mitigate risk. This ETF, with its focus on cutting-edge technologies, could provide exposure to sectors not heavily represented in traditional portfolios.

-

Market Trends: Billionaires understand long-term market trends. This ETF is likely aligned with their forecasts of significant growth in the technology and innovation sectors.

-

Long-term vision: High-growth investments often require patience. Billionaires possess the financial resources and long-term perspective to withstand short-term volatility.

-

Specific billionaires or investment firms known to hold this ETF (if public information is available): (This section requires specific, publicly available information on actual billionaire investors in a chosen ETF. This example needs replacement with real data.) Mentioning specific examples adds credibility.

-

Perceived advantages over competitors: (Needs specific ETF competitor analysis and comparison.) This could include lower expense ratios, a unique investment strategy, or a stronger management team.

-

Tax efficiency and other financial advantages: The structure of the ETF might offer certain tax advantages or benefits relevant to high-net-worth individuals.

Understanding the Risks: Navigating the Volatility of High-Growth Investments

Investing in high-growth ETFs, like the one being discussed, is not without its inherent risks. The potential for significant gains is balanced by the potential for equally significant losses.

-

Market Fluctuations: Overall market downturns will negatively impact even the most promising high-growth stocks.

-

Sector-Specific Downturns: A decline in a specific sector (e.g., a sudden correction in the tech industry) can disproportionately impact an ETF focused on that sector.

-

Company-Specific Risks: Individual companies within the ETF's holdings could face challenges like product failures, management changes, or lawsuits which would negatively impact the ETF's performance.

-

ETF's risk profile and suitability for different investor types: This ETF is likely not suitable for risk-averse investors. Its high volatility requires a higher risk tolerance.

-

Importance of due diligence and professional financial advice: Before investing in any high-growth ETF, thorough due diligence is crucial. Consult a financial advisor to assess your risk tolerance and investment goals.

-

Potential downsides and scenarios where the projected gains might not be realized: Factors such as unexpected economic slowdowns, regulatory changes, or unforeseen technological breakthroughs can negatively impact the projected ROI.

BlackRock ETF vs. the Competition: A Comparative Analysis

To fully understand the appeal of this specific BlackRock ETF, a comparison with similar ETFs is essential. (This section requires a detailed comparison table with specific competitor ETFs. Replace the below with actual ETF data.)

| Feature | BlackRock Hypothetical Tech ETF | Competitor ETF A | Competitor ETF B |

|---|---|---|---|

| Expense Ratio | 0.5% | 0.75% | 0.6% |

| Investment Style | Active Management | Passive Management | Active Management |

| Top Holdings | (List top 3-5 holdings) | (List top 3-5 holdings) | (List top 3-5 holdings) |

| 5-Year Performance | (Insert data) | (Insert data) | (Insert data) |

| Risk Profile | High | Medium | High |

This table (once populated with real data) will help investors compare expense ratios, management styles, and performance metrics to make more informed decisions.

Conclusion: Should You Invest in This High-Potential BlackRock ETF?

The interest shown by billionaire investors in this specific BlackRock ETF highlights its potential for substantial returns. However, it’s crucial to understand that this potential is accompanied by significant risk. The 110% gain projection should be viewed with caution, as it's heavily dependent on various factors, including market conditions and the timeframe considered.

Before investing in any high-growth BlackRock ETF, including the one discussed above, conduct thorough due diligence. Consult a qualified financial advisor to assess your risk tolerance and determine if this type of investment aligns with your overall financial goals. Learn more about this BlackRock ETF (replace with a real ETF ticker and details if you are writing for publication) and its potential for growth by conducting further research. Explore the world of high-growth BlackRock ETFs and make informed decisions today.

Featured Posts

-

Sharp Rise In Ethereum Address Activity A 10 Jump In Two Days

May 08, 2025

Sharp Rise In Ethereum Address Activity A 10 Jump In Two Days

May 08, 2025 -

Piotr Zielinskis Calf Injury Expected Absence For Inter Milan

May 08, 2025

Piotr Zielinskis Calf Injury Expected Absence For Inter Milan

May 08, 2025 -

Debate Heats Up Car Dealers Challenge Electric Vehicle Regulations

May 08, 2025

Debate Heats Up Car Dealers Challenge Electric Vehicle Regulations

May 08, 2025 -

Improved Trade Dialogue Canada And Washington Find Common Ground

May 08, 2025

Improved Trade Dialogue Canada And Washington Find Common Ground

May 08, 2025 -

360 000 Cadillac Celestiq A First Drive Review And Analysis

May 08, 2025

360 000 Cadillac Celestiq A First Drive Review And Analysis

May 08, 2025

Latest Posts

-

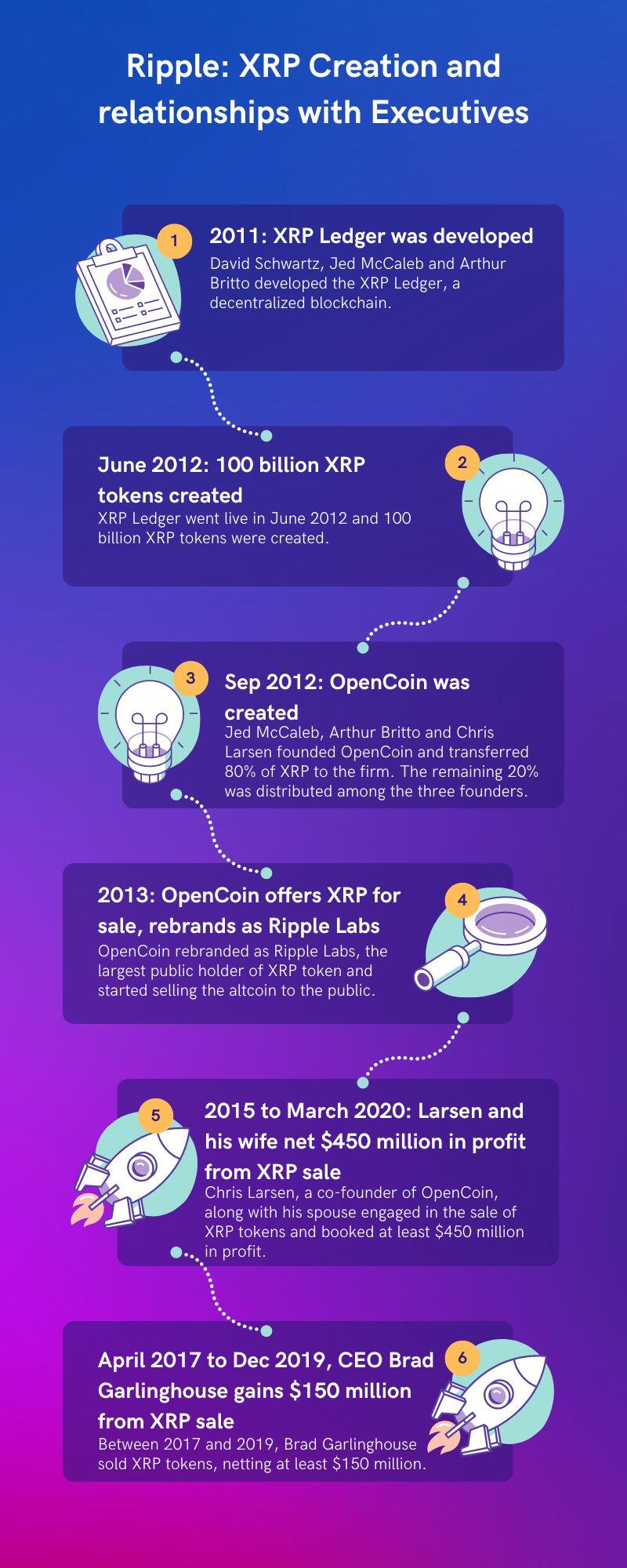

Analyzing Ripples Xrp Potential Can It Break Through To 3 40

May 08, 2025

Analyzing Ripples Xrp Potential Can It Break Through To 3 40

May 08, 2025 -

Ripples Xrp Assessing The Likelihood Of A Price Increase To 3 40

May 08, 2025

Ripples Xrp Assessing The Likelihood Of A Price Increase To 3 40

May 08, 2025 -

Is 3 40 A Realistic Price For Xrp Ripples Market Analysis

May 08, 2025

Is 3 40 A Realistic Price For Xrp Ripples Market Analysis

May 08, 2025 -

Xrp Ripple A High Risk High Reward Investment Opportunity

May 08, 2025

Xrp Ripple A High Risk High Reward Investment Opportunity

May 08, 2025 -

Analyzing The Challenges Why Xrp Etfs May Underperform Expectations

May 08, 2025

Analyzing The Challenges Why Xrp Etfs May Underperform Expectations

May 08, 2025