BP Executive Compensation: A 31% Decrease

Table of Contents

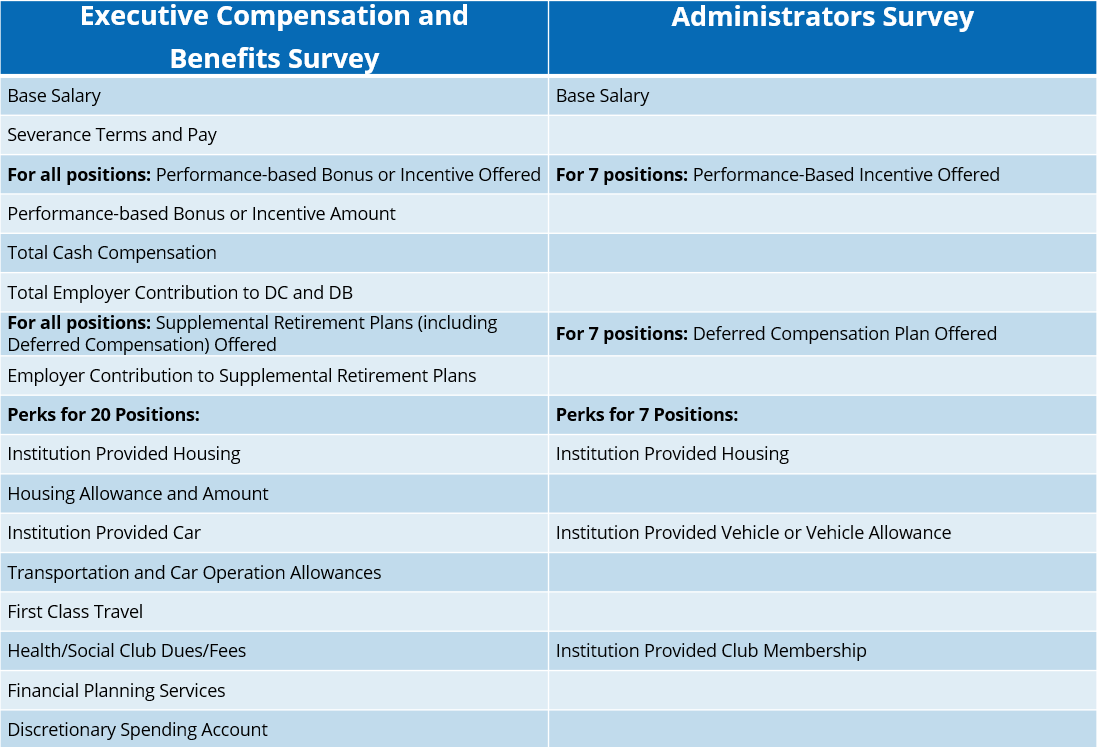

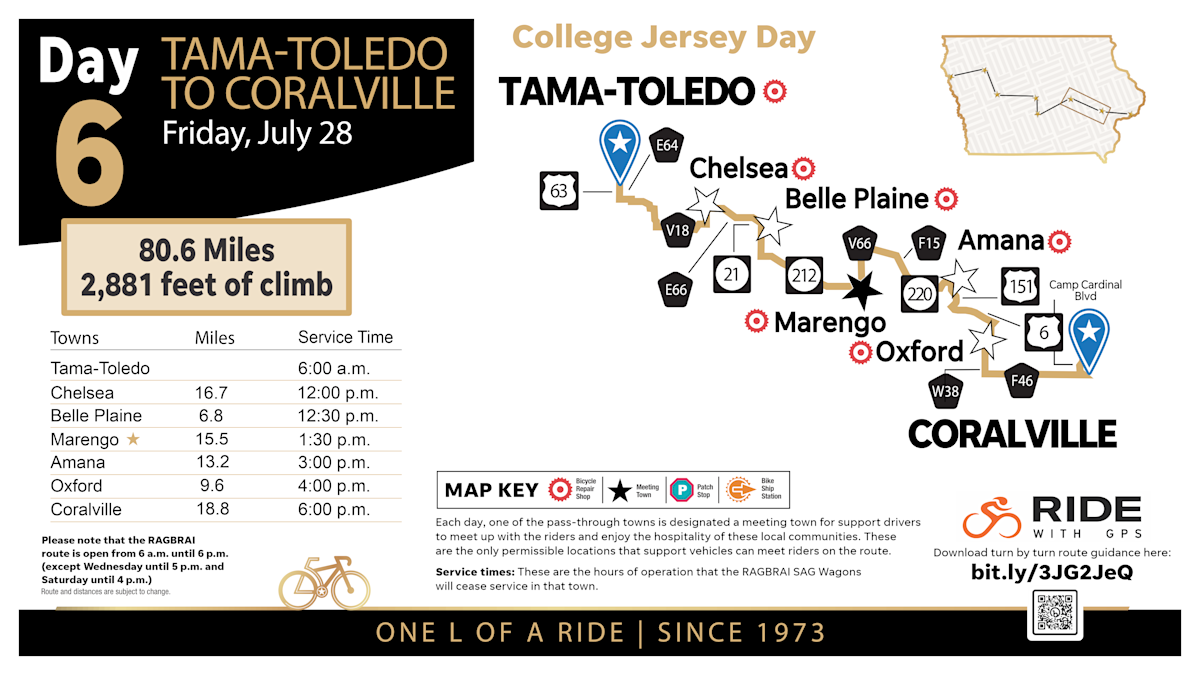

Executive compensation typically encompasses a range of elements including base salary, annual bonuses, long-term incentives like stock options and performance shares, and various benefits packages. This complex structure often reflects a company’s performance and the perceived value of its executive leadership.

Analyzing the 31% Reduction in BP Executive Compensation

The 31% reduction in BP executive compensation represents a substantial shift. Several factors likely contributed to this decision. It wasn't an isolated event but rather a response to a confluence of pressures.

- Falling oil prices and profitability: The fluctuating energy market, marked by periods of low oil prices, significantly impacted BP's profitability. Lower profits naturally lead to a reassessment of executive compensation packages.

- Increased scrutiny of executive pay in the energy sector: The energy industry is under increasing public and regulatory scrutiny regarding executive pay, especially in the context of environmental concerns and fluctuating energy prices. This heightened scrutiny puts pressure on companies to justify high executive compensation.

- Pressure from investors and activist shareholders: Investors and activist shareholders increasingly demand greater alignment between executive pay and company performance. They may push for pay cuts during periods of underperformance or when executive actions appear misaligned with shareholder interests.

- Company performance metrics: BP's overall financial performance, including missed targets or strategic setbacks, undoubtedly played a role in the decision-making process regarding executive compensation. Poor performance often translates to reduced bonuses and other incentive-based payments.

- Changes in BP's compensation structure: BP might have implemented structural changes to its executive compensation model, shifting the balance towards performance-based incentives and reducing fixed salaries.

Comparing BP's executive compensation to competitors like Shell, ExxonMobil, and Chevron reveals varied approaches. While direct comparisons are complex due to differing reporting structures and compensation methodologies, a detailed analysis could reveal whether BP's reduction aligns with or deviates from industry trends in oil executive salaries. (A visual representation, like a chart comparing average executive compensation across these companies, would be beneficial here.)

Impact of the Decrease on BP's Stock Performance and Shareholder Value

The correlation between the executive pay cut and BP's stock performance needs careful examination. While a decrease in executive compensation can signal a commitment to fiscal responsibility, it doesn't guarantee immediate positive stock market reactions.

- Increased investor confidence: The move might signal a commitment to shareholder value and responsible resource allocation, potentially boosting investor confidence.

- Improved company reputation: A perceived reduction in lavish executive pay can enhance BP's public image and corporate social responsibility profile.

- Potential impact on attracting and retaining top talent: However, significantly reducing executive salaries might make it harder to attract and retain top talent in a competitive industry. This could potentially create long-term challenges for the company.

- Short-term vs. long-term effects on shareholder value: The impact on shareholder value is likely complex and will unfold over time. While short-term gains are possible due to improved public perception, the long-term consequences of potentially losing top talent need consideration.

Shareholder reactions to the compensation changes have been mixed, indicating the complexities of linking executive pay directly to short-term stock performance. Detailed analysis of shareholder communications and trading patterns is needed to gain a more comprehensive understanding.

The Broader Context: Executive Compensation Trends in the Energy Sector

The reduction in BP executive compensation is part of a broader trend in the energy sector. Several factors are driving this change.

- Increased focus on ESG (Environmental, Social, and Governance) factors: Growing investor and public interest in ESG factors is influencing executive compensation practices. Companies are increasingly incorporating ESG performance metrics into compensation packages.

- Pressure to align executive compensation with long-term sustainability goals: Companies are under pressure to demonstrate that executive pay is aligned with their long-term sustainability objectives, fostering a long-term perspective beyond short-term profit maximization.

- Growing demand for transparency in executive pay practices: There's a growing demand for greater transparency in executive compensation disclosures, allowing shareholders and the public to scrutinize pay practices and assess their fairness and effectiveness.

Many other companies in the oil and gas industry are facing similar pressures and are adapting their executive compensation strategies to reflect these broader shifts in investor expectations and societal concerns.

Future Implications for BP and its Executive Compensation Strategy

The future of BP's executive compensation strategy remains uncertain. Will this 31% decrease be a one-time event, or a significant, long-term shift in policy? Several possible scenarios can be considered.

- Increased emphasis on performance-based incentives: BP may shift toward greater reliance on performance-based incentives, aligning executive rewards more closely with company outcomes and shareholder returns.

- Greater transparency in compensation disclosures: Increased transparency in compensation reporting can help improve shareholder confidence and better align executive pay with the company's overall strategic goals.

- Alignment of executive pay with broader company sustainability objectives: BP may further integrate sustainability metrics into executive compensation schemes, incentivizing executives to prioritize environmental and social responsibility alongside financial performance.

The long-term sustainability of the current compensation model depends on various factors, including market conditions, regulatory changes, and evolving investor expectations.

Conclusion: Understanding the Significance of the BP Executive Compensation Decrease

The 31% decrease in BP executive compensation is a significant event with far-reaching implications. It reflects evolving investor expectations, increased scrutiny of executive pay in the energy sector, and a growing focus on ESG considerations. While the short-term impact on BP's stock performance remains to be seen, the long-term implications for its compensation strategy and the broader energy sector are profound. The move may increase investor confidence and improve the company's reputation, but could also present challenges in attracting and retaining top talent.

To stay informed about BP executive pay trends, analyzing BP compensation, and the future of BP executive compensation, subscribe to our newsletter, follow us on social media, or check the BP investor relations website for regular updates.

Featured Posts

-

Quantum Stocks Surge In 2025 Rigetti And Ion Q Lead The Charge

May 21, 2025

Quantum Stocks Surge In 2025 Rigetti And Ion Q Lead The Charge

May 21, 2025 -

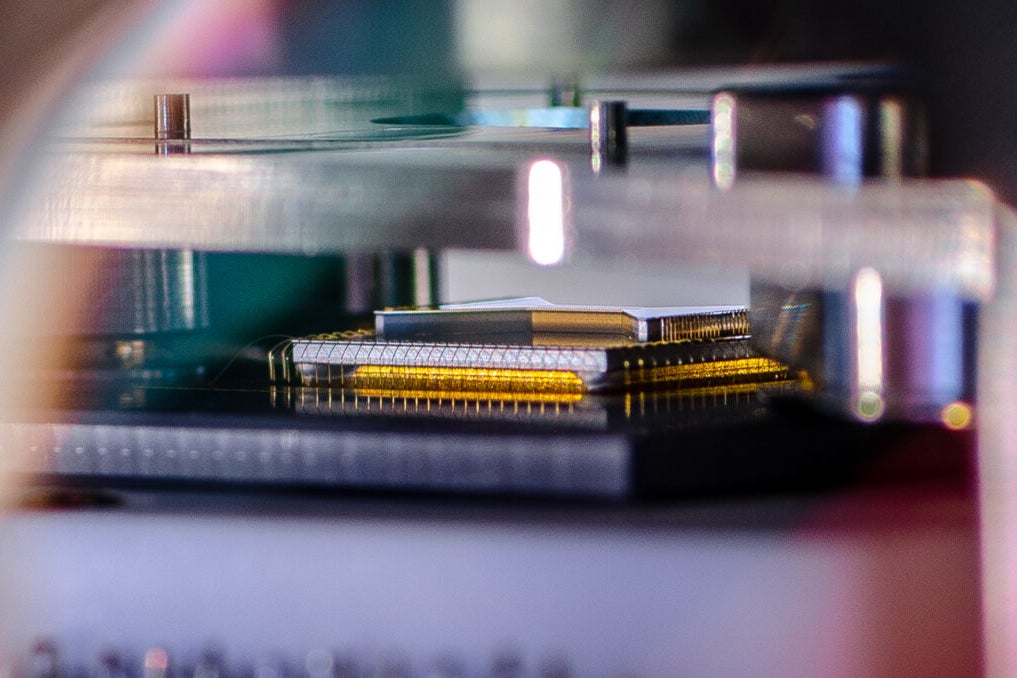

Scott Savilles Cycling Journey From Ragbrai To Daily Commutes

May 21, 2025

Scott Savilles Cycling Journey From Ragbrai To Daily Commutes

May 21, 2025 -

Espn Uncovers The Key To The Bruins Transformative Offseason

May 21, 2025

Espn Uncovers The Key To The Bruins Transformative Offseason

May 21, 2025 -

Home Office Vs Kancelaria Ktora Forma Prace Je Efektivnejsia

May 21, 2025

Home Office Vs Kancelaria Ktora Forma Prace Je Efektivnejsia

May 21, 2025 -

Kaellmanin Ja Hoskosen Puola Seikkailu Paeaettyi

May 21, 2025

Kaellmanin Ja Hoskosen Puola Seikkailu Paeaettyi

May 21, 2025