Broadcom's VMware Acquisition: AT&T Highlights Potential 1,050% Cost Increase

Table of Contents

AT&T's Dependence on VMware and Potential Cost Increases

AT&T's extensive infrastructure relies heavily on VMware's virtualization technologies. Their current deployment includes a vast array of VMware products and services, making them particularly vulnerable to the significant price increases projected following Broadcom's takeover. Reports, including leaked internal documents, suggest a potential 1050% increase in licensing fees. This staggering figure threatens to dramatically impact AT&T's budget and overall profitability.

- Specific VMware Products Used by AT&T (examples):

- VMware vSphere (for server virtualization)

- VMware NSX (for network virtualization)

- VMware vRealize (for cloud management and automation)

- VMware Workspace ONE (for unified endpoint management)

The potential cost increase isn't merely hypothetical; it represents a real and significant threat to AT&T's financial stability. A comparison with other telecommunication companies reveals a similar reliance on VMware, suggesting that many organizations face comparable challenges. The impact on AT&T's bottom line could be substantial, forcing them to reassess their IT spending and potentially impacting service offerings.

Broadcom's Track Record and Pricing Strategies

Broadcom has a history of acquiring companies and subsequently raising prices. This pattern raises concerns about their intentions regarding VMware. While Broadcom claims the acquisition aims to integrate and improve VMware's offerings, analysts and industry experts remain skeptical. The potential for a significant cost increase stems from several factors:

-

Consolidation of services: Broadcom could eliminate competition and bundle services at inflated prices.

-

Removal of competition: The acquisition eliminates a major competitor in the virtualization market, reducing consumer choice and leverage.

-

Market dominance: Broadcom’s already significant market share, coupled with the VMware acquisition, gives them immense power to dictate pricing.

-

Previous Broadcom Acquisitions and Subsequent Pricing Changes (Examples):

- [Insert example 1 of a Broadcom acquisition and subsequent price increase]

- [Insert example 2 of a Broadcom acquisition and subsequent price increase]

The concern extends beyond VMware itself. This acquisition sets a precedent, raising concerns about potential future price hikes for other Broadcom products, creating a ripple effect throughout the enterprise software market.

The Broader Implications for the Enterprise Software Market

The Broadcom-VMware acquisition has far-reaching consequences for the enterprise software market. The potential for increased consolidation and reduced competition is a major concern. This could lead to:

- Limited innovation: Less competition may stifle innovation and limit the development of new features and technologies.

- Reduced customer choice: Businesses may have fewer options and less leverage in negotiating contracts.

- Increased vendor lock-in: Companies heavily invested in VMware may find it difficult and costly to switch to alternative solutions.

Businesses relying on VMware products are facing significant risks. Finding alternative virtualization solutions, such as OpenStack, Proxmox, or Citrix, and implementing migration strategies are now crucial steps to mitigating the risk of excessive price increases.

- Potential Risks for Businesses Relying on VMware:

- Substantial increases in licensing costs.

- Limited options for alternative solutions.

- Increased vendor lock-in.

- Potential disruption to operations during migration.

Regulatory Scrutiny and Antitrust Concerns

The Broadcom-VMware merger faces significant regulatory scrutiny and antitrust concerns globally. Several regulatory bodies are investigating the acquisition to determine whether it violates antitrust laws. These investigations could lead to:

-

Potential legal challenges: Lawsuits could delay or even prevent the acquisition from proceeding as planned.

-

Price caps: Regulators could impose price caps on VMware products to prevent excessive price increases.

-

Divestiture: Broadcom may be forced to divest certain assets to address antitrust concerns.

-

Regulatory Bodies Involved (Examples):

- [Insert regulatory body 1]

- [Insert regulatory body 2]

- [Insert regulatory body 3]

The outcome of these investigations will significantly impact the price increase, potentially mitigating or exacerbating the cost implications for AT&T and other businesses.

Conclusion: Navigating the Post-Acquisition Landscape of Broadcom and VMware

The Broadcom VMware acquisition presents a significant challenge for businesses, particularly those heavily reliant on VMware's virtualization technologies. The potential 1050% cost increase for AT&T underscores the gravity of this situation. This acquisition highlights the need for businesses to proactively assess their reliance on VMware and consider alternative solutions to avoid being caught off guard by future price hikes. The increased consolidation within the enterprise software market raises concerns about competition and innovation. Regulatory scrutiny offers a glimmer of hope for mitigating potential price gouging, but the outcome remains uncertain.

Don't let the Broadcom VMware acquisition catch your business off guard. Start planning your strategy today by exploring alternative virtualization solutions and preparing for potential cost increases. Actively monitor the ongoing developments surrounding the acquisition and engage with your VMware provider to understand your options and potential costs. The future of enterprise software pricing is uncertain, but proactive planning can mitigate the risks.

Featured Posts

-

Luxury Homes A Look At Rich Kids Cribs Featured On Mtv

May 12, 2025

Luxury Homes A Look At Rich Kids Cribs Featured On Mtv

May 12, 2025 -

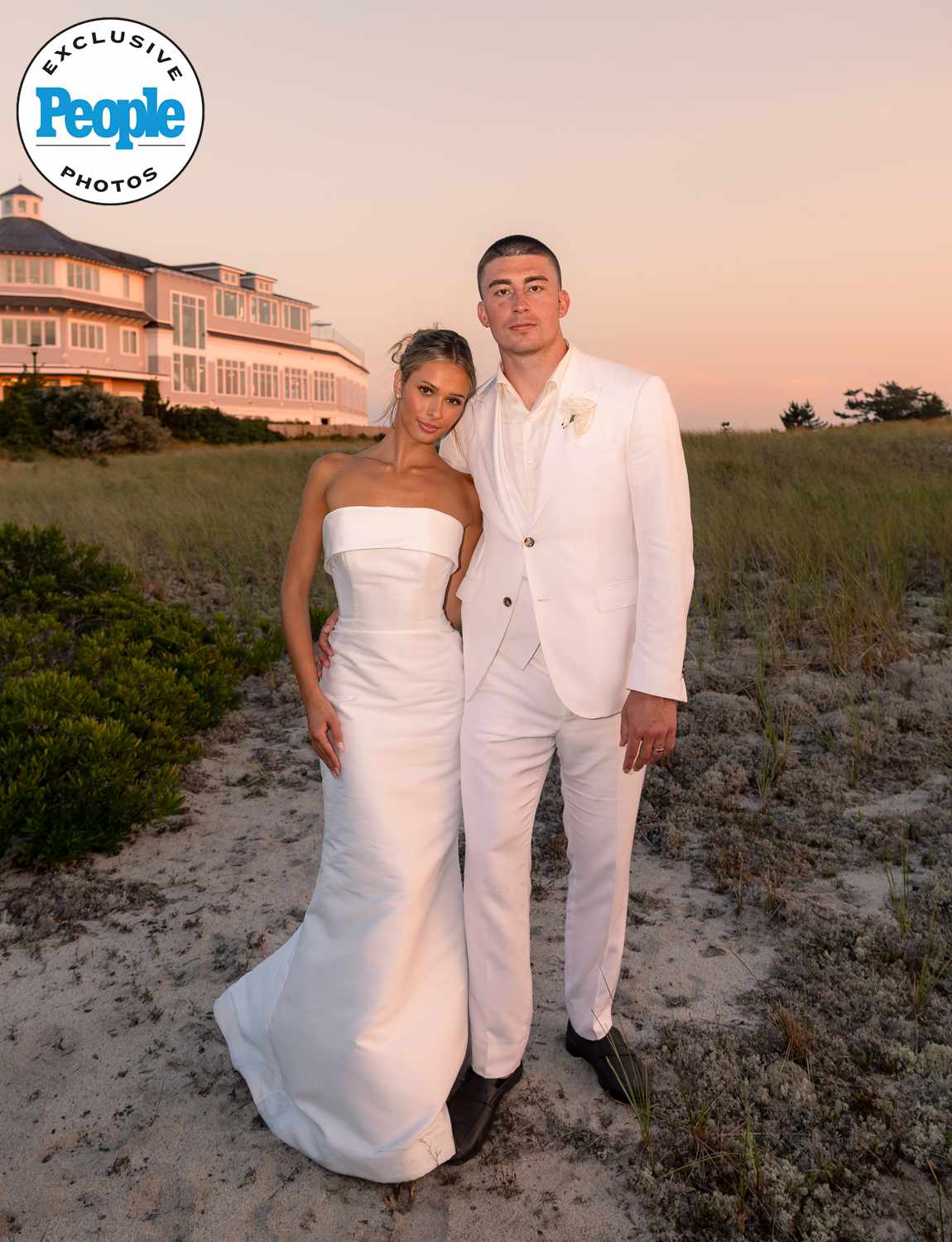

First Photos Lily Collins Charlie Mc Dowell And Daughter Toves Family Album

May 12, 2025

First Photos Lily Collins Charlie Mc Dowell And Daughter Toves Family Album

May 12, 2025 -

Payton Pritchards Game 1 Playoff Performance How He Changed The Celtics Win

May 12, 2025

Payton Pritchards Game 1 Playoff Performance How He Changed The Celtics Win

May 12, 2025 -

Bof As Take Why Stretched Stock Market Valuations Shouldnt Worry Investors

May 12, 2025

Bof As Take Why Stretched Stock Market Valuations Shouldnt Worry Investors

May 12, 2025 -

Prints Endryu 65 Rokiv Ditinstvo V Korolivskiy Rodini

May 12, 2025

Prints Endryu 65 Rokiv Ditinstvo V Korolivskiy Rodini

May 12, 2025