Bundestag Elections And The Dax: Analyzing The Correlation

Table of Contents

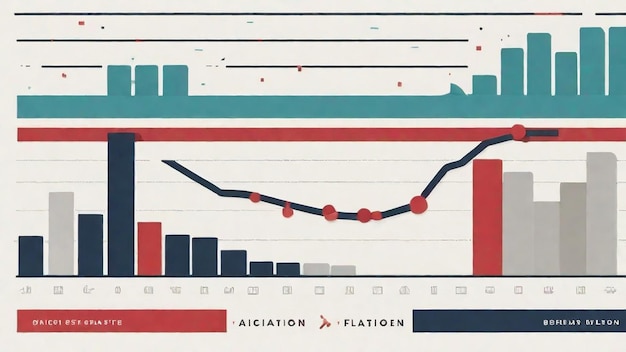

Historical Analysis of DAX Performance Around Bundestag Elections

Analyzing past Bundestag elections provides valuable insights into the DAX's typical response. We can observe distinct patterns in pre- and post-election market behavior.

Pre-Election Volatility

The months leading up to a Bundestag election often witness increased volatility in the DAX. Campaigning, policy debates, and fluctuating poll results create uncertainty, impacting investor confidence. This uncertainty often translates into increased trading volume and price fluctuations.

- Increased trading volume in the weeks before the election: Investors react to changing political narratives, leading to more active trading.

- Fluctuations based on poll results and campaign promises: Positive poll numbers for parties perceived as business-friendly may boost the DAX, while negative projections can trigger sell-offs. Specific campaign promises regarding taxation, regulation, or social programs also influence sector-specific reactions.

- Sector-specific reactions to proposed policy changes: For example, proposed environmental regulations might negatively impact energy sector stocks, while tax reform proposals could benefit certain industries. Analyzing these sector-specific reactions provides a granular understanding of the election's impact on the DAX.

For example, the 2017 election saw increased volatility in the months leading up to the vote, with the DAX fluctuating significantly based on poll results and the unfolding political narratives.

Post-Election Market Reactions

The DAX's immediate response to election results varies depending on whether the outcome aligns with market expectations. Unexpected results can cause sharper and more pronounced reactions. The subsequent coalition negotiations also play a crucial role in determining market stability.

- Short-term gains or losses depending on the winning party and coalition: A victory for a party perceived as pro-business might lead to short-term gains, while a win for a more left-leaning party might result in initial losses.

- Long-term effects of policy changes implemented by the new government: The long-term impact depends on the new government's policies. Pro-business reforms may lead to long-term growth, while more interventionist policies might cause uncertainty and slow growth.

- Investor confidence and its influence on market trends: Confidence plays a major role. A clear mandate and a stable coalition government tend to boost investor confidence, while protracted negotiations or a weak government may dampen market sentiment.

Key Factors Influencing the Correlation

The correlation between Bundestag elections and the DAX isn't solely determined by domestic political events. Several crucial factors influence this relationship.

Policy Uncertainty and Investor Sentiment

Uncertainty surrounding election outcomes significantly affects investor decisions. Markets dislike uncertainty; clear and predictable policies foster confidence, while ambiguous stances lead to risk aversion.

- Risk aversion and capital flight during periods of high uncertainty: Investors may withdraw investments from the German market until the political landscape clarifies.

- The impact of specific policy proposals (e.g., tax reforms, environmental regulations): The specifics of proposed policies are carefully scrutinized by investors. Tax reforms favoring businesses usually have a positive impact, while stricter regulations might negatively affect certain sectors.

- Analysis of investor sentiment indices related to German politics: Various indices track investor sentiment toward German politics, providing further insights into the market's reaction to the election cycle.

Global Economic Context

Global factors can significantly amplify or mitigate the impact of Bundestag elections on the DAX. A global economic downturn can overshadow even the most significant domestic political events.

- Examples of global crises impacting the DAX irrespective of domestic elections: The 2008 financial crisis demonstrates the dominance of global factors over purely domestic events.

- The interplay between global market trends and domestic political events: A strong global economy can buffer the DAX against negative election-related news, while a weak global economy can exacerbate negative impacts.

- Assessing the relative weight of global vs. domestic factors in influencing the DAX: It's crucial to understand the relative importance of global and domestic factors when analyzing the DAX's performance around election time.

Predicting Future DAX Behavior Based on Upcoming Bundestag Elections

Analyzing the current political landscape and the platforms of major parties is crucial for predicting the DAX's behavior around the next Bundestag election.

Analyzing Current Political Landscape

Understanding the key policy differences between major parties is essential. Analyzing current polls and identifying potential sources of uncertainty (e.g., coalition negotiations) helps anticipate market reactions.

- Key policy differences between major parties: Focus on economic policies: tax plans, spending priorities, and regulatory approaches.

- Potential market reactions to different election outcomes: Assess how different outcomes might influence investor confidence and market sentiment.

- Scenarios for coalition governments and their potential impact: Consider various coalition scenarios and their likely policy implications.

Strategies for Investors

Investors should employ long-term investment strategies but also consider tactical adjustments based on election outcomes. Risk management is vital during periods of political uncertainty.

- Importance of long-term investment strategies: Short-term fluctuations should not dictate long-term investment decisions.

- Opportunities for tactical adjustments based on election outcomes: Investors can adjust their portfolios based on anticipated policy changes.

- Seeking professional financial advice: Seeking expert guidance can help investors navigate the complexities of the market during election periods.

Conclusion

The relationship between Bundestag elections and the DAX is complex. Historical analysis shows a correlation between election-related uncertainty and market volatility, but the impact's magnitude is influenced by numerous factors – including specific policies, the global economic climate, and investor sentiment. Understanding these dynamics is vital for investors navigating the German stock market. To make informed investment decisions, continuously monitor the political landscape, analyze economic indicators, and stay updated on developments impacting both Bundestag elections and the DAX. Mastering the nuances of this interplay is key to effective investment strategies.

Featured Posts

-

The Imminent Arrival Of A Fifth Champions League Spot For The Premier League

Apr 27, 2025

The Imminent Arrival Of A Fifth Champions League Spot For The Premier League

Apr 27, 2025 -

El Camino De Cerundolo A Cuartos De Final En Indian Wells Impacto De Las Ausencias De Fritz Y Gauff

Apr 27, 2025

El Camino De Cerundolo A Cuartos De Final En Indian Wells Impacto De Las Ausencias De Fritz Y Gauff

Apr 27, 2025 -

The Professionals Behind Ariana Grandes Stunning Hair And Tattoo Makeover

Apr 27, 2025

The Professionals Behind Ariana Grandes Stunning Hair And Tattoo Makeover

Apr 27, 2025 -

Us Economy Feels The Pinch Analyzing The Impact Of The Canadian Travel Boycott

Apr 27, 2025

Us Economy Feels The Pinch Analyzing The Impact Of The Canadian Travel Boycott

Apr 27, 2025 -

Ackmans Trade War Prediction Us Vs China

Apr 27, 2025

Ackmans Trade War Prediction Us Vs China

Apr 27, 2025

Latest Posts

-

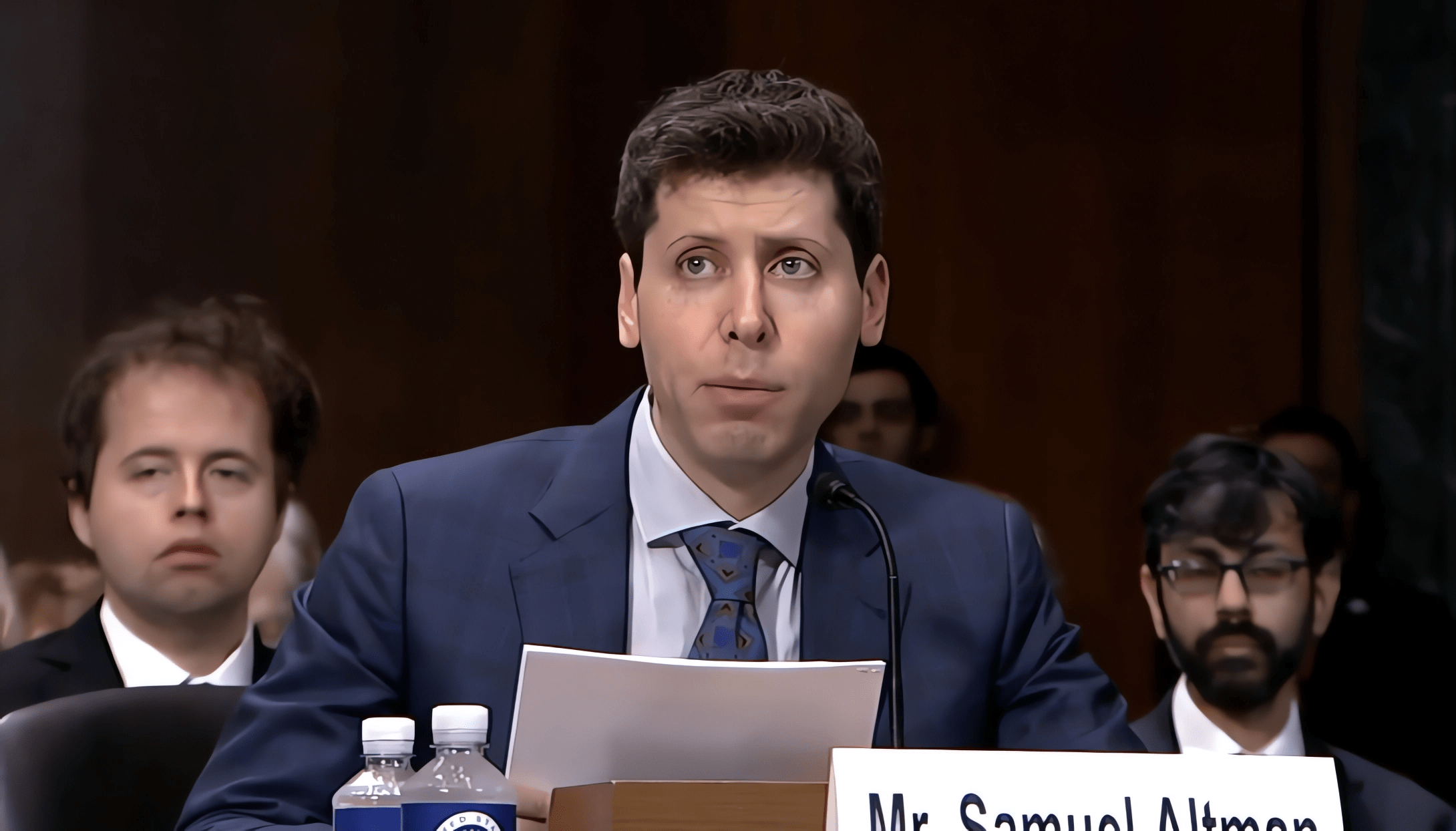

Open Ais Chat Gpt An Ftc Investigation And Its Potential Consequences

Apr 28, 2025

Open Ais Chat Gpt An Ftc Investigation And Its Potential Consequences

Apr 28, 2025 -

Chat Gpt Developer Open Ai Faces Ftc Investigation

Apr 28, 2025

Chat Gpt Developer Open Ai Faces Ftc Investigation

Apr 28, 2025 -

Ftc Investigates Open Ais Chat Gpt What It Means For Ai Development

Apr 28, 2025

Ftc Investigates Open Ais Chat Gpt What It Means For Ai Development

Apr 28, 2025 -

Jan 6 Witness Cassidy Hutchinson To Publish Memoir This Fall

Apr 28, 2025

Jan 6 Witness Cassidy Hutchinson To Publish Memoir This Fall

Apr 28, 2025 -

Cassidy Hutchinson Plans Memoir A Look Inside The January 6th Hearings

Apr 28, 2025

Cassidy Hutchinson Plans Memoir A Look Inside The January 6th Hearings

Apr 28, 2025