Can Cryptocurrencies Survive A Trade War? One Potential Winner

Table of Contents

How Trade Wars Impact Traditional Markets

Trade wars, characterized by escalating tariffs and economic sanctions, significantly disrupt global trade and traditional financial systems. The imposition of tariffs increases the cost of goods, impacting consumer spending and potentially leading to inflation. Simultaneously, economic sanctions can severely limit trade between nations, causing supply chain disruptions and impacting businesses reliant on global supply networks. This uncertainty ripples through the entire economic system, increasing market volatility for stocks, bonds, and other traditional assets.

Keywords: global trade, tariffs, economic sanctions, market volatility, global economy

- Increased uncertainty for investors: The unpredictable nature of trade wars makes it difficult for investors to forecast future market trends, leading to cautious investment strategies and potential market downturns.

- Supply chain disruptions: Tariffs and sanctions create bottlenecks in global supply chains, leading to shortages of goods and increased prices.

- Reduced consumer spending: Higher prices due to tariffs and uncertainty about future economic conditions can cause consumers to reduce their spending, slowing economic growth.

- Currency fluctuations: Trade wars can significantly impact currency exchange rates, creating additional risks for businesses involved in international trade.

Cryptocurrencies as a Hedge Against Trade War Uncertainty

Unlike traditional financial systems heavily reliant on centralized institutions and government regulations, cryptocurrencies offer a decentralized alternative. This decentralized nature, facilitated by blockchain technology, makes them less susceptible to the geopolitical risks associated with trade wars. The ability to conduct cross-border transactions without relying on traditional banking systems, which are often subject to trade restrictions and sanctions, represents a significant advantage.

Keywords: decentralized finance, DeFi, blockchain technology, geopolitical risk, asset diversification, cryptocurrency investment

- Reduced reliance on centralized institutions: Cryptocurrencies operate on a decentralized network, minimizing their vulnerability to government interventions and trade restrictions.

- Potential for cross-border transactions unaffected by trade restrictions: Transactions on the blockchain are not subject to the same restrictions as traditional banking systems.

- Increased demand during periods of economic uncertainty: As investors seek alternative safe haven assets, the demand for cryptocurrencies might increase during times of economic turmoil.

Which Cryptocurrency Could Be a Winner? Analyzing Bitcoin's Resilience

Bitcoin, the leading cryptocurrency by market capitalization, stands out as a potential winner in a trade war scenario. Its established market position and resilience to previous economic shocks make it an attractive option for investors seeking diversification and a hedge against geopolitical risk. Its limited supply, often referred to as "digital gold," and growing institutional adoption further solidify its position as a potential store of value.

Keywords: Bitcoin, market capitalization, store of value, digital gold, long-term investment, cryptocurrency trading

- Historically proven resilience: Bitcoin has weathered previous economic storms, demonstrating its potential to retain value even during periods of uncertainty.

- Limited supply: Bitcoin's capped supply of 21 million coins contributes to its scarcity and potential for long-term value appreciation.

- Growing institutional adoption: Major financial institutions are increasingly integrating Bitcoin into their portfolios, lending credibility and legitimacy to the asset.

- Potential for increased demand as a safe haven asset: During times of economic instability, investors often seek assets perceived as safe havens, potentially driving up demand for Bitcoin.

Exploring Alternative Cryptocurrencies with Trade War Resistance

While Bitcoin holds a prominent position, other cryptocurrencies could also benefit from a trade war. Privacy coins, designed to enhance transaction anonymity, could see increased demand in regions facing strict capital controls or censorship. Stablecoins, pegged to fiat currencies like the US dollar, offer relative price stability, making them attractive alternatives in volatile markets.

Keywords: Privacy coins, stablecoins, alternative investments, crypto portfolio diversification

- Monero (XMR): A privacy-focused cryptocurrency designed to enhance transaction confidentiality. (Disclaimer: Investing in privacy coins carries inherent risks.)

- Tether (USDT): A stablecoin pegged to the US dollar, offering relative price stability compared to other cryptocurrencies. (Disclaimer: Stablecoins are not without risk. Their value is dependent on the underlying asset and issuer's solvency.)

Conclusion: Navigating the Crypto Landscape During a Trade War

Trade wars significantly impact traditional markets, creating economic uncertainty and volatility. However, the decentralized nature of cryptocurrencies, particularly Bitcoin, presents a compelling alternative. Bitcoin's resilience, limited supply, and growing institutional adoption position it as a potential safe haven asset during periods of global economic instability. While other cryptocurrencies, such as privacy coins and stablecoins, also offer unique advantages, they also carry significant risks.

Invest wisely in cryptocurrencies, carefully considering your risk tolerance and conducting thorough research. Learn more about Bitcoin's potential and explore the world of cryptocurrencies and their resilience to trade wars. Remember to diversify your crypto portfolio and always stay informed about the evolving landscape of global trade and the cryptocurrency market.

Featured Posts

-

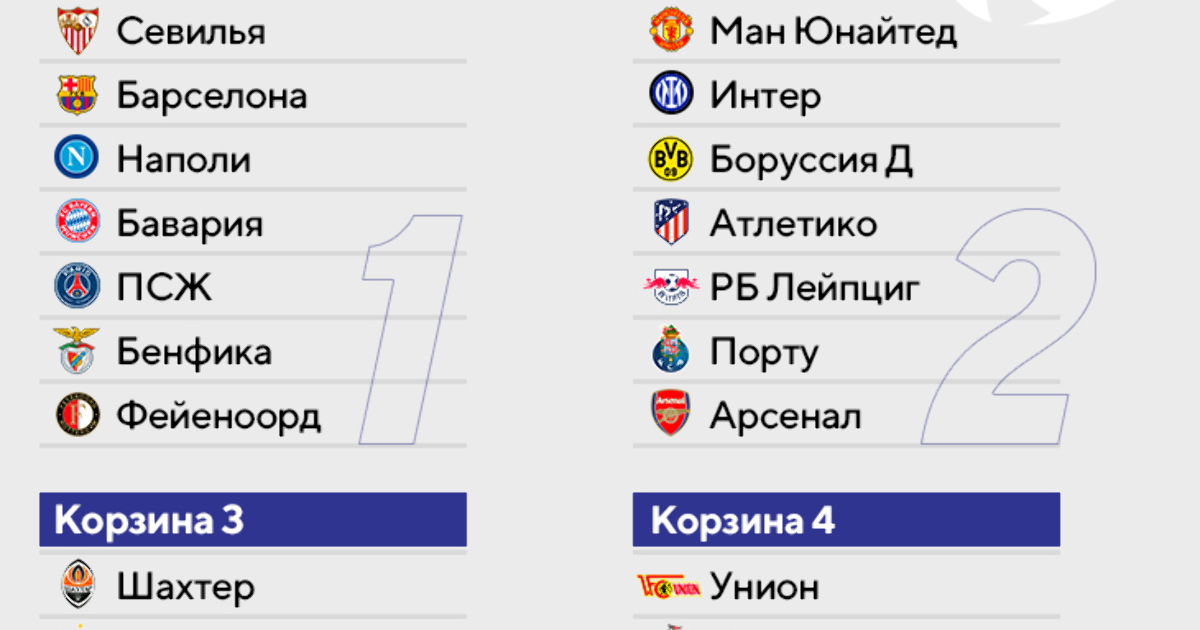

Anons Matchey Ligi Chempionov Arsenal Protiv Ps Zh Barselona Protiv Inter 2024 2025

May 08, 2025

Anons Matchey Ligi Chempionov Arsenal Protiv Ps Zh Barselona Protiv Inter 2024 2025

May 08, 2025 -

Saturday Night Live And Counting Crows A Defining Moment

May 08, 2025

Saturday Night Live And Counting Crows A Defining Moment

May 08, 2025 -

Psl 10 Ticket Sales Starting Today

May 08, 2025

Psl 10 Ticket Sales Starting Today

May 08, 2025 -

Analysis 67 M Ethereum Liquidation And The Implications For The Market

May 08, 2025

Analysis 67 M Ethereum Liquidation And The Implications For The Market

May 08, 2025 -

Lotto Plus Results Saturday April 12 2025 Check Winning Numbers

May 08, 2025

Lotto Plus Results Saturday April 12 2025 Check Winning Numbers

May 08, 2025

Latest Posts

-

Tatum Faces Backlash From Colin Cowherd After Celtics Game 1 Setback

May 08, 2025

Tatum Faces Backlash From Colin Cowherd After Celtics Game 1 Setback

May 08, 2025 -

Celtics Vs Nets Will Jayson Tatum Play Tonight Injury Report

May 08, 2025

Celtics Vs Nets Will Jayson Tatum Play Tonight Injury Report

May 08, 2025 -

Tnt Announcers Roast Jayson Tatum In Hilarious Lakers Celtics Promo

May 08, 2025

Tnt Announcers Roast Jayson Tatum In Hilarious Lakers Celtics Promo

May 08, 2025 -

Celtics Game 1 Loss Prompts Sharp Criticism From Colin Cowherd On Tatum

May 08, 2025

Celtics Game 1 Loss Prompts Sharp Criticism From Colin Cowherd On Tatum

May 08, 2025 -

Jayson Tatum Reflects On Larry Birds Influence A Celtics Perspective

May 08, 2025

Jayson Tatum Reflects On Larry Birds Influence A Celtics Perspective

May 08, 2025