Can Ethereum Reach $2,000? Recent Price Movement Suggests Possibility

Table of Contents

Keywords: Ethereum price prediction, Ethereum $2000, ETH price, Ethereum price movement, cryptocurrency price, crypto investment, Ethereum future, ETH investment

The cryptocurrency market is constantly fluctuating, and Ethereum (ETH), the second-largest cryptocurrency by market capitalization, is no exception. With its recent price movements, many investors are asking: Can Ethereum reach $2,000? This article delves into the current ETH price performance, analyzes key influencing factors, and explores the potential for this significant price target to be achieved. We'll examine the Ethereum price prediction, weighing both the possibilities and the considerable risks involved.

Recent Ethereum Price Performance and Key Trends

Ethereum's price has experienced significant volatility in recent months. While it's impossible to predict with certainty where the price will go next, analyzing past trends can offer valuable insights. Let's review some key events and price movements:

- [Date]: ETH price reached a high of $[Price]. This was largely attributed to [Reason, e.g., positive market sentiment, successful network upgrade].

- [Date]: A sharp decline saw ETH drop to $[Price], possibly influenced by [Reason, e.g., broader market downturn, negative news].

- [Date]: Trading volume surged to [Volume] during this period, indicating increased market activity. This could be a sign of [Possible interpretation, e.g., increased investor interest, or potentially panic selling].

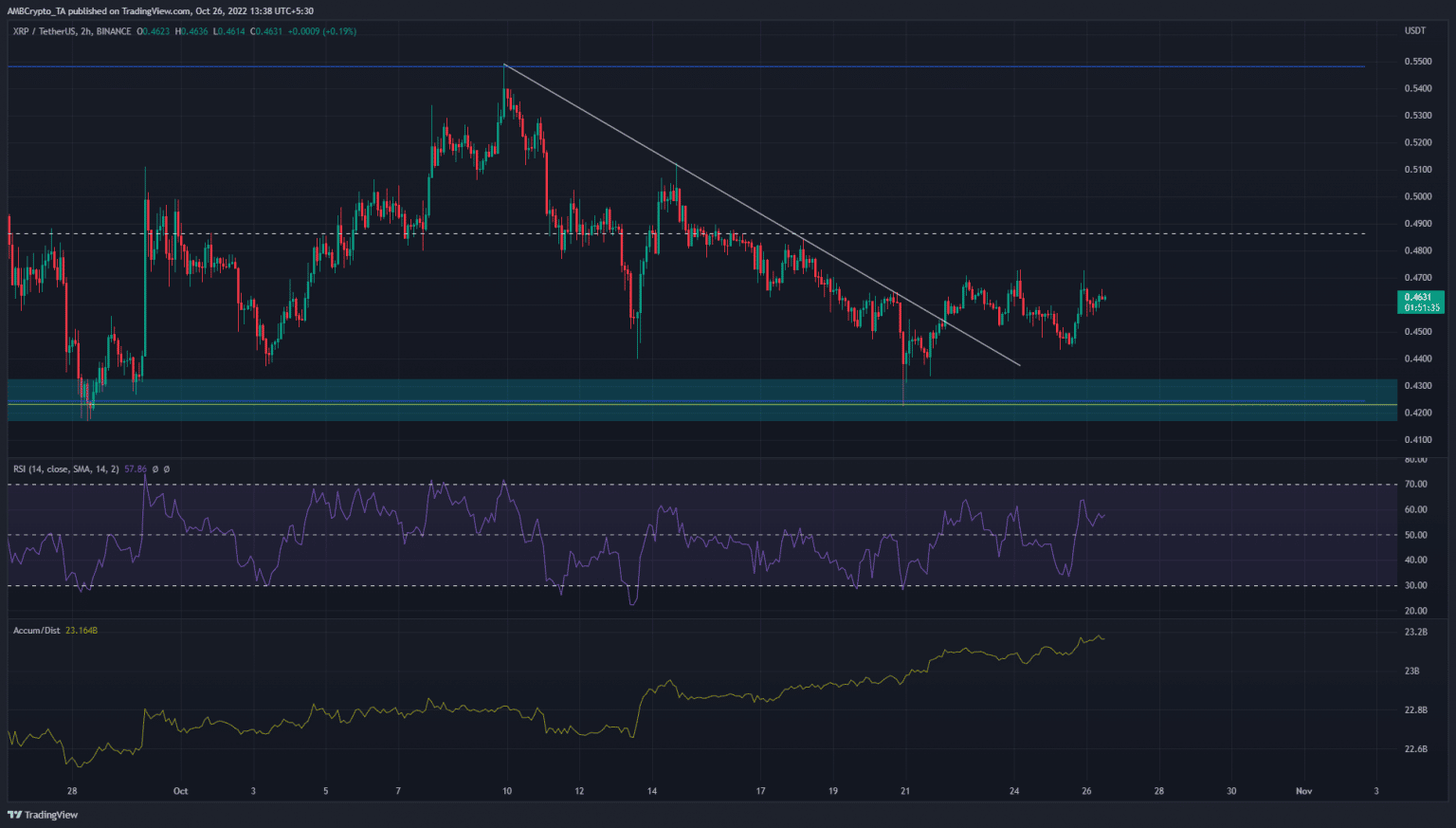

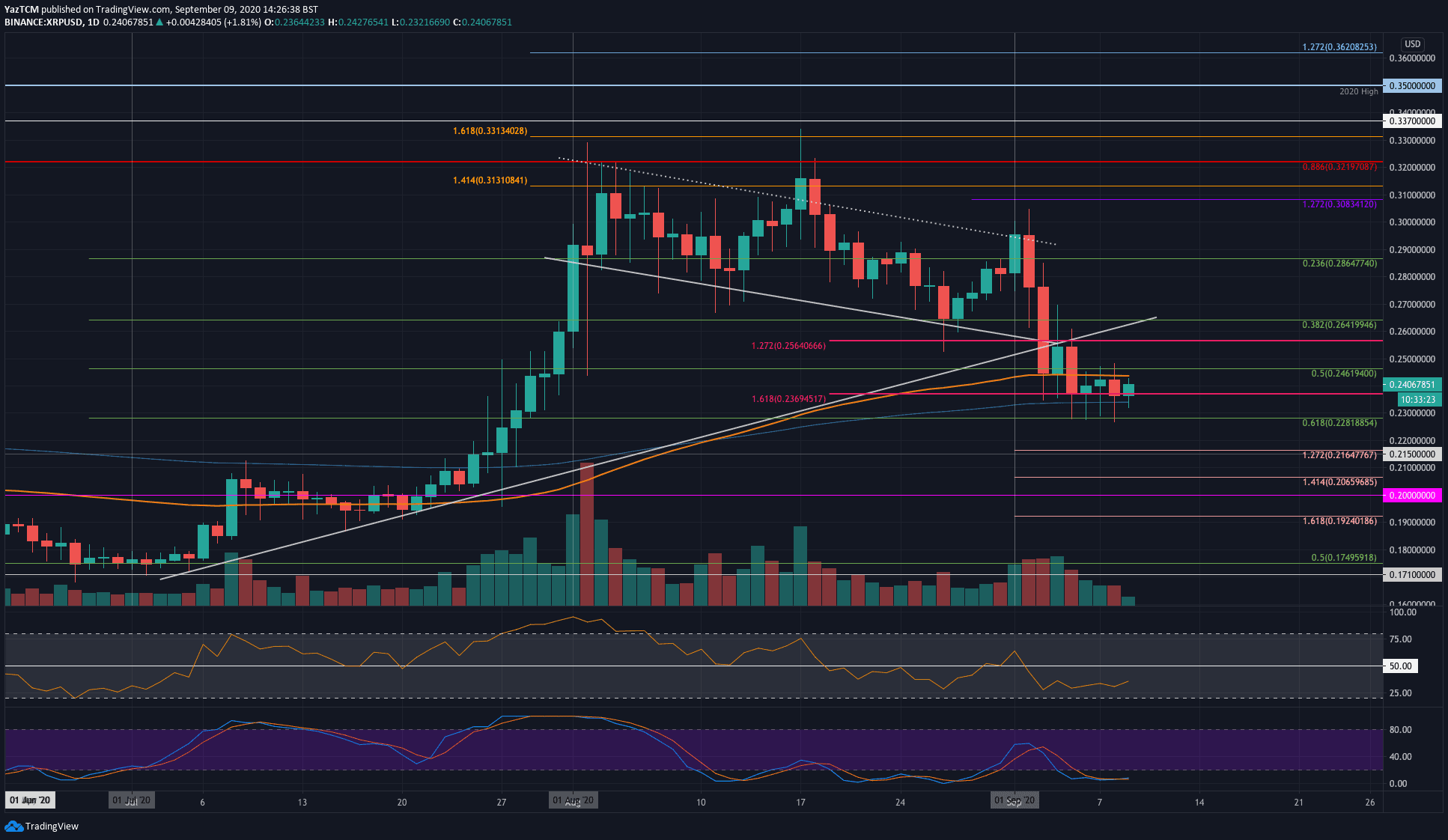

[Insert chart visualizing ETH price over the last few months. Alt text: "Chart showing Ethereum price fluctuations from [Start Date] to [End Date], highlighting key highs and lows."]

Analyzing these trends alongside the overall cryptocurrency market sentiment and Bitcoin's performance provides a more complete picture of Ethereum's price movement. A correlation between Bitcoin's price and Ethereum's price is often observed, suggesting a degree of interdependence within the crypto market.

Factors Influencing Ethereum's Price

Several factors contribute to Ethereum's price fluctuations. Understanding these factors is crucial for forming a realistic Ethereum price prediction.

Technological Developments

Ethereum 2.0, with its transition to a proof-of-stake (PoS) consensus mechanism, is a major driver of potential price growth. This upgrade aims to significantly improve scalability, reduce transaction fees, and enhance the overall network security.

- Sharding: This feature will dramatically increase transaction throughput, making Ethereum faster and more efficient.

- Proof-of-Stake: This reduces energy consumption compared to proof-of-work, making it more environmentally friendly and potentially reducing operational costs.

These developments attract more developers and users, potentially increasing demand and pushing the ETH price higher.

Adoption and Usage

The growing adoption of Ethereum across various sectors is another significant factor influencing its price. The Ethereum blockchain is fundamental to:

- Decentralized Finance (DeFi): Numerous DeFi applications, including lending platforms like Aave and Uniswap, operate on Ethereum. The growth of these platforms directly impacts ETH demand.

- Non-Fungible Tokens (NFTs): Ethereum is the leading platform for NFT creation and trading. The booming NFT market contributes substantially to network activity and ETH demand.

The increasing number of decentralized applications (dApps) built on the Ethereum blockchain demonstrates its growing utility and strengthens its position as a leading platform for innovation in the crypto space.

Macroeconomic Factors and Market Sentiment

External factors also influence Ethereum's price.

- Inflation and Interest Rates: Changes in macroeconomic conditions, such as inflation and interest rates, can affect investor appetite for riskier assets like cryptocurrencies.

- Regulatory Developments: Government regulations and policies regarding cryptocurrencies significantly impact market sentiment and price volatility.

Positive media coverage and investor confidence generally drive prices up, while negative news or regulatory uncertainty can trigger significant price drops.

Potential Challenges and Risks

Despite the positive factors, several challenges and risks could hinder Ethereum's price reaching $2,000.

Competition from other Blockchains

Several other blockchains are competing with Ethereum, offering potentially faster transaction speeds or lower fees. This competition could affect Ethereum's market share and price.

- Solana: Known for its high transaction speeds.

- Cardano: Focuses on scalability and sustainability.

These competitors represent potential threats to Ethereum's dominance.

Regulatory Uncertainty

The regulatory landscape for cryptocurrencies remains uncertain globally. Stringent regulations or outright bans could negatively impact Ethereum's price and adoption.

Market Volatility

The cryptocurrency market is inherently volatile. Sudden price swings can be triggered by various events, including unexpected news, security breaches, or changes in market sentiment. This volatility underscores the importance of careful risk management for any Ethereum investment.

Conclusion

The potential for Ethereum to reach $2,000 depends on a complex interplay of technological advancements, adoption rates, macroeconomic conditions, and regulatory developments. While the positive factors, such as Ethereum 2.0 and the growing DeFi and NFT markets, suggest the possibility of such a price surge, the inherent risks associated with the cryptocurrency market, including competition and regulatory uncertainty, should not be overlooked. Therefore, while an Ethereum price prediction reaching $2000 is possible, it's crucial to conduct thorough research and understand the associated risks before making any investment decisions.

Call to Action: Stay informed about Ethereum's price movement and future developments to make informed decisions about your Ethereum investment. Learn more about investing in Ethereum and potential strategies. Continue to research the Ethereum price prediction to stay updated and make sound investment choices.

Featured Posts

-

Crook Accused Of Millions In Office365 Executive Account Hacks

May 08, 2025

Crook Accused Of Millions In Office365 Executive Account Hacks

May 08, 2025 -

San Franciscos Anchor Brewing Company Shuts Down A Historic Brewery Closes Its Doors

May 08, 2025

San Franciscos Anchor Brewing Company Shuts Down A Historic Brewery Closes Its Doors

May 08, 2025 -

Inter Milan Vs Barcelona A Classic Champions League Showdown

May 08, 2025

Inter Milan Vs Barcelona A Classic Champions League Showdown

May 08, 2025 -

La Temporada Historica Del Betis Un Hito Para El Club

May 08, 2025

La Temporada Historica Del Betis Un Hito Para El Club

May 08, 2025 -

Recent Gains In Dogecoin Shiba Inu And Sui Causes And Potential Impacts

May 08, 2025

Recent Gains In Dogecoin Shiba Inu And Sui Causes And Potential Impacts

May 08, 2025

Latest Posts

-

Can Xrp Continue Its Ascent After A 400 Increase

May 08, 2025

Can Xrp Continue Its Ascent After A 400 Increase

May 08, 2025 -

Is Xrps 400 Rally Sustainable A Look At Future Price Predictions

May 08, 2025

Is Xrps 400 Rally Sustainable A Look At Future Price Predictions

May 08, 2025 -

Xrps 400 Jump Whats Next For The Ripple Cryptocurrency

May 08, 2025

Xrps 400 Jump Whats Next For The Ripple Cryptocurrency

May 08, 2025 -

Xrp Future Price Analyzing The Potential For Growth Following The Sec Case

May 08, 2025

Xrp Future Price Analyzing The Potential For Growth Following The Sec Case

May 08, 2025 -

Xrp Price Prediction Can Xrp Rise Further After A 400 Surge

May 08, 2025

Xrp Price Prediction Can Xrp Rise Further After A 400 Surge

May 08, 2025