XRP's 400% Jump: What's Next For The Ripple Cryptocurrency?

Table of Contents

XRP, the cryptocurrency associated with Ripple Labs, recently experienced a dramatic 400% price jump, leaving investors stunned and wondering about the future. This unexpected surge has sparked intense interest, with many questioning the reasons behind this rally and speculating on XRP's potential trajectory. This article delves into the factors contributing to this significant price increase, analyzes the current market sentiment, and explores potential future scenarios for XRP within the broader cryptocurrency landscape. We'll examine the ongoing legal battle, institutional adoption, on-chain activity, and overall market sentiment to provide a comprehensive overview and aid in understanding potential future price movements.

Factors Contributing to XRP's Recent Rally

Several interconnected factors have contributed to XRP's remarkable price surge. Let's break them down:

The Ripple vs. SEC Lawsuit

The ongoing legal battle between Ripple Labs and the Securities and Exchange Commission (SEC) has been a major driver of XRP's volatility. The lawsuit, alleging that XRP is an unregistered security, has cast a long shadow over the cryptocurrency's price.

- Summary of the lawsuit: The SEC claims that Ripple's sale of XRP constituted an unregistered securities offering.

- Recent court decisions or filings: Recent positive developments in the case, such as favorable court rulings or statements, have often led to surges in XRP's price. Conversely, negative news can trigger significant price drops.

- Impact of legal uncertainty on price volatility: The uncertainty surrounding the outcome of the lawsuit has created significant price volatility. A clear victory for Ripple could lead to a substantial price increase, while a loss could have the opposite effect.

- Potential outcomes and their effect on XRP: A favorable ruling could unlock significant institutional investment, boosting XRP's price. An unfavorable outcome might lead to a prolonged period of depressed prices.

Increased Institutional Adoption

Growing interest from institutional investors is another key factor driving XRP's price. Larger players are increasingly recognizing XRP's potential for cross-border payments and its efficiency on the XRP Ledger.

- Examples of institutional adoption: Several financial institutions have begun integrating XRP into their payment systems.

- Potential partnerships: Rumors of new partnerships and collaborations with large financial institutions can fuel speculative buying, driving up the price.

- Increased liquidity: Increased institutional involvement often leads to improved liquidity, making it easier to buy and sell XRP, thereby reducing price volatility.

- Impact on price stability: While institutional involvement can bring volatility, it can also contribute to long-term price stability as these investors tend to hold for the long term.

Growing On-Chain Activity

A significant increase in XRP's on-chain activity indicates growing usage and adoption of the XRP Ledger.

- Data points showing increased transactions: Metrics like daily transaction volume and the number of active addresses on the XRP Ledger demonstrate increasing usage.

- Network usage: The overall network usage, including the volume of XRP transferred, is a strong indicator of growing adoption.

- Analysis of potential drivers of increased activity: This increased activity might be driven by growing partnerships, improved utility, or increased interest from developers building on the XRP Ledger.

- Correlation with price increases: A strong correlation exists between increased on-chain activity and rising XRP prices, suggesting a positive feedback loop.

Overall Market Sentiment

The broader cryptocurrency market significantly influences XRP's price.

- Correlation with Bitcoin's price: Like most cryptocurrencies, XRP often shows a strong correlation with Bitcoin's price.

- General market trends: Positive overall market sentiment tends to benefit XRP, while negative sentiment can lead to price drops.

- Impact of macroeconomic factors: Global economic conditions and regulatory changes can also influence the cryptocurrency market and, consequently, XRP's price.

Analyzing the Current Market Sentiment Towards XRP

Understanding current market sentiment is crucial for predicting XRP's future. Let's analyze various indicators:

Social Media Sentiment

Social media platforms reflect the overall sentiment towards XRP.

- Overview of positive and negative sentiment: Tracking mentions and sentiment analysis on platforms like Twitter can reveal the prevailing opinion.

- Identification of influential voices: Key opinion leaders and influencers in the crypto space can significantly shape public sentiment.

- Impact on trading volume: Positive social media sentiment can often drive increased trading volume and price increases.

Analyst Predictions

Leading cryptocurrency analysts provide various predictions for XRP's future price.

- Range of price predictions: Analyst predictions vary widely, reflecting the inherent uncertainty in the market.

- Justification for predictions: Analysts often base their predictions on technical analysis, fundamental analysis, and market sentiment.

- Potential risks and opportunities: Analysts highlight both potential risks (e.g., negative legal outcomes) and opportunities (e.g., increased adoption) when making predictions.

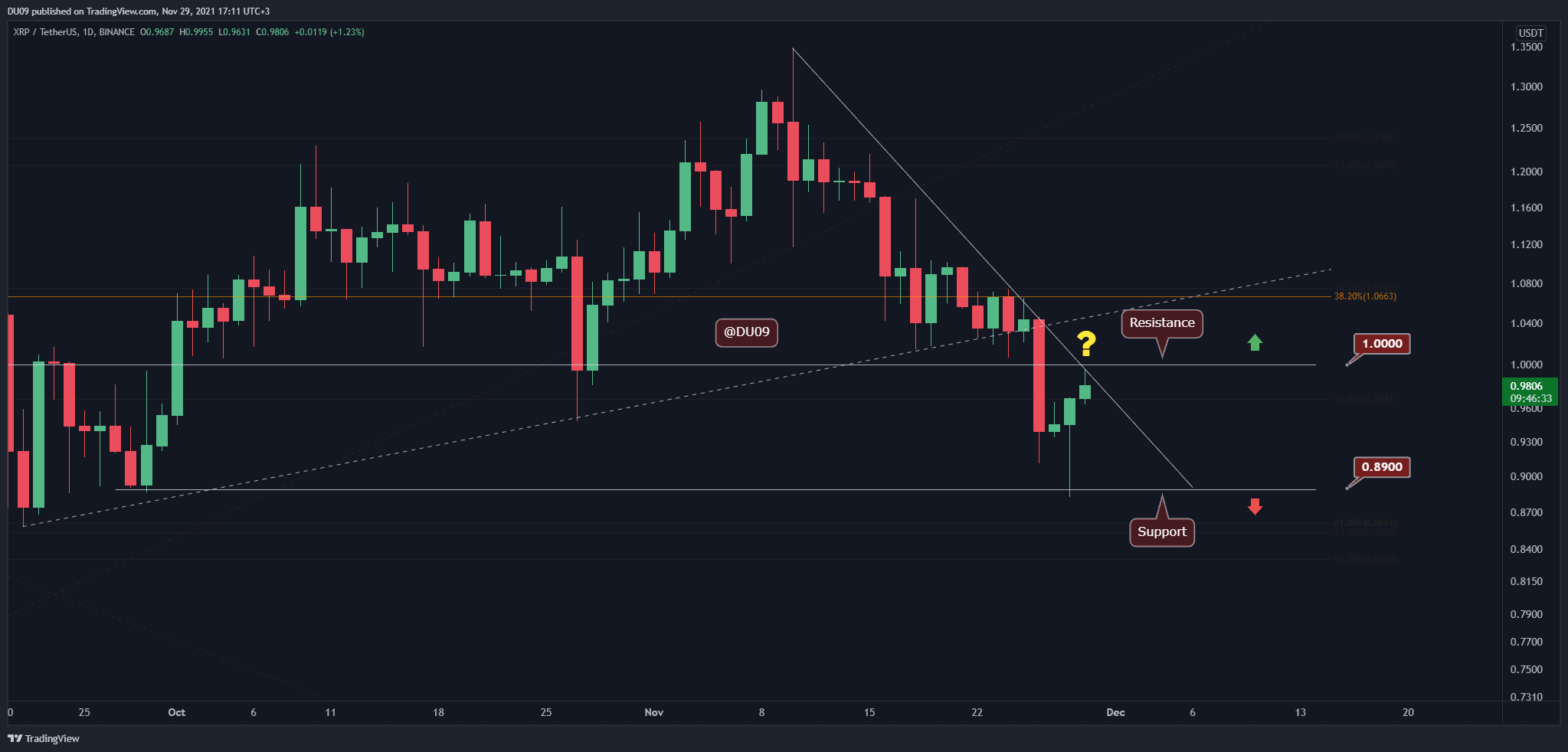

Technical Analysis

Technical analysis uses charts and indicators to forecast future price movements.

- Key technical indicators: Indicators like moving averages, Relative Strength Index (RSI), and MACD can provide insights into potential price trends.

- Chart patterns: Identifying chart patterns such as head and shoulders or double tops/bottoms can offer clues about potential price reversals.

- Support and resistance levels: These levels represent price points where the price is likely to find support or resistance, influencing future movements.

Potential Future Scenarios for XRP

Predicting the future of XRP is inherently speculative, but we can outline potential scenarios:

Best-Case Scenario

In a best-case scenario, XRP continues its upward trajectory driven by a favorable outcome in the SEC lawsuit, increased institutional adoption, and robust on-chain activity.

- Factors contributing to sustained growth: Positive legal news, widespread institutional adoption, and significant growth in utility and network activity.

- Potential price targets: This scenario could lead to substantial price increases, potentially reaching new all-time highs.

- Implications for investors: Early investors could see enormous returns, but high volatility remains a risk.

Worst-Case Scenario

A worst-case scenario might involve a negative court ruling in the SEC lawsuit, decreased institutional interest, and a decline in on-chain activity.

- Factors contributing to a price decline: An unfavorable court ruling, a general downturn in the crypto market, and reduced adoption.

- Potential price targets: This scenario could result in a significant price drop, potentially wiping out a significant portion of investment value.

- Implications for investors: Investors could face substantial losses, highlighting the risks associated with cryptocurrency investments.

Most Likely Scenario

A more realistic projection considers a balanced view of the risks and opportunities.

- Balanced assessment of risks and opportunities: This scenario considers the potential for both positive and negative outcomes, acknowledging the ongoing legal uncertainty and market volatility.

- Factors influencing the most likely outcome: The outcome of the SEC lawsuit, the broader cryptocurrency market's performance, and the pace of XRP adoption will all be crucial.

- Potential price targets: This scenario might see modest growth or stagnation, depending on the balance of these influencing factors.

Conclusion

XRP's recent 400% price jump is a testament to the volatility and potential of the cryptocurrency market. The factors contributing to this surge – the Ripple vs. SEC lawsuit, increased institutional adoption, growing on-chain activity, and broader market sentiment – all play a crucial role in shaping XRP's future. While the potential for significant returns is undeniable, it's crucial to remember the inherent risks involved. A thorough understanding of these factors, along with careful consideration of both best-case and worst-case scenarios, is essential for making informed investment decisions. Stay informed about the latest developments in the XRP and Ripple ecosystem to make informed decisions about your investment in this volatile yet potentially rewarding cryptocurrency. Learn more about XRP price predictions and trading strategies to navigate the dynamic world of Ripple and XRP investments.

Featured Posts

-

Bitcoin Price Soars Trumps Crypto Expert Issues Surprise Forecast

May 08, 2025

Bitcoin Price Soars Trumps Crypto Expert Issues Surprise Forecast

May 08, 2025 -

Thunder Vs Pacers Latest Injury News For March 29th

May 08, 2025

Thunder Vs Pacers Latest Injury News For March 29th

May 08, 2025 -

Central Cordoba Fortaleza Institucional En Su Estadio El Gigante De Arroyito

May 08, 2025

Central Cordoba Fortaleza Institucional En Su Estadio El Gigante De Arroyito

May 08, 2025 -

Is The Xrp Recovery Stalling Derivatives Market Insights

May 08, 2025

Is The Xrp Recovery Stalling Derivatives Market Insights

May 08, 2025 -

5 3 0 355

May 08, 2025

5 3 0 355

May 08, 2025

Latest Posts

-

Scholar Rock Stocks Monday Dip Causes And Consequences

May 08, 2025

Scholar Rock Stocks Monday Dip Causes And Consequences

May 08, 2025 -

Universal Credit Changes Dwps Six Month Rule Explained

May 08, 2025

Universal Credit Changes Dwps Six Month Rule Explained

May 08, 2025 -

New Six Month Rule For Universal Credit Dwps Official Statement

May 08, 2025

New Six Month Rule For Universal Credit Dwps Official Statement

May 08, 2025 -

Dwp Update Important Information Regarding Your Bank Account And 12 Benefits

May 08, 2025

Dwp Update Important Information Regarding Your Bank Account And 12 Benefits

May 08, 2025 -

Dwp Issues Warning Secure Your 12 Benefits Bank Account Action Needed

May 08, 2025

Dwp Issues Warning Secure Your 12 Benefits Bank Account Action Needed

May 08, 2025