Can XRP Hit $3.40? Analyzing Ripple's Resistance Levels

Table of Contents

Ripple's Current Market Position and Price Analysis

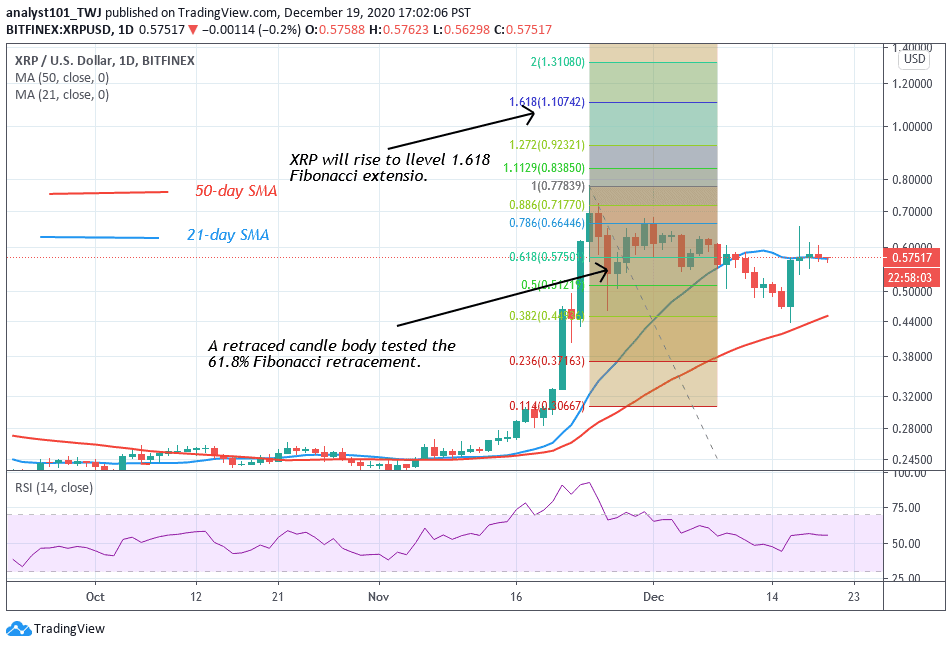

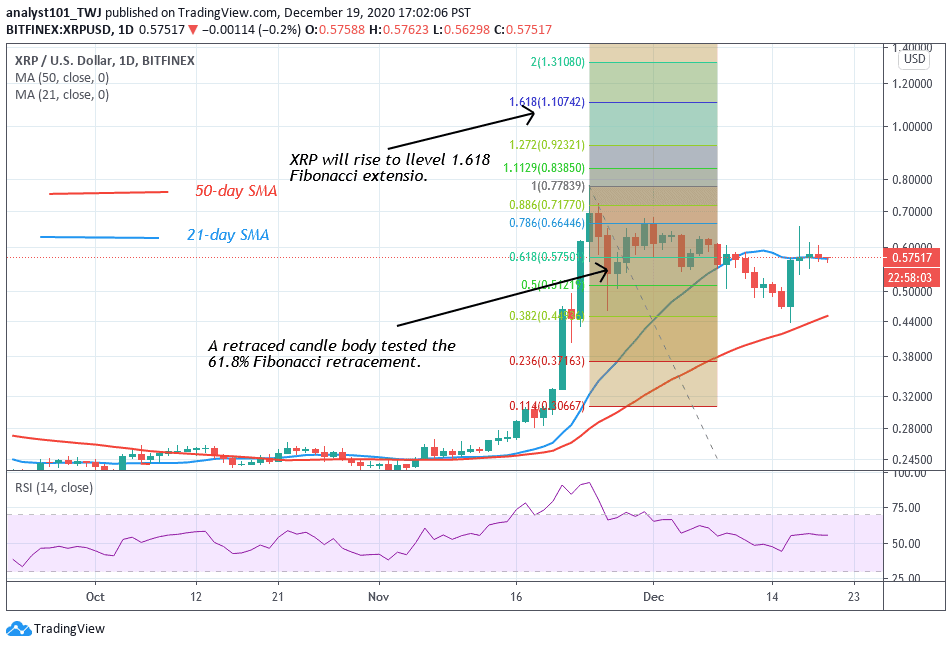

Analyzing XRP's current trajectory requires a look at its market capitalization and trading price alongside key technical indicators. Currently, XRP holds a significant position among cryptocurrencies, but its price has shown considerable volatility. [Insert relevant chart showing XRP price history and market cap].

Key technical indicators like moving averages (MA), Relative Strength Index (RSI), and Moving Average Convergence Divergence (MACD) provide insights into potential price movements. For example, a bullish crossover of the 50-day and 200-day MA could signal a strong upward trend. Conversely, a bearish divergence between the price and RSI might indicate an impending price correction.

- Current XRP price and market ranking: [Insert current data]. This ranking fluctuates based on market conditions and the performance of other cryptocurrencies.

- Analysis of recent price trends and volatility: [Insert analysis of recent price action, noting significant highs and lows and their potential causes].

- Identification of key support and resistance levels: [Identify key price levels where XRP's price has historically struggled to break through or has found support]. These levels act as potential barriers or catalysts for further price movements.

- Discussion of potential bullish and bearish signals: [Analyze current technical indicators and explain potential bullish (e.g., increasing trading volume alongside price increases) and bearish (e.g., declining trading volume with price decreases) signals].

The Impact of the SEC Lawsuit on XRP's Price

The ongoing SEC lawsuit against Ripple Labs significantly impacts XRP's price. The SEC alleges that XRP is an unregistered security, a claim Ripple vehemently denies. The outcome of this legal battle will likely have a profound effect on XRP's future.

Positive news, such as a favorable court ruling or settlement, could trigger a significant price surge. Conversely, negative developments could lead to further price declines. The uncertainty surrounding the lawsuit contributes to XRP's volatility.

- Summary of the SEC's arguments against Ripple: [Summarize the SEC's main arguments, focusing on their claims about XRP’s functionality and distribution].

- Ripple's defense strategy and recent court developments: [Outline Ripple’s defense and highlight any recent significant court rulings or filings].

- Potential scenarios and their impact on XRP's price: [Explore potential scenarios, such as a win for Ripple, a settlement, or a loss, and the likely impact on XRP's price for each].

- Expert opinions and market sentiment surrounding the lawsuit: [Include summaries of opinions from legal experts and the general market sentiment regarding the lawsuit's outcome].

Ripple's Technological Advancements and Partnerships

Ripple's technological innovations and partnerships are crucial factors in determining XRP's long-term potential. RippleNet, Ripple's payment solution, facilitates cross-border transactions for financial institutions, increasing the demand for XRP.

Furthermore, Ripple's exploration of Central Bank Digital Currencies (CBDCs) positions it at the forefront of financial innovation. These advancements, coupled with strategic partnerships, could significantly boost XRP's adoption and price.

- Explanation of RippleNet and its role in cross-border payments: [Explain how RippleNet works and its benefits for financial institutions]. Highlight its use cases and the role of XRP within the network.

- Discussion of new technologies like CBDCs and their relevance to XRP: [Discuss Ripple's involvement in CBDC projects and how this could potentially increase XRP's utility and adoption].

- Key partnerships and their potential influence on XRP’s price: [List significant partnerships and explain how these collaborations could drive XRP adoption and price appreciation].

- Analysis of XRP's adoption rate and market penetration: [Assess XRP's current adoption rate and market share, highlighting areas for potential growth].

Macroeconomic Factors and the Crypto Market

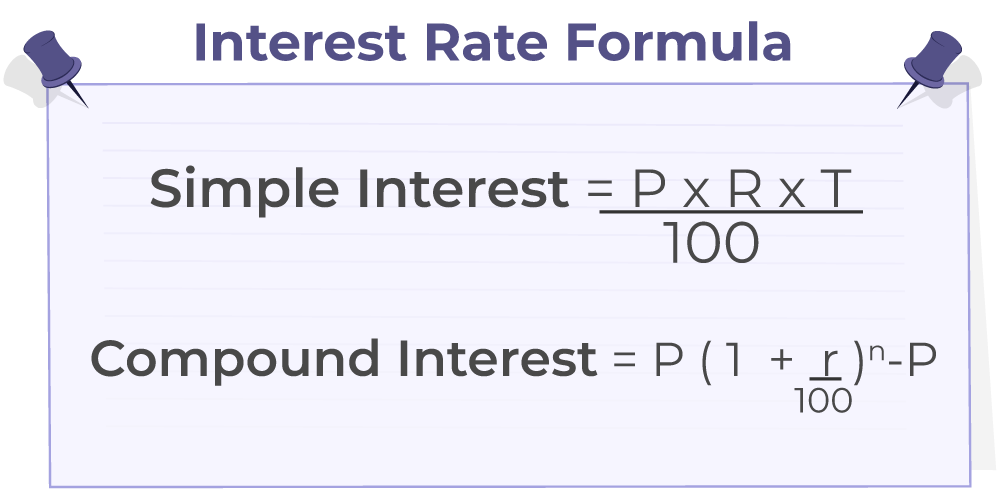

The broader macroeconomic climate and overall crypto market sentiment significantly influence XRP's price. Factors like inflation, interest rates, and regulatory developments in both the traditional finance and cryptocurrency sectors play a critical role.

Bitcoin's price movements often impact altcoins like XRP, creating a correlation between their price actions. Positive overall sentiment in the crypto market can lead to increased investment in XRP, while negative sentiment can result in price drops.

- Influence of Bitcoin's price on altcoins like XRP: [Explain the typical relationship between Bitcoin's price and the prices of other cryptocurrencies, including XRP].

- Impact of regulatory changes on the cryptocurrency market: [Discuss the influence of global and regional regulatory changes on the entire crypto market and its impact on investor confidence and XRP price].

- Analysis of global economic trends and their effect on investor sentiment: [Analyze how macroeconomic factors like inflation and interest rates impact investor risk appetite and cryptocurrency investment, including XRP].

- Discussion of potential risks and opportunities in the crypto market: [Discuss the general risks and opportunities inherent in the cryptocurrency market and how these factors can impact XRP's price].

Conclusion

This analysis has explored the multifaceted factors influencing XRP's price trajectory, considering its current market position, the ongoing SEC lawsuit, Ripple's technological advancements, and the broader cryptocurrency market environment. While reaching $3.40 presents a significant challenge, the potential for growth exists depending on the resolution of the legal issues and continued market adoption of Ripple's technology.

Ultimately, whether XRP can hit $3.40 remains speculative. However, continuous monitoring of XRP's price, the SEC lawsuit, and Ripple's progress is crucial for informed investment decisions. Stay informed on the latest developments surrounding XRP and Ripple to navigate the market effectively. Further research into Ripple's technological advancements and the overall cryptocurrency market will help you form your own opinion on whether XRP can hit $3.40.

Featured Posts

-

The Long Walks First Trailer Simple Yet Frightening

May 08, 2025

The Long Walks First Trailer Simple Yet Frightening

May 08, 2025 -

People Betting On La Wildfires A Troubling Trend

May 08, 2025

People Betting On La Wildfires A Troubling Trend

May 08, 2025 -

Expected Lahore Weather Eid Ul Fitr And Following Day

May 08, 2025

Expected Lahore Weather Eid Ul Fitr And Following Day

May 08, 2025 -

Hong Kong Dollar Interest Rate Sharpest Fall Since 2008 After Monetary Authority Intervention

May 08, 2025

Hong Kong Dollar Interest Rate Sharpest Fall Since 2008 After Monetary Authority Intervention

May 08, 2025 -

Shreveport Police Crack Multi Vehicle Theft Ring Suspects Arrested

May 08, 2025

Shreveport Police Crack Multi Vehicle Theft Ring Suspects Arrested

May 08, 2025

Latest Posts

-

Universal Credit Recipients Face Benefit Cuts Under Dwp Reforms

May 08, 2025

Universal Credit Recipients Face Benefit Cuts Under Dwp Reforms

May 08, 2025 -

Dwp To Axe Two Benefits Final Payments Incoming

May 08, 2025

Dwp To Axe Two Benefits Final Payments Incoming

May 08, 2025 -

Dwp Overhaul Universal Credit Changes And Potential Loss Of Benefits

May 08, 2025

Dwp Overhaul Universal Credit Changes And Potential Loss Of Benefits

May 08, 2025 -

Dwp Increases Home Visits For Benefit Claimants Impact And Concerns

May 08, 2025

Dwp Increases Home Visits For Benefit Claimants Impact And Concerns

May 08, 2025 -

Dwp Doubles Home Visits Thousands Of Benefit Claimants Affected

May 08, 2025

Dwp Doubles Home Visits Thousands Of Benefit Claimants Affected

May 08, 2025