Hong Kong Dollar Interest Rate: Sharpest Fall Since 2008 After Monetary Authority Intervention

Table of Contents

The HKMA's Intervention and its Impact on Interest Rates

The HKMA's intervention directly caused the sharp fall in the Hong Kong dollar interest rate. The authority used its established mechanism – adjusting the base rate – to lower borrowing costs.

- Specific Mechanism: The HKMA reduced its base rate, a key benchmark for interbank lending.

- Extent of the Fall: The interest rate plummeted by [Insert Percentage Here]%, marking the most significant single drop since 2008.

- Comparison to Previous Changes: This surpasses previous rate adjustments in both magnitude and speed, highlighting the urgency of the HKMA's response.

- Overnight Interbank Rate: The overnight interbank lending rate, a crucial indicator of liquidity in the banking system, also fell significantly, reflecting the impact of the HKMA's actions.

The HKMA's rationale likely stemmed from a confluence of factors: the prevailing US interest rate environment, the strength of the US dollar, and the pressure on the Hong Kong dollar's peg to the US dollar. Maintaining this peg, a cornerstone of Hong Kong's monetary policy, requires careful management of interest rates to prevent significant capital flows and maintain currency stability.

Reasons Behind the Unprecedented Drop

Several interconnected factors contributed to this dramatic fall in the Hong Kong dollar interest rate.

The Influence of US Monetary Policy

The US Federal Reserve's monetary policy decisions significantly impact Hong Kong's interest rates due to the currency peg.

- Correlation: Historically, changes in US interest rates have been closely mirrored by adjustments in Hong Kong's interest rates to maintain the peg.

- Influence of US Rate Cuts: Recent US rate cuts created pressure on the HKMA to follow suit, preventing a significant divergence between US and Hong Kong interest rates.

- Diverging Monetary Policies: The challenge lies in balancing the need to maintain the peg with the potential implications of diverging monetary policies between the US and Hong Kong, which can strain the financial system.

Pressure on the Hong Kong Dollar Peg

The Hong Kong dollar peg has faced pressures, necessitating the HKMA's intervention.

- Capital Flows: [Mention specific capital flows – inflows or outflows, and their impact on the peg. For example, "Increased capital outflows due to [reason] put downward pressure on the Hong Kong dollar."]

- Interest Rate Cut as a Response: The interest rate cut aims to make the Hong Kong dollar less attractive for capital outflows, thereby supporting the currency peg. Lower interest rates reduce the return on investments in Hong Kong, making them less appealing compared to other markets.

- Risks Associated with Maintaining the Peg: Maintaining the peg under pressure requires careful balancing. [Discuss potential risks, such as depletion of foreign currency reserves or the need for further interventions in the future.]

Implications for the Hong Kong Economy and Investors

The sharp drop in the Hong Kong dollar interest rate has wide-ranging implications.

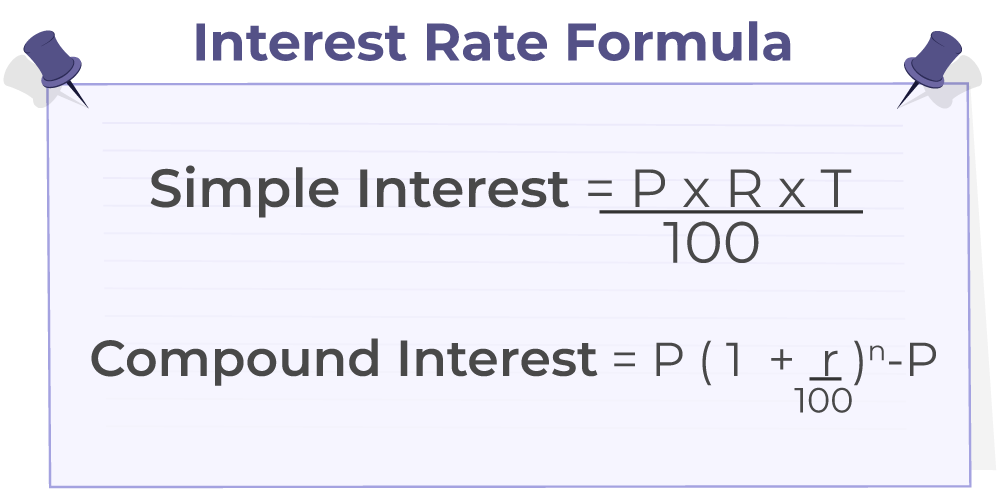

Impact on Borrowing Costs

Lower interest rates translate to reduced borrowing costs for businesses and consumers.

- Increased Investment and Economic Activity: Lower borrowing costs can stimulate investment and economic activity, as businesses find it cheaper to borrow for expansion and capital expenditure.

- Mortgage Rates and Consumer Spending: Lower mortgage rates can boost the property market and increase consumer spending, potentially fueling economic growth.

- Risks of Easy Credit Availability: However, easily available credit could also lead to increased debt levels and potential risks to financial stability if not managed carefully.

Impact on Investment Strategies

The change in interest rates significantly affects investment strategies.

- Fixed-Income Investments: Returns on fixed-income investments are directly impacted by interest rate changes. Lower rates reduce returns on bonds and other fixed-income securities.

- Hong Kong as an Investment Destination: The attractiveness of Hong Kong as an investment destination depends, in part, on its interest rate environment. Lower rates might reduce its appeal to some investors.

- Investor Sentiment: The interest rate drop might influence investor sentiment, leading to shifts in investment allocations across different asset classes.

Conclusion

The unprecedented drop in the Hong Kong dollar interest rate, triggered by the HKMA's intervention, reflects the challenges of maintaining the currency peg amidst changing global economic conditions and pressures on capital flows. This move has significant implications for borrowing costs, investment strategies, and the overall health of the Hong Kong economy. Understanding the intricacies of the Hong Kong dollar interest rate and the HKMA’s monetary policy is crucial for navigating the Hong Kong financial market effectively. Stay informed about the evolving Hong Kong dollar interest rate and the HKMA's monetary policy decisions. Monitor the Hong Kong dollar's performance against other major currencies to understand how these changes will affect your financial strategies. Careful analysis of the Hong Kong dollar interest rate is key to making sound financial decisions in this dynamic market.

Featured Posts

-

Surface Pro 12 Inch Price Specs And Review

May 08, 2025

Surface Pro 12 Inch Price Specs And Review

May 08, 2025 -

Could A 10x Bitcoin Multiplier Reshape Wall Street A Weekly Market Chart Analysis

May 08, 2025

Could A 10x Bitcoin Multiplier Reshape Wall Street A Weekly Market Chart Analysis

May 08, 2025 -

113

May 08, 2025

113

May 08, 2025 -

Arsenal Manager Arteta Under Fire From Collymore

May 08, 2025

Arsenal Manager Arteta Under Fire From Collymore

May 08, 2025 -

Is This Ethereum Buy Signal Real Weekly Chart Analysis And Predictions

May 08, 2025

Is This Ethereum Buy Signal Real Weekly Chart Analysis And Predictions

May 08, 2025

Latest Posts

-

Xrp Trading Volume Outpaces Solana Amidst Etf Speculation

May 08, 2025

Xrp Trading Volume Outpaces Solana Amidst Etf Speculation

May 08, 2025 -

Xrp Etf In Brazil Ripple News And Trumps Social Media Activity

May 08, 2025

Xrp Etf In Brazil Ripple News And Trumps Social Media Activity

May 08, 2025 -

Pro Shares Launches Xrp Etfs This Week Impact On Xrp Price

May 08, 2025

Pro Shares Launches Xrp Etfs This Week Impact On Xrp Price

May 08, 2025 -

Xrp Price Up 400 Predicting Future Growth Potential

May 08, 2025

Xrp Price Up 400 Predicting Future Growth Potential

May 08, 2025 -

Pro Shares Announces Xrp Etfs No Spot Market But Price Jumps

May 08, 2025

Pro Shares Announces Xrp Etfs No Spot Market But Price Jumps

May 08, 2025