Canada Defends Tariff Policy: Oxford Report Challenged

Table of Contents

Key Arguments in Canada's Defense of its Tariff Policy

The Canadian government's defense of its tariff policy rests on several pillars. These include economic justifications, direct responses to the Oxford Report's criticisms, and an emphasis on the nation's adherence to international trade agreements.

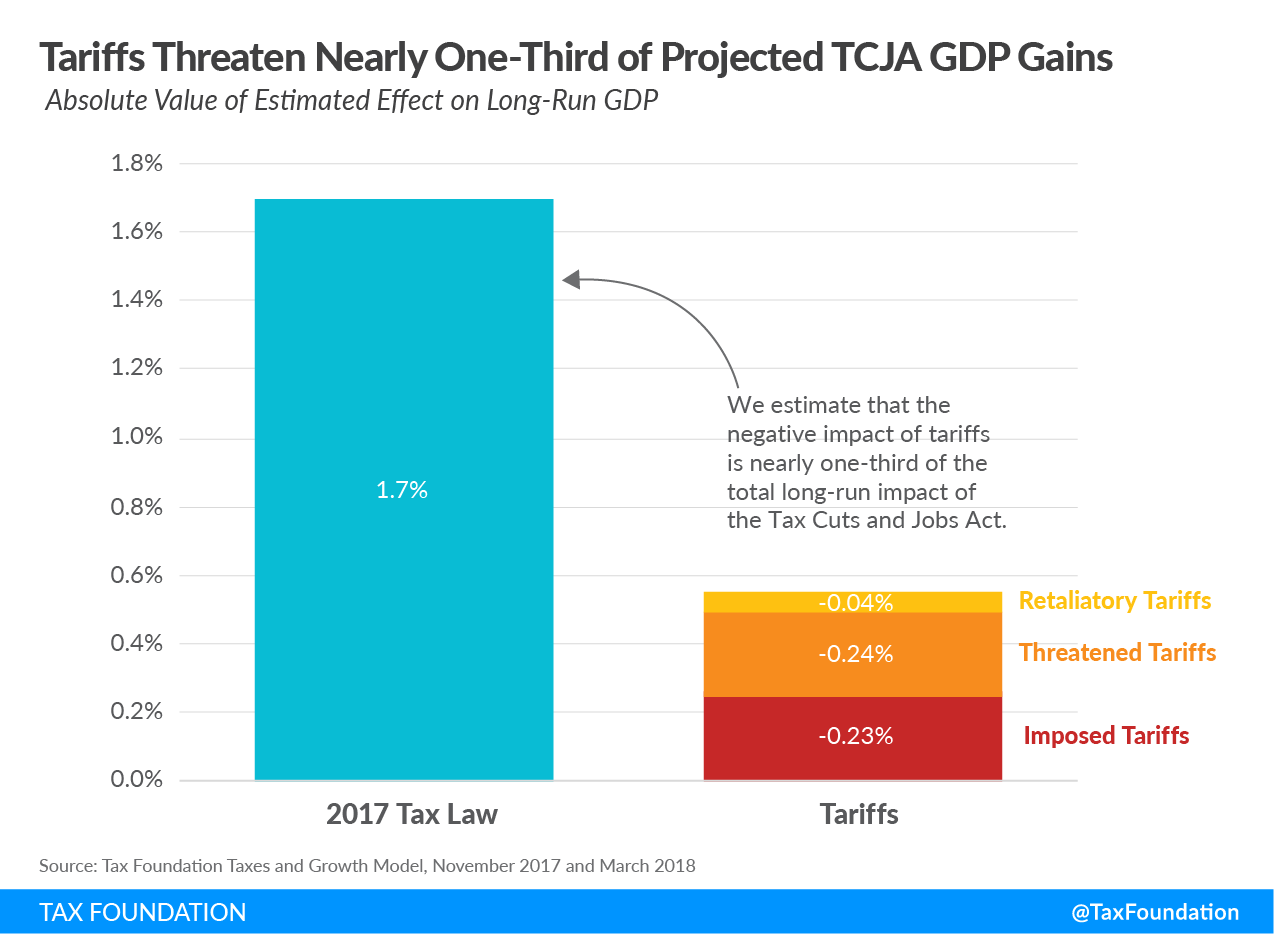

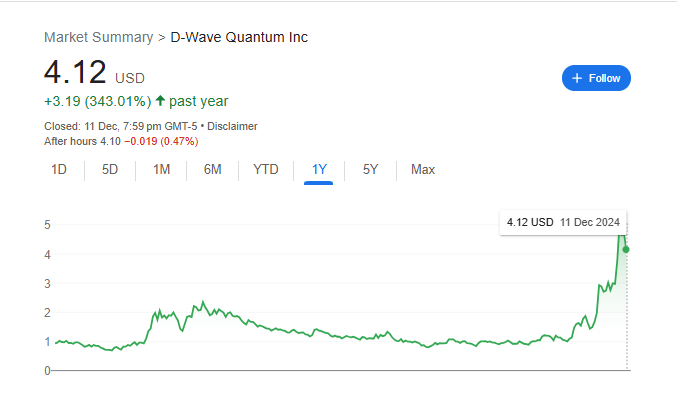

Economic Justification

The government argues that tariffs are essential tools for protecting key domestic industries and stimulating economic growth. This approach, while sometimes leading to higher prices for consumers, is seen as necessary to safeguard jobs and maintain national competitiveness.

- Steel and Lumber Industries: Tariffs have been instrumental in shielding these crucial sectors from foreign competition, preserving jobs and fostering domestic production.

- Job Creation and Economic Growth: Government data suggests that tariffs have led to a net increase in employment within protected industries and contributed to overall GDP growth, although critics dispute these claims.

- Counterarguments to Price Increases: The government contends that the long-term benefits of protecting domestic industries outweigh the short-term increase in consumer prices for certain goods. They also point to the potential for increased innovation and a more diversified economy.

Addressing the Oxford Report's Criticisms

The Oxford Report highlighted several concerns regarding the effectiveness and fairness of Canada's tariff policies. The Canadian government has directly addressed these criticisms.

- Point-by-Point Rebuttal: The government has issued detailed responses to each point raised in the report, providing alternative data and analysis to challenge the report's conclusions.

- Methodological Flaws: The government has pointed to potential methodological flaws in the Oxford Report's analysis, questioning the accuracy and reliability of its findings.

- Alternative Perspectives: The government has offered alternative perspectives and data sets to counter the negative portrayal of the tariff policy presented in the Oxford Report.

International Trade Agreements and Obligations

Canada is a strong proponent of free and fair trade and remains committed to its international obligations. The government argues that its tariff policies largely comply with existing trade agreements.

- CUSMA (Canada-United States-Mexico Agreement): The government emphasizes its adherence to the rules and regulations set forth within CUSMA.

- WTO Compliance: Canada maintains that its tariff policies are generally compliant with World Trade Organization rules and regulations, although specific tariffs might be challenged.

- Potential Implications of Violations: The government acknowledges the potential negative consequences of violating trade agreements but asserts that its current approach strives for a balance between protecting domestic interests and upholding international commitments.

Impact of the Tariff Policy on Canadian Businesses and Consumers

Canada's tariff policy has a multifaceted impact on both businesses and consumers, creating both winners and losers.

Positive Impacts

Certain sectors have experienced significant benefits from the tariff regime.

- Increased Domestic Production: Protected industries have seen a rise in domestic production, leading to increased output and economic activity.

- Job Growth in Targeted Sectors: Data suggests job creation in specific sectors benefiting from tariffs, although the extent of this growth is subject to ongoing debate.

- Economic Indicators: Positive changes in various economic indicators, such as employment rates and production levels within specific sectors, are cited as evidence of the policy's success.

Negative Impacts

However, the policy's drawbacks are also evident.

- Increased Consumer Prices: Tariffs have resulted in higher prices for certain goods, impacting consumer purchasing power.

- Impact on Export Industries: Some export-oriented industries have faced challenges due to retaliatory tariffs imposed by other countries.

- Reduced Consumer Purchasing Power: The increase in prices on some goods has demonstrably affected consumer spending and overall economic activity.

Future Outlook and Potential Adjustments to Canada's Tariff Policy

The Canadian government is actively responding to the criticisms surrounding its tariff policy.

Government Response to Criticism

The government's response includes a commitment to transparency and ongoing evaluation.

- Potential Adjustments: The government has signaled a willingness to adjust the tariff policy based on data analysis and stakeholder feedback.

- Future Reviews and Evaluations: Ongoing reviews and evaluations of the tariff policy's effectiveness are planned to ensure its continued alignment with economic goals.

- Stakeholder Engagement: The government is committed to open dialogue and collaboration with various stakeholders to refine the tariff policy.

Long-Term Implications for Canadian Trade

The long-term consequences of Canada's tariff policy remain uncertain.

- Impact on Foreign Investment: Concerns exist regarding the potential impact of tariffs on foreign investment in Canada.

- Retaliatory Measures: The possibility of retaliatory tariffs from other countries remains a significant risk.

- Long-Term Economic Projections: Predicting the long-term economic effects of the current tariff policy requires ongoing monitoring and analysis.

Conclusion: Canada's Tariff Policy: A Balancing Act

Canada's defense of its tariff policy highlights the inherent complexities of balancing domestic interests with international trade obligations. While the policy aims to protect key industries and foster economic growth, it also carries the potential for increased consumer prices and strained international relations. The government's commitment to ongoing review and adjustment suggests a willingness to navigate this delicate balance. To stay abreast of developments and engage in informed discussions on "Canada's tariff policy," consult official government websites and reports for the most up-to-date information. Understanding the nuances of this complex issue is crucial for shaping a future trade policy that benefits all Canadians.

Featured Posts

-

Amazon Workers Union Fights Warehouse Closure In Quebec

May 20, 2025

Amazon Workers Union Fights Warehouse Closure In Quebec

May 20, 2025 -

Rashfords Double Propels Manchester United Past Aston Villa In Fa Cup

May 20, 2025

Rashfords Double Propels Manchester United Past Aston Villa In Fa Cup

May 20, 2025 -

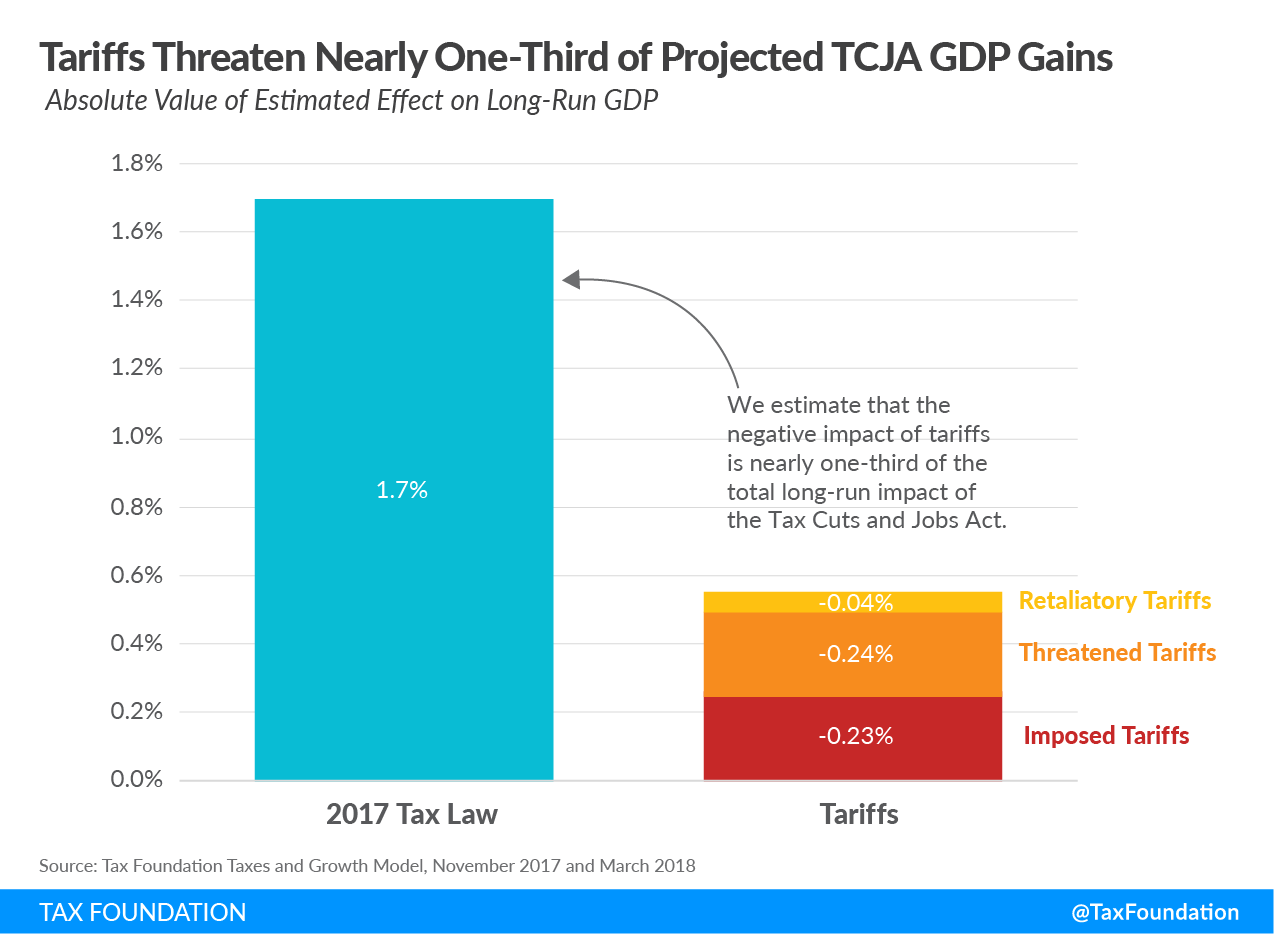

How Will Qbts Stock Perform After The Next Earnings Announcement

May 20, 2025

How Will Qbts Stock Perform After The Next Earnings Announcement

May 20, 2025 -

Agatha Christies Poirot A Comprehensive Guide

May 20, 2025

Agatha Christies Poirot A Comprehensive Guide

May 20, 2025 -

The Monday Rally In D Wave Quantum Inc Qbts Stock An Investors Perspective

May 20, 2025

The Monday Rally In D Wave Quantum Inc Qbts Stock An Investors Perspective

May 20, 2025